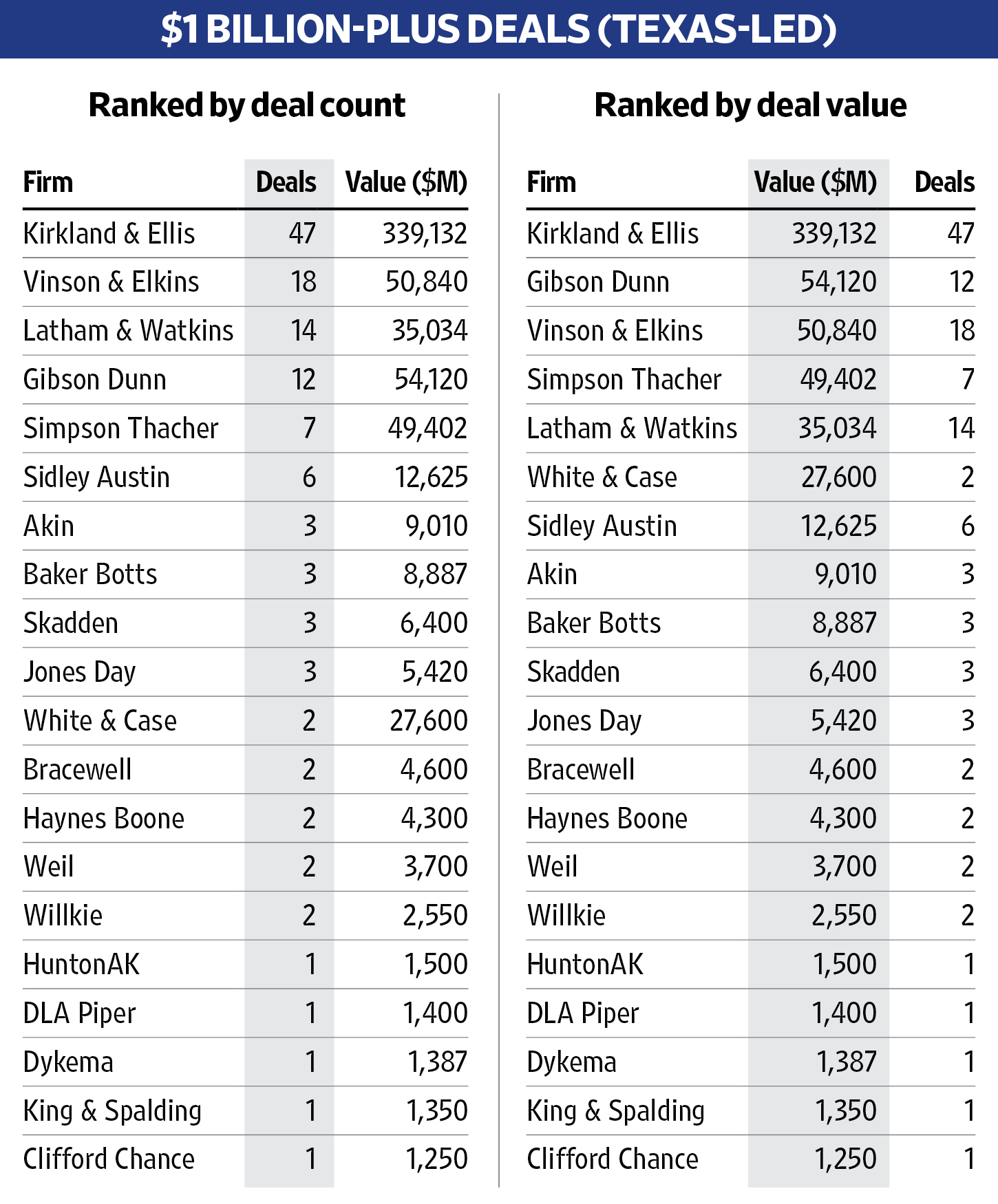

The Texas lawyers at four law firms — Kirkland & Ellis, Vinson & Elkins, Latham & Watkins and Gibson, Dunn & Crutcher — were the lead legal advisors in the majority of mergers, acquisitions, joint ventures and divestitures valued at $1 billion or more last year.

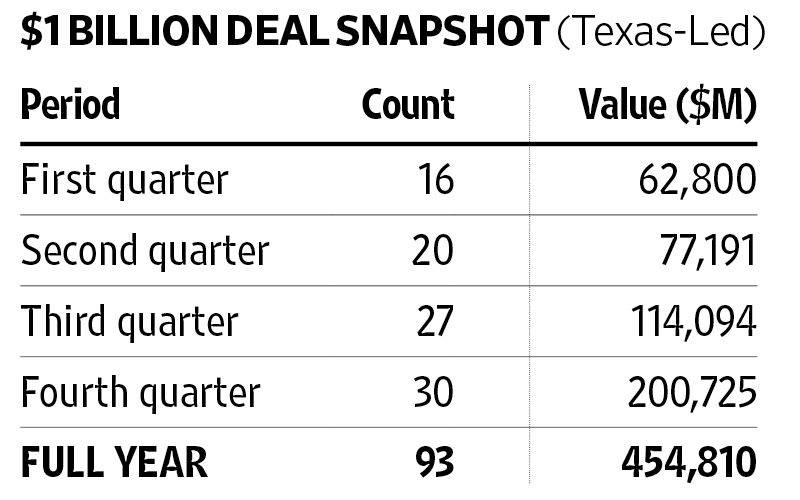

In fact, attorneys in the Texas offices at those four large corporate law firms were lead counsel for the transactions principals — buyers, sellers or targets — in 67 of the 93 M&A deals in 2025 that had a value of $1 billion or more, according to new data from The Texas Lawbook’s Corporate Deal Tracker.

The Houston, Dallas and Austin offices of Kirkland were the lead legal advisors for one of the principals on 47 of those transactions.

Houston-based V&E ranked second, with 18 instances where its lawyers served as lead legal advisors on 10-digit deals for the principals. Texas lawyers for Latham & Watkins ranked third with 14, while Gibson, Dunn & Crutcher placed fourth with a dozen.

In all, the CDT shows that 20 law firms operating in Texas had their Lone Star lawyers lead 93 deals for the principals that were valued at $1 billion or more. Fifteen of those 20 firms were the lead legal advisors in two or more of those transactions.

Five of the 20 law firms — V&E, Akin, Baker Botts, Bracewell and Haynes Boone — are headquartered in Texas. The other 15 are based or were founded outside of the state.

WEEKLY CDT NEWSLETTER: Click here to sign up now so that you don’t miss the first of multiple stories over the next few weeks that examine Texas lawyers and their dealmaking.

The CDT tracks M&A deal activity of lawyers in Texas no matter if the clients are based in The Woodlands or Hell for Certain, Kentucky. The CDT divides the Texas legal advisors into two categories: those who led or co-led the transactions for the principals and those represented financial advisors, conflicts committees, investment banks or other third parties, which are described as Texas-related.

Eight of Kirkland’s 47 Texas-led transactions had deal values of $10 billion or more. The Texas attorneys for Gibson Dunn led two megadeals with price tags of $10 billion or more, while White & Case and Simpson Thacher each led one megadeal.

The 93 Texas-led billion-dollar deals had a combined value of $454.8 billion, according to the CDT database.

Kirkland’s 47 $1 billion-plus transactions had a combined $339.1 billion in deal value, which is an astonishing 74.5 percent of the $454.8 billion.

The Texas lawyers for Gibson Dunn are second in the billion-dollar-plus deal value ranking at $54.1 billion. V&E is ranked third with a combined deal value of $50.8 billion. Ranked fourth is Simpson Thacher, whose Houston office led seven billion-dollar M&A transactions with a combined value of $49.4 billion. Latham is fifth with $35 billion in deal value for its 14 Texas-led transactions.

Jeff Schnick contributed to this report.

Coming This Week

On Wednesday, The Texas Lawbook will publish the Corporate Deal Tracker 2025 M&A rankings of Texas lawyers by deal count and deal value in transactions that were valued at $1 billion or more. The CDT measures law firm and lawyers rankings by two formulas: Those who were the lead legal advisors for the transaction for the buyers, seller or targets; and the second measurement includes those who represent any party to the deal, including financial advisors, conflicts committees, investment banks and others.

Throughout the month of January, The Lawbook will roll out the 2025 law firm and lawyer rankings for M&A and CapM.