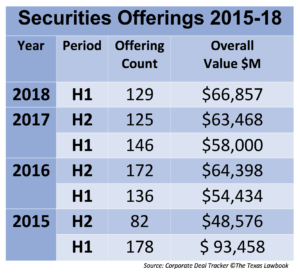

The number of securities offerings handled by Texas lawyers who specialize in capital markets remained disappointingly low during the first six months of 2018, while the amount of money raised jumped to the second highest level in three years, according to exclusive new data collected by The Texas Lawbook’s Corporate Deal Tracker.

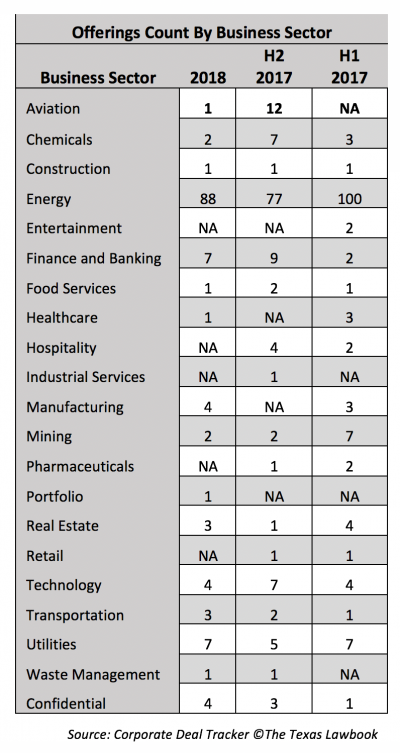

The Corporate Deal Tracker shows that Texas-based CapM lawyers handled 129 offerings – including initial public offerings, equity offerings and debt offerings – during H1 2018 and raised $66.8 billion. Not surprisingly, 70 percent of the securities involved the energy sector.

The 129 offerings in H1 2018 is 3 percent higher than the second half of 2017, but 11.6 percent lower than the first half of 2017 and 27 percent fewer than H1 2015.

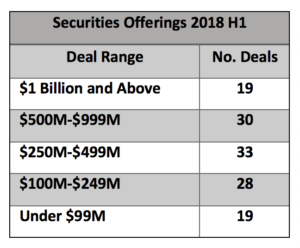

The size of the offerings, however, is getting larger.

The $66.8 billion raised by Texas lawyers during the first six months of 2018 was 15.2 percent higher than the first half of 2017, when activity was at $58 billion, and 5.3 percent higher than in the second half of 2017, when activity was at almost $63.5 billion, according to the Corporate Deal Tracker.

In fact, the $66.8 billion raised during the first six months of 2018 was the most generated through securities offerings since H1 2015, when Texas oil and gas companies blitzed the capital markets ahead of banks lowering their asset valuations of energy companies because of plunging oil prices.

There were 178 offerings during the first half of 2015, which raised $93.4 billion. Banks issued their new oil asset valuations during the summer of 2015. As a result, the number of offerings and the amounts raised were sliced in half for H2 2015. The capital markets have never fully recovered.

The Corporate Deal Tracker, which is owned and operated by The Texas Lawbook, tracks all securities offerings and M&A activity involving lawyers based in Texas. There are 14 law firms in Texas with active CapM practices.

Continued softness in capital markets activity in Texas is due to lower commodity prices in the energy sector, which led investors to want the oil and gas companies to live within cash flow and not take on more debt.

“The industry is going through a moment of change, when companies are focusing on growing operations from their cash flow,” said Hillary Holmes, firm-wide co-chair of Gibson, Dunn & Crutcher’s capital markets practice in Houston. “Companies have had to be disciplined in how they raise and spend their capital. There’s a lot more focus on use of proceeds, with investors asking, ‘What are you going to do with my money?’”

Experts say there also has been investor disinterest in IPOs after being burned in the most recent downturn. But that may be changing.

“We’re seeing activity, with the oil names and the minerals companies having the best opportunity for IPOs,” Kirkland & Ellis partner Sean Wheeler told The Texas Lawbook in an interview last month. “The recent Berry [Petroleum] deal priced below the range, but the good news is that it got done, which is a good omen for 2019.

“I don’t think the floodgates will open, but oil-weighted companies and mineral companies will have the best chances,” Wheeler said. “The gas names are still weighed down by commodity prices.”

Wheeler and others said they are seeing a number of special purpose acquisition companies, also known as SPACs.

”They’re not going to take over the universe, but we are seeing them on a fairly regular basis,” he said.

Despite caution in the oil patch, the energy industry dominated securities offerings with almost $46.6 billion worth of deals in the first half, which is 13.4 percent more than the second half of 2017 and 24.6 percent higher than the first half of 2017.

The utilities sector ranked second in value at almost $6.9 billion, thanks to transactions by NRG Energy and FirstEnergy. Finance/banking was third with $4.17 billion, followed by chemicals at $1.6 billion and manufacturing with $1.58 billion.

There were 88 energy-related capital markets transactions during the first half of 2018 – up from 77 in the second half of 2017 but down from 100 in the first half of 2017.

David Oelman, who co-heads Vinson & Elkins’ M&A and capital markets practice, said there is still a great need for long-term capital, citing IHS Markit figures that project the energy sector will require $890 billion in investment through 2025.

“Private equity is an alternative form of financing, but it’s not there to be long-term,” he said. “The need for capital markets activity in the form of initial public offerings and follow-on offerings over the long term should be robust for an extended period of time.”

Oelman said there were only six energy-related IPOs in the first half, versus 20 for all of 2014 and 21 between 2015 and 2017. But he thinks a healthy amount of activity is coming, although it may come in spurts.

“It will be cyclical depending on commodity prices and other areas to invest in,” he said, noting technology and biotech. “There are reasons for optimism.”

Exploration and production companies are showing new discipline in capital spending while midstream entities are changing their structures, deleveraging and delivering better returns at a time of great demand for more infrastructure, Oelman said.

“We have over a dozen clients that are in various phases with the SEC,” he said.

Potential IPOs on the horizon include Diamondback Energy infrastructure unit Rattler Midstream, which filed with the Securities and Exchange Commission to go public in August, and Five Point Capital-backed oilfield water services provider WaterBridge Resources, which announced in June that it had filed confidentially.

Baker Botts capital markets practice leader Josh Davidson is more encouraged by the capital markets given higher activity levels, but he said it’s a far cry from the boom years of 2011 to 2014.

“There are a lot of private equity firms sitting on investments that they may want to monetize and will look at the private and the public markets,” said Davidson, who is working on several IPOs, including one for Yorktown Energy Partners-backed Carbon Energy. “The stock market is healthy now.”

Of the 129 securities offerings during H1, 74 were public debt offerings and 40 were public equity offerings. There were six private debt offerings and five IPOs.

Ryan Maierson, global co-chair of Latham & Watkins’ public company representation practice, said that while the number of new energy issues is way down from historic highs and down from last year, the amount of optimism that the IPO market will improve is as high as he’s ever seen it.

“There’s a view that there will be sustained levels of relatively higher oil prices – high $60’s to low $70’s [per barrel] – creating a favorable commodity price backdrop,” he said. “While some investors have gotten beaten up over the years, some of those investors will be willing to wade back into energy space. And the need for capital is as strong as it’s ever been, to build out pipeline capacity in the Perman and export capability.”

Maierson wouldn’t be surprised to see a couple of the backlogged IPOs this fall, including in the oilfield services sector – “They often have the most dramatic increase on the leading edge of the recovery,” he said – but mostly he’s looking to early 2019 for more activity.

“A lot of institutional investors will try to lock in their gains this fall and be reluctant to put money at risk,” he said. “But once the calendar turns, they’ll be ready to put money to work again.”

Maierson said the rest of the market, including high-yield debt, has been relatively stable, with 64 high-yield issues by Texas companies across all industries over the last year – half of which were handled by Latham, he said.

The Latham partner added that follow-on equity offerings are down from a year ago – five so far this year versus 35 last year.

Mike O’Leary, co-head of Hunton Andrews Kurth’s corporate team, said 2018 started with opportunities for oilfield services companies to go public but only a handful made it out the chute. He counseled the underwriters on the Quintana Energy Services IPO, which priced in February below its expected range.

“There has been some discussion that maybe fall will be better. But it doesn’t look like it’s open, with the Permian having issues, sand companies under pressure from pricing and so much competition,” O’Leary said. “The hope for a renaissance for oilfield services may be in 2019, but it’s a bit of a hostile environment right now.”

O’Leary said the market hasn’t been receptive to the upstream story, either, and oil and gas producers may have to wait until next year to launch their IPOs.

“We’ve seen M&A activity around the upstream markets but not in the public market,” he said.

Gibson Dunn’s Holmes isn’t sure when the IPO market for energy companies will turn around.

“Even when you talk with bankers, it’s still hard to tell,” she said. “There are so many deals in the pipeline, so many IPOs on file publicly or confidentially, so there’s clearly a lot of interest. But it all comes down to when someone is willing to pull the trigger.”

Holmes notes an issue she worked on involving Concho Resources, which did a $1.6 billion bond offering this summer to finance the debt of its $9.5 billion acquisition prize RSP Permian.

“The interest rate was quite low and investors liked that,” she said. “That’s a smart use of proceeds.”

Holmes said that companies are coming out with issues to refinance existing debt at better rates and terms. She counseled the underwriters on a $750 million issue for Waste Management last fall and has two other such issues she’s working on right now.

She acknowledged that the severe drop in issues for midstream master limited partnerships has really hurt the market.

“It used to be that MLPs would do ATM [at-the-market] programs every quarter, alternating equity and debt offerings every four or five months,” she said. “That kind of capital management is no longer in favor.”