Litigation spend by Texas companies with revenues of $1 billion or more has soared more than 300 percent in 12 years, according to global law firm Norton Rose Fulbright’s annual trends survey of corporate general counsel.

Texas respondents reported spending an average of $3.9 million in 2023, with about 66 percent allocated for outside counsel, the firm shared. And general counsels said they expected to boost their in-house litigation teams citing insufficient staffing levels and inadequate internal technology resources, Norton Rose added.

The post-Covid era has ushered in a new wave of potential factors for the ballooning figure, said Rachel Roosth, firm partner in Houston, and Steven Jansma, the San Antonio-based head of litigation and disputes, in an interview with The Texas Lawbook. The amount excludes settlement and judgment costs.

The litigation spend by Texas companies with revenues of $1 billion or more averaged $889,000 in 2011 and climbed to $1.2 million in 2016 before reaching $3.9 million last year.

Risk management costs are believed to be included in the $3.9 million, Jansma said, based on the way the question was posed in the survey, which questioned more than 400 in-house legal professionals in the U.S. and Canada. The firm also conducts interviews with its clients to gather more detailed information, Jansma added.

The firm heard from clients that plaintiffs attorneys seem to be more aggressive post-covid at billboard and television advertising, Jansma said. More “aggressive” is also how Jansma described plaintiffs’ handling of cases from evaluation to deciding whether and when to go to trial. Defendants have felt the need to respond by sending a message that they aren’t afraid of going to court, Jansma said.

“I think all of those factors that I’ve mentioned have really driven up defense costs for the companies doing business in Texas,” Jansma said.

Roosth added that the courts are still chipping away at the backlog of cases that built up during the pandemic, which she suggests has an effect on costs. Large complex cases don’t seem to be getting as many preferential docket settings, she said. Those settings have historically helped parties know when they’ll be going to trial.

“So we might end up prepping for trial multiple times because we’re on a long list of a trial docket,” Roosth explained. “We prep with that trial date coming up and then don’t get called, so then we’re pushed back to another day, we prep again. Each time we have to prep for trial, that’s expensive.”

Roosth has also noticed clients seem less eager to settle cases than they used to be, and she wonders if that’s also a product of “riding the docket.”

“When trial is coming up, that is a time that really makes parties think about their cases … but because we’re not getting those preferential trial settings as much as we used to, it’s not as much of a hard deadline,” Roosth said.

Another factor to consider, Roosth said, is an increase in national and international firms entering the Texas market. Clients have more and more expensive outside counsel options to hire, Roosth said.

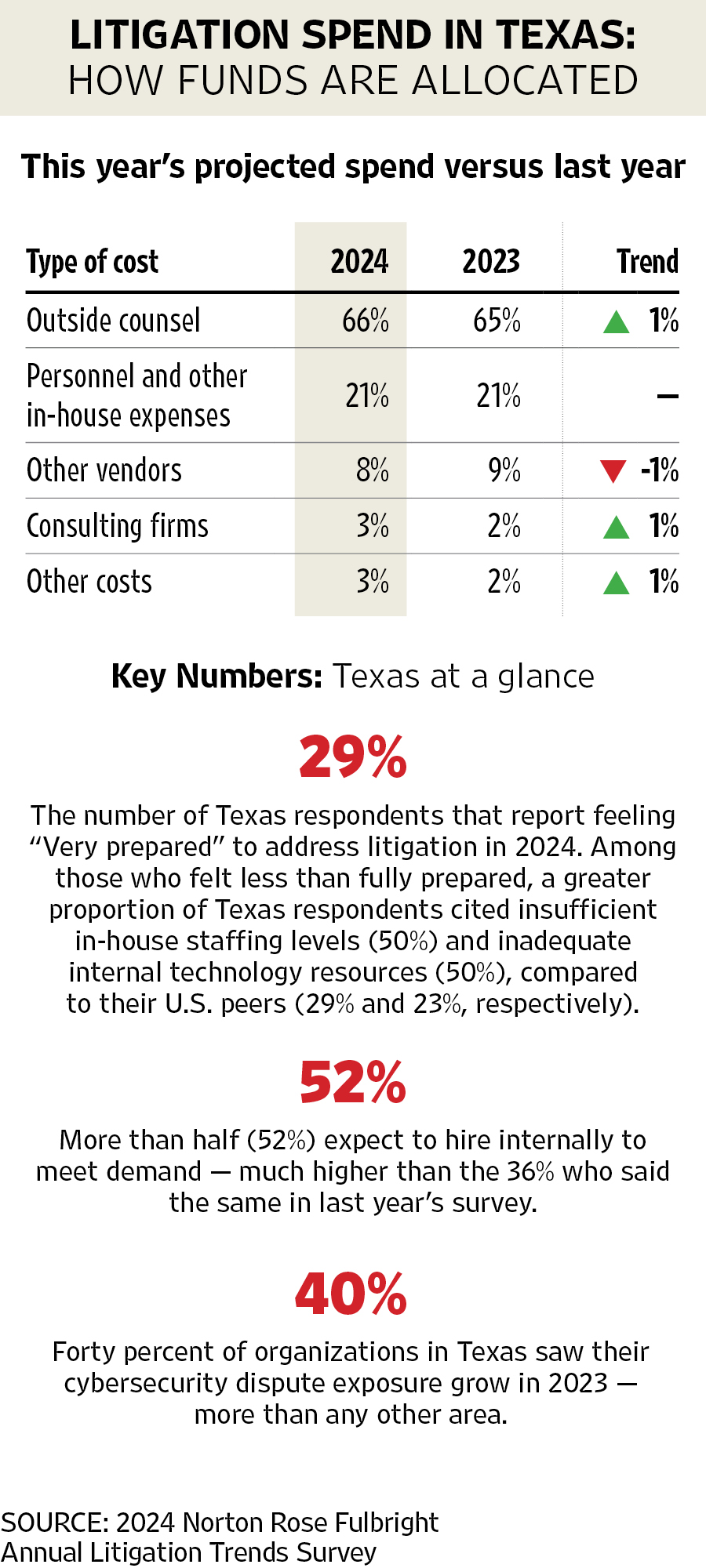

Texas survey respondents shared that 66 percent of their litigation spend in 2024 is allocated for outside counsel. The rest of the breakdown is as follows: 21 percent for personnel and other in-house expenses, 8 percent for other vendors, 3 percent for consulting firms and 3 percent for other costs.

Forty-two percent of responding general counsels expect the volume in litigation will increase, the survey shows, and 52 percent of respondents anticipate they’ll hire internally to meet demand (up from 36 percent of respondents who said the same last year).

In-house staffing issues and inadequate technological resources were of concern to a greater proportion of Texas respondents than overall U.S. respondents.

Twenty-nine percent of Texas respondents said they felt “very prepared” for litigation in 2024, but of those who felt less prepared, 50 percent of Texas respondents pointed to insufficient in-house staffing levels compared to 29 percent of their U.S. peers. Fifty percent of Texas respondents who felt less than fully prepared also cited inadequate technology resources, compared to 23 percent of U.S. peers who also felt less prepared.

Cybersecurity and energy matters, as well as environmental, social and governance disputes, are among the top concerns of general counsels.

Similarly to their peers in other states, 40 percent of Texas respondents saw their cybersecurity litigation exposure grow last year. Cybersecurity was the area with the most increase in dispute exposure.

Significantly, more Texas companies (13 percent of organizations) faced ESG lawsuits in 2023 than they did in 2022 (2 percent). Concern for ESG matters is also more prevalent in Texas than the rest of the country. Only 1 percent of Texas respondents said ESG disputes were “not relevant,” compared to 12 percent of U.S. respondents.

Roosth suspects the concentration of energy companies in Texas is a factor in ESG concerns. Perhaps unsurprisingly, she said, Texas respondents were also more involved in energy disputes than those in other states. Twenty-four percent of Texas respondents handled energy litigation versus 10 percent of overall U.S. respondents, Roosth said.

“The energy industry has been ahead of the curve on analyzing ESG issues and analyzing whether there are disputes coming down the pipeline and figuring out how to mitigate that risk,” Roosth said. “That being said, ESG is a really broad category of disputes. Social and governance are all covered with that and so that can include cybersecurity issues and workplace safety and human rights issues. There’s a lot that’s covered under the ESG umbrella. It really is relevant to all companies but in Texas, where there’s the higher energy focus, respondents seem to understand that more.”