There are some new leaders atop the scoreboard of mergers and acquisitions for 2024, and some repeated from 2023.

Most of the regulars are there, as well as some fresh faces.

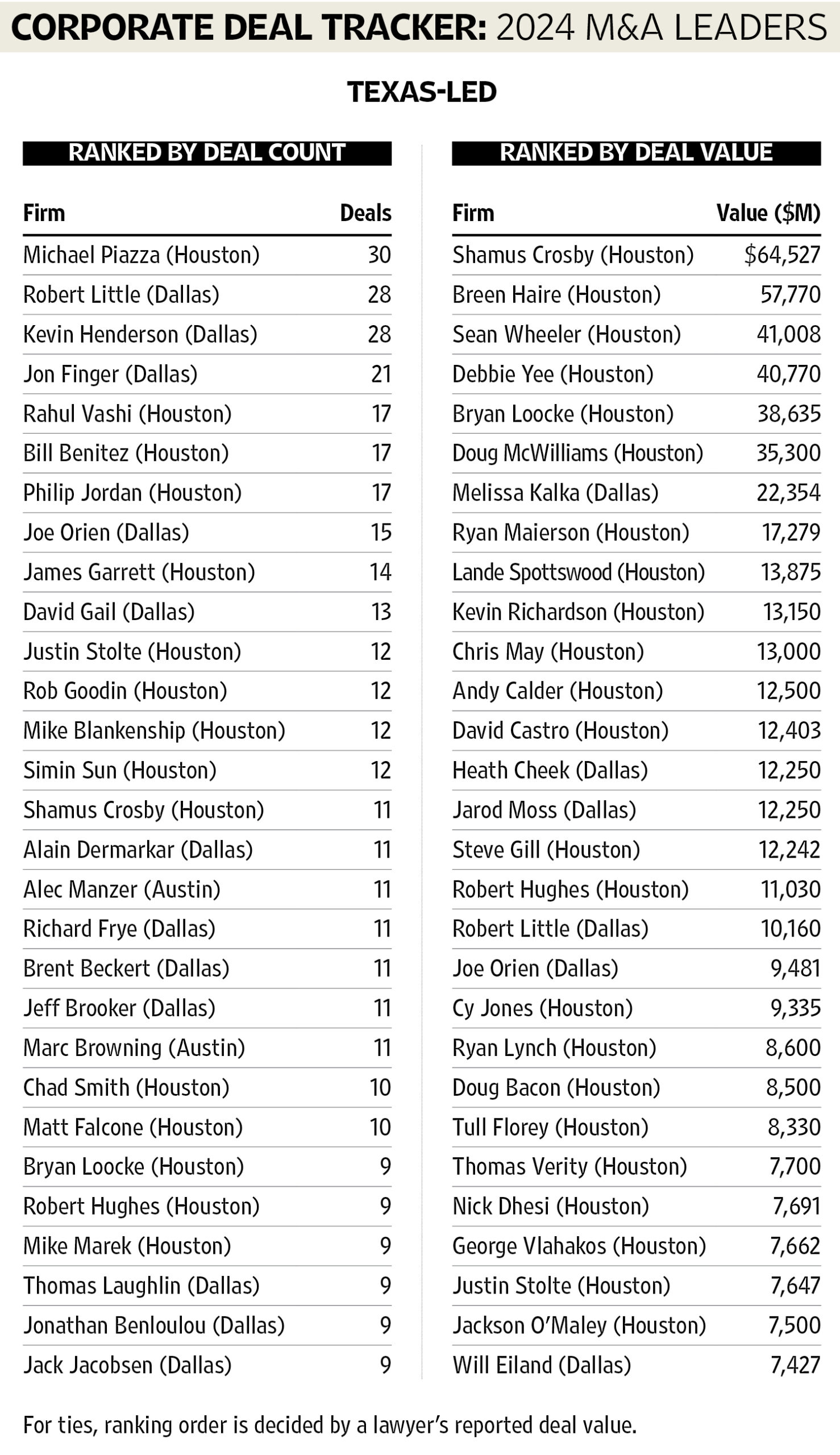

In all, 535 Texas lawyers working for 52 law firms led 1,545 M&A transactions in 2024, according to The Texas Lawbook’s exclusive Corporate Deal Tracker, which documents corporate dealmaking involving lawyers and firms in the Lone Star State. The CDT’s Texas-led category focuses on Texas lawyers who lead or co-lead deals for the buyer, seller or target and there are two separate rankings for those transactions — deal count and deal value.

Not one of the Texas lawyers in the top 10 for deal count are in the top 10 for deal value.

Needless to say, the lawyers on both lists had an extraordinary 2024.

Texas-led Deal Count Rankings

Some high-profile Texas lawyers are among the 259 attorneys that the CDT shows led only one M&A transaction in 2024, including Andy Calder, Michael Darden, Bill Finnegan and Mark Kelly.

The CDT shows that 104 lawyers led two M&A deals last year and 44 attorneys were the lead or co-lead advisors in three transactions.

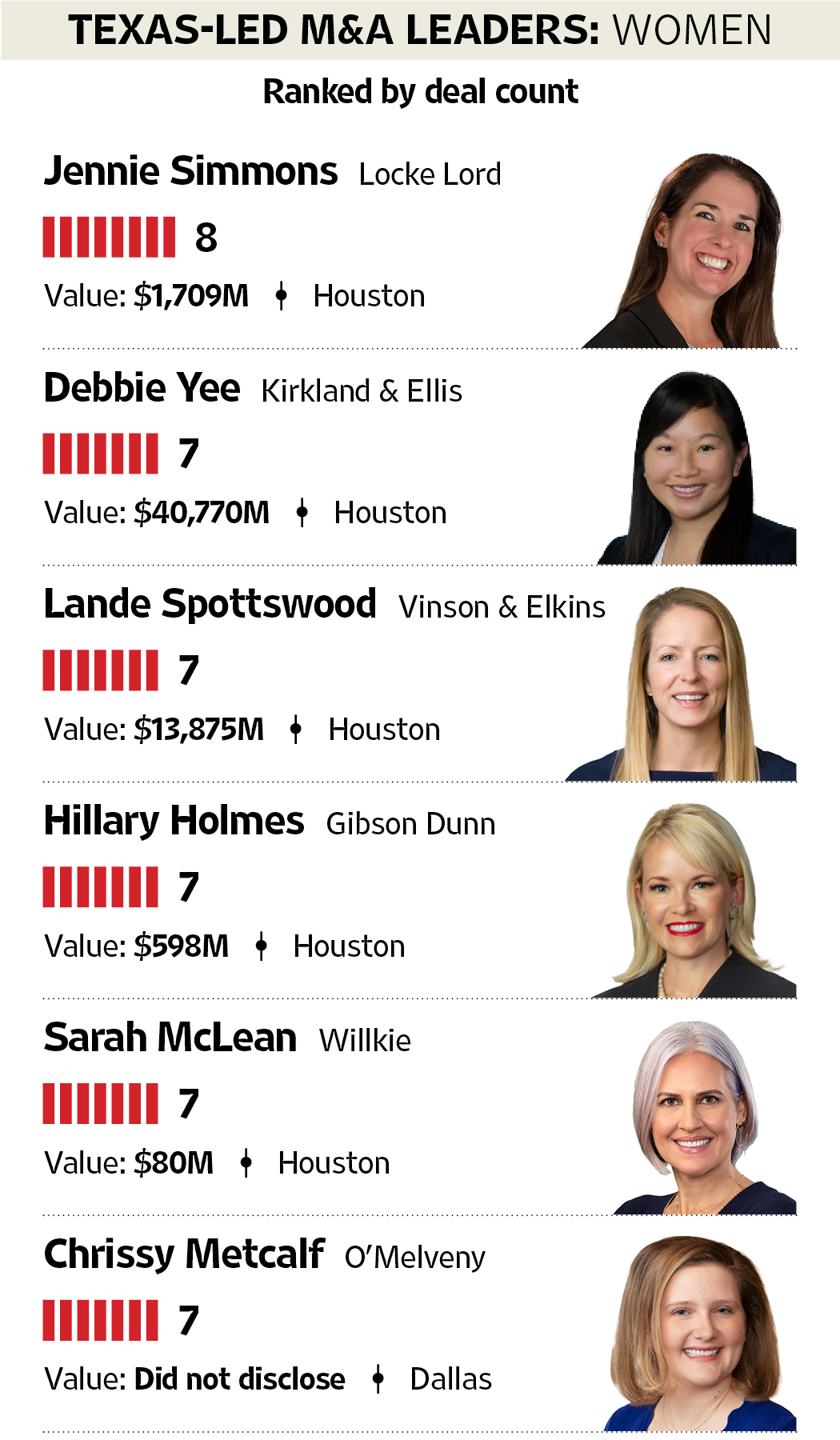

Forty-eight Texas lawyers worked on seven or more deals. Eighteen of those attorneys work in the Texas offices of Kirkland & Ellis. Gibson Dunn has six, Vinson & Elkins has five of the 48 and Latham & Watkins has three.

Twenty-three lawyers were lead or co-lead counsel in 10 or more M&A deals — five from Kirkland, four from Gibson Dunn, two from Latham and one from V&E.

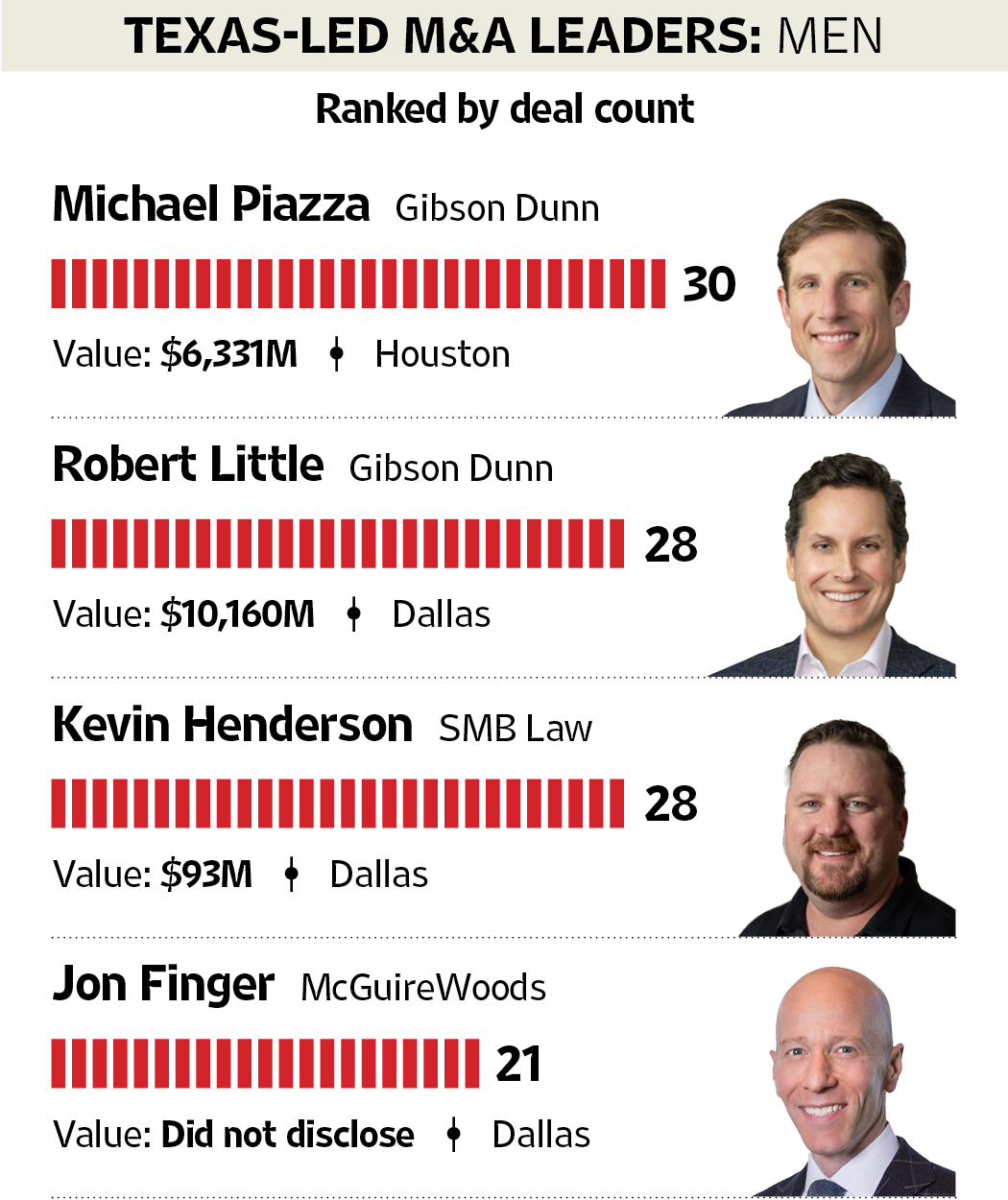

The new king of M&A deal count in 2024, according to CDT data, is Michael Piazza, a partner in the Houston office of Gibson Dunn.

Piazza led 30 different transactions last year — up from 13 in 2023 when he ranked eighth on the CDT deal count charts. He led or co-led three billion-dollar deals, including Andros Capital Partners’ $1.6 billion acquisition of West Virginia-based HG Energy II and Oklahoma-headquartered Vital Energy’s $1.1 billion purchase of Point Energy Partners of Fort Worth.

For the second year in a row, Piazza’s partner at Gibson Dunn, Rob Little, ranked second in Texas lawyers leading the most deals. Little led or co-led 21 transactions in 2023 but jumped to 28 in 2024. Little was lead counsel for AT&T in its $7.6 billion sale of DirecTV to the private equity firm TPG.

CDT data shows that SMB Law Group’s Kevin Henderson — last year’s top Texas dealmaker — tied Little in the second spot for deals led or co-led with 28.

McGuireWoods partner Jon Finger jumped from 18 in 2023 with nine deals to fourth place last year with 21 transactions.

Rahul Vashi, a partner in Gibson Dunn’s Houston office, jumped from No. 41 on the 2023 CDT’s rankings of Texas-led M&A deals with six to rank fifth in 2024 with 17 transactions.

Kirkland & Ellis partner Bill Benitez and Gray Reed partner Phillip Jordan tied Vashi at fifth with 17 deals in 2024.

Only three associates cracked the top 94 dealmakers by leading five or more transactions in 2024 — Kirkland’s Jeffrey Siwik, Willkie Farr’s Joe Laurel and McGuireWoods’ William Fullenweider.

Texas-led Deal Value Rankings

CDT data shows that 318 Texas lawyers led or co-led transactions that had deal values of $1 million or more in 2024, while 215 attorneys were lead counsel on deals that had no reported value.

For example, none of Jon Finger’s 21 deals in 2024 had dollar values that were public and Kevin Henderson’s total deal value for his 28 transactions was $93 million.

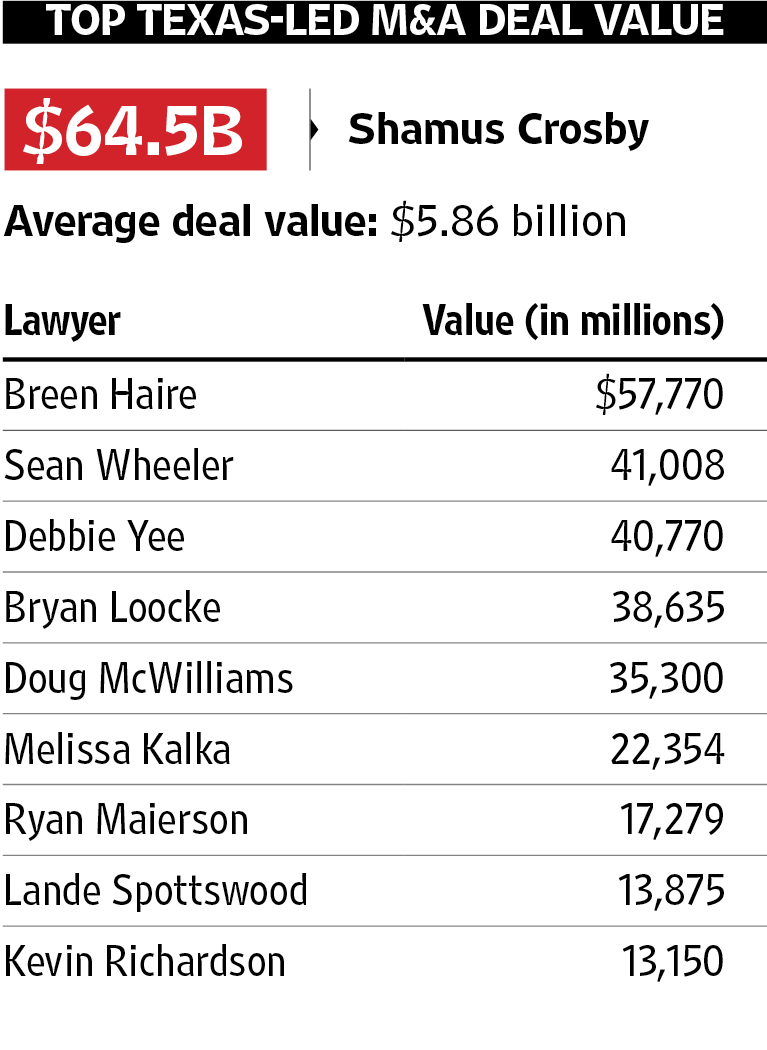

Last year, 141 lawyers led deals that had a combined value of $1 billion or more. Forty-five lawyers were the lead or co-lead counsel with combined values exceeding $5 billion. And 18 Texas lawyers were the lead legal advisors in transactions totaling $10 billion or more.

Six lawyers — two apiece at Simpson Thacher, Kirkland and V&E — had 2024 deal values exceeding $30 billion.

Shamus Crosby and Breen Haire, both partners in Simpson Thacher’s Houston office, were the lead legal advisors for the private equity firm KKR in its $50 billion acquisition of New Jersey-based Energy Capital Partners. Crosby also was co-lead counsel for Florida-headquartered Digital Bridge in its $6.4 billion purchase of Vantage Data Centers. And Crosby and Haire teamed up again in representing KKR in its $4.9 billion acquisition of telecommunications company Metronet.

Those transactions made Crosby and Haire No. 1 and No. 2 in the CDT’s 2024 rankings for Texas-led counsel in deal value.

No two Texas lawyers team up more on large M&A deals than Debbie Yee and Sean Wheeler at Kirkland. The Houston partners were co-lead counsel in seven billion-dollar deals, including advising Marathon Oil in its $22.5 billion sale to ConocoPhillips, Callon Petroleum’s $4.5 billion sale to Apache and ONEOK’s $4.3 billion purchase of EnLink Midstream.

V&E partners Bryan Loocke and Doug McWilliams of Houston were co-lead counsel for Endeavor Energy Partners in its $26 billion sale to Diamondback Energy. McWilliams was also co-lead counsel for Waste Management in its $7.2 billion acquisition of Stericycle, while Loocke led Grayson Mill Energy in its $5 billion sale to Devon Energy.

Kirkland’s Melissa Kalka ranked seventh on CDT M&A deal value list for 2024 with five transactions with a combined value of $22.3 billion and Latham’s Ryan Maierson ranked eighth with eight transactions valued at $17.3 billion.

V&E’s Lande Spottswood, Latham’s Kevin Richardson and Simpson Thacher’s Chris May — all three partners in their firms’ Houston offices — had deals in 2024 with a combined value of more than $13 billion.