January 2018 was greeted by stable energy markets, pent-up private equity and a spanking new investor-friendly tax law. That sounds like the elements of a record year, right?

The first half of 2018 didn’t exactly play out that way. The numbers were strong enough, but not record-breaking.

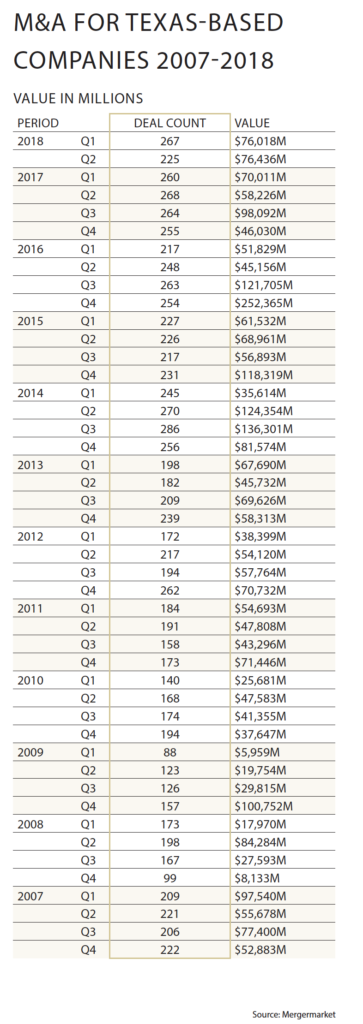

Dealmaking activity involving Texas companies actually dropped in the second quarter to the lowest count since the first quarter of last year, according to exclusive Mergermarket data provided to The Texas Lawbook.

“There’s a lot of cash around that needs to be put to use.”–Michael Considine

Even so, it was still the 18th straight quarter with a deal count above 200.

There were 225 deals in the second quarter valued at $76.4 billion, versus 267 transactions valued at $76 billion in the first quarter. The second quarter of 2017 saw more deals (268) but lower deal values ($58.2 million), according to Mergermarket data.

Likewise, the deal count (492) was lower for the first half of this year over the same period last year (528), but deal value, at $152.4 billion, was 18.9 percent higher than the first half of last year, at $128.2 billion.

Michael Considine, an M&A lawyer who recently left Jones Day to join Kirkland & Ellis’ new Dallas office, said dealmaking was extremely strong in the first half and will continue to be so through the end of the year. He cites pent-up transactions from 2017 but also the abundance of debt and capital available for deals. “There’s a lot of cash around that needs to be put to use,” he said.

Higher interest rates don’t seem to be dampening demand, Considine said. But he notes that deal values are creeping up, making it very much a seller’s market, and that new tariffs and increasing regulatory scrutiny could take some of the air out of the M&A market.

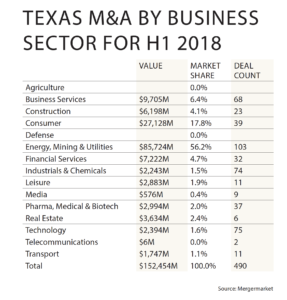

Not surprisingly, energy, mining and minerals deals made up the majority of the activity – 56 percent – in the first half with 103 transactions valued at $85.7 billion.

The next biggest industry was consumer at 17.8 percent of the total (39 deals valued at $27.1 billion), probably due to Keurig Green Mountain’s $23.1 billion acquisition of Dr Pepper Snapple transaction. That sector was followed by business services at 6.4 percent (68 deals worth $9.7 billion), thanks to Brookfield Infrastructure Partners’ purchase of AT&T’s data centers for $1.1 billion; and financial services at 4.7 percent (32 deals worth $7.2 billion), with the largest deal being Cadence Bancorp.’s $1.37 billion purchase of Georgia’s State Bank Financial.

Construction drove 4.1 percent of the activity with 23 deals valued at $6.2 billion, featuring Leonard Green & Partners’ acquisition of Berkshire Partners-owned roofing company SRS Distribution for $3 billion. Meanwhile, real estate made up 2.4 percent of the activity with six deals worth $3.6 billion and pharma, medical and biotech contributed 2 percent with 37 transactions worth almost $3 billion.

The three biggest deals among Texas companies in the first half were Marathon Petroleum’s $31.3 billion purchase of San Antonio-based Andeavor; the Keurig Green Mountain-Dr Pepper Snapple merger; and Concho Resources’ $9.4 billion pickup of Texas rival RSP Permian.

Considine said he’s been most active in industries such as consumer products, financial services, software and manufacturing and that his clients are looking for technology-driven projects or new production techniques.

“There are a lot of baby boomers who don’t know whether to sell their businesses or give them to their kids.”–Benton Cantey

Benton Cantey, a partner at Kelly Hart & Hallman in Fort Worth, said his practice also has been busy, with oil and gas services, industrial and manufacturing being the most active sectors.

“In the M&A group, the first half of the year was the busiest we’ve ever had,” he said. “With the economy doing well and the amount of money out there, there’s a lot of competition for deals. And there are a lot of baby boomers who don’t know whether to sell their businesses or give them to their kids and are being contacted by potential buyers.”

On the energy front, Vinson & Elkins partner Keith Fullenweider said M&A and joint ventures have driven the firm’s transactional practice, a trend he expects will continue through year-end. “A lot of the activity is tax driven,” he said, referring to the Trump administration’s tax cuts.

Fullenweider noted the firm’s work advising RSP Permian on the sale to Concho and TPG Pace Energy Holdings on its acquisition of oil and gas properties from distressed EnerVest for $2.6 billion, both of which were consolidation plays. V&E also represented private equity firms in midstream as well as renewable deals, including one by TPG. “The area has become more active,” he said.

Gibson Dunn partner Mike Darden, who advised Concho on the RSP Permian deal and Enervest on the TPG deal, said he’s seen a lot of activity at the corporate and asset levels, including by private equity firms big and small, and doesn’t think it will let up. “We have a lot in the pipeline,” he said. “There are more good things to come.”

The former Latham & Watkins attorney said he sees a lot of clients doing acreage exchanges and coring up and consolidating in their plays, which will enable them to drill longer “laterals,” or horizontal segments, to make their wells more profitable.

“Those deals are normally handled through land departments with assistance from legal departments,” he said. “But they are great projects for our younger attorneys and can lead to bigger deals for us.”

Thompson & Knight partner Wesley Williams in Dallas said a lot more midstream deals have been crossing his desk than oil exploration and production, noting his counsel of Old Ironsides Energy-backed Brazos Midstream on the sale of its Delaware Basin units to Morgan Stanley’s North Haven Infrastructure Partners II for $1.75 billion.

“The big question in my mind is: are we going to see some real green shoots in the IPO market?”

-Adam Larson

“Pricing was moving around a bit [for E&P deals] in the first half and stable pricing is better for getting deals accomplished,” he said. “People seem to be getting more comfortable now with commodity levels.”

Jeff Muñoz, a partner at Latham & Watkins in Houston, agrees: “With oil prices kind of stabilized and continuing to go up, people are more interested in getting deals done.”

Kirkland & Ellis partner Adam Larson in Houston also is seeing a lot of midstream deals, noting his work on EnCap Flatrock’s Lucid II sale to Riverstone for $1.6 billion. But a few corporate deals may continue pop up, with companies like SandRidge Energy continuing to study their strategic alternatives and BHP Billiton selling its U.S. oil and gas properties, with BP said to be the lead bidder.

“The big question in my mind is: are we going to see some real green shoots in the IPO market?” he asked. “There are a lot of people prepping for IPOs, judging by the calls we’re getting, and that’s going to be very meaningful for M&A activity in the second half, as every private equity IPO is going to have a dual track component.”

David Patton, co-chair of Locke Lord’s energy practice group in Houston, believes there’s going to be a continuation in upstream activity from the first part of the year at least through the fourth quarter.

“We are beginning to see quite a bit of competition among buyers for transactions,” he said. “[That’s] different because in the bid stage at this time last year, some deals fell apart when the ask was too much and sellers had to move to Plan B.”

Mitch Tiras, co-chair of Locke Lord’s tax department and partner in Houston, thinks deals in the Bakken formation and Eagle Ford areas have a better chance of closing “while the Permian seems to have more buyer resistance,” he said. Jason Schumacher, a partner in the firm’s Dallas and Houston offices, agrees, saying deals outside the Permian are more likely to get done “because buyers aren’t meeting expectations in the Permian.”

Bill Swanstrom, co-chair of Locke Lord’s energy practice group and a partner in Houston who worked on CDM Resource Management’s $1.67 billion purchase of USA Compression in January, said the midstream has continued to be pretty robust on the development/commercial side and the M&A side but notes that the capital markets look to be challenging for the rest of the year.

“We’re not seeing a slowdown in the sector and are kicking off a number of new deals,” he said. “Most of the M&A activity is being driven by private equity and infrastructure funds, while commercial/development activity is strong with both strategics and PE-backed companies.”

Meanwhile, in healthcare, Jones Day partner Todd Kelly in Dallas said the sector has been pretty active, with more deals in the ancillary part of the industry – outpatient facilities and clinics, as well as imaging, ambulatory or laboratory providers – rather than in-care patient level, such as hospitals. Moreover, private equity firms are increasingly getting involved in that part of the sector.

“It’s been centered around those providers that support the health industry supply chain,” Kelly said.

Digital health also is getting a lot of play on the technology side, he said, with providers trying to figure out how to deliver services directly to the consumer. His provider clients also are looking abroad for opportunities, given foreign interest in how medical care is delivered in the U.S. “People want to import our expertise with technological advantages,” he said.