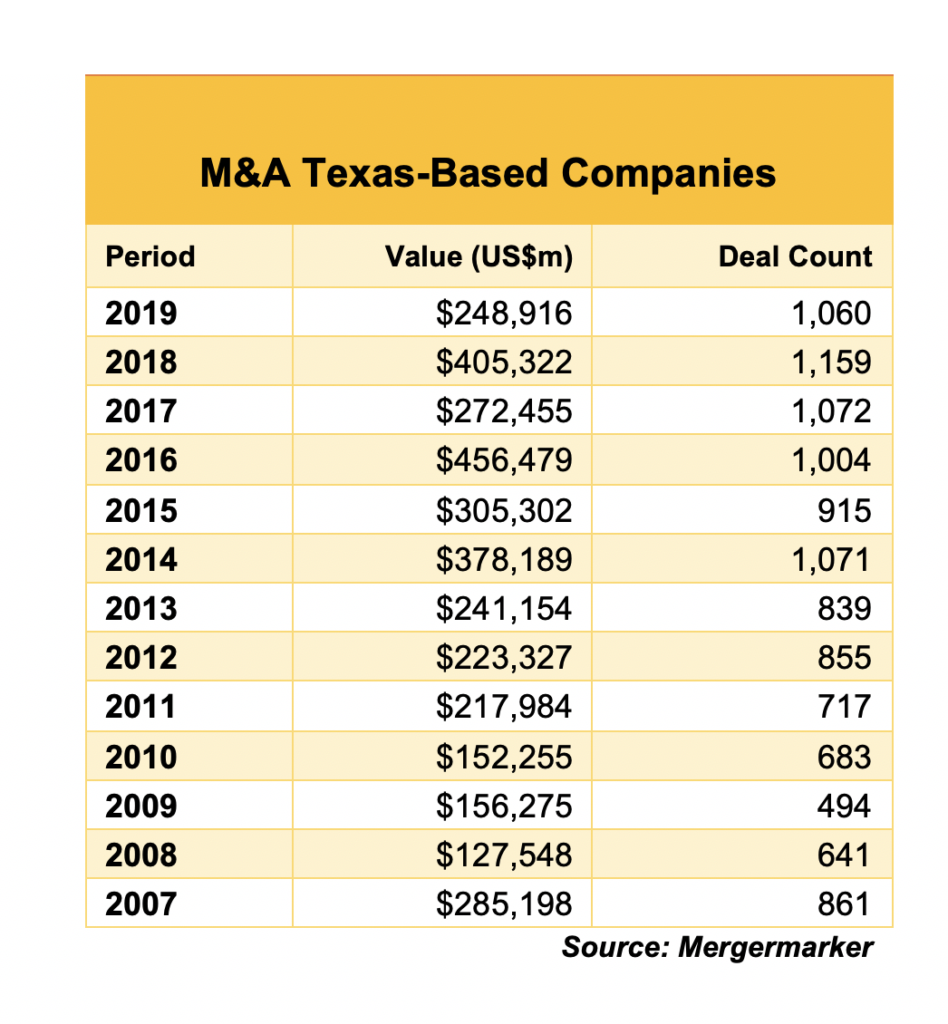

Texas companies weren’t in much of a buying or selling mood in 2019, particularly in the energy sector, leading the value of mergers and acquisitions activity to fall by 38.6% year-over-year to $248.9 billion – the worst performance since 2013, according to Mergermarket data provided exclusively to The Texas Lawbook.

The year’s deal count also slid to 1,060 transactions, 99 fewer than the 1,159 recorded in 2018 and the lowest number since 2016.

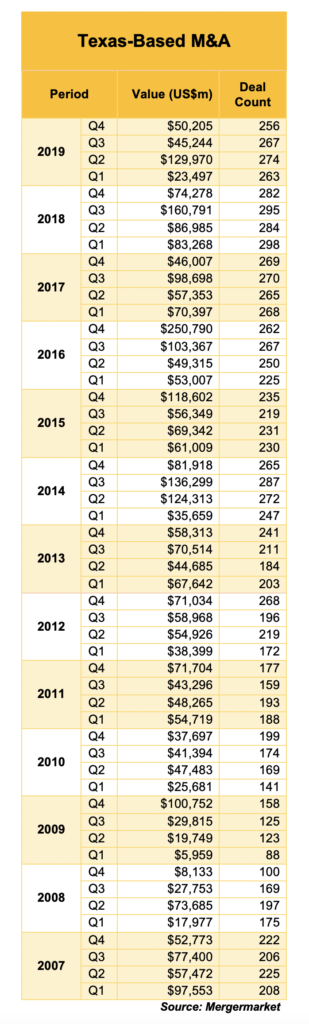

The second quarter was the strongest of the year in terms of value, logging 274 transactions valued at almost $130 billion, followed by the fourth quarter with 256 deals worth $50.2 billion and the third quarter with 267 transactions valued at $45.2 billion.

The first quarter only brought in $23.5 billion worth of transactions over 263 deals, which is not surprising given that the beginning of the year is usually slow for dealmaking. But 2019’s first quarter was the worst performing on a value basis since the first quarter of 2009, which only saw $5.9 billion worth of deals (thanks to the collapse in oil prices).

Lawyers and investment bankers blame the transactional slowdown last year on Wall Street’s disdain for the oil and gas sector, which put a damper on dealmaking. Other factors included the U.S.’ trade war with China, worries about the continuing strength of the U.S. economy and the upcoming presidential election.

“Clearly there were fewer oil and gas asset transactions, which typically can drive a lot of M&A work in Texas,” said Keith Fullenweider, partner and co-head of the corporate department at Vinson & Elkins in Houston. “Our M&A practice was up in 2019 and this reflected an increase in tech and renewables and a greater market share on energy deals.”

Rick Lacher, an investment banker at Houlihan Lokey in Dallas, agreed that the drop was likely due to continued woes in the oil and gas industry. “[I’m] cautiously optimistic about 2020, but it is an election year, so that creates uncertainties,” he said.

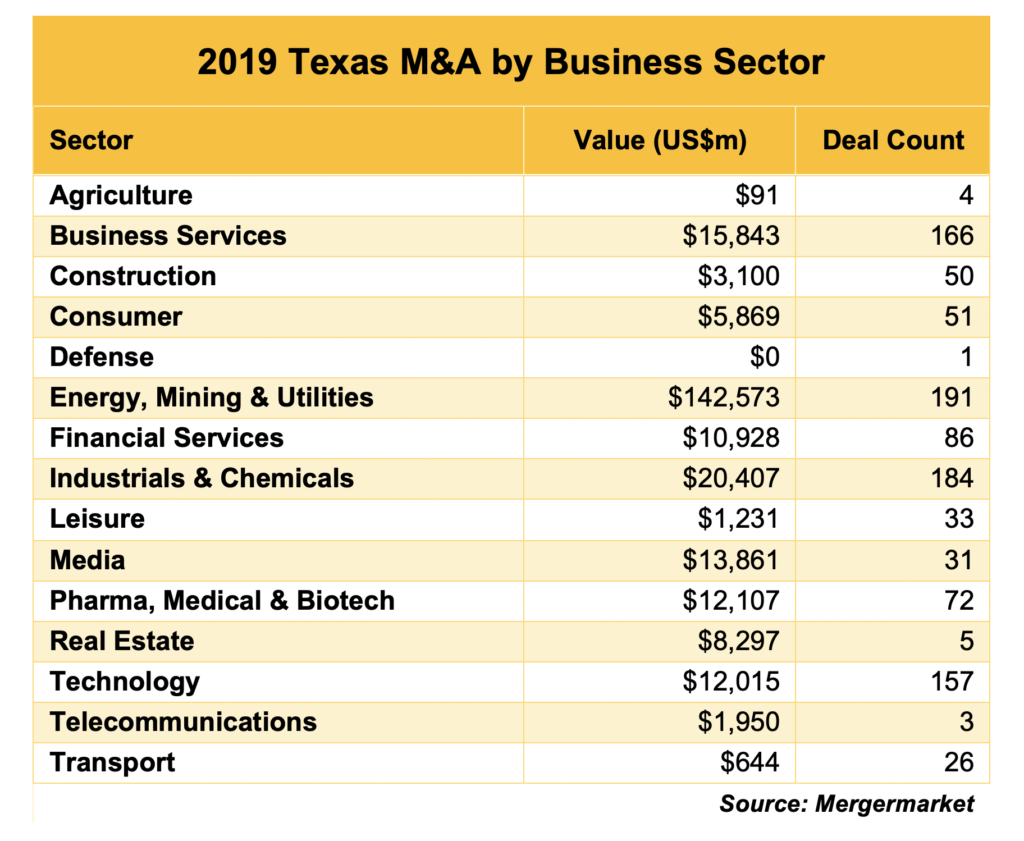

Energy, mining and utilities still made up most of the M&A activity in 2019, generating 191 deals valued at $142.6 billion, or 57.3% of the market. Occidental Petroleum’s $54.4 billion purchase of Anadarko made up a big chunk of that, but the industry’s deal value was still down nearly 44% over last year, which saw $254 billion over 233 deals.

Kirkland & Ellis partner Sean Wheeler in Houston said his firm noticed the drop in volume of oil and gas deals, particularly in the A&D – or acquisition and divestiture – part of the market.

“In the second quarter, people started seeing concerning signals about oil and gas prices, and in the third and the beginning of the fourth quarter stock prices began falling,” he said. “That led sellers to pull their properties from the market.”

Wheeler said the first quarter has been slow so far, which he expects to continue, but there may be a lot more activity in the second and third quarters. And the fourth? “Who knows,” he said. “It depends on who gets elected and where commodity prices are, but I’m cautiously optimistic that 2020 will be better than 2019.”

Ryan Maierson, a partner and global chair of the public company representation practice at Latham & Watkins in Houston, said dealmaking in natural resources was certainly spotty in 2019, but he’s optimistic about 2020.

“We continue to believe mergers of equals will make sense for some companies as a means of fortifying their balance sheets and streamlining costs without paying premiums,” he said. “Also the coming debt maturity walls, particularly in 2021, will spur some otherwise reluctant companies to consider mergers coupled with liability management transactions as a potentially viable path forward.”

Carla Tharp, an investment banker at Raymond James in Houston, isn’t so sure about M&A prospects for the industry this year. “With the capital markets’ negative view of the energy sector, public companies haven’t had the currency to buy out the privates and the private companies lost their usual exit route,” she said. “I personally see another slow year since the equity markets haven’t opened up yet.”

Among other sectors, industrials and chemicals came in second in deal activity last year generating 184 transactions valued at $20.4 billion, or 8.2% of the market.

The segment was followed by business services at 166 transactions worth $15.8 billion (6.4% of the market); media at 31 deals valued at almost $13.9 billion (5.6%); pharma, medical and biotech at 72 transactions worth $12.1 billion (4.9%); technology at 157 transactions valued at $12 billion (4.8%); and financial services at 86 deals worth $10.9 billion (4.4%).

The Oxy-Anadarko combination came in as the biggest deal of the year last year, followed by Buckeye Partners’ $10.1 billion take-private by IFM Investors. Next in line were Fox Sports Net’s $9 billion sale to Sinclair Broadcast Group; Anadarko’s $8.8 billion divestiture of its African assets to Total; and Acelity’s $6.7 billion sale to 3M Co. As it happens, the top five deals were all announced in the second quarter.