ONEOK’s $18.8 billion acquisition of Magellan Midstream Partners. Energy Transfer’s $7.1 billion purchase of Crestwood Equity Partners. Permian Resources’ $4.5 billion acquisition of Earthstone Energy. Ranger Oil’s $2.5 billion sale to Baytex Energy. And NexTier Oilfield’s $1.9 billion divestiture to Patterson-UTI.

Those five M&A deals from 2023 with a combined value of $35 billion were led by either Sean Wheeler or Debbie Yee — who are partners at Kirkland & Ellis in Houston — or were co-led by both of them.

Yee and Wheeler led more deals with a value of $1 billion or more than all but three law firms in Texas last year.

Ryan Maierson of Latham & Watkins and Steve Gill of Vinson & Elkins — both partners in Houston — are not far behind.

Maierson led or co-led four billion-dollar-plus M&A transactions for a combined deal value of $25.4 billion. In fact, he was the lead legal advisor for Magellan, sitting across the negotiating table from Wheeler and Yee, in an $18.8 billion oil and gas midstream deal.

The four billion-dollar-plus deals that Gill led or co-led had a combined price tag of $28.6 billion. He was the co-lead advisor for Crestwood opposite of Yee and Wheeler in the Energy Transfer transaction.

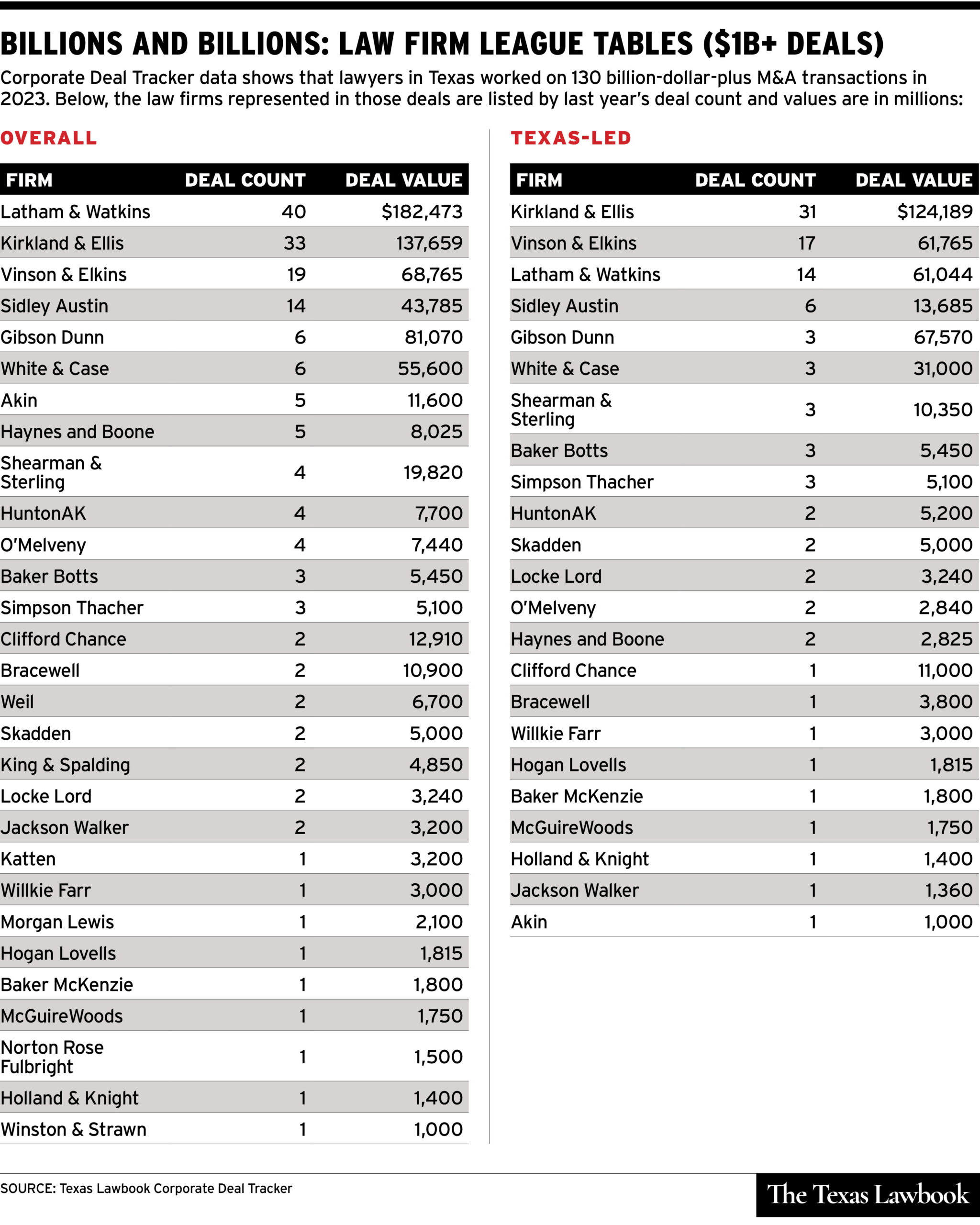

New data from The Texas Lawbook‘s exclusive Corporate Deal Tracker shows that Texas lawyers from those three law laws — Kirkland, V&E and Latham — led more billion-dollar M&A deals in 2023 than all the other law firms operating in Texas combined.

CDT data shows that lawyers in Texas worked on 130 M&A transactions with values of $1 billion or more in 2023 — meaning those Texas attorneys represented any party, from the buyers, sellers or targets (also known as the principals) to financial advisors, banks, private equity lenders, conflict committees and so forth. Of those 130, 69 qualify as Texas-led, meaning that a Texas lawyer was the lead or co-lead counsel for one of the principals. The 130 deals with values of $1 billion or more is the most in Texas history, according to CDT data.

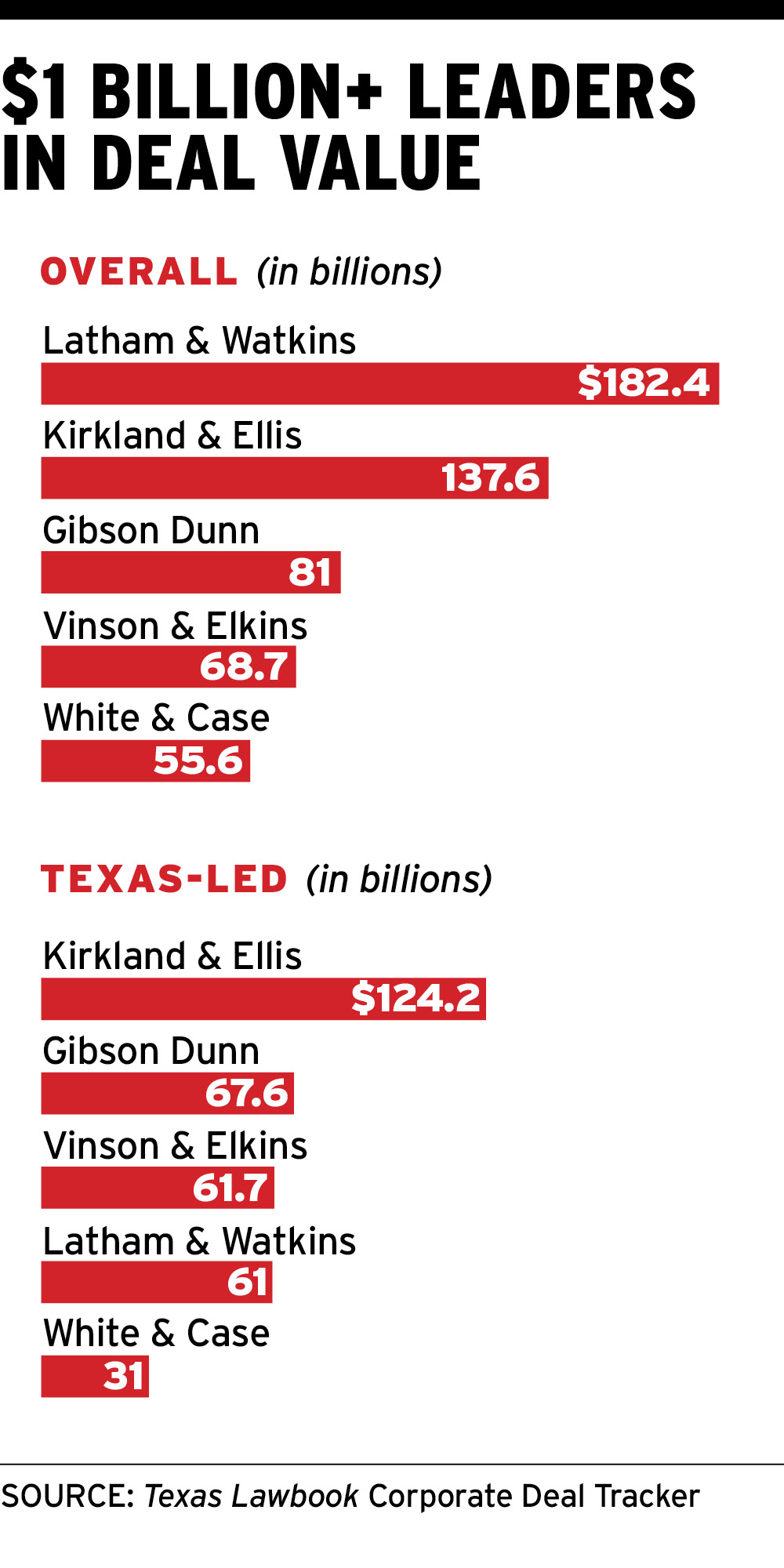

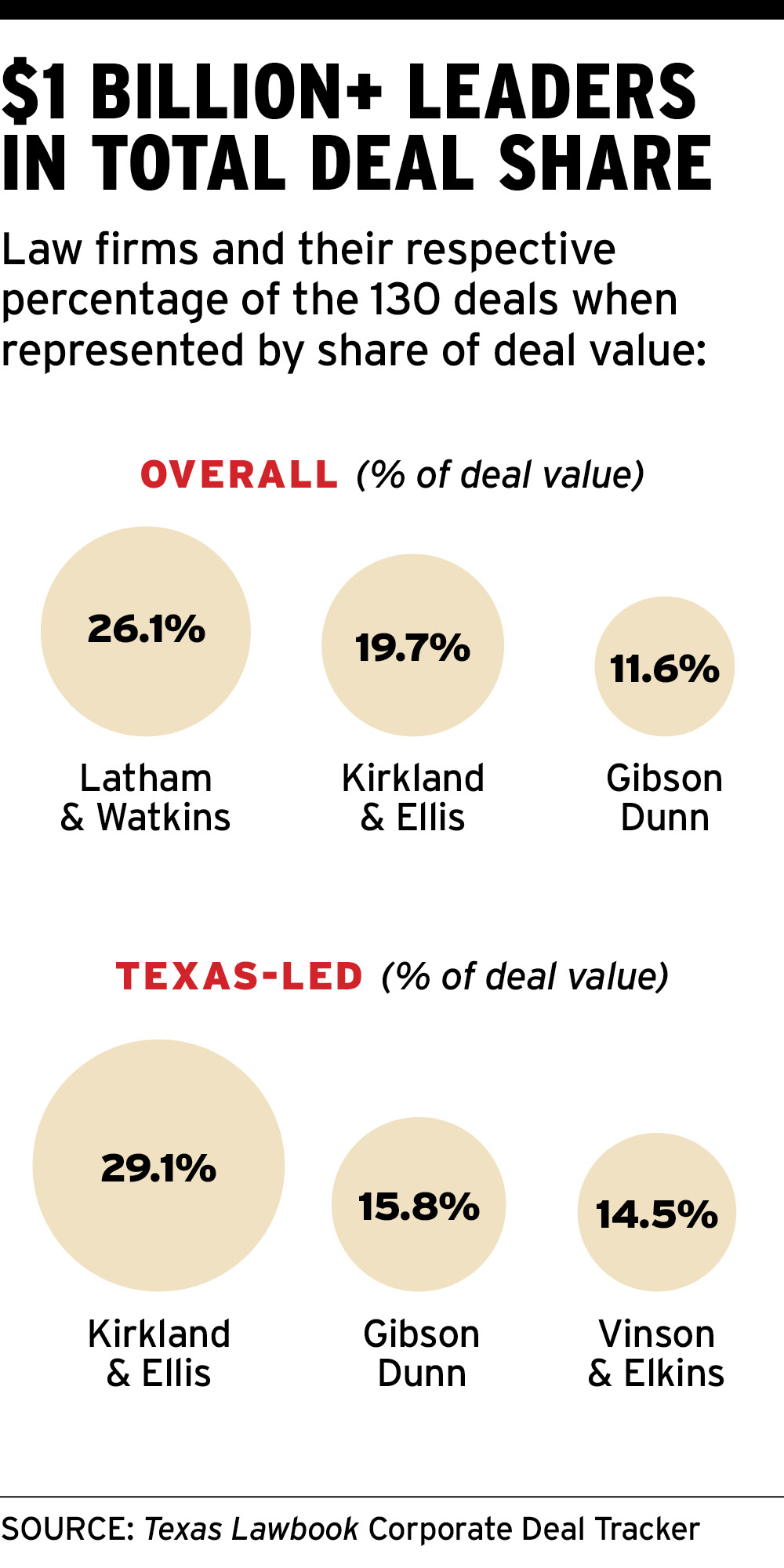

Texas lawyers for Kirkland were lead legal advisors for the buyers, sellers and targets, in 31 billion-dollar-plus deals in 2023 that had a combined deal value of $124.2 billion, according to CDT data.

V&E lawyers in Texas were lead counsel for the principals in 17 M&A transactions that were each valued at more than $1 billion.

Lawyers in Latham’s Houston and Austin offices led or co-led 14 billion-dollar-plus deals.

While CDT ranks Kirkland first in deal count and deal value for leading billion-dollar M&A deals, Gibson Dunn actually ranks second in total deal value.

Texas lawyers for Gibson Dunn were lead counsel for the buyers, sellers and targets in only three transactions valued at $1 billion or more, but Gibson Dunn partner Jeff Chapman in Dallas and Houston partner Tull Florey were the co-lead legal advisors for Pioneer Natural Resources in its $64.5 billion sale to Exxon Mobil, which was the largest M&A deal in the world in 2023.

In all, 23 law firms with lawyers in Texas were lead counsel for the principals in 2023.

Latham Rules on Overall $1B+ Work

While the biggest law firm paydays in M&A is representing the buyers, sellers or targets, there’s good money to be made advising third parties, including the financial advisors, lending institutions and conflicts committees.

CDT data shows that Texas lawyers at 29 law firms worked on billion-dollar-plus deals. Some were teams of lawyers representing the likes of Citibank, Goldman Sachs, JP Morgan Chase. Others were a handful of attorneys advising conflicts committees or third-party private equity investors.

A few of the Texas attorneys are specialists at large law firms, such as Latham, Sidley, White & Case, Akin or Haynes Boone, who have an expertise in corporate tax or executive compensation or environmental regulations or an area of law unique to the specific transaction.

There are a handful of non-Texas M&A deals — led lawyers at large global law firms in New York, London or Chicago — where the partners simply need more bodies to handle due diligence or other matters and they turn to attorneys in their Dallas or Houston offices for assistance. Those lawyers may only bill five or 50 hours on the deal, but they are still being paid $1,000 an hour and it is great experience for younger Texas attorneys. And it still counts on the Corporate Deal Tracker.

To be clear, the CDT recognizes these Texas lawyers and their firms because it demonstrates both the depth of the firms’ benches in Texas and that the Texas lawyers on these firms’ rosters have expertise that dealmakers across the U.S. want to utilize.

The two law firms whose Texas lawyers fell into one of these categories most often in 2023 are Latham and Sidley Austin.

Latham’s lawyers in Texas worked on 40 deals with a value of $1 billion or more in 2023, which is the most of any law firm. The combined value of those 40 transactions was $182.5 billion. Slightly more than two dozen of those transactions were representing third parties or were deals led by Latham lawyers outside of Texas.

Texas lawyers for Sidley worked on 14 billion-dollar deals — eight of those were either for third parties or were transactions led by non-Texas dealmakers. In six of the 14 deals, Sidley lawyers in Texas represented the buyers, sellers or targets, including Dallas partner Kristen Smith who advised Clearlake Capital Group in its $4.4 billion acquisition of Alteryx.

Overall, four law firms — Latham, Kirkland, V&E and Sidley — had Texas lawyers who worked on more than 70 percent of the 130 billion-dollar M&A deals.

Lawyers in the Texas offices of Gibson Dunn and White & Case each worked on six deals valued in the billions of dollars, while Akin and Haynes Boone were both involved in five $1 billion-plus transactions.