Twenty-six North American oil and gas producers have filed for bankruptcy so far in 2019 – 20 of them in the last three months, according to a report released Wednesday by Haynes and Boone.

The firm blames low commodity prices for the rise in bankruptcy activity.

“Natural gas and natural gas liquids prices continue to remain depressed,” the firm said. “Since the beginning of 2019, oil has been range bound in the $50s without any clear indication that prices are heading north anytime soon.”

The firm said it’s too early to predict a new wave of filings based on the recent number of oil and gas producer bankruptcies this summer, but it’s clear that some stakeholders of producers financially wounded by the crash in 2015 may have given up hope that resurgent commodity prices will “bail” everyone out.

“For these producers, the game clock has run out of time to keep playing ‘kick the can’ with their creditors and stakeholders,” the firm said.

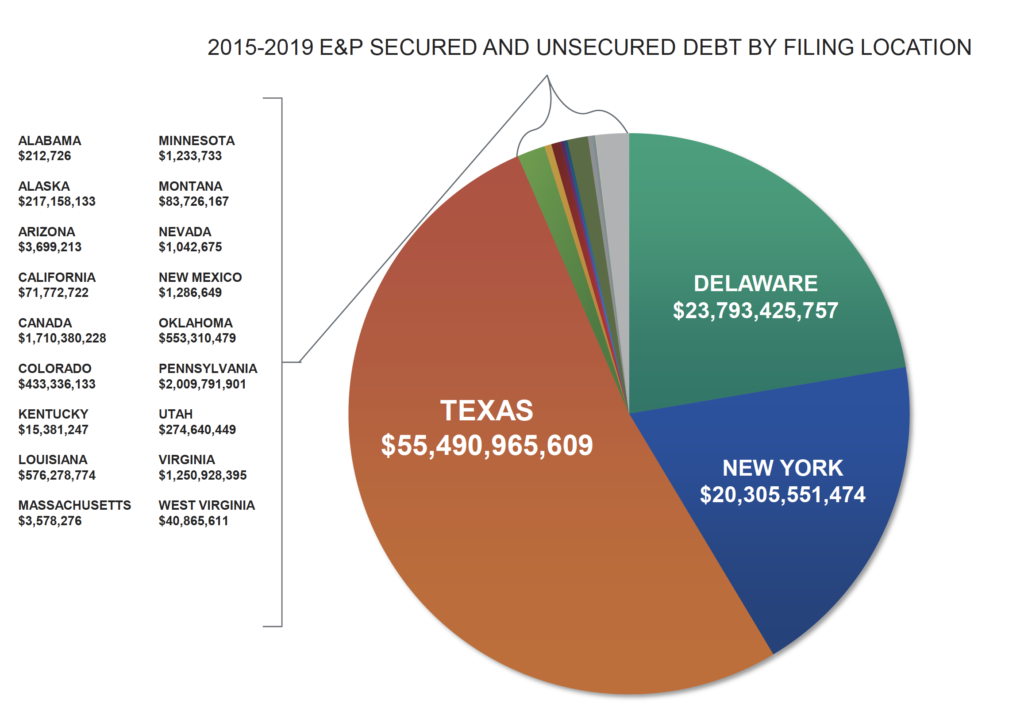

Since Haynes and Boone began tabulating oil and gas filings in 2015, there have been 192 producers that have filed for bankruptcy involving around $106.8 billion in debt.

Texas has seen the most E&P bankruptcies by far – 87 since the start of 2015 – followed by Delaware at 31, Colorado at 10, Louisiana at 9, New York at 8, Oklahoma at 6 and California at 5. Canada has seen 18 bankruptcies.

In terms of debt by filing location, Texas tops the list again at $55.49 billion followed by Delaware at $23.79 billion and New York at $20.3 billion.

Oilfield services, or OFS, also has been hit with Chapter 11’s but not as hard, with 185 bankruptcies since the beginning of 2015 and debt amounting to $65 billion.

Between the beginning of 2018 and the second quarter of this year, OFS bankruptcy filings decreased in number (22 filings) and in debt ($11.5 billion) compared with 2017, which saw 40 filings and debt of $35 billion, Haynes and Boone found.

“We note the July 2019 filing of Weatherford [and] the announced reductions of drilling programs and observe that the OFS sector is in a trough,” the firm said.

Texas has had the most OFS bankruptcies since the beginning of 2015 at 98 with debt of $26.6 billion, followed by 17 in Delaware ($15.86 billion) and 10 in New York ($21.6 billion). Canada had seven.

The midstream sector hasn’t suffered the same level of distress experienced by E&P or OFS companies, Haynes and Boone said, with 27 midstream companies filing for Chapter 11 bankruptcy in the U.S. since 2015 involving around $21.3 billion in secured and unsecured debt.

Again, Texas won the top prize with 11 midstream bankruptcies involving $9.6 billion in debt followed by seven in Delaware ($3.78 billion) and three in New York ($5.8 billion).