There were two women Texas deal lawyers who led billion-dollar mergers and acquisitions in 2016, and only one ranked in the Top 20. That same year, Kirkland & Ellis had only one partner ranked among the Top 10 Texas-based lawyers who served as lead legal advisors on transactions that topped $1 billion, and only five lawyers on the full list of 43.

What a difference a decade has made.

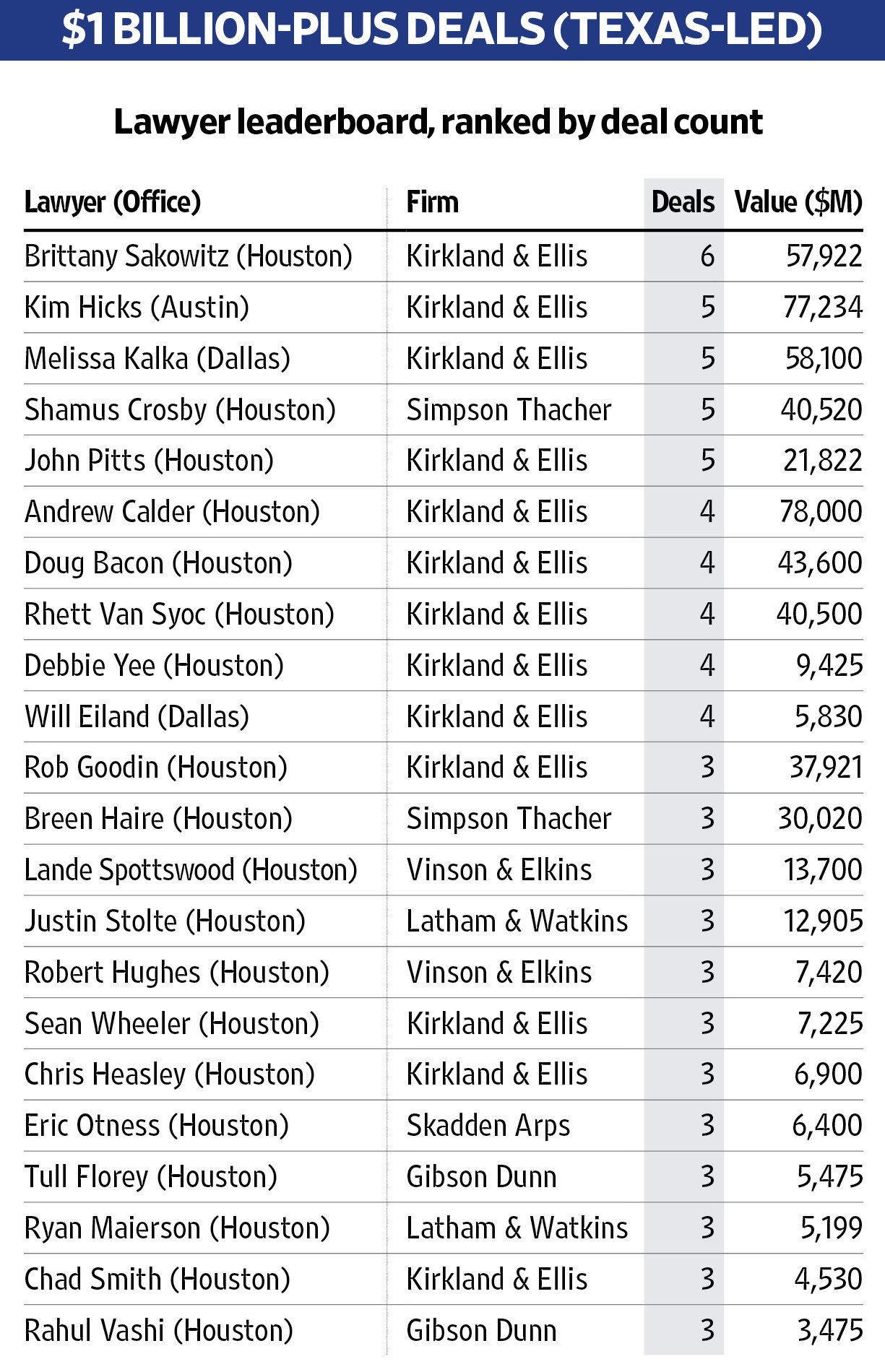

The Texas Lawbook’s exclusive Corporate Deal Tracker data shows that, in 2025, 135 lawyers in Texas led or co-led billion-dollar deals for buyers, sellers or targets. The highlights of the 2025 CDT data include:

— Twenty-two Texas women lawyers led M&A transactions with a value of $1 billion or more last year;

— Four women lawyers ranked among the Top 10 billion-dollar dealmakers, including the Top 3;

— Forty-nine of the 135 led two or more billion-dollar deals;

— Thirty-eight of the 135 attorneys are lawyers at Kirkland, including nine of the Top 10;

— Twenty-one Texas attorneys at Vinson & Elkins, including Lande Spottswood, Robert Hughes and Doug McWilliams, led billion-dollar deals;

— Fifteen lawyers in the Texas offices of Latham & Watkins — including Justin Stolte, James Garrett and David Miller — and a dozen attorneys for Gibson Dunn — including Rob Little, Jeff Chapman and Tull Florey — were lead counsel in 10- and 11-digit M&A transactions; and

— Five Texas lawyers led five transactions with deal values of $1 billion or more.

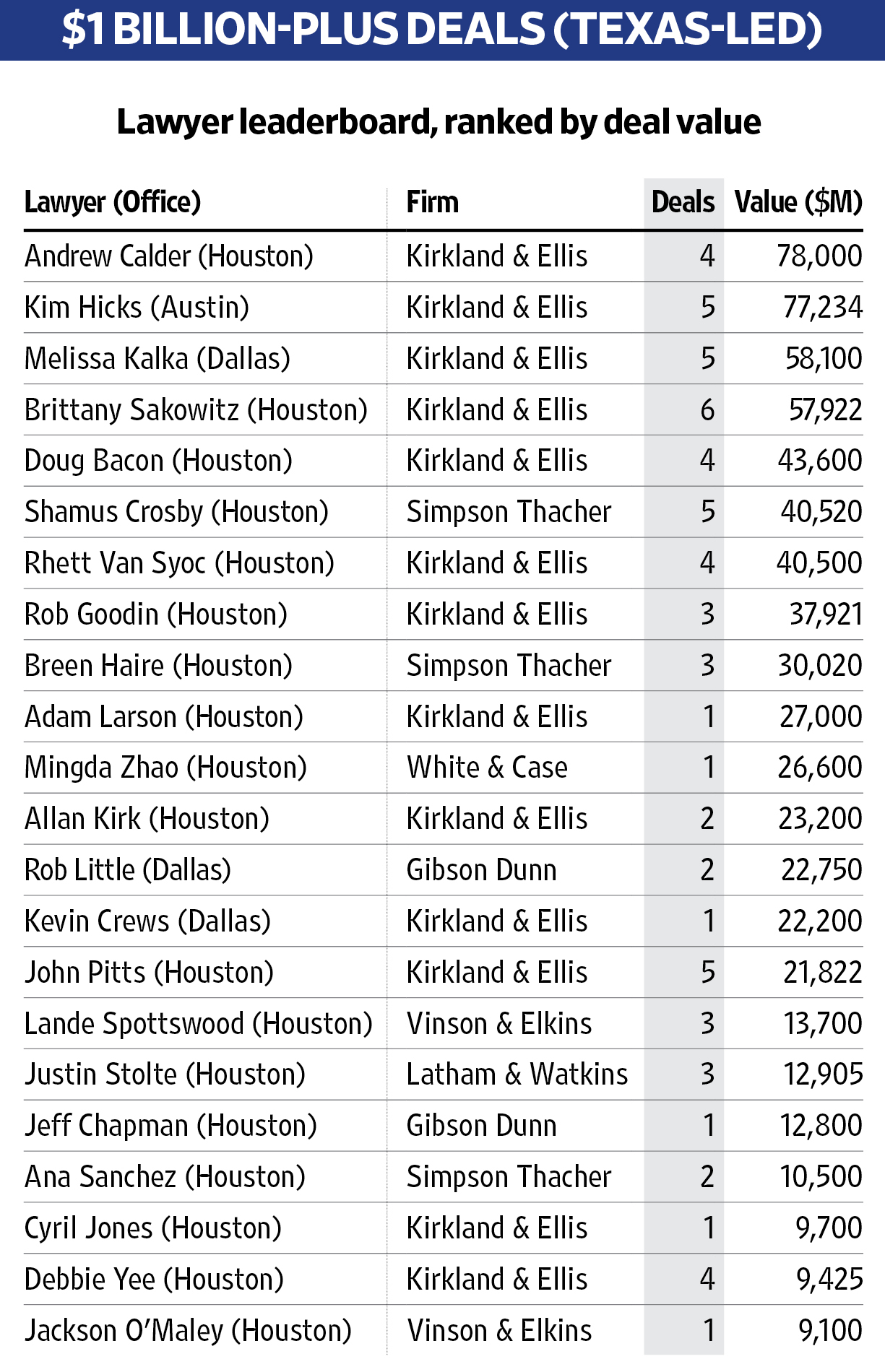

There is one similarity with 2016 and 2025: The same Texas lawyer — Kirkland partner Andy Calder — ranked No. 1 in M&A deal value, according to CDT data.

The CDT tracks M&A handled by Texas attorneys, no matter if the clients are based in Fort Worth or Cowtown, New Jersey.

Kirkland partner Brittany Sakowitz of Houston sits atop the 2025 CDT leaderboard for billion-dollar M&A deal count, with six transactions that had a combined value of $57.9 billion. Sakowitz was co-lead counsel with fellow Kirkland partner Adam Larson for New York-based Blue Owl Capital in its $27 billion acquisition of Meta Hyperion.

Sakowitz was also co-lead counsel with Kirkland Austin partner Kim Hicks for Brookfield Infrastructure Partners in its $9 billion purchase of Colonial Enterprises.

Hicks, according to CDT data, ranked second in 2025’s billion-dollar deal count rankings with five transactions.

Three other Texas lawyers — Kirkland partners Melissa Kalka of Dallas, John Pitts and Andy Calder of Houston and Simpson Thacher partner Shamus Crosby — each led or co-led five transactions valued at $1 billion or more.

Crosby was co-lead counsel with partner Breen Haire in representing the private equity firm KKR in its $22.2 billion purchase of Sempra Infrastructure Partners.

Calder ranked No. 1 in billion-dollar deal value, with four transactions that had a combined price tag of $78 billion. Calder was co-lead counsel with Kalka in Artificial Intelligence Infrastructure Partners’ $40 billion acquisition of Plano-based Aligned Data Centers.

Jeff Schnick contributed to this report.