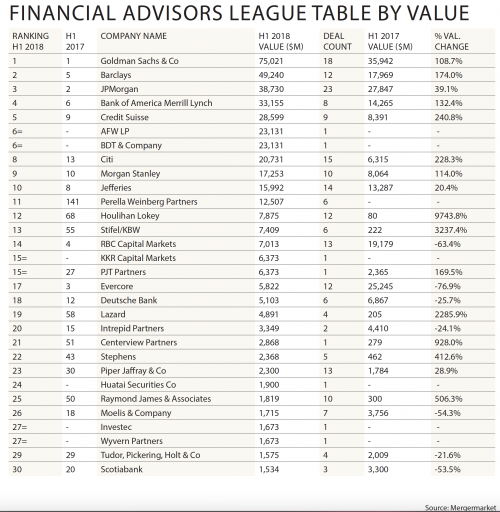

(Aug. 13) – Investment banking stalwarts Goldman Sachs and JP Morgan were the top financial advisors on deals involving Texas companies in the first half, according to Mergermarket data provided exclusively to The Texas Lawbook.

Goldman took the top spot in terms of value, handling $75 billion worth of deals in the period, more than twice the amount in the same period of last year. It was followed by number-two Barclays, which rose from fifth; third-ranked JP Morgan, which was second last year; fourth-ranked Bank of America Merrill Lynch, which came up from sixth; and fifth-ranked Credit Suisse, which jumped from ninth.

Newcomers AFW LP and BDT & Co. tied for sixth, having advised Keurig Green Mountain – which is owned by the billionaire Reimann family’s JAB Holdings – on its $18.7 billion purchase of Dallas-based Dr Pepper Snapple, along with Goldman. Citi came in eighth (from 13th), Morgan Stanley at ninth (from 10th) and Jefferies at 10th (from eighth).

AFW is led by Antonio Weiss, a former investment banker at Lazard who also was a counselor to the U.S. Treasury Secretary under the Obama administration. Chicago-based BDT is headed by Byron Trott, a onetime Goldman banker who has advised the Hyatt’s Pritzker family and billionaire Warren Buffett. Trott’s affiliate BDT Capital is investing in Dr Pepper alongside JAB, as he does with many of his deals.

JP Morgan, meanwhile, was the winner in terms of volume, working on 23 deals for Texas companies worth $38.7 billion, up from fourth in the same period last year. JPM was followed by Goldman at second (from 6th), Citi at third (from 16th), Jefferies at fourth (from third) and RBC Capital Markets at fifth (from 11th).

Rounding out the top 10 were Piper Jaffray at sixth (which was ranked first last year), Barclays at seventh (from eighth), Houlihan Lokey at eighth (versus fifth), Evercore at ninth (from second) and Morgan Stanley at 10th (from 15th).

Chad Watt, southwest bureau chief and energy sector head at Mergermarket, said Citi’s move up the charts is interesting but expected and Piper Jaffray falling off from the top spot is a function of slowing energy deals (it owns oilfield services-focused investment banker Simmons & Co. International).

“Simmons and other energy specialists are very busy, but it’s been challenging to get deals to transaction in the energy space,” he said.

Sanjiv Shah, a managing director at Simmons in Houston, said M&A activity in the U.S. land oilfield services sector in particular is in an unusual and paradoxical state.

A historically high number of middle market oilfield services companies have been trying to sell themselves, but a historically low level of active buyers are participating – primarily due to less generalist private equity interest in the industry, he notes. Also, these companies’ public share prices haven’t correlated to their rising earnings given higher oil prices.

“These public valuation multiples are often applied as benchmarks for private M&A transactions,” he said. “So, their compression has a cascading impact on M&A valuations and a widening of the proverbial bid-ask spread between buyers and sellers.”

Shah said the phenomenon is particularly true for Permian-focused service companies that are enjoying strong trailing earnings while simultaneously facing a valuation impairment caused by temporary midstream bottlenecks.

Steve Trauber, vice chairman and global head of energy at Citi in Houston, said there’s confidence in the boardroom again about M&A with stronger oil prices. But he said oil and gas exploration and production companies are being cautious about acquisitions after the negative reaction to the EQT-Rice and Concho-RSP deals given the high premiums paid, among other things.

“You’ll see a few deals get done as companies are realizing there is a premium in the public markets for size, which provides an incentive to look at consolidation more seriously,” he said. “But there won’t be an onslaught in the next 18 to 24 months.”

Among midstream companies, Trauber expects more entities to simplify their structures (he said Citi is working on some of them) and then consolidation can begin. He agrees with Simmons’ Shah that it’s been tough to get much M&A done in the oilfield services sector, although he thinks it needs consolidating as well.

“There are too many smaller companies that need to be pushed together so they can boost their liquidity, including 20 private ones valued at less than $1 billion that are up for sale,” he said. “We’re about six months away from some consolidation, although 80 percent of the private ones won’t get sold.”

Mark Deverka, head of acquisitions and divestitures at JP Morgan in Houston, agrees with Trauber that M&A trends are on the rise at both the asset and corporate levels, with a renewed vigor at management/board levels to investigate consolidation or monetization alternatives due to higher oil prices, the rebound in share prices and shareholder activism.

“Oil remains king over clean methane as the majority of long-only investors have picked Texas tea over natural gas in their investment thesis,” he said.

Rick Lacher, managing director at Houlihan Lokey in Dallas, said the M&A market has been good but he thinks it’s going to hit a bump in the road at some point, as it’s been difficult finding deals at reasonable values.

“It’s been a seller’s market with a lot of interest, which drives the price,” he said. “It’s also forcing people to want limited due diligence, doing it faster and taking some risks, with no escrow in some cases.”

Lacher said he’s starting to see distress in the healthcare industry, where companies borrowed too much and expanded too fast. “Distressed healthcare will lead companies to restructure or be sold,” he predicts. “We see opportunities there.”

Lacher acknowledged the recent movement of M&A lawyers from firm to firm given the vibrant Texas market but isn’t seeing the same level of activity in the investment banking community. He did note his bank’s recent hire of former Lazard dealmaker Nathan Pund, who is managing director in its consumer group in Dallas with a focus on the active lifestyle sector.

Other banker moves so far this year included Jonathan Cox, who left Morgan Stanley to join JP Morgan as global co-head of oil and gas investment banking and co-head of its Houston office. Paschall Tosch, who previously was co-head of oil and gas investment banking in Houston, will become vice chairman of investing banking.

Also, Ali Akbar, who specializes in midstream energy deals, left RBC Capital Markets for Greenhill & Co. earlier this year. He’s based in New York but spends a lot of time in Texas.