Prospects for mergers and acquisitions may seem bleak for 2020 given the spread of COVID-19, the resulting uncertainty in the financial markets and the fall in oil prices. But overall deal work for Texas lawyers was already evaporating last year.

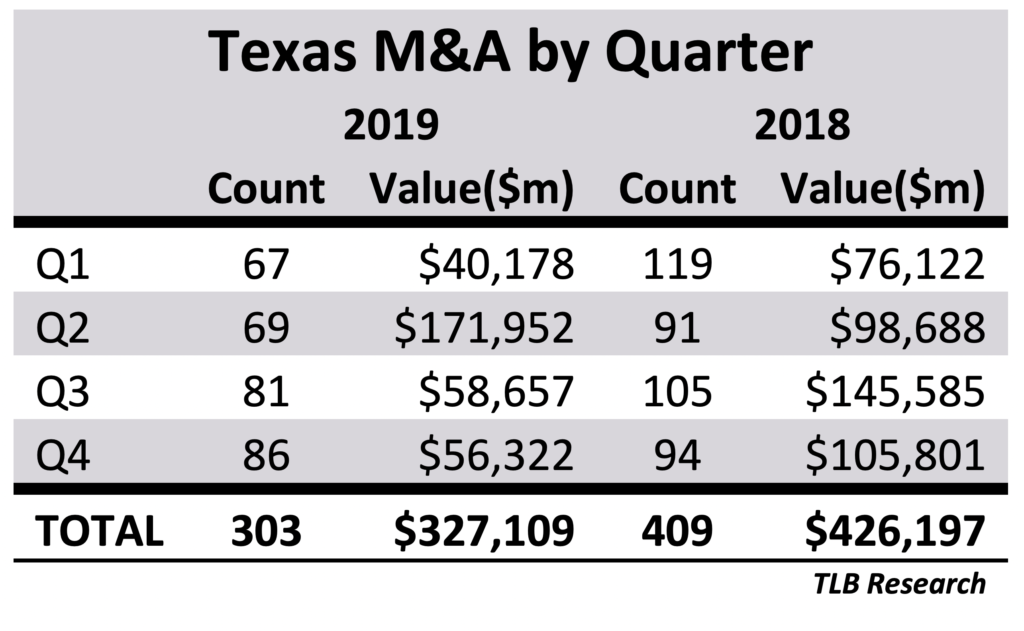

According to exclusive data collected by The Texas Lawbook’s Corporate Deal Tracker, or CDT, there were 303 non-confidential deals handled by Texas lawyers last year, down a quarter from 409 logged the previous year. That compared with a 5% slide in volume globally over the same period, data provider Refinitiv reported.

The value of deals advised on by Texas lawyers also sank 23% to $327.1 billion over the $426.2 billion booked in 2018, compared with a 3% drop globally to $3.9 trillion, Refinitiv found.

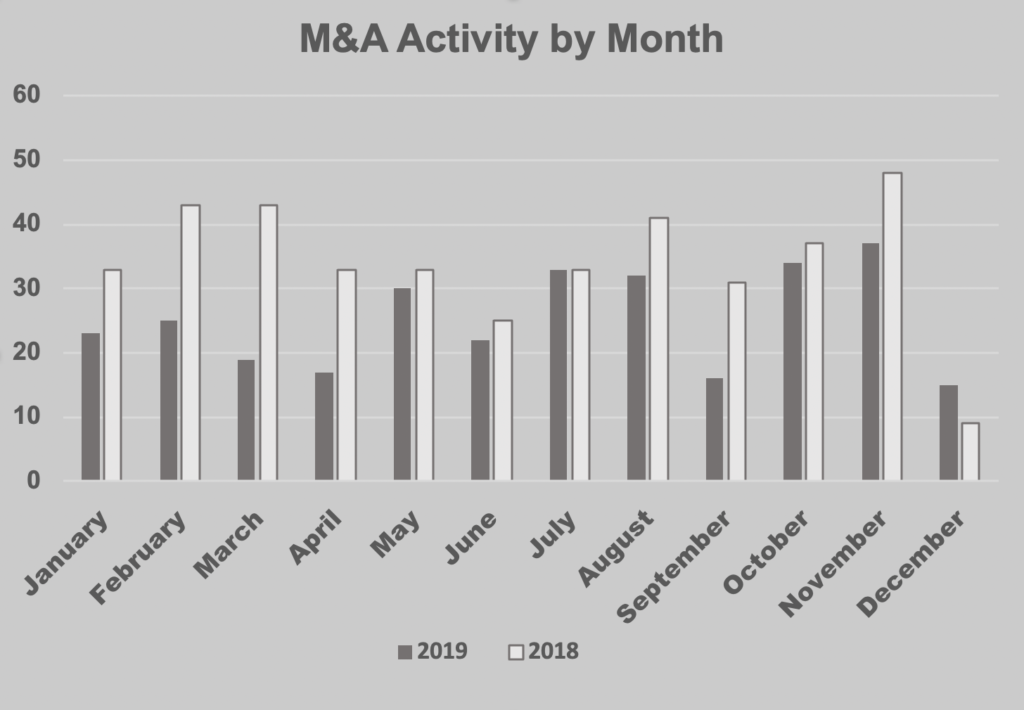

Overall transaction activity handled by Texas lawyers started slowly in 2019, with 67 transactions valued at $40 billion in the first quarter. Dealmaking then picked up steam through the second and third quarters and ended the year with 86 deals in the fourth quarter, but it wasn’t enough to reach 2018 levels.

Each quarter of 2019 was lower in deal count value than the same period in 2018, except for a 75% increase in deal value during the second quarter ($171.9 billion). That blip was due to multi-billion-dollar offers by Chevron and Occidental Petroleum to buy Anadarko, with Oxy’s $54.4 billion winning bid ranked as the top deal of the year.

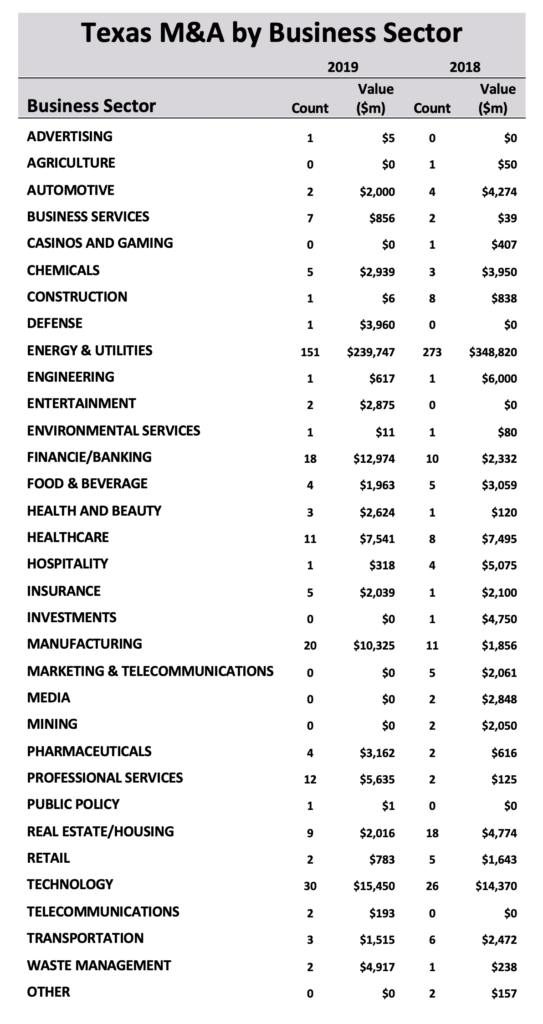

Blame the year’s deal slippage on the energy industry, which is consistently the biggest transaction generator for Texas lawyers. Oil and gas companies in particular had difficulty getting deals done because of investor disinterest and insistence on free cash flows, throttle-down capital markets and sluggish oil and gas prices.

Houlihan Lokey investment banker Rick Lacher in Dallas said the bank had a very active M&A year across virtually all sectors of the economy “other than the oil patch, which was more financing and restructuring,” he said.

Steve Trauber, a longtime energy investment banker with Citi in Houston, said in an interview that oil and gas M&A started out at a pretty reasonable pace last year but the public markets didn’t respond well to deals.

“They wanted to see industry consolidation, but they didn’t want companies to pay premiums to make it happen – and deals started to slow down in the second half of the year,” he said.

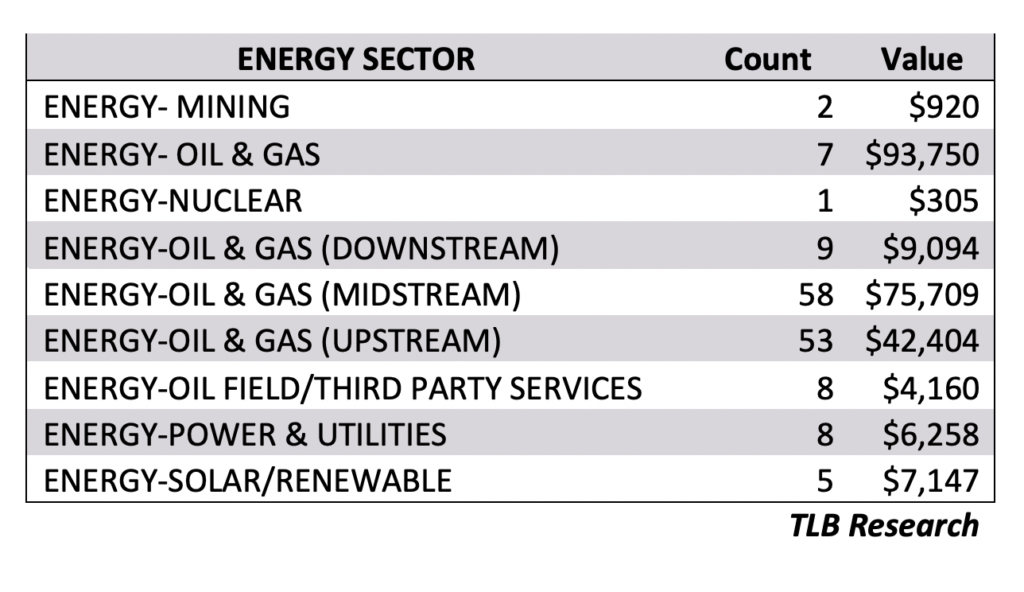

CDT figures show that the number of deals by the energy sector last year was almost cut in half to 151 transactions while the value of those deals slid by a third to $239.7 billion.

Most of the deal activity was concentrated in the infrastructure, or midstream, part of the sector, including among master limited partnerships, or MLPs, with 58 transactions valued at $75.7 billion, according to the data.

The oil and gas exploration and production, or upstream, part of the industry followed, with 53 deals valued at $42.4 billion. Oilfield services lagged with only eight deals valued at $4.2 billion.

“M&A [in the energy sector] has been depressed, although there have been some MLP simplifications and buy-ins,” said Baker Botts partner Josh Davidson, noting the firm’s involvement in several midstream deals. “However, there are fewer MLPs left to be restructured. I think they will be eventually but the market is too volatile right now.”

Joe Perillo, a Locke Lord partner in Houston who had the best year of his career last year, agrees that midstream and infrastructure-related deals were plentiful in 2019. “Oilfield services deals suffered a bit more and were not nearly as attractive unless they had a technology component,” he said.

Sidley partner Jim Rice in Houston said that except for the Oxy-Anadarko “mega deal” and a few other public-to-public transactions (Callon-Carrizo and Parsley-Jagged Peak) and large asset sales (Hilcorp’s purchase of BP’s properties in Alaska), the market was poor for energy M&A.

“If there was a bright spot, it was the minerals space, which had quite a few transactions,” he said. “Deal flow was really constrained due to an uncertain price environment and that persisted into 2020, with nothing indicating it would turn around. The sector was really operating under a dark cloud.”

Latham & Watkins partner Ryan Maierson in Houston said the firm witnessed fairly consistent deal flow last year, particularly in the midstream sector, plus a few merger-of-equals, or MOE, transactions in the upstream and oilfield services sectors for companies that were able to “align their relative valuations and balance sheets.”

But Maierson noted the decrease in upstream asset-level transactions, which were down about 25% last year relative to the prior five-year average.

“We expected to see more MOE transactions coming into this year, but those are harder to pull off during times of significant value fluctuations and declines,” he said. “Even distressed M&A among upstream companies and OFS [oilfield service] providers is challenging in times of extreme commodity price volatility. MLP simplifications likely still make sense for many sponsors.”

Keith Fullenweider, a partner at Vinson & Elkins, said M&A deal volume was relatively flat for the firm last year compared with 2018 in terms of volume and median deal size compared with deal value down 4.5% globally and up 2% in North America.

“One sector where we did see a significant uptick was in technology deals,” he said, noting the firm’s representation of Vista Equity Partners’ portfolio companies in multiple acquisitions, Houston-based ForeFlight on its sale to Boeing and Dallas-based MoneyGram on its agreement to use Ripple’s blockchain-based digital currency in its cross-border payments process.

“While traditional energy transactions were down on an industry-wide basis in 2019, we’ve also had a market leading practice in renewables for many years and we saw a significant increase in transactional activity there,” he said, noting the firm’s work on 28 renewables M&A transactions and projects for such investors as Goldman Sachs, Sixth Street Partners, Riverstone, Macquarie, Global Atlantic and the Carlyle Group. “Concerns about climate change and sustainability have led many of our clients to make investments in clean energy.”

The next five biggest deal generating sectors among Texas lawyers were all up on a volume and value basis last year over 2018.

Technology logged 30 deals worth $15.4 billion while manufacturing brought in 20 deals valued at $10.3 billion, according to CDT data. Those industries were followed by finance/banking at 18 transactions worth $12.97 billion; professional services at 12 transactions valued at $5.6 billion; and healthcare at 11 deals worth $7.5 billion.

Chris Converse, a partner at Foley in Dallas, noted that manufacturing deals were particularly strong, with clients like Clavis Capital Partners and Sky Island Capital purchasing value-added U.S. manufacturing businesses.

“Generally speaking, domestic manufacturing businesses that showed consistent cash flow, a dependable backlog and a stable supply chain were big winners in this environment,” he said.

Katten partner Mark Solomon in Dallas said healthcare, food and beverage and industrials were strong for his firm with technology being relatively strong.

“Our clients for the most part are agnostic,” he said. “The things they stay away from – and weren’t strong in anyway – are retail and energy.”

Indeed, retail was one of the sector laggards, with only two deals valued at $783 million last year versus five in 2018 worth $1.6 billion, CDT data found. Deals in the real estate/housing sector also fell in a big way, from 18 deals valued at $4.7 billion in 2018 to 9 transactions worth $2 billion in 2019.

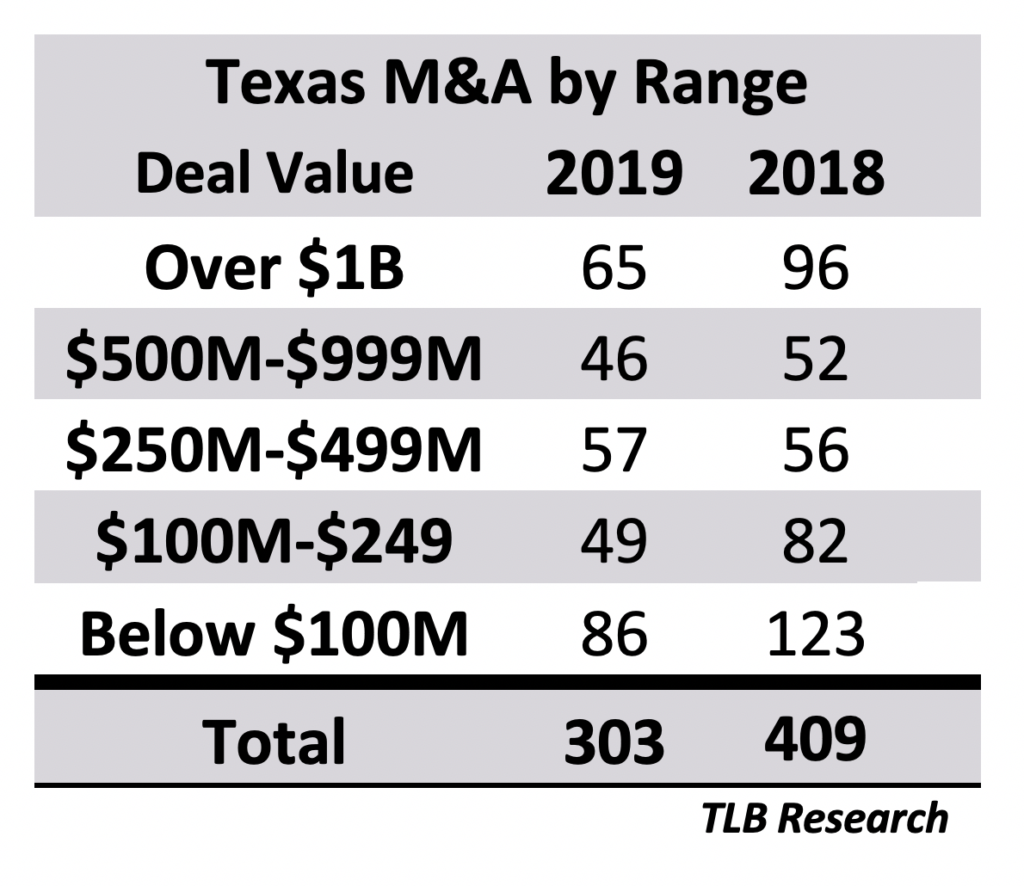

Sizes of deals handled by Texas lawyers also slid last year, with 65 $1 billion-plus transactions versus 96 in 2018 and 46 agreements in the $500 million to $999 million category compared with 52 the previous year, according to CDT data.

The smaller segments were mixed in terms of activity. The $250 million to $499 million category held steady – it was up by one transaction to 57 deals – but the $100 million to $249 million segment fell by 40% to 49 deals while the under-$100 million category dropped by 30% to 86 deals.

“The sizes seemed higher, but if you remove Oxy, you find the deal size was down a little bit,” Locke Lord’s Perillo said.

Predictions for 2020 are difficult to make given uncertainty about the length and depth of COVID-19’s spread and the direction of oil prices, which have been hit with a lack of demand due to the virus and too much supply thanks to a price war between Saudi Arabia and Russia.

“Last year, which seems like a lifetime ago, deals were brisk in various industries and at different price points. In many industries, it was a seller’s market,” Gibson Dunn & Crutcher partner Rob Little said, noting consumer, infrastructure and technology. “Of course, everything has changed now. Everything is so dynamic and fluid.”

“It is hard to predict the future given current developments, but it is hard for me to be optimistic.” — Josh Davidson

Little expects overall M&A activity to be impacted significantly but says there will be areas where there is more activity, such as distressed M&A and restructuring. He also thinks there will be situations where buyers with access to capital or who are better positioned to deal with the crisis “acquire competitors or other targets that are struggling more.”

Eric Williams, who recently moved to Akin Gump from Haynes and Boone in Dallas, said the beginning of 2019 was pretty slow then picked up and turned out to be a “decent” year. But then buyers became a little more picky on diligence issues.

“We had multiple transactions that started, paused and started again; things took longer to get done,” he said. “We’ll see what happens this year.”

Foley’s Converse said his firm helped clients close more deals in 2019 than in 2018 and starting in December closed seven M&A, recapitalization and/or refinancing transactions for clients in a 60-day period. “That is unprecedented in my 20 years in M&A,” he said.

The lawyer credited the activity to several deals being pushed to the latter half of 2019, continued favorable credit markets and some global private equity firms eager to deploy capital through acquisitions.

Converse said for the firm’s clients who sold businesses during the period, valuation multiples were higher than at previous times, noting Rosewood Private Investments’ sale of Novaria Group to KKR and Strait Lane Capital Partners’ sale of Arise Virtual Solutions to Warburg Pincus.

On the energy front going forward, Baker Botts’ Davidson said the double whammy of collapsing oil prices in an already fraught environment of over-leverage, excess demand and lack of Wall Street interest along with the effects of the coronavirus don’t portend much deal activity except for restructurings and bankruptcies.

“Oil prices would need to recover a great deal and the coronavirus pandemic needs to be past us before there can be much deal activity. I don’t know the appetite of the majors to buy smaller frackers on-the-cheap,” he said. “It is hard to predict the future given current developments, but it is hard for me to be optimistic.”

“During this uncertain and pessimistic period, there will be a real opportunity for private equity – especially those with bundles of cash.” — Chris Converse

Davidson said it’s also hard to predict M&A activity under a Democratic president given the party’s hostility to the energy industry.

“Regulation of the type they are talking about would further depress prospects in the industry,” he said. “Maybe someone would be able to find bargains in that environment.”

Locke Lord’s Perillo said if a Democratic president comes in, companies might sell their businesses if they think capital gains rates will go up.

“When Trump came into office, people delayed their transactions thinking he would reduce capital gains rates,” he said. “We have favorable capital gains rates right now, so people would have to figure out whether they want to sell or not.”

During the crisis, Perillo has seen some deals be put on hold (“I had a lot in the pipeline,” he said) but some are moving forward.

“It’s a perfect storm in the energy sector, with lower oil prices, the conflict between Russia and Saudi Arabia, the coronavirus, the lack of capital access and redeterminations coming up,” he said. “Once the coronavirus clears up and we see where oil prices go from there, we might see activity in the third and fourth quarter if people have the opportunity to sell their businesses and the delta between buyer and seller narrows.”

Katten’s Solomon doesn’t think there will be a pickup anytime soon, noting that the crisis is hurting small and medium-sized businesses, not just financial institutions as in 2008.

“Meaningful certainty as to the effects of the pandemic would obviously help. Pending that, significant government actions might help,” he said. “You could easily see everything seize up for a while; it would take a massive injection to move things forward.”

Foley’s Converse said 2020 is going to be “interesting,” as the COVID-19 pandemic will probably lead to a recessionary environment through the second quarter of the year – and a dramatic fall in M&A activity and an increase in bankruptcies, particularly in the oil and gas services sector.

“During this uncertain and pessimistic period, there will be a real opportunity for private equity – especially those with bundles of cash from successful exits or with significant untapped capital commitments from their limited partners – to acquire undervalued businesses,” he said. “In many ways, the longer this economic environment continues, the greater this opportunity will be for those private equity firms willing and able to deploy capital.”

Converse thinks by late 2020 and into 2021, the U.S. economy could bounce back dramatically, at which point consumer sentiment will have rebounded and businesses will be back to deploying capital.

“Once we are beyond the presidential election, regardless of who wins, that will remove some natural uncertainty in the markets and likely help the economy and M&A generally,” he said. “At this point, I can’t see that a Biden presidency would have much of an immediate effect on M&A activity, positively or negatively.”

As for oil and gas companies, Sidley’s Rice said they will hunker down, cut capital expenditures “to the bone” and look at improving costs and well head margins that could help them ride out to recovery.

“There also will be a liability management, looking for opportunities to improve balance sheets and deleverage and using free cash flow to purchase bonds, which are trading at a significant discount in the market,” he said.

Rice is not sure about whether will be an appetite for more consolidation in West Texas’ and New Mexico’s once popular Permian Basin, including deals like Parsley-Jagged Peak.

“Companies and boards will be challenged with the viability of a public company running one rig,” he said. “With debt loads, are companies able to be a consolidator or attractive to a buyer? There are good values out there, but it’s like buying a house and assuming the mortgage. M&A in the restructuring context is probably where activity will be in the next six to 12 months.”

The Sidley lawyer thinks there could be situations in which wealthy individuals or family offices – who have much longer investment time horizons than private equity – bring much needed capital into the industry. He also could see debtholders take over oil and gas companies and bring on private equity-backed companies to manage the assets until better times come when they can unload them.

“The banks might say, ‘Among terrible alternatives, this wouldn’t be bad,’” he said.

Rice thinks this time around could be like the mid-1990s, when there was a bad price shock but which also proved to be a great time to invest in the oil and gas business.

“I expect we’ll see recovery; it’s just the timing, which is a bit uncertain,” he said. “But generally speaking, actors are less inclined to act unless the price is going up or they have reason to believe that prices are going up.”

As for the presidential election, Rice said the oil and gas industry – “perversely” – has done better under Democratic administrations. Why?

“I don’t have a reason for you,” he said. “But for the balance of 2020, it’s hard not to see the glass half empty, except in the restructuring context.”

Latham’s Maierson said he’s seen a dramatic uptick in companies wanting to talk to the firm about creative solutions for their balance sheet in today’s commodity price environment.

“In the last wave of bankruptcies and restructurings in 2016, some companies were able to stave off restructuring through asset divestitures,” he said. “Now we are seeing fewer buyers in the market, as well as financial stress caused by the widespread use of three-way hedges over the last couple of years. So companies facing near-term maturities will have fewer out-of-court options this time around.”

Citi’s Trauber said everything is dead right now and he personally thinks it may remain that way until the end of the year.

“It’s the perfect time for Exxon and Chevron to act, but they have their own problems, with oil prices and the refining business turned upside down and their stock losing so much value,” he said. “Conoco is in best position to do something, but I can’t see anyone wanting to do a deal right now. The only way to make money is in the liability and restructuring business.”

How about private equity? Trauber said those firms already have a lot of money invested in the sector, which impedes their ability to act.

“There’s a lot of money out there,” he said. “But Blackstone is going wait to be opportunistic, because things are going to get worse. Kayne Anderson has money, but they’re going to wait to act, six to eight months down the road.”

V&E’s Fullenweider said that the firm’s real estate transactions are moving forward, except those involving hospitality and retail, and that it’s already working on a number of new liability management and restructuring matters.

“It’s difficult to predict deal flow right now,” he said. “Certainly, as the credit markets continue to tighten, we expect to see a surge in desire for alternative forms of capital in the energy space. We expect a very busy year with this kind of work.”