The Corporate Deal Tracker is a Texas Lawbook-produced database that collects information on M&A deals and securities offerings handled by Texas-based lawyers. This means the transaction must have either been led by a Texas-based lawyer or involved a Texas-based lawyer for the firm submitting to receive credit.

Each quarter, the Lawbook analyzes the data reported to the Deal Tracker and publishes various in-depth reports such as the kinds of deals law firms’ Texas offices worked on, trends the deal data reflects, how many deals were reported to the database compared to previous years and how many deals were in each value range (small, mid-sized, or mega). The Lawbook also publishes rankings on which law firms and individual lawyers worked on the most corporate transactions.

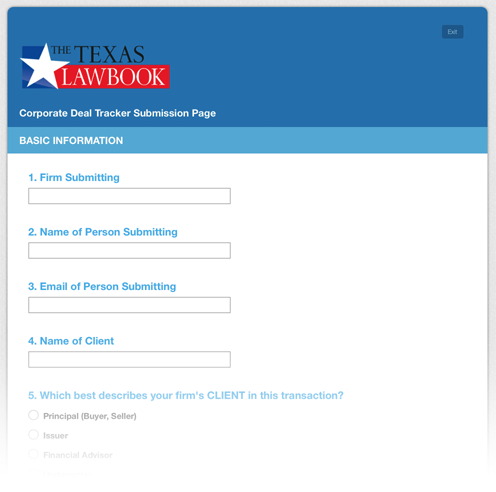

How to submit

To submit a transaction to our database, fill out our survey HERE.

Criteria

The information we seek is laid out in the survey, but for firms’ convenience, click here to view a PDF that lays out all of the survey’s questions in one place.

What we accept

Deals we accept as M&A include:

- Mergers

- Acquisitions

- Divestitures

- Joint ventures

- Private equity/venture capital investments

Deals we accept as securities offerings include:

- IPOs

- Follow-on public offerings (equity or debt)

- Private equity stock offerings

- Private debt offerings

- Exchange offerings

- At-the-market offerings (or ATMs)

- (Note: we do not accept tender offerings)

The Lawbook produces a new edition of the database each year. Therefore, in order for a deal to be accepted in the current year, the transaction must have been announced on or after January 1 of that year. For example, for the 2017 edition, the Lawbook will not accept a deal that closed in 2017 but was announced in 2016. The logic behind this is that we would have already credited a firm for this deal in the previous year’s edition. The Lawbook will also not accept a deal that closed the year before but was not announced until the current year in examination (ex: a deal that was announced in 2017 but closed in October of 2016).

Policy on confidential deals

On the M&A side, we will credit a law firm for up to 10 confidential deals per year. Our definition of a confidential deal is a submission that is unable to disclose both the buyer party and the seller party. If that is the case, you still must disclose the deal value and business sector that the deal best falls under.

If your firm submits more than 10 confidential deals, we will credit the firm for the 10 confidential deals that had the highest value. We limit the amount of confidential M&A deals credited to an individual attorney to three per year.

Conversely, on the securities side, we do not accept confidential submissions. Our reasoning behind this is that about 99 percent of the time, the information identifying the company issuing its stock will be publicly available on an SEC document.

We realize that a large majority of all deals that occur involve privately-held companies. Therefore, we do not put a limit to the amount of submissions in which you can provide almost all the information we seek except the deal value. As noted in our survey, if you are unable to give us the deal’s value, you have the option of providing a dollar range that the deal best falls under.

Crediting methodology

Unlike other databases, the Corporate Deal Tracker collects information based on where the lawyer is located, not the company. This means that it doesn’t matter whether a Texas-based lawyer led a deal for a Houston company or a Chinese company; the lawyer and his or her law firm will still receive credit.

Even if a deal was led by a firm’s New York or another out-of-state office, the firm will still receive credit if a Texas-based lawyer was on the deal team and played a significant role in the transaction.

We allow law firms to submit up to two lead attorneys on a deal. If a law firm submits an M&A deal that was led by two Texas-based lawyers, each lawyer will receive a half-credit with respect to the charts we publish on rankings of individual lead lawyers’ deal count. However, if a firm submits a securities offering that involved two lead attorneys, each lead attorney will receive a full credit. We have recently changed our policy on the securities side after receiving strong feedback from readers advising us that it is widely discouraged from a regulatory standpoint for a law firm to have only one lead attorney listed on an S-1 filing.

We recognize that some M&A transactions require legal advisory roles beyond representing the buyer or seller – such as representing the financial advisor that advised the buyer or seller. Because of that, we will give a firm credit if they played a role in the deal beyond representing the buyer or seller, but the lead lawyer of the firm’s deal team will not receive credit on the individual lawyers’ chart.

For more information on Corporate Deal Tracker, please contact Natalie Posgate or Allen Pusey.