As a growing population continues to apply pressure on the state’s infrastructure needs, Texas public finance practices remained busy in 2022.

While rising interest rates made certain types of bonds less desirable, there continues to be an increasing need for more schools, more hospitals, more roads, and more public transportation — all of which are funded primarily by municipal bonds.

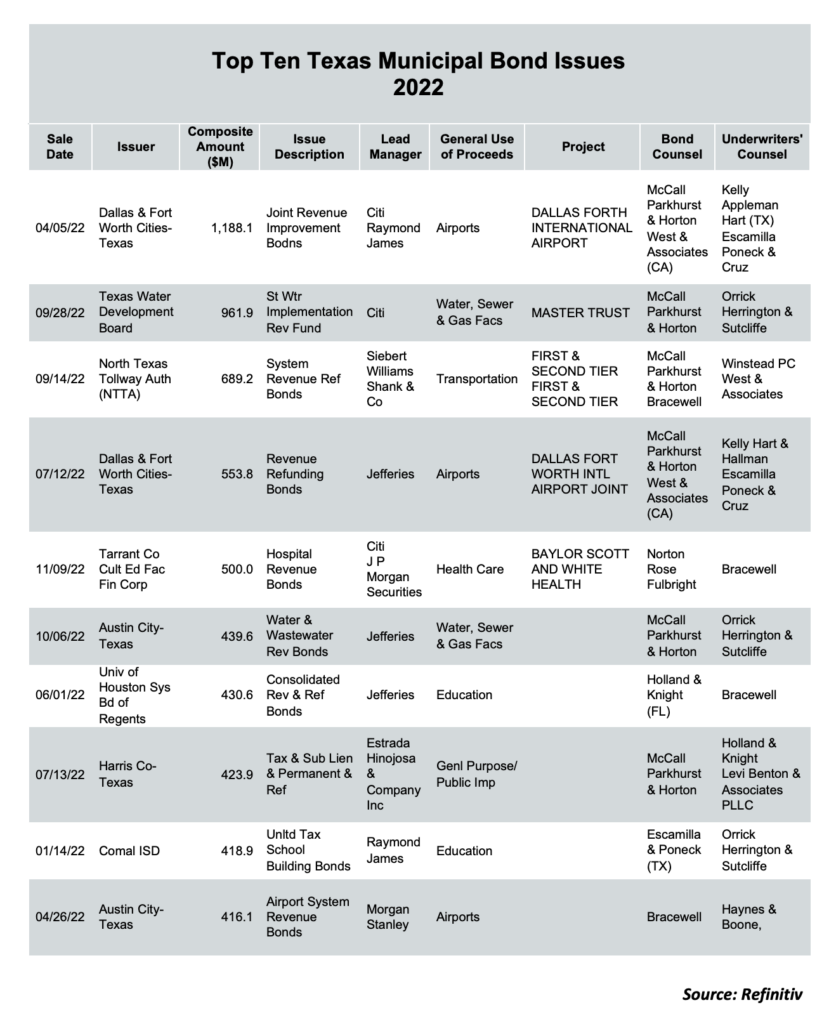

In 2022, there were 1,250 issues totaling $46.38 billion, according to Refinitiv Deals Intelligence, a slight dip from 2021, when 1,683 municipal bonds were issued for a total par amount of $49.85 billion. But these numbers — though down in both issue and value — represent new bond activity, not all bond deals.

“I think at the end of the day, 2022 was still a very strong year,” said Mark Malveaux,” managing partner at Dallas-based McCall, Parkhurst & Horton, said. “If we can do another 2022, I don’t know if people would be complaining.”

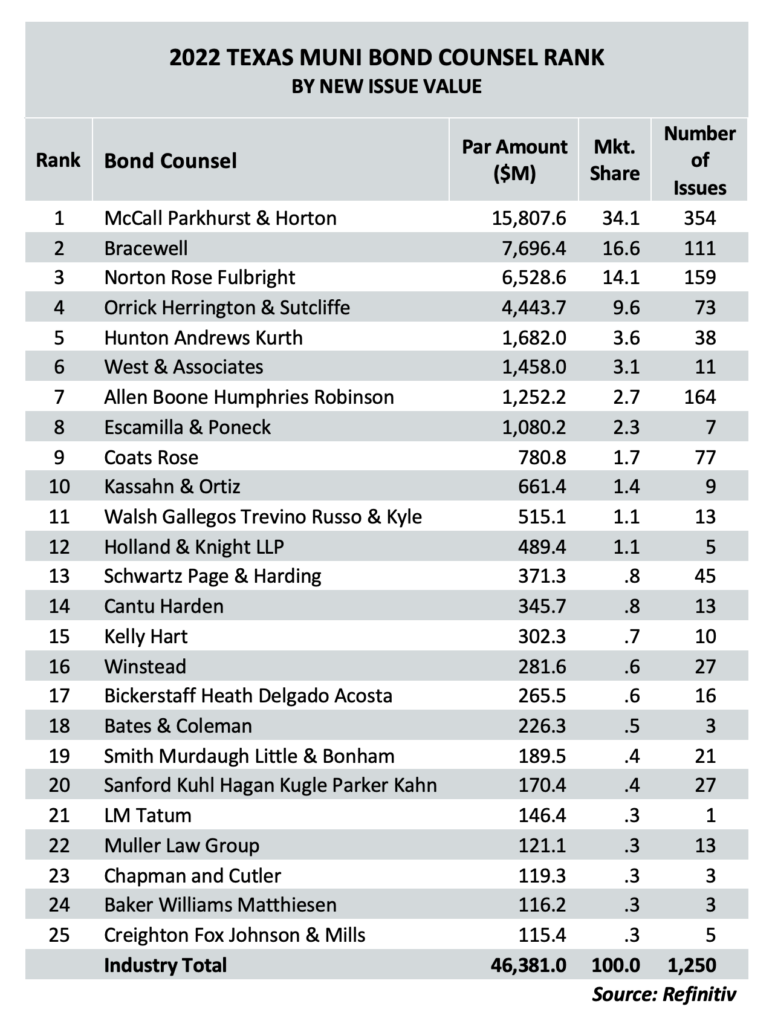

McCall, Parkhurst and Horton had the largest market share of Texas bond work in 2022, acting as bond counsel to 354 issues totaling a par amount of $15.8 billion. The firm had the second largest market share for underwriters’ counsel.

Rounding out the top five firms for bond counsel in market share, were Bracewell, Norton Rose Fulbright, Orrick Herrington & Sutcliffe and Hunton Andrews Kurth, according to Refinitiv.

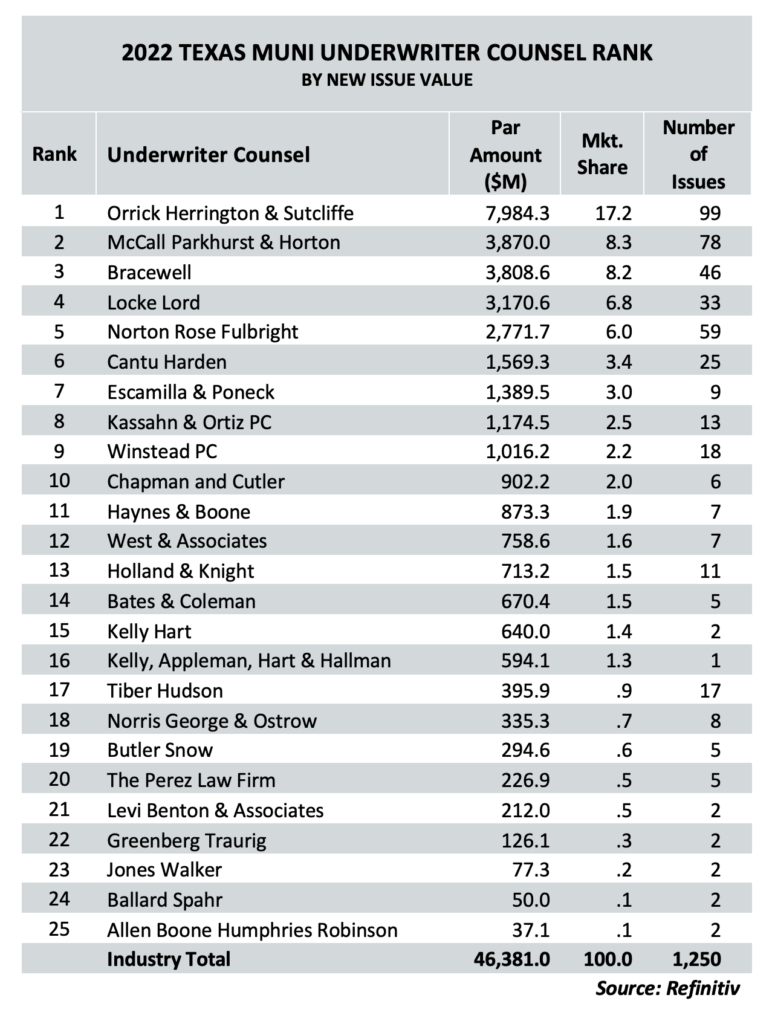

Orrick Herrington & Sutcliffe held the top spot for underwriters’ counsel, followed by McCall Parkhurst, Bracewell, Locke Lord and Norton Rose Fulbright.

Public finance attorneys attribute part of the slight dip to the rise in the interest rate environment. For new debt deals, interest rates typically have less of an impact for large issuers, Malveaux said. Though larger issuers try to tailor their financings to their needs, interest rates have an influence on timing.

“If a school is overpopulated, they need to build a school,” Malveaux said. “ For new money financings, the number one driver is probably not rates, but rates are probably second in terms of timing. I think some of the deals that weren’t done in 2022 for whatever reason, will get done in the first quarter of 2023.”

Looking ahead to 2023, the demand for new money, while impacted by higher rates, is still there, Malveaux said.

Rising interest rates in 2022 made issuers question whether they wanted to be in the market at that moment, said Barron Wallace, a partner in Bracewell’s public finance practice.

“We did see less refundings,” Wallace said. “[In] the third and fourth quarter, things picked up just a little bit. There were quite a few school district bond elections, quite a few other types of transactions, and the housing sector seemed to be strong throughout the year. Overall, we considered a successful year with some challenges in terms of interest rates.”

Bracewell advised on $7.70 billion in bond issues, the second largest market share of bond counsel workin 2022. The firm ranked third largest in underwriter counsel marketshare.

A 2017 change in federal tax law eliminated the ability to refund tax-exempt bonds in advance. In 2020 and 2021, nistorically low interest rates prompted historical high volumes of bond issues, as issuers refunded and refinanced previously issued bonds to take advantage of savings through low interest rates. Many used taxable refundings to achieve advanced refundings.In 2022, rising interest rates no longer provided the same savings opportunities through refinancing for both tax exempt and taxable bonds as in previous years.

“We hardly saw any taxable refundings last year, so that seemed to me to indicate that the ability to do some of the advanced refundings went down,” Wallace said.

A lot of issuers are actively pursuing transactions, and a number of them are thinking about bond elections, Wallace said.

“I think they may have gotten used to the fact that we’re in a slightly different interest rate environment and moving forward capital plans,” Wallace said.

While no one can predict the market, public finance attorneys weren’t surprised by the drop in refunding or the dip in new debt.

“Things were fairly predictable,” said Adrian Patterson, partner and Houston office leader at Orrick, Herrington & Sutcliffe, describing 2022. “I think we may have been seduced in some ways over many years with super low rates, particularly during Covid when the Fed was keeping rates down.”

As interest rates increased, some issuers paused on issuing new debt if they were able to.

“[Issuers] refinanced everything they could because rates have been so low, and a lot of political subdivisions have gotten the benefit of all of this federal stimulus money,” Patterson said. “They don’t need to issue bonds as much, aside from capital needs some have, because they’re certainly sitting on a lot of cash that’s come from like Covid Cares Act.”

While interest rates may have contributed to a slow down, the state’s growing infrastructure needs ensured that public finance practices remained busy in 2022 and into 2023. Patterson pointed to the high number of bonds elections held in May and November, 2022, giving local governments and agencies the authority to issue more bonds, and the expectation of more municipal bonds issued in 2023 and beyond.

“That’s a forward-looking indicator,” Patterson said.

Orrick represents the Houston and Harris County public transportation provider, METRO. In 2019, voters approved a nearly $3.5 billion bond proposal by METRO, none of which has been issued yet, Patterson said. Both Harris County and the City of Houston passed billion- dollar bonds referendums in 2022 as well.

“We’ve all seen the data that nationally, bond deals were off last year,” said Paul Braden, Norton Rose Fulbright’s head of public finance. “While there were fewer deals in Texas, it wasn’t as big of a drop as nationally.”

In Texas, NRF was either bond or underwriter counsel for 218 issues totaling $9.3 billion paramount.

While the number of deals the NRF’s public finance practice was involved in 2022 was slightly less that 2021, there was revenue growth when compared to the prior year, Braden said.

Public finance attorneys are also seeing an increased use of public improvement districts, a type of financing tool for fast growth areas to help build out infrastructure. PIDs have been more prevalent in North Texas, but are becoming more popular south and central Texas, said Braden.

“We’re one of the first firms involved and we’re still one of the leaders in that field, and that’s been a real lucrative area that we’ve seen a lot of clients gravitate towards,” Braden said.

PIDs are similar to municipal utility districts, or MUDs, in that they are both used to finance infrastructure, though MUDs require additional approvals through the Texas Commission on Environmental Quality.

While PIDs have been around for some time, they’ve gained popularity in the last three or four years, said Braden. Even as interest rates have increased, their practice has had a steady stream of PID work

While the infrastructure and accompanying need for dollars to finance project remains, higher interest rates and new financing tools aren’t the only issues keeping public finance work interesting.

The state’s permanent school fund is quickly reaching its federally capped guarantee for school bonds. Legislation was introduced in Congress late last year to raise those guarantees, but the bills did not make it into year-end legislation. The Internal Revenue Service could still raise the cap with a private letter ruling.

Because of the federal cap, many school districts that would normally issue bonds with a PSF guarantee, were denied, Bracewell’s Wallace said. The last time the cap was raised was in 2009. Without a guarantee from the PSF, school districts would pay millions for insurance on those bonds.

“It’s definitely something we’re dealing with right now, and of course it raises the borrowing rates for our school districts, which ultimately means that they have to pay more in an interest cost.”

At NRF, some clients are asking about products that went out of vogue when interest rates were low, Braden said. These more sophisticated products haven’t been as common over the last ten years, but some issuers are starting to talk about these alternatives again.

“They’re still issuing bonds, they’re building projects and they’re trying to build them as soon as reasonably possible in order for them to get as much bang for the buck,” Braden said.

“Everything that’s old is new again, and people are starting ask about variable rate debt where you can get a lower interest rate, but it’s floating, and what can you do in terms of putting that in or a commercial paper program where you don’t issue the bonds all at once.”

Public finance attorneys are also keeping an eye on the legislature foranything that concerns public finance bonds, whether it makes it easier or harder to issue debt, or easier or harder to pass bond elections.

In 2021, the Texas legislature passed two laws SB 13 and SB 19, which disallowed the state from doing business with companies that discriminated against energy companies or the firearms industry. Several large banks took themselves out of the market.

On January 18, the Texas attorney general’s office released a letter stating that it determined that Citigroup has a policy that discriminates against the firearm industry. “Until further notice, we will not approve any public security issued on or after today’s date in which Citigroup purchases or underwrites the public security, or in which Citigroup is otherwise a party to a covered contract relating to the public security” the letter said.

Braden said he is concerned about the effect of the legislative policy behind the letter.

“We are very sympathetic to Citibank and other banks that have served the Texas bond market for years and now find themselves on the sidelines through no fault of any of the bankers who worked on all those deals, and all the good work they put in,” Braden said. “I think the less competition is not a good thing in the long run, and at some point, Texas bond issuers should be concerned if there are less banks calling on them and providing services and good ideas and bidding on their bonds to drive down interest rates. I don’t think we’re there yet, but it’s a concern the industry is paying attention to.”

In the meantime, public finance attorneys will continue helping their clients issue bonds. At the end of the day, municipal bond issuers aren’t trying to play the market, Braden said. Whether or not interest may rise or fall, they issue the debt so they can begin working on needed projects.

“I think as long as we continue to have the economic growth and the people moving to our state, you’ll still have state and local government issuers having to finance needed infrastructure and that typically is meant for the issuance of debt,” Braden said.