Looking at the Fort Worth skyline and prairies beyond the office windows, Marianne Auld can see the geographical manifestation of a key asset for Kelly Hart & Hallman, a 40-year-old firm with Texas roots.

“Yes, absolutely, being in Fort Worth and Texas does add value,” said Auld, managing partner at the firm with a list of nearby clients that includes the Bass family, American Airlines, Justin Brands and BNSF railroad. “It helps to know local businesses, the court system and the culture.”

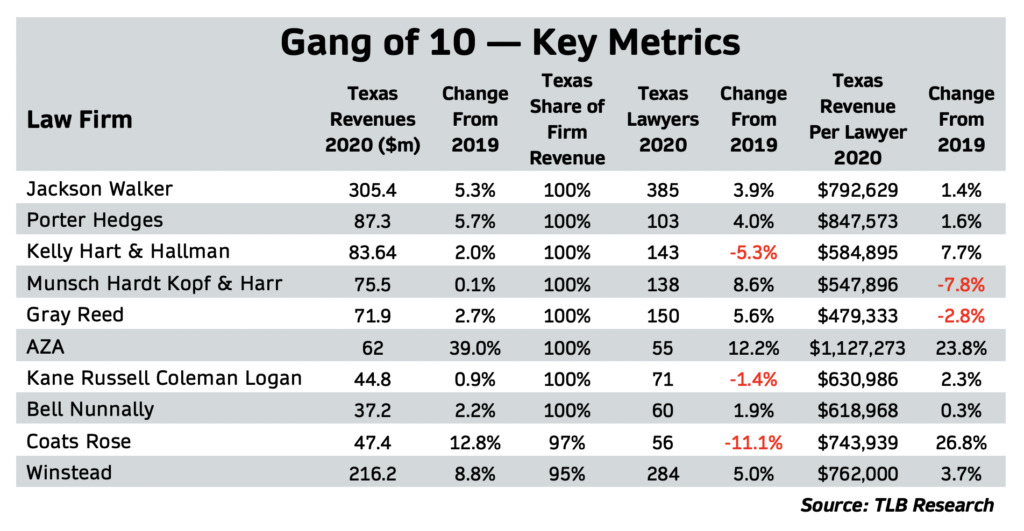

In 2020, Kelly Hart was one of eight Texas-based Lawbook 50 firms generating 100% of their revenues in the state. Coats Rose approached 97%. Winstead was at 95%.

We dubbed these firms the Gang of 10 to set them apart from the rest of the 18 Texas-based firms in the Texas Lawbook 50, our annual review of corporate law firm’s finances. The Gang of Six, our other cluster of Texas-based firms, differs markedly in geographic scope, generating between 30% and 80% of their revenues out of state.

The Gang of 10 shared one thing in 2020, a year disrupted by a global pandemic, recession and unprecedented stresses on businesses of all types. All increased revenues, every one of them, suggesting a certain strategic wisdom in staying close to home. By contrast, five of the eight other Texas-based firms had lower revenues than the previous year.

“This was an opportunity to prove value,” Auld said. “Many of our client relationships strengthened. It turned out to be a remarkably good year – as weird as it was.”

The Gang of 10’s unanimity has carried over into 2021. In response to a recent Texas Lawbook survey of firms based in the state, all reported revenues for the first half of the year were higher than the same period in 2020. All expect to continue doing better in the final six months and finish this year ahead of last year.

“It has been a pretty amazing year,” said Phil Appenzeller, CEO at Munsch Hardt, which posted only a slight revenue gain last year. “It has been hard keeping up with all the work. All the pent-up demand from 2020 is being felt now.”

Finding the Right Niche

At around $1.8 trillion, the Texas economy is big and diverse, and it has been growing faster than other big states for decades. Companies are moving into the state on a weekly basis. For corporate law firms, Texas’ bustling economy means an expanding market – this is what attracted dozens of out-of-state firms to Texas in the past decade.

It’s also key to the Gang of 10 firms’ ability to grow while doing all or nearly all their work without leaving the state.

It turned out to be a remarkably good year – as weird as it was.”

— Marianne Auld

The Gang of Six offers a cautionary tale. They established national and even global footprints, expanding practices to compete in U.S. corporate law’s big leagues. The business model is why a dozen or so big home-grown firms dominated the Texas market a decade ago, each with a full menu of practices. The cost of keeping up with the competition rose sharply when wealthy out-of-state firms opened Texas offices and bid up the pay of top lawyers.

Rather than trying to build a national footprint and play in big leagues, the Gang of 10 firms each maintains a comfortable and, in some way, specialized space in the state’s legal market.

For Kelly Hart, it’s being Fort Worth’s premier local firm. Dallas’ Jackson Walker has done well as an ally of Chicago-based Kirkland & Ellis on bankruptcy and restructuring work in Texas. Houston’s Ahmad, Zavitsanos, Anaipakos, Alavi & Mensing (AZA) operates a litigation boutique that grew Texas revenues faster than all but one other Lawbook 50 firm.

Staying in Texas hasn’t shielded the Gang of 10 from the influx of new competition. Many out-of-state middle-market firms – among them, Polsinelli, Baker Hostetler and Perkins Coie – joined the big national firms in seeking a piece of Texas’ expanding legal market. Like the Gang of 10, the non-Texas firms have found their niches and increased revenues.

2020: Running Out Front

Not venturing outside Texas means most Gang of 10 firms accept limits on size. In 2020, only Jackson Walker ($305 million) and Winstead ($216 million) ranked among the Top 10 in the Lawbook 50. The rest of the Gang operated on a more modest scale, with Houston-based Porter Hedges next in line at $87 million, then down to Dallas’ Bell Nunnally in the 10th spot at $37 million.

On a per firm basis, Gang of 10 revenues were a third the Gang of Six billings in 2020. Despite the gap, the Gang of 10 firms fill an important role in the state’s corporate law. Among the Lawbook 50, they employ about a fifth of the lawyers and account for almost a sixth of revenues. In comparison, the Gang of Six had about a quarter of both lawyers and revenues.

Taken together, the Gang of 10 firms produced just more than $1 billion in revenue in 2020, a gain of almost 7% over the previous year. They outperformed the overall Lawbook 50 (up 4%) and the larger, geographically expansive Gang of Six (down 3%).

Two Group of 10 firms had big years. AZA increased revenues 39%, better than any other Texas-based firm and behind only New York-based Simpson Thacher (58%) in the Lawbook 50. Coats Rose was the other Texas-based firm with a double-digit gain – up 13%.

Revenues rose in single digits for the rest of the firms, led by Winstead (8.8%), Porter Hedges (5.7%) and Jackson Walker (5.3%).

The Gang of 10 had a net increase of 42 lawyers, a rise of 3%. That represents two-thirds of the Lawbook 50’s gain of 65 lawyers. Perhaps more notable, these 10 firms accounted for all the growth in attorney jobs among the Lawbook 50’s Texas-based firms. The collective headcount fell 1.6% for the 18 Texas-based firms in the Lawbook 50 and 4.6% for the Gang of Six.

A handful of Gang of 10 firms added more than 10 lawyers – Jackson Walker at 15, Winstead at 14 and Munsch Hardt at 11. In percentage terms, the most active were AZA at 12% and Munsch Hardt at 9%. Coats Rose saw a decline of seven lawyers (11%) – in a year when its revenues shot upward by 13%.

Two other firms ended 2020 with fewer lawyers than they started – Kelly Hart and Kane Russell Coleman Logan (KCRL).

By and large, the Gang of 10 firms didn’t generate gaudy revenue per lawyer numbers. Only AZA, a firm doing a lot of alternative fee work, eclipsed $1 million. Otherwise, RPLs ranged from $847,543 at Porter Hedges down to $479,000 at Gray Reed. Even with AZA, these 10 firms produced a weighted-average RPL of $709,793 – which would rank 41st among the Lawbook 50.

“We have figured out our price point in the market and our clients know we are a good value,” Appenzeller said. “A lot of partners are getting priced out of the market at their current firms.”

2021: Looks Even Better

In 2021, Gang of 10 firms are anticipating more growth in revenue and lawyer ranks. AZA had an extraordinary year in 2020 – but if contingency fees hit the books on time, it expects to beat it this year. AZA’s litigation practice has been busy on healthcare, trade secret and patent cases.

Each member of the Gang of 10 has its own story to tell in 2021. Real estate development, leasing, hospitality and real estate M&A, restructuring and litigation have been especially active at Munsch Hardt.

Busy practices include litigation, labor and employment and oil and gas at Kelly Hart, business litigation, corporate and bankruptcy at Porter Hedges, real estate, corporate, bankruptcy and real estate at KCRL and life sciences, healthcare and litigation at Winstead.

“2021 is looking fantastic,” Winstead Chairman David Dawson said. “We’ve added 38 attorneys for eight different practice areas, and the demand is absolutely there to keep them all busy. Some of these lawyers come from smaller law firms and some come from Am Law 100 firms and they want to be entrepreneurial and some who want a shorter path to be a shareholder.”

Tying Up Some Loose Ends

Our two Gangs, one with six members and the other with 10, include 16 or the 18 Texas-based firms in the Lawbook 50. We dropped Thompson & Knight because it merged this year with Florida-based Holland & Knight. In 2020, the Dallas firm did more than 90% of its work in Texas, with declines of 8% in headcount and 9% in revenues.

Chamberlain Hrdlicka simply didn’t fit well in either Gang. It had the geographic footprint for the Gang of Six – 57% of its revenue came from non-Texas work. With revenues of $51 million in 2020, it’s much smaller and more specialized than the rest of the Gang of Six.

Chamberlain Hrdlicka increased its lawyer headcount 7% in 2020 but its revenues fell almost 4%. Revenues were weaker out-of-state than in Texas.

Managing shareholder Larry Campagna is optimistic about 2021. “Last year was a rollercoaster,” he said. “Our work and revenues are clearly up this year. Our lawyers are very busy. We are interested in adding corporate and securities and M&A lawyers.”

Earlier this month, Part 1 of the series looked at how 18 Texas-based firms fared on key financial metrics in 2020, plus a midyear survey on expectations on head counts and revenues in 2021.

Last week, Part 2 of the series focused on the six big Texas-based firms trying to compete against the nation’s top firms in Texas and elsewhere.

Today, Part 3 of the series surveyed 10 Texas-based firms that aren’t among the financial titans of corporate law. They’ve found a niche in the Texas legal market and managed steady growth.

Up next, Part 4 of the series will reveal the twist The Lawbook found when trying to determine whether Dallas or Houston can claim to be the capital of Texas corporate law.