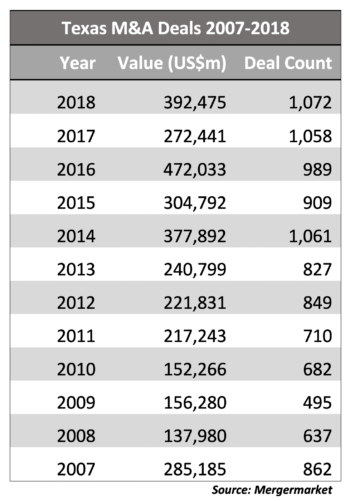

The number of mergers and acquisitions involving Texas companies reached 1,072 last year, a number that is not only a 12-year high, but may well be the highest number of Texas deals ever, according to Mergermarket data provided exclusively to The Texas Lawbook.

While the 2018 deal count was up by only 14 transactions over 2017, their value of $392 billion jumped 44.1 percent. The dollar amount was the second highest since 2007, the highest being the $472 billion worth of transactions logged in 2016.

Although Texas-exclusive M&A data is sparse prior to 1999, Mergermarket’s southwest bureau chief Chad Watt said he can’t recall – or even imagine – a larger number of transactions before then.

“That would be before private equity funds came into play,” Watt said.

Watt noted that larger transactions dominated Texas dealmaking in 2018.

“The bulk of the deal value involved the acquisition of listed companies or public companies shedding assets to refocus their businesses,” he said.

A buoyant stock market helped fuel and support M&A activity for most of last year, Watt said. But given the broad market declines in December, “it appears that big public dealmaking is starting 2019 in search of a new catalyst,” he added.

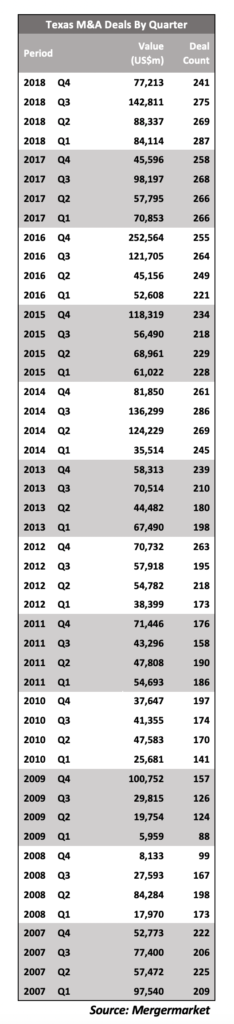

Although 2018’s final quarter was the 22nd straight quarter of 200 or more transactions – dating back to mid-2013 – Watt said he worries about expressed concern about the overall dynamics of the market for 2019.

Indeed, the fourth quarter generated 34 fewer deals than in the previous quarter with values sliding by almost half to $77.2 billion. The number of transactions also was down over the fourth quarter of 2017 (by 17 deals) and was the lowest number of transactions since the first quarter of 2016.

But the value of those deals was actually up by almost 70 percent over the fourth quarter of 2017 – showing how big deals are ruling the day.

Watt is worried that Texas didn’t see more growth in lower middle-market and private deals. “Acquisitions, exits and mergers are part of the life cycle for growing companies and it would be better if we saw deal counts climbing in correlation with deal values,” he said. “Are we getting too top-heavy?”

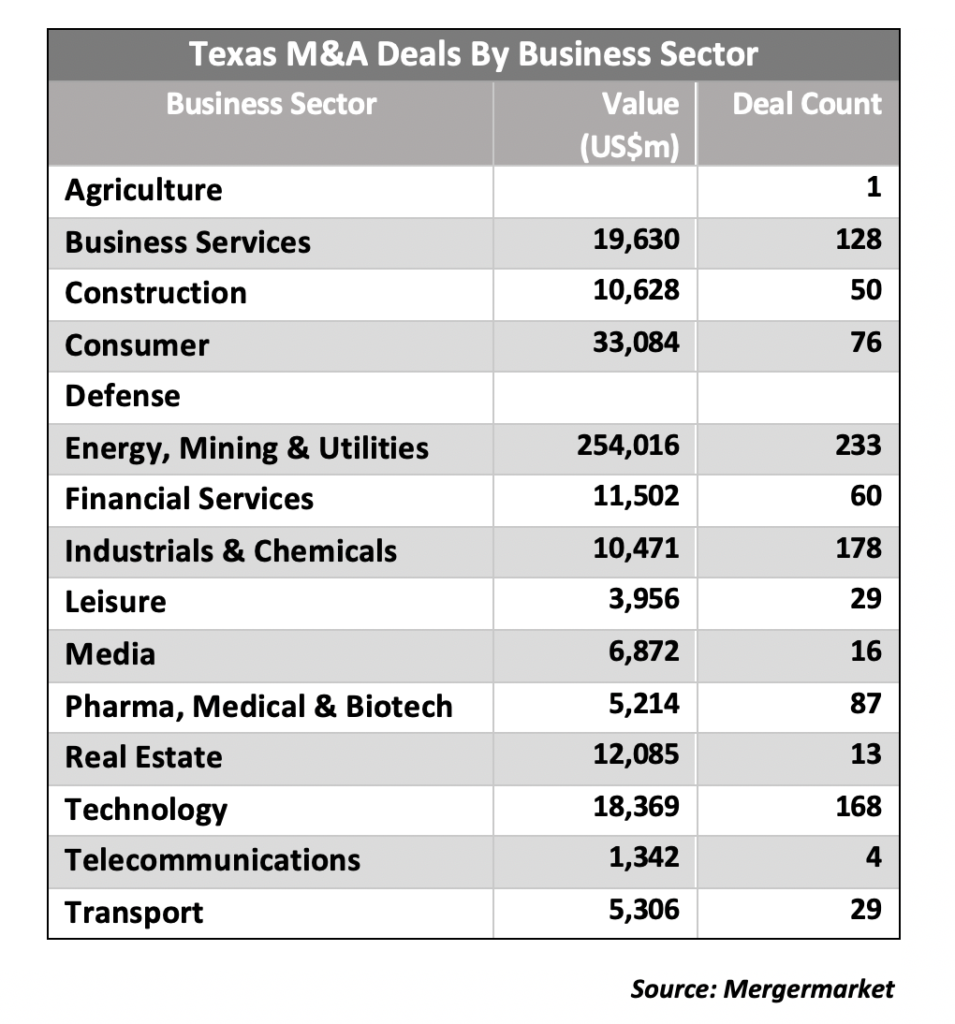

Not surprisingly, the energy sector dominated deal activity in 2018, racking up 233 transactions valued at $254 billion, or nearly 65 percent of the M&A activity overall, about the same as in 2017.

Consumer goods came in second generating 76 deals valued at $33.1 billion, or 8.4 percent of the total. The industry was helped along by Keurig Green Mountain Inc.’s $26.8 billion purchase of Dallas-based Dr Pepper Snapple Group Inc., which ranked as the third largest deal of 2018.

Business services generated 128 deals worth $19.6 billion, or about 5 percent of the total, while technology came in at 168 transactions worth $18.4 billion (4.7 percent). Real estate followed at 13 deals valued at $12 billion (3.1 percent) and financial services at 60 transactions worth $11.5 billion (2.9 percent).

The largest deal in the state last year was Energy Transfer Equity’s $59.6 billion combination with Dallas affiliate Energy Transfer Partners, according to Mergermarket. Coming in second was Marathon Petroleum Corp.’s $31.3 billion acquisition of San Antonio-based refiner Andeavor Corp.

BHP Billiton’s sale of its Petrohawk assets to BP plc for $10.5 billion ranked fourth and Western Gas Equity Partners’ purchase of a 67.15 percent stake in affiliate Western Gas Partners for almost $9.6 billion came in fifth.

While it was a good year for energy deals in Texas, possibly a record in some contexts, according to Watt, oil and gas businesses’ need to combine further could be stifled by headwinds from the capital and commodity markets.

A catalyst could be developing in the form of activist investors forcing consolidation, Watt said. He noted the first big energy deal of 2019 was a $2.7 billion offer by activist shareholder Elliott Management to acquire QEP Resources, which is based in Denver but whose main asset is in West Texas’ and New Mexico’s Permian Basin.

Analysts at Tudor, Pickering, Holt noted in a recent report that the QEP takeout offer has sparked another wave of conversations around consolidation in the industry.

“We continue to believe 2019 is going to be an extremely active year on the merger front with the integrateds [major oil companies] potentially entering the fray at some point,” they said.

Baker Botts corporate partner Joshua Davidson in Houston isn’t so sure that dealmaking will be that brisk, pointing out that low energy prices might make for reluctant sellers as they wait for higher prices again, as was the case several years ago. “Stock market volatility is not good for dealmaking, either, as it makes it harder to peg values,” he said.

Davidson still expects further consolidation in the energy industry – including among midstream master limited partnerships, or MLPs – given the need for efficiencies and deleveraging and the challenges of a maturing shale industry.

“Although most of the obvious MLP simplifications have occurred, there are several more that could occur in 2019 and there is likely to be consolidation among some of the smaller, PE [private equity]-owned MLPs,” he said.

Mergermarket’s data includes all deals that were announced last year, including those that are still pending and those that have closed.