It was a tale of two years.

Lawyers in Texas worked on more deals in 2017 than 2016, but total deal values dropped, according to data reported exclusively to Corporate Deal Tracker and The Texas Lawbook.

But 2017 was also a year of two tales.

The first half of 2017 continued the furious pace of 2016; the second half ended in an exhausted whimper.

According to law firm submissions and other data collected by the Corporate Deal Tracker, the deal count hit 735 in 2017 versus 705 the previous year while deal values reached $399.6 billion versus a previous $451.6 billion.

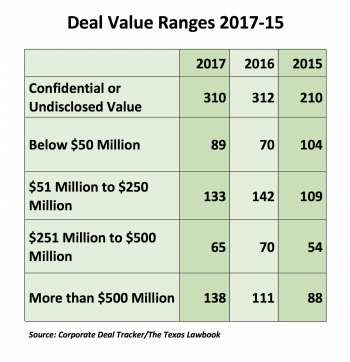

In other words, lawyers in Texas worked on 4.3 percent more deals than the previous year, according to CDT data, but their total value dropped 11.5 percent–even though there were more deals valued at $1 billion or more. In fact, there is contrast revealed in the 2017 deal value ranges, as upper- and lower-level deals increased, while deals in the middle ranges declined.

Last year’s first quarter performance exceeded that of the previous year by 34.9 percent in terms of deal count and 75 percent in terms of value. But the second quarter saw a drop-off in value (42.5 percent) that continued into the third and fourth quarters.

The first quarter was skewed, of course, by British American Tobacco’s $49 billion purchase of Reynolds American, which was advised by Jones Day partner Alain Dermarkar in Dallas. But every year seems to feature a blockbuster deal that skews the quarterly data, with the $43 billion ChemChina acquisition of Syngenta in the first quarter of 2016 and the $67 billion Dell-EMC deal announced in the fourth quarter of 2015.

Still, Texas lawyers were less busy in the fourth quarter of last year than in the six previous quarters, according to the data. In fact, the fourth quarter deal count of 156 mirrored the second quarter of 2015, when uncertainty was high given the severe drop in oil prices. The lowest deal count over the three-year period was in the first quarter of 2015, when only 121 were reported given many companies’ shock over plunging oil prices (see table).

In terms of deal value, the fourth quarter was the worst-performing in 2017 hitting only $53.7 billion, the lowest since the first quarter of 2015, which came in at $51.6 billion.

And in terms of deal value ranges, the greatest contrasts came at the extremes. Upper-end mega deals ($500 million or more) increased 24 percent (111 to 138); but so did smaller deals (less than $50 million), from 70 to 89 (27 percent). At the same time both lower-middle deals ($50 million to $250 million) and upper-middle deals ($251 million to $500 million) declined (see table).

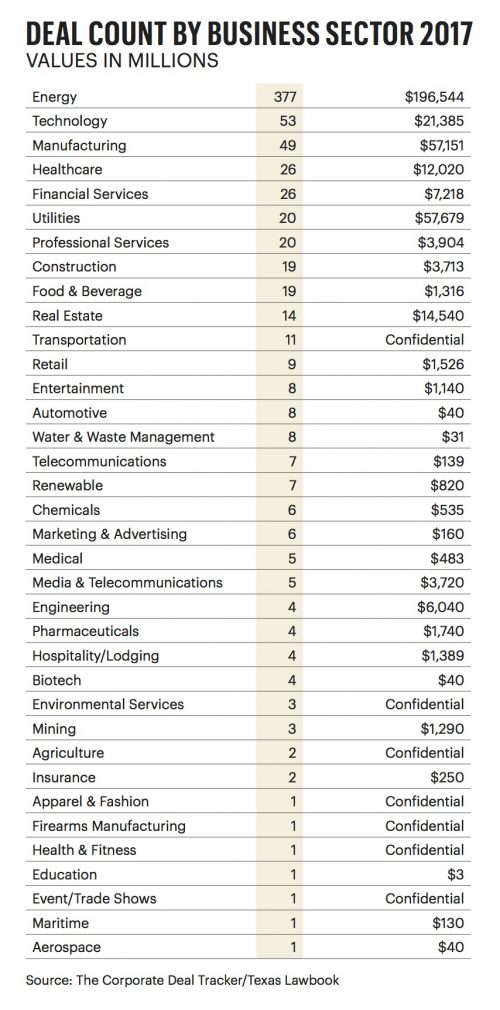

The drop in deals for 2017, especially in the fourth quarter, was mostly due to Texas’ dominant energy industry, which saw transactions slip from 112 in the second quarter to 96 in the third and 82 in the fourth, according to the data.

Potential buyers were concerned about the possibility of peak oil demand in the U.S. and around the world, which would make investments in the sector not a good long-term play. Indeed, such a phenomenon could lead oil prices to drop again – and no one wanted to be seen as buying oil-related assets as prices were hitting new highs for the year.

“Even though commodity prices rose, there wasn’t a solid view on where they were headed,” Houston oil and gas investment banker Bill Marko said on a financing panel last week at energy conference CERAWeek by IHS Markit.

Moreover, throughout the extended downturn, oil and gas companies spent a lot of money on acquisitions at higher and higher prices — especially in West Texas’ and New Mexico’s Permian Basin – and were hitting the point of “deal exhaustion,” as one Houston oil and gas lawyer put it.

The largest such exploration and production deal was Cenovus Energy’s acquisition of ConocoPhillips’ oil sands properties in Canada for $13.3 billion, which ranked number-four overall. King & Spalding’s Houston office counseled ConocoPhillips on that one.

Other big deals in that subsector included EQT’s $6.7 billion takeover of Rice Energy, which ranked 12th. (Vinson & Elkins advised Rice); and Exxon Mobil’s 16th ranked purchase of the Bass family’s Permian properties for $5.6 billion (Kelly Hart out of Fort Worth assisted the Bass family on that).

Also putting a damper on dealmaking was the fact that many oil and gas companies’ shares continued to underperform the broader U.S. stock market – despite having cut costs and having paid down debt to appease returns-focused investors. That gave buyers less available cash and less valuable stock to pay for transactions.

Among the other Corporate Deal Tracker findings: The average deal value in the first quarter amounted to $1.6 billion versus $530 million in the second quarter, the differential mostly due to the big BAT/Reynolds merger.

Similarly, the average deal value jumped back up to $978 million in the third quarter (due to Energy Future Holdings’ sale of its Oncor unit to Sempra Energy) but then fell to $631 million in the fourth.

The Sempra/Oncor deal ranked as the second largest deal of the year involving Texas lawyers, according to the data, with Kirkland & Ellis partners Andy Calder and John Pitts in Houston leading the transaction for Energy Future Holdings.

While most value ranges don’t seem to have changed much over the last three years, it’s curious to see that mega-deals (over $500 million) have steadily increased their presence — from 25 percent of the total in 2015 to 28 percent in 2016 to 32 percent last year — despite the fall in overall reported deal values.

Even with a slide in energy deals in the second half of 2017, the number of energy transactions reached 377 for the year versus 316 in 2016 and 270 in 2015.

Technology and manufacturing deals were also up for 2017 highlighted by Zix’s $6.5 billion purchase of Greenview Data (with Baker Botts’ Dallas office advising Zix) and BAT’s purchase of Reynolds.

However, the count for financial services and healthcare transactions was lower than in 2016 — 26 versus 36 in the former case and 26 versus 32 in the latter. The biggest deals in those two sectors were SoftBank’s purchase of Fortress Investment for $3.3 billion (with advice from Weil’s Dallas office) and Mars’ purchase of pet healthcare business VCA for $9.1 billion (with counsel from Akin Gump’s Dallas outpost).

And way down in number were real estate deals, 14 transactions in 2017 versus 26 in 2016 and 27 in 2015, despite record levels in the U.S. overall due to foreign companies’ interest in the asset class as a safe haven to stow their cash. The biggest deal in that sector was RLJ Lodging’s purchase of FelCor Lodging Trust for $7 billion, for which Sidley’s Dallas office received bragging rights.