No corporate transactional lawyers have been busier in 2015 than Mollie Duckworth and John Goodgame.

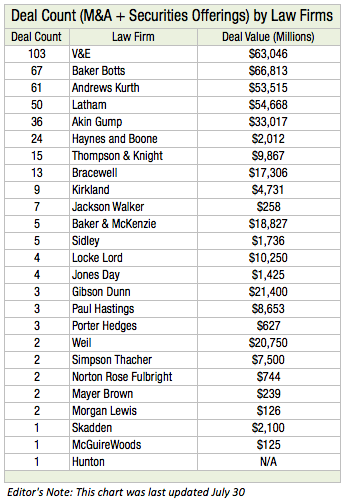

No Texas law firm came close to being the legal advisers in more deal making during the first seven months of 2015 than Vinson & Elkins. V&E, which ranks first in both M&A and securities offerings, was involved in a total of 103 transactions that have a combined value of $65 billion.

The race for second is close. Baker Botts lawyers were involved in 67 mergers, acquisitions, joint ventures and securities offerings with a price tag of $66.8 billion.

Andrews Kurth was involved in 61 transactions with a combined value of $53.5 billion. Lawyers at Latham & Watkins handled 50 deals with a total worth of $54.7 billion.

Baker Botts, Latham and Akin Gump advised in the biggest deal of the year so far – Energy Transfer Partners’ acquisition of Regency Energy Partners for $18 billion.

Seven months into 2015, The Texas Lawbook’s Corporate Deal Tracker leaderboard shows that the most prominent corporate law firms operating in the state are handling the lion’s share of business mergers, acquisitions, joint ventures and securities offerings.

The Corporate Deal Tracker follows mergers, acquisitions, joint ventures and securities offerings handled by lawyers based in Texas. Unlike other league tables, the Corporate Deal Tracker includes all transactions handled by Texas lawyers, including deals companies from other states or countries. Even many confidential transactions are counted.

M&A Activity

During the first seven months of the year, Texas-based lawyers worked on 179 deals valued at $127.1 billion.

The Corporate Deal Tracker shows that 24 of the transactions had a deal value of $1 billion or more.

Twenty-one of the deals were valued between $500 million and $1 billion.

Of the 45 transactions that had a deal value of $500 million or more, 38 – or 84 percent – were in the energy sector. Eleven of the 45 deals involved no Texas companies, according to the Corporate Deal Tracker.

Another 84 transactions have a deal value between $1 and $500 million. Meanwhile, 50 of the deals had no deal value assigned or the amount was confidential.

Energy companies comprised 107 of the 179 deals. Sixteen of the transactions involved manufacturers. Technology businesses completed eight of the mergers or acquisitions. There were two deals each in the health care and biotechnology sectors.

Seven months into the year, V&E tops the M&A leaderboard with 43 deals with a combined value of $26.3 billion. Seven of those transactions had a deal value of $1 billion or more, including the firm’s representation of Oklahoma-based Hiland Partners $3 billion sale to Kinder Morgan. Thirty-eight of V&E’s 43 M&A clients were energy companies, according to the Corporate Deal Tracker.

Andrews Kurth lawyers were involved in 32 deals valued at $26.2 billion, including two of the five largest transactions so far this year. The firm was the legal adviser for Oklahoma-based Williams Companies in its $13.8 billion financial restructuring and Crestwood Equity’s $7.5 billion acquisition of its sister company, Crestwood Midstream.

The M&A team at Akin Gump handled 31 deals with a combined value of $27 billion, while Baker Botts represented companies involved in 30 transactions with a total price tag of $40.2 billion.

Haynes and Boone and Thompson & Knight handled 23 deals and 15 transactions respectively.

Akin Gump M&A partner John Goodgame was the lead lawyer or shared the lead spot in 11 mergers and acquisitions, with a combined value of $5.5 billion. Two Haynes and Boone partners – Tom Tippetts and Darrell Rice – were the lead legal advisers in five transactions each.

Rounding out the top 10 Corporate Deal Tracker M&A legal advisers so far this year are Adam Larson of V&E, Chris LaFollette of Akin Gump, Doug Rayburn and Mike Bengston of Baker Botts, Vic Vanetti of Andrews Kurth, John Pitts of Kirkland & Ellis and Michael Dillard of Latham.

Securities Offerings

While mergers and acquisitions have been down slightly in Texas, the world of securities offerings has been red hot.

So far this year, Texas-based lawyers have handled 123 securities offerings, raising a total of $79 billion for their clients, according to the Corporate Deal Tracker.

Twenty-seven of the securities offerings were worth $1 billion or more. More than 85 percent of the capital offerings involved businesses in the energy sector.

The Corporate Deal Tracker includes securities offerings submitted to The Texas Lawbook prior to July 29.

Four law firms dominate capital markets work in Texas. V&E, Baker Botts, Latham and Andrews Kurth have handled 89 percent of the 123 securities offerings between Jan. 1 and June 30.

Sitting atop the Corporate Deal Tracker leaderboard for securities offerings is V&E. The Houston-based firm handled 60 of the transactions for $36.8 billion. The firm represented Columbia Pipeline Group in a $2.75 billion offering and Enterprise Products in a $2.5 billion offering.

Baker Botts is second, acting as legal advisers in 37 offerings that raised $26.6 billion. The firm represented Valero Energy, Ensco and Noble Corporation in $1 billion-plus offerings. Baker Botts partners Mollie Duckworth and Doug Rayburn handled 10 offerings with a combined value of $5.7 billion during the first seven months of 2015, according to The Texas Lawbook’s Corporate Deal Tracker.

In third place, Latham represented 36 clients raising $21 billion. Latham represented the issuer in two of the three largest offerings. The firm advised ETP in $3 billion and $2.5 billion security offerings. Latham partners William Finnegan and Michael Dillard were each legal advisers in four offerings for a total of $13.2 billion. Latham submitted several additional capital markets offerings Friday, but those have not been included in these statistics.

Andrews Kurth, which ranked fourth, handled 31 offerings valued at $17.6 billion. The firm was the legal adviser for the underwriters in the two ETP offerings mentioned above. Andrews Kurth partners Muriel McFarling and Mike O’Leary advised in a combined five offerings valued at $1.7 billion. O’Leary also advised in two M&A transactions with a total price tag of $7.9 billion.

The final five months of the year are likely to bring a great amount of activity in the world of M&A. Stay tuned.