Whatever else may have happened in the Texas-related capital markets during 2024, the deals they represented left behind some unnervingly easy math.

How else would you explain a year in which all the major numbers, even after filtering, are divisible by 10: 470, 320, 140 and 10?

But here we go: In 2024, there were 470 individual capital markets transactions: 320 were debt offerings, 140 were equity issues, and 10 were convertibles in some form.

These are all based on what’s actually reported to The Texas Lawbook Corporate Deal Tracker, but as a statistic, 2024 ranks better than 2023 (329 deals) or 2022 (265 deals) and only one transaction short of the landmark year following the pandemic: 2021 (471 deals).

As is true of most years, debt issues, at 68 percent of the deal count, outnumbered equity offerings about 2 to 1. But that doesn’t mean there weren’t some interesting trends and transactions alongside the usual reshuffling of debt.

- Of the 470 CapM deals involving Texas, 261 (55%) were energy-related.

- There are 25 IPOs issued by Texas companies or advised by Texas lawyers.

- In 395 of the transactions, at least one principal party — issuer or underwriter — was advised by a team led by one or more Texas lawyers.

- The largest transaction was an $11 billion secondary offering in June by the Saudi Arabian Oil Company engineered by White & Case involving Houston partner Taylor Pullins.

- The smallest transaction was a $4.95 million PIPE placement advised by Haynes Boone Dallas partner Matt Fry for Brand Engagement Network.

- The largest IPO handled involving a Texas lawyer was the $4.4 billion initial issue in July by Lineage Inc., a frozen storage REIT advised by Latham & Watkins with a team that included several lawyers from their Houston office.

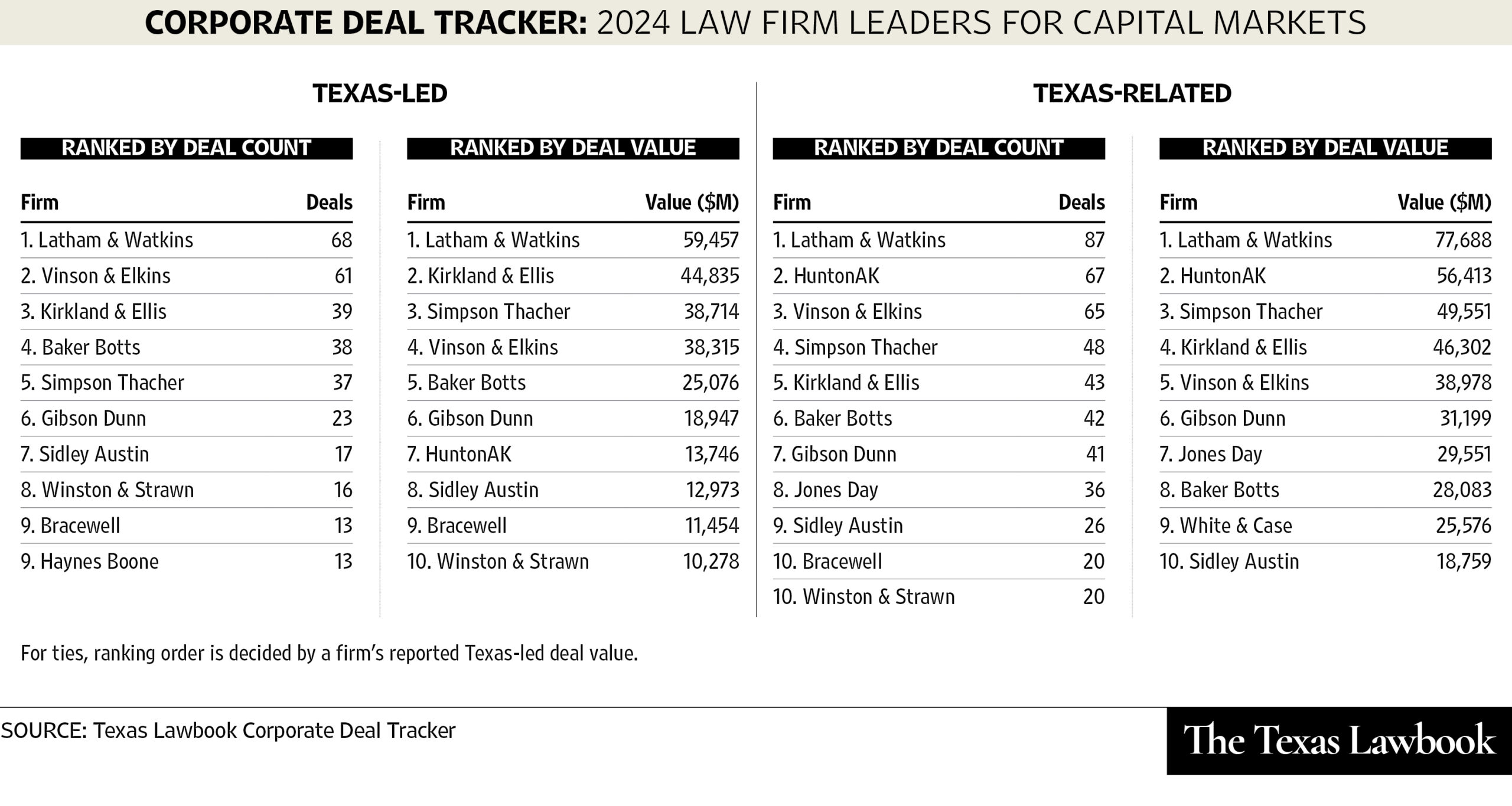

Which brings us to our Texas-related capital markets rankings, which were dominated in 2024 by Latham & Watkins. Whether our exclusive “Texas-led” listing or our broader “Texas-related” category, whether in deal count or deal value, Latham dominated.

Latham claimed a share in 87 of the 470 unique transactions and 68 of the 395 Texas-led deals. They also led in aggregate deal value for both categories, claiming $77.7 billion in the Texas-related category and $59.5 billion in total for their Texas-led deals.

Latham advised in 87 of the 470 transactions. In 38, they were on the issuer’s side; in 49, they were on the side of the agents and purchasers. And 59 of Latham’s capital markets transactions were energy-related — the largest, a $5.5 billion slate of debt offerings in April 2024 by Diamondback. The debt offerings, led by partners David Miller and Michael Chambers, were issued to support Diamondback’s $26 billion acquisition of Endeavor Energy announced two months earlier. The deal was closed in September 2024.

In the most prestigious category, Texas-led transactions, it was Vinson & Elkins that followed Latham in deal count with 61 at $38.3 billion. Kirkland followed Latham in deal value with a total of $44.8 billion in 39 transactions led by their Texas-based lawyers.

But there is another way of looking at capital markets: those who represent the issuer. If we total only those firms who advised the issuer, the same three firms are represented, but in an entirely different order:

- 1. Vinson & Elkins with 40 deals valued at $22.1 billion

- 2. Kirkland & Ellis with 38 deals at $44.3 billion

- 3. Latham & Watkins with 33 deals at $33.4 billion

- 4. Baker Botts with 25 deals at $18.6 billion

Two Texas-founded firms rivaled by the Texas offices of two national firms.

It’s a very, very interesting list.

In the meantime, you will see below the Lawbook law firm leaders for capital markets from last year for both Texas-led and Texas-related transactions. Also, don’t forget that premium subscribers can search our data in the master list for CapM transactions from 2024.