The 40-Year Legacy of Pennzoil v. Texaco — An Appeal for the Ages

Executives at Texaco woke up Nov. 20 — exactly 40 years ago today — like it was the morning after aliens attacked in the movie Independence Day. A day earlier, a Houston jury ruled the New York-based oil and gas giant had tortiously interfered with a 1984 agreement Getty Oil made to merge with Pennzoil and awarded Pennzoil $10.53 billion. Texaco’s stock took a beating — dropping from $80 per share when the litigation started to $32 the week following the trial. Some Wall Street analysts were openly warning about bankruptcy. The company’s convertible bonds plummeted in value. Texaco’s debt rating was cut by Standard & Poor’s. Interest accruing on the judgment was $2.8 million every single day.

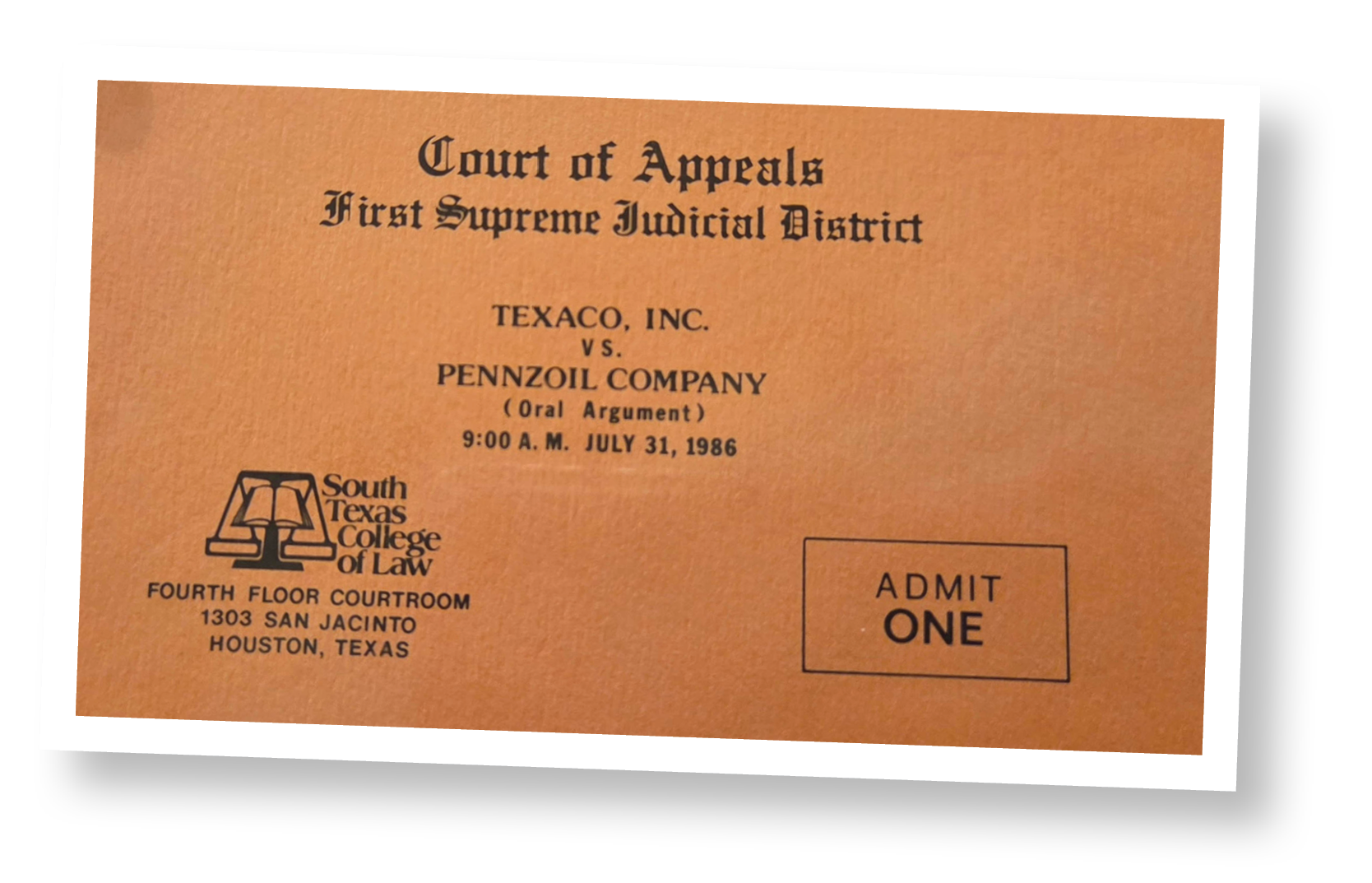

Between Thanksgiving 1985 and Christmas 1987, the two energy companies and their ever-expanding roster of litigators did battle. The litigation itself multiplied, including a precedent-setting federal case in New York over Texaco’s appeals bond, a monumental appellate battle, a bizarre decision by the Texas Supreme Court, the world’s largest corporate bankruptcy at the time and a historic settlement.

Both sides hired major reinforcements — fresh legs and fresh eyes, if you will — as the trial teams had been going full speed for 21 straight months. The appeals team for Texaco beefed up with several heavy hitters from Fulbright & Jaworski and David Boies of Cravath in New York. Pennzoil added a Texas superstar in V&E’s Harry Reasoner and Laurence Tribe of Harvard Law School.

In Part II of our series looking back at the significance of the Pennzoil v. Texaco trial, The Lawbook examines the post-verdict appeals, which were historic and precedent-setting.