Lawyers in Texas worked on 18 percent more transactions last year than in 2017 with $1 billion-plus deals dominating the activity, according to submissions and other data collected exclusively by The Texas Lawbook’s Corporate Deal Tracker.

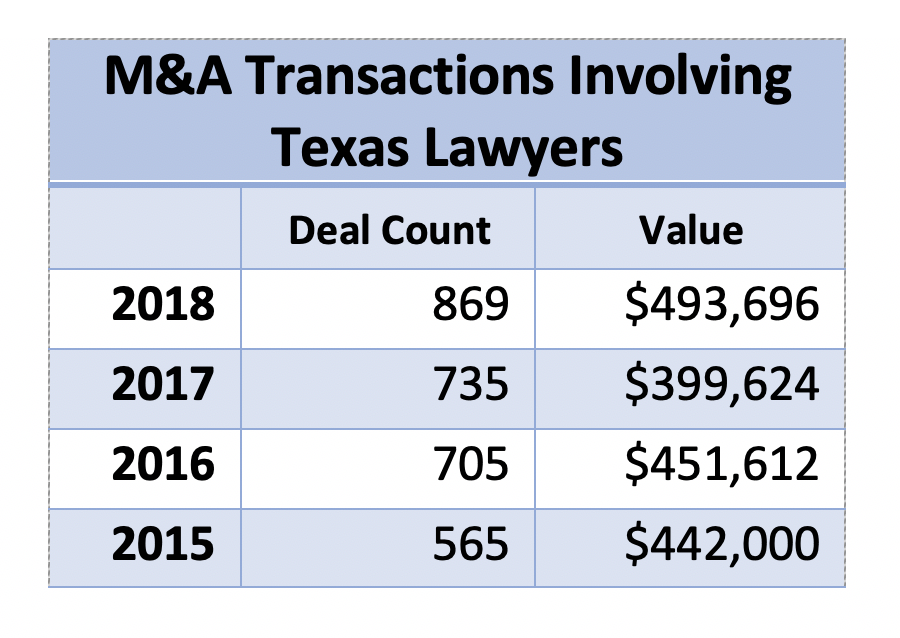

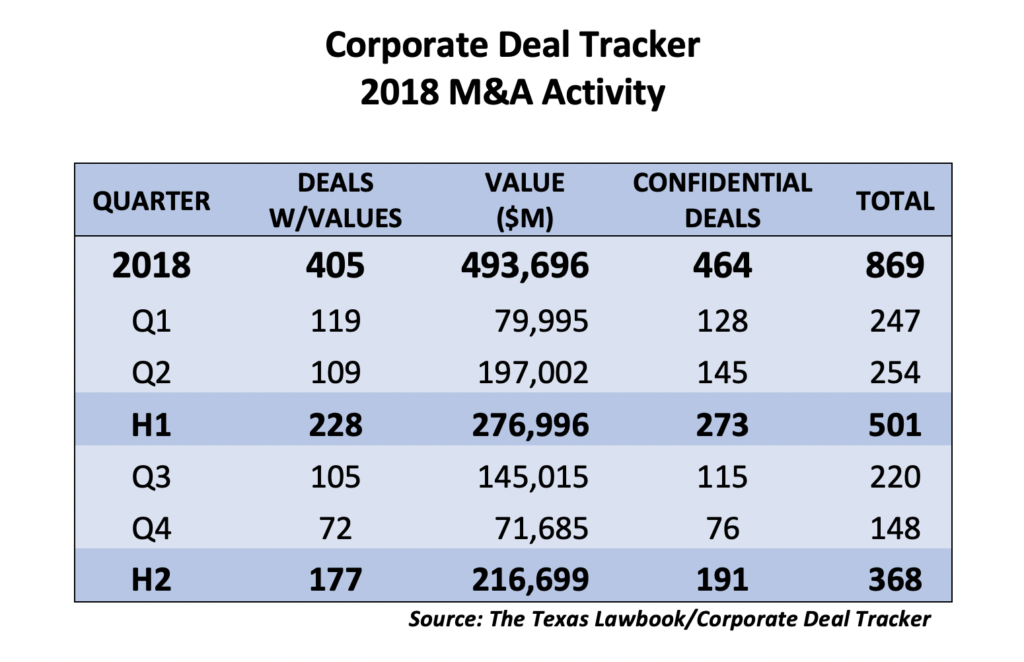

There were 869 M&A deals in 2018, up from 735 in 2017. The 405 deals reporting a value totaled $493.7 billion, compared with $399.6 billion in 2017. There were 464 transactions marked confidential. Last year’s activity also surpassed 2016, when there were 705 M&A deals worth $451.6 billion.

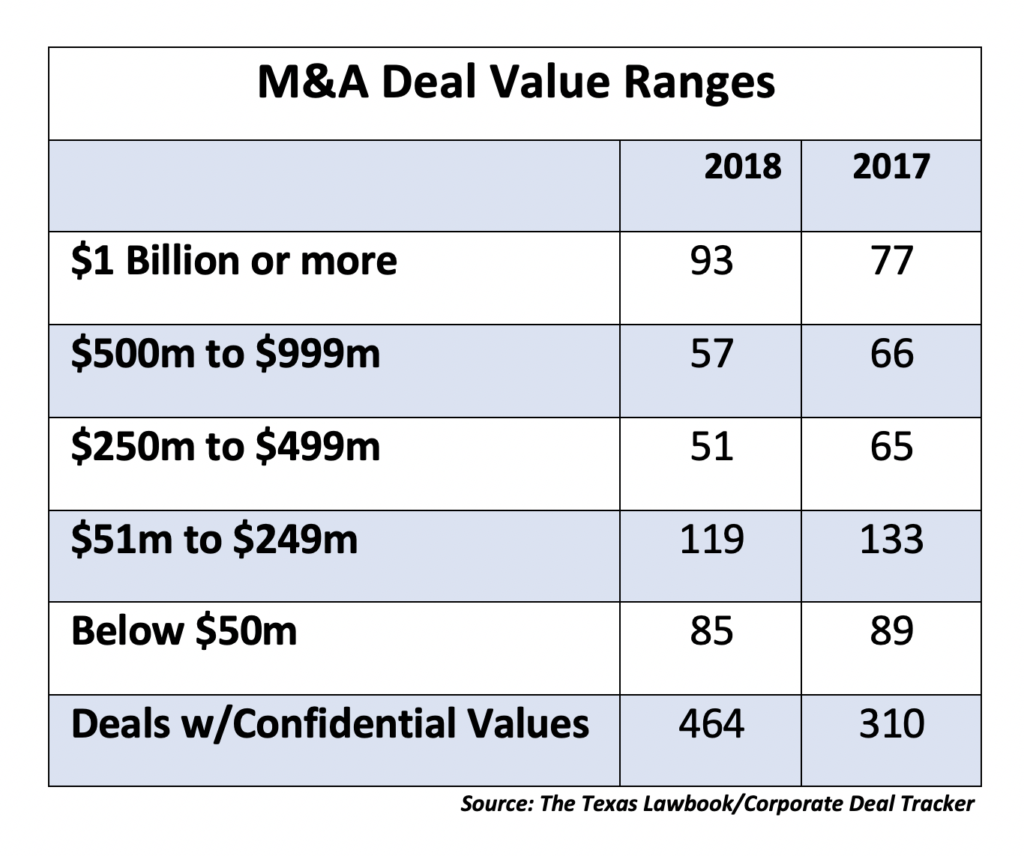

The biggest increase in deal flow came from the $1 billion-plus category, which hit 93 transactions last year compared with 77 in 2017.

Consequently, the average deal value also rose to $1.219 billion in 2018, versus $934.7 million the year before ($1.6 billion in the first quarter, $530 million in the second quarter, $978 million in the third and $631 million in the fourth).

However, deal activity slid in the $500 million to $999 million category, with 57 deals last year versus 68 in 2017. Deal flow also fell in the $250 million to $499 million category, with 51 transactions in 2018 versus 65 the previous year and 70 in 2016.

Interestingly, the 464 deals with confidential or undisclosed values were up from 310 in 2017, 312 in 2016 and 210 in 2015. That rising trend is likely due to the sheer bump-up in the number of deals last year – as well as the increasing involvement of private equity firms in M&A given the record levels of capital they’ve raised.

Dealmaking among Texas lawyers started out the year strong, with 247 transactions in the first quarter rising to 254 in the second, adding up to 501 agreements in the first half.

At the time, transactional lawyers credited pent-up transactions from 2017 and the abundance of debt and capital available for deals for the rise in activity in the first half – and predicted that the second half would also be strong.

But that wasn’t the case. Dealmaking began to slow, falling to 220 transactions in the third quarter and 148 in the fourth for a total of 368 in the second half.

Kirkland & Ellis partner Sean Wheeler attributes the drop in energy-related dealmaking to stock market turmoil and commodity price collapse in the fourth quarter along with several announced public deals “that were not well received initially.”

Vinson & Elkins partner Steve Gill agrees that the fourth quarter was rough on market valuations, with both the Dow Jones Industrial Average and S&P 500 down more than 10 percent for the quarter and oil prices experiencing even greater declines. “In the public M&A space, declining prices and volatility result in people sitting on the sideline until things calm down,” he said.

Fellow V&E partner Keith Fullenweider added that the sharp drop in oil prices resulted in cancellations of deals that weren’t going to receive shareholder support and a tightness in the debt capital markets, with historical levels of investor outflow from the leverage loan markets particularly after Thanksgiving. “As a result, it was difficult and expensive to arrange debt financing for acquisitions,” he said.

Latham & Watkins partner Ryan Maierson said the oil price pullback was due in part to Saudi Arabia, Russia and other major producers stepping up production as well as the dramatic rise of U.S. shale production. “When oil prices are volatile, it’s challenging for buyers and sellers to see eye-to-eye on valuation,” he said. “When prices settle down—almost regardless of absolute levels—deals tend to get done.”

Though it was signed in 2016, the closing of AT&T’s $85 billion purchase of Time-Warner Inc. was the largest M&A transaction of the year, with Akin Gump Strauss Hauer & Feld litigation partner Mike Warnecke in Dallas working with AT&T as lead antitrust counsel on pre-merger integration planning efforts.

Energy Transfer Equity’s $62 billion acquisition of affiliate Energy Transfer Partners was second, with V&E partner Lande Spottswood as well as Gill advising the seller and William Finnegan IV and Debbie Yee of Latham & Watkins advising the buyer.

Though it was signed in 2016, the closing of AT&T’s $85 billion purchase of Time-Warner Inc. was the largest M&A transaction of the year…(see complete list of 2018 CDT Transactions here).

The next two biggest deals of the year also involved energy midstream entities picking up their affiliates as part of the “simplification” trend: EnLink Midstream’s $13 billion acquisition of EnLink Midstream Partners and Williams Cos.’ purchase of Williams Partners for $10.8 billion.

Baker Botts worked on both of those deals, with Dallas partner Preston Bernhisel and Houston partner Joshua Davidson advising the buyer on the EnLink combination and Davidson counseling the seller’s conflicts committee on the Williams deal with co-counsel Travis Wofford. Latham’s Finnegan worked on the Enlink deal through Global Infrastructure Management.

Baker Botts also worked on the fifth largest deal of the year, BHP Billiton’s $10.8 billion sale of its U.S. oil and gas shale properties. Houston partner Erin Hopkins counseled the mining giant on the sale of its Eagle Ford, Haynesville and Permian properties to BP plc for $10.5 billion and Craig Vogelsang advised it on the sale of its Fayetteville shale properties to Merit Energy for $300 million.

Energy deals populated the rest of the top 10 deals of the year, including Vistra Energy buying Dynegy for $10 billion (Simpson Thacher’s Breen Haire in Houston was on the team advising Vistra); Concho Resources acquiring RSP Permian for $9.5 billion (Vinson & Elkins’ Doug McWilliams and Gill represented RSP); and Encana buying Newfield Exploration for $7.7 billion (Kirkland’s Sean Wheeler counseled Newfield).

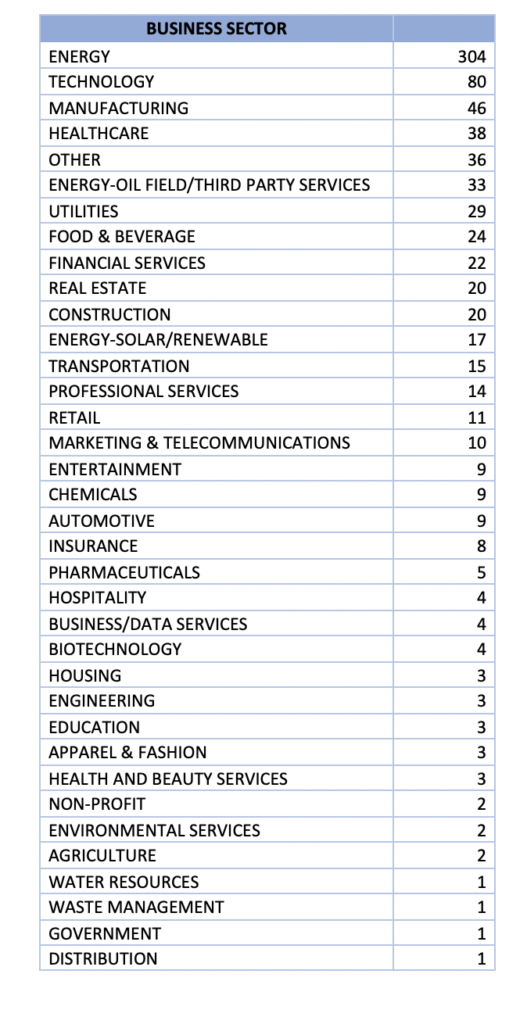

Not surprisingly, the energy sector dominated all dealmaking, logging 354 transactions last year (including oilfield/third party services and renewable/solar), although that figure lagged last year’s 377 agreements. Energy was followed by the technology industry (80 deals, versus 53 last year), manufacturing (46 versus 49) and healthcare (38 versus 26).

Other active industries were utilities (29 transactions compared with 20 in 2017), food and beverage (24 versus 19) and financial services (22 versus 26). The real estate and construction sectors were tied at 20 deals apiece, both up from 14 deals in real estate and 19 deals in construction in 2017.

What’s expected for this year, especially in the important energy sector?

Steve Trauber, vice chairman and global head of energy at Citi, said the level of M&A dialogue now is at “record levels” and he expects 2019 to be a big year with many deals. “The key will be the willingness of target CEOs to leave,” he said.

Kirkland’s Wheeler said energy M&A started 2019 slowly as companies recovered from a “terrible” November/December, got through earnings season, waited to see how the market reacted to capital budget announcements and assessed stock performance.

“There is still plenty of pent up demand for M&A and a number of people are actively pursuing opportunities, but there is no urgency,” he said. “Executives definitely see value in M&A but are being cautious.”

Wheeler thinks the second half will be much more active than the first and that there are some activist situations that could force M&A, noting Elliott Management’s $2 billion-plus offer to take QEP Resources private. “But there is also a general understanding that scale is important, as is living within cash flows, so deals that can deliver on those items will get done eventually,” he said.

Wheeler said mainly only stock deals are being considered (“people don’t want to sell for cash at these levels and miss the upside,” he said). Besides, there’s no equity market to fund the cash portion of acquisitions and the debt markets are still a little tight, “so issuing equity for acquisitions is the most viable alternative,” he said.

V&E’s Gill notes that the first two months have seen a recovery in both the broader market and commodity prices, with the S&P about back to where it was at the beginning of 2018 and West Texas crude oil up to the mid-$50’s per barrel versus $43 in December.

“I expect to see people reengaging in M&A discussions as confidence in the markets increases,” he said. “Anecdotally, we are seeing a lot more preliminary stage discussions, whereas that was pretty quiet in December and January.”

Gill expects to see further consolidation in the upstream M&A space in particular. “There remains a whole host of companies who are sized at an inflection point where they either need to acquire or be acquired,” he said. “There are also a number who are smaller than that inflection point and are likely to be acquired.”

V&E’s Fullenweider said he believes there will be a number of transactions announced in the weeks ahead now that pressure on the stock market and oil prices has eased up.

Latham’s Maierson said activity has been relatively strong so far this year, with private equity sponsors looking for both exits and new places to invest.

“We are also seeing M&A interest from smaller upstream companies that are facing growth headwinds due to balance sheet constraints,” he said. “Finally, MLP simplification and consolidation seems likely to continue apace this year.”