Last week, The Texas Lawbook published the exclusive Corporate Deal Tracker ranking of law firms whose Texas lawyers handled the most mergers, acquisitions and joint ventures in 2023.

Unfortunately, we missed 65 M&A transactions done by three law firms that were submitted to the CDT at the end of the year. We accidentally recorded one transaction as a $4 million deal when it was for $4 billion. The Lawbook withdrew the article from publication as soon as we recognized our error.

We start with an apology and a plan, described at the end of the article, that we believe will prevent the mistake from happening again.

Today’s Lawbook article corrects our mistakes, provides the updated accurate law firm rankings and identifies how we made the errors.

But before we explain what happened with the data, we focus on the results.

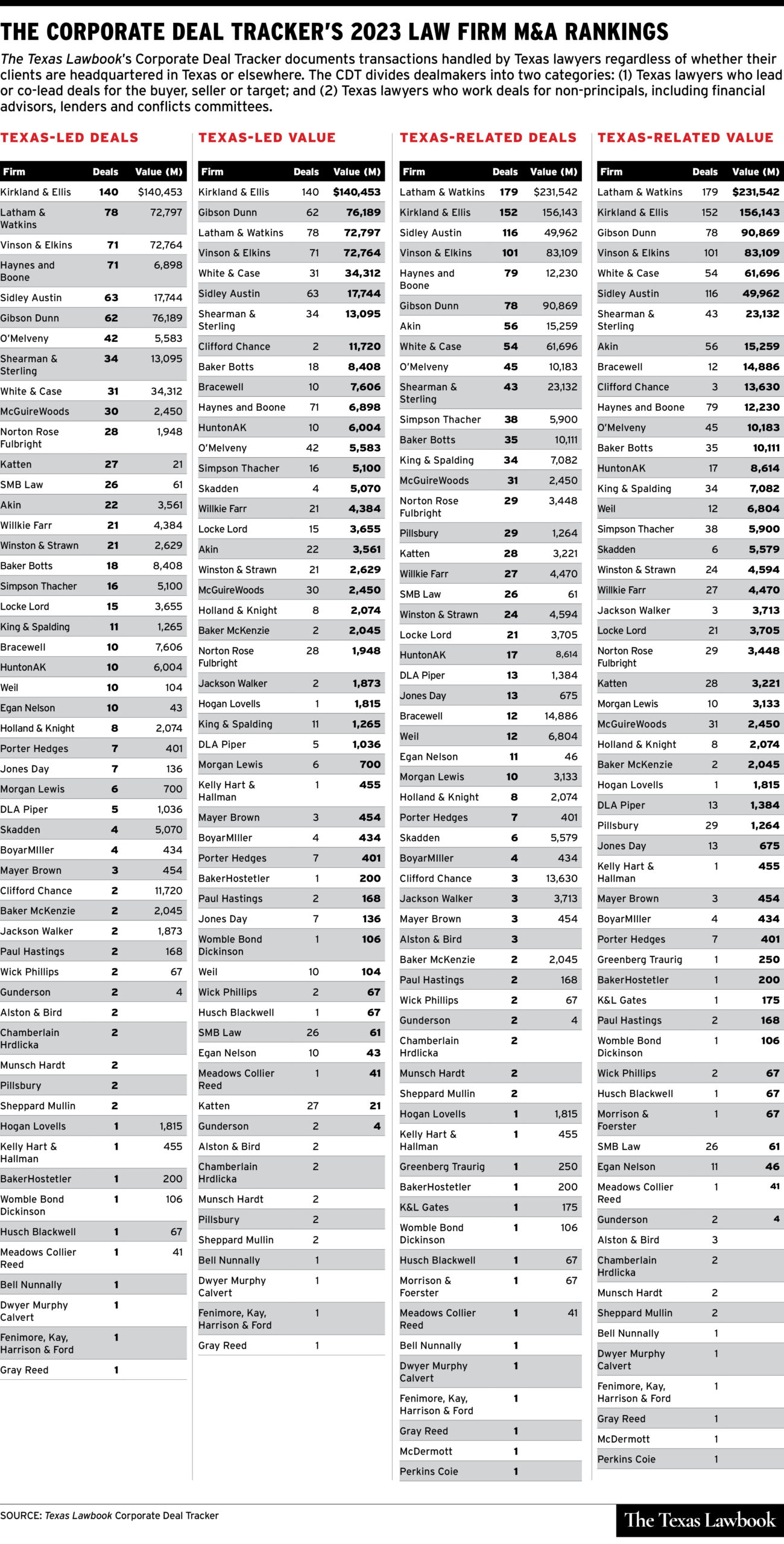

The Lawbook’s Corporate Deal Tracker shows that hundreds and hundreds of transactional lawyers working at 57 law firms in Texas worked on about 1,500 M&A deals last year. Fourteen of the 57 law firms are headquartered in Texas.

Texas lawyers at 28 law firms worked on 10 or more M&A transactions last year. Nineteen firms had Texas attorneys involved in 25 or more deals in 2023.

Eight law firms — Akin, Gibson, Dunn & Crutcher, Haynes Boone, Kirkland & Ellis, Latham & Watkins, Sidley Austin, Vinson & Elkins and White & Case — reported their lawyers in Texas worked on 50 or more transactions.

Four law firms — Kirkland, Latham, Sidley and V&E — had lawyers in their Texas offices work on 100 or more M&A deals last year, according to CDT data.

The Texas attorneys at only two firms recorded total 2023 deal counts at 150 or more and deal values exceeding $150 billion.

And a single law firm saw its lawyers in Austin, Dallas and Houston act as lead or co-lead legal advisor for the buyers, sellers or targets in 140 deals — nearly twice as many as any other law firm.

The CDT tracks transactions handled by Texas lawyers regardless of whether their clients are headquartered in Texas, New York or Dildo, Newfoundland. The CDT divides dealmakers into two categories:

• Texas-led, in which a firm’s Texas lawyers lead or co-lead as counsel for one of the principals (buyer, seller or target); and

• Texas-related, which is our more inclusive list that tracks all Texas lawyers who worked on a deal for any party, including financial advisors, lenders and conflicts committees.

The Lawbook relies on multiple sources — including company press releases, public filings with the U.S. Securities and Exchange Commission, Bloomberg Law and other media sources such as LinkedIn — to identify M&A and CapM activity by lawyers in Texas. The most prevalent sources are the actual dealmakers, including the law firms, reporting the transactions to Lawbook reporter Claire Poole for the CDT Weekly Roundup and to the CDT through its online data submission portal.

For the first time since the creation of the CDT in 2015, different law firms ranked No. 1 in the two categories.

CDT Lead Texas Counsel Rankings

The champion of M&A in Texas in 2023 was once again Kirkland.

Texas lawyers for the Chicago-founded corporate firm led or co-led 140 mergers, acquisitions and joint ventures in 2023 with a combined deal value of $140.4 billion, according to CDT data. The 140 transactions led by Kirkland attorneys in Texas are down from 163 deals in 2022 but still nearly double any other law firm.

Latham ranked second, as its lawyers in Austin and Houston led or co-led 78 transactions — the exact same number Latham led in 2022 — with a total price tag of $72.7 billion.

The Texas lawyers for Haynes Boone and V&E were the lead or co-lead legal advisors in 71 deals. For Dallas-based Haynes Boone, the deal count was nine percent higher than in 2022. For V&E, it was actually a decline from 93 such transactions a year earlier, according to CDT data.

Sidley’s Texas lawyers led 63 transactions valued at $17.7 billion.

CDT data shows that Gibson Dunn saw its Texas-led M&A jump 77 percent in 2023. The Dallas and Houston lawyers at Gibson Dunn ranked sixth in leading M&A transactions with 62 — up from 35 in 2022 — and ranked second in value at $76.1 billion.

CDT Overall M&A Law Firm Rankings

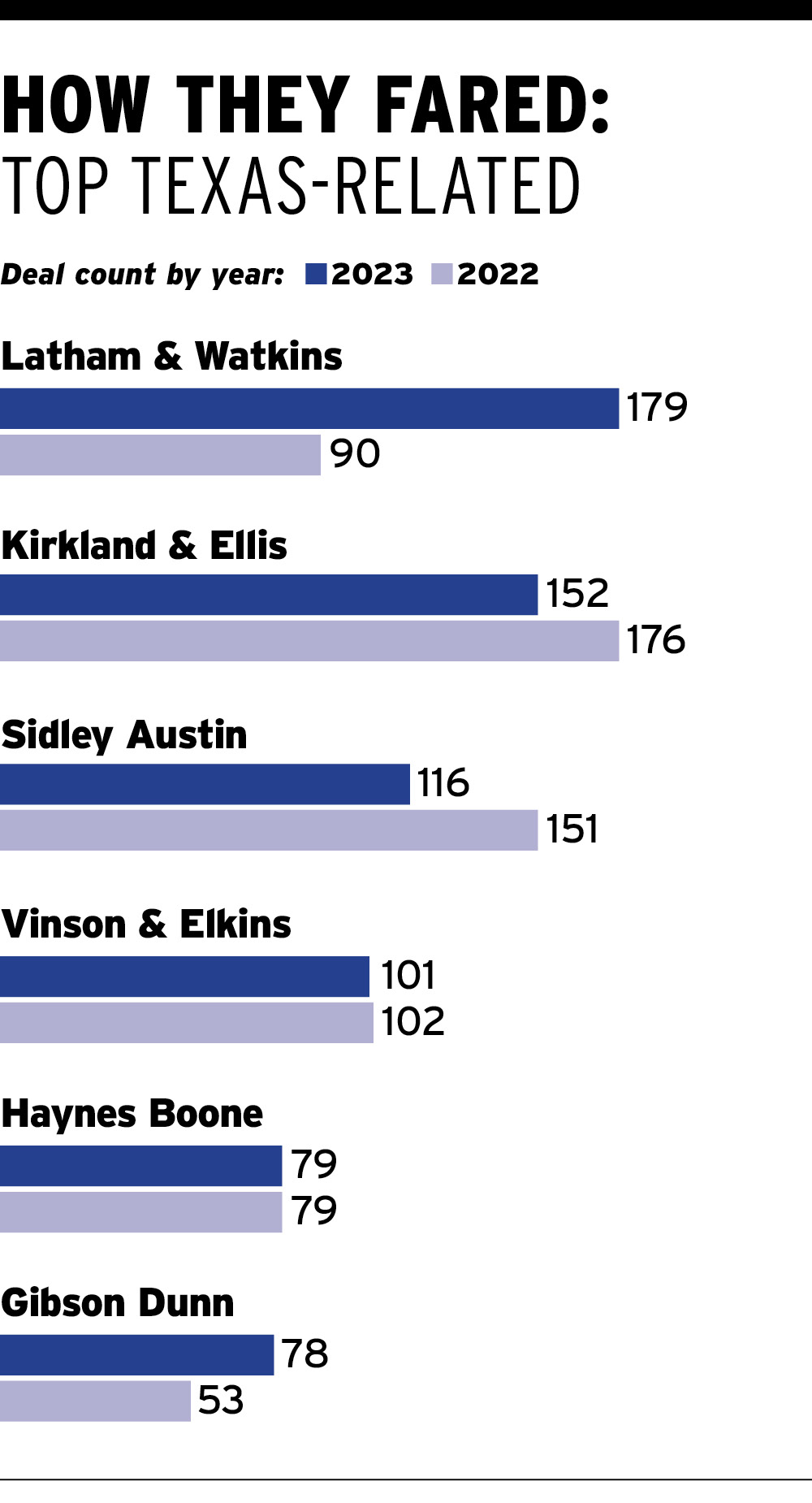

The Texas lawyers for Latham worked on a record-setting number of M&A deals — 179 in all — and nearly twice as many as the firm reported in 2022. The combined value of those transactions was a whopping $231.5 billion, according to CDT data.

Of the 179 transactions reported by the Los Angeles-founded corporate firm, 101 were deals in which its Texas lawyers either worked on M&A being led by partners in non-Texas offices or they advised parties, such as financial advisors or conflicts committees, other than the principals. Latham also improved its deal reporting efforts to identify its Texas lawyers who worked on transactions outside of the state.

CDT data shows that Kirkland’s Texas attorneys were involved in 152 M&A deals with a combined value of $156.1 billion. More than 90 percent of Kirkland’s reported deals were led by Texas lawyers representing the buyers, sellers or targets.

Ranked third on the CDT M&A law firm list are Texas lawyers for Sidley, who worked on 116 M&A transactions valued at $49.9 billion.

V&E lawyers in Texas worked on 101 deals with a combined price tag of $83.1 billion, while Haynes Boone attorneys in Texas worked on 79 transactions with a value of $12.2 billion.

While Kirkland and Sidley witnessed declines in their overall M&A deal count work. Haynes Boone and V&E remained even. Gibson Dunn saw the number of deals its Texas attorneys billed hours on jump from 53 in 2022 to 78 last year.

Lawbook Correction Explanation

In 2023, law firms with operations in Texas submitted more than 2,000 transactions to the CDT, which documents M&A activity handled by Texas attorneys.

The CDT team examines each one to make sure that they qualify — that the deals were announced in 2023, that they involved lawyers in the firms’ Texas offices and they were actually M&A or CapM and not fundings or contractual agreements or some other kind of hybrid transaction. Hundreds of submissions were reclassified or disqualified, most often as duplicates of previous submissions.

Then, the CDT team determines whether the Texas lawyers were the lead or co-lead legal advisors for the buyers, sellers or targets.

In an effort to be as accurate as possible, The Lawbook sent law firm leaders in Texas an email on Dec. 11 with an attachment of the firm’s M&A transactions in the CDT database in 2023. The email asked firms to review the list and to send us full details of M&A transactions that met the criteria — that the transactions were announced in 2023 and involved their Texas lawyers — by Dec. 18.

The CDT team was inundated by law firms with spreadsheets listing hundreds and hundreds of deals with missing details — some did not even name lawyers for their own firms that were involved. This required the CDT team to try to track down the legitimacy of each of the deals.

The purpose of the Dec. 11 outreach and the specific information being sought may not have been clearly explained by The Lawbook. The resulting data submissions by firms created a bottleneck that we failed to adequately handle. The Lawbook’s policy of fairness and transparency required that we take down the original story and re-evaluate the data.

For the past week, the CDT team reviewed incomplete and sometimes incorrect data submitted by law firms, but the team also identified submissions that had not been properly researched.

The result is that The Lawbook will issue clearer reporting methods to law firms for 2024. The goal is simple: To give law firms the opportunity to report all of their qualified transactions. But these reporting methods will require the firms to provide all the necessary information or their submissions will not be accepted.

The Lawbook regrets the errors we’ve described, but with the help of the firms who provide us their data we will work hard to assure that such a significant failure of process will not happen again.