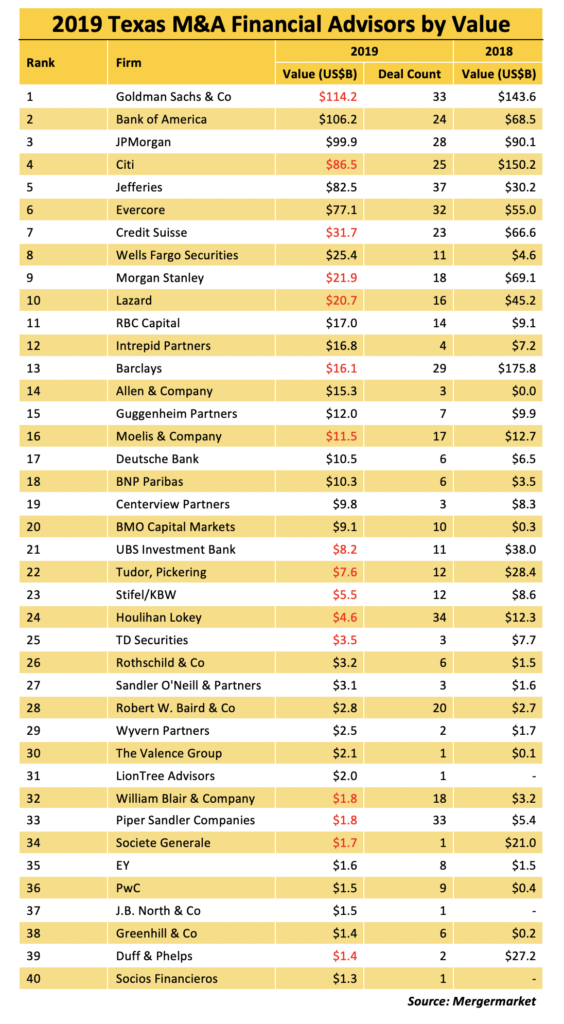

Goldman Sachs regained its crown as Texas’ king dealmaker last year on a value basis handling $114 billion worth of transactions, displacing Barclays, according to Mergermarket data provided exclusively to The Texas Lawbook.

The New York investment banking giant, which came in third in 2018, was followed in the dollar ranking by Bank of America, which rose to second place from sixth; JP Morgan, which climbed a notch to third; Citi, which fell to fourth from second place; and Jefferies, which jumped from 12th to 5th.

The remaining banks in the top 10 in terms of value were Evercore, Credit Suisse, Wells Fargo Securities, Morgan Stanley and Lazard.

Jefferies was the winner in terms of deal count handling 37 transactions, up by 3 over 2018. The investment bank was followed by Houlihan Lokey at 34 (also up by 3), Goldman at 33 (down by 10), Piper Sandler at 33 (down by 3) and Evercore at 33 (up by 2). Rounding out the top 10 were Barclays, JP Morgan, Citi, Bank of America and Credit Suisse.

Slowing merger and acquisition activity has led some investment banks to lay off personnel, most notably Evercore. At the end of January, the independent investment banking advisory boutique announced it was dismissing 6% of its staff in the first quarter — or more than 100 people — after reporting a slight slide in revenue.