©The large, “bulge-bracket” banks — so called because their names are in larger font on transaction notices — typically rank at the top of the financial adviser league tables in Texas, much like they do nationally. But boutique investment banks—notably Evercore, Moelis and Intrepid—continue to make inroads, creating fierce competition for dealmaking business in the Lone Star State.

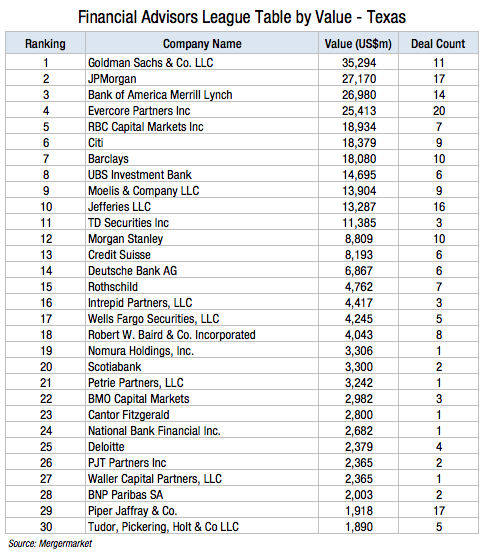

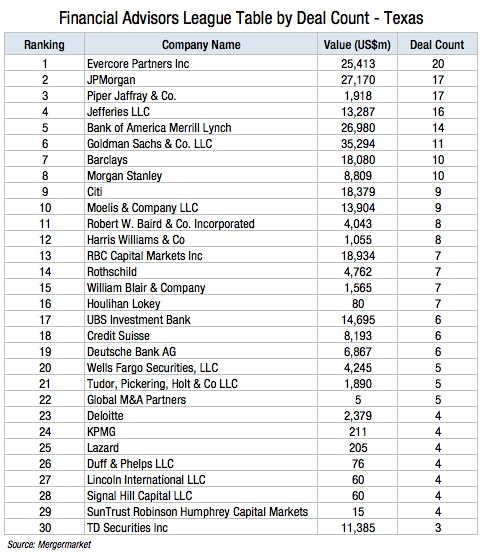

First half data from independent research firm Mergermarket provided exclusively to The Texas Lawbook shows Goldman Sachs and JP Morgan in the number-one and -two positions in terms of deal value in the state, followed by Bank of America Merrill Lynch. But Evercore Partners grabbed the number-four spot, followed by RBC Capital Markets, Citi, Barclays, UBS, Moelis Capital Partners and Jefferies.

In terms of deal count, Evercore topped the league tables, with JP Morgan ranking second and Goldman sixth. Piper Jaffray, which bought energy-centric investment bank Simmons & Co. International in 2015, came in third, followed by Jefferies at fourth and Bank of America at fifth. Barclays, Morgan Stanley and Citi followed, with Moelis coming in tenth.

Boutique investment banks specializing in the oil and gas sector have long been a fixture in Texas, with Simmons & Co. having its founding in 1974 by the late Matt Simmons. But New York firms began migrating southward after Enron’s 2001 bankruptcy to expand their energy practice, most notably Lazard in 2003, which pinched Harry Pinson from Credit Suisse. New boutiques also formed, including Tudor, Pickering & Co. in 2007 led by former Goldman banker Bobby Tudor, who 10 months later brought on fellow Goldman banker Maynard Holt as co-president.

The trend accelerated after the financial crisis of 2008 when the big banks began to teeter and some — like Lehman Brothers — disappeared. Greenhill opened in Houston in 2009 followed by Evercore and Moelis in 2011. After oil prices began to slide in 2014, creating fears of widespread bankruptcies, Rothschild & Co. formed a partnership with Petrie Partners’ Houston office to go after the restructuring business. And this past fall, Perella Weinberg Partners expanded into Texas when it purchased Tudor, Pickering, Holt. “We recognize the preeminent role that TPH has built as an energy banker in North America,” Perella Weinberg CEO Robert Steel said at the time.

Evercore has made a big dent in the dealmaking business in the oil and gas industry. But it was helped in the first half standings because of its work advising Austin-based Whole Foods Market on its purchase by Amazon in June for $13.5 billion, Texas’ biggest deal in the period.

Whole Foods brought in Evercore initially to help defend itself against activist Jana Partners, which had amassed a 9% stake in the grocery store chain and was agitating for the company to speed up a turnaround or put itself up for sale. (“Greedy bastards” is how Whole Foods CEO John Mackey described Jana Partners.)

The Whole Foods deal was ultimately handled out of Evercore’s New York headquarters by Bill Anderson, global head of its activism/raid defense business who joined from Goldman last year; Eduardo Mestre, chairman of global advisory; and William Hiltz, head of its general advisory group and special committee practice. Goldman advised Amazon.

Evercore also advised Clayton Williams Energy — along with Goldman — on the company’s purchase by Noble Energy in January for $3.2 billion. Leading that deal was Shaun Finnie, head of the firm’s oil and gas acquisition and divestiture advisory business in Houston along with Goldman partner Brian Haufrect, who is also based in Houston.

Another boutique, Denver-based Petrie Partners, advised buyer Noble on the deal, vaulting it to 21st on the league table in terms of value. Jon Hughes in Denver and Mark Carmain out of the firm’s Houston office led the deal team.

Hughes previously worked on two previous Noble acquisitions when he was at Petrie predecessor Petrie Parkman but on the side of the targets: Patina Oil & Gas in 2004 for $2.9 billion and United States Exploration in 2006 for $411 million.

Moelis scored in the top 10 of the Texas league tables because of its assistance to the Woodlands, Texas-based chemical company Huntsman on its sale to Clariant AG in May for $10.3 billion, the second biggest deal in the first half of the year (Bank of America also advised). Managing director David Faris in New York led the deal team.

Moelis also advised Quinpario Acquisition Corp. 2 on its purchase of Apollo Global Management-backed Novitex Holdings and HandsOn Global Management-owned SourceHOV in February for $2.8 billion. Those deals were also handled out of New York by bankers Jared Dermont, Jonathan Kaye and Eliot Freeston. Credit Suisse and RBC Capital Markets advised Novitex and Rothschild and Morgan Stanley assisted SourceHOV.

Moelis has a Houston office that’s been expanding over the last few years. Last year it added managing director Adrian Goodisman from Scotiabank, where he focused on oil and gas exploration and production deals, and Brian Jinks from Deutsche Bank, where he worked on transactions in the midstream, or infrastructure, industry. Other managing directors in the office include David Cunningham, who joined from Tudor, Pickering, Holt in 2015 and focuses on oil and gas; and Scott DeGhetto, who came on board from Credit Suisse in 2011 and focuses on power and renewables.

Another boutique with a Texas presence, Intrepid Partners, also made the Texas league tables with two big deals. It worked with Jefferies assisting the Blackstone Group and Sanchez Energy on their $2.3 billion purchase of properties in South Texas’ Eagle Ford Shale from Anadarko Petroleum in January (JP Morgan advised Anadarko). It also advised Blackstone (with Morgan Stanley) on its purchase of EnCap Flatrock Midstream-backed EagleClaw Midstream Services for $2 billion.

Intrepid was founded in 2015 by Skip McGee, a longtime oil and gas banker who previously worked at Lehman Brothers and Barclays. Last year the firm started aggressively adding to its New York and Houston offices, poaching talent from competing investments banks such as Jefferies, Goldman, Lazard, Deutsche Bank, Morgan Stanley, Wells Fargo, Barclays and Bank of America Merrill Lynch.

McGee was able to win both deals due to longstanding relationships, which include Blackstone senior managing director David Foley as well as Sanchez Energy CEO Tony Sanchez III. He worked on EagleClaw along with Matt Barton, August Kehn and Tyler Pratt in Houston and the Sanchez deal with Adam Miller, David Gehring and Brice Simpson in Houston and Carter Glatt in New York.

Besides the EagleClaw deal, Jefferies had a busy half. It advised Plains All American on its $1.2 billion purchase of the Alpha Crude Connector pipeline from Concho Resources (Piper Jaffray’s Simmons assisted Concho); BC Operating on its $1.1 billion sale of properties in the Permian Basin to Marathon Oil (which was assisted by Evercore); and Carrier Energy Partners and Panther Energy Co. II on their $775 million sale of properties to WPX Energy (which received guidance from Tudor, Pickering, Holt).

Jefferies also worked on a non-energy deal, advising TA Associates Management and HGGC on their $1.1 billion purchase of software company Idera (William Blair assisted Idera).