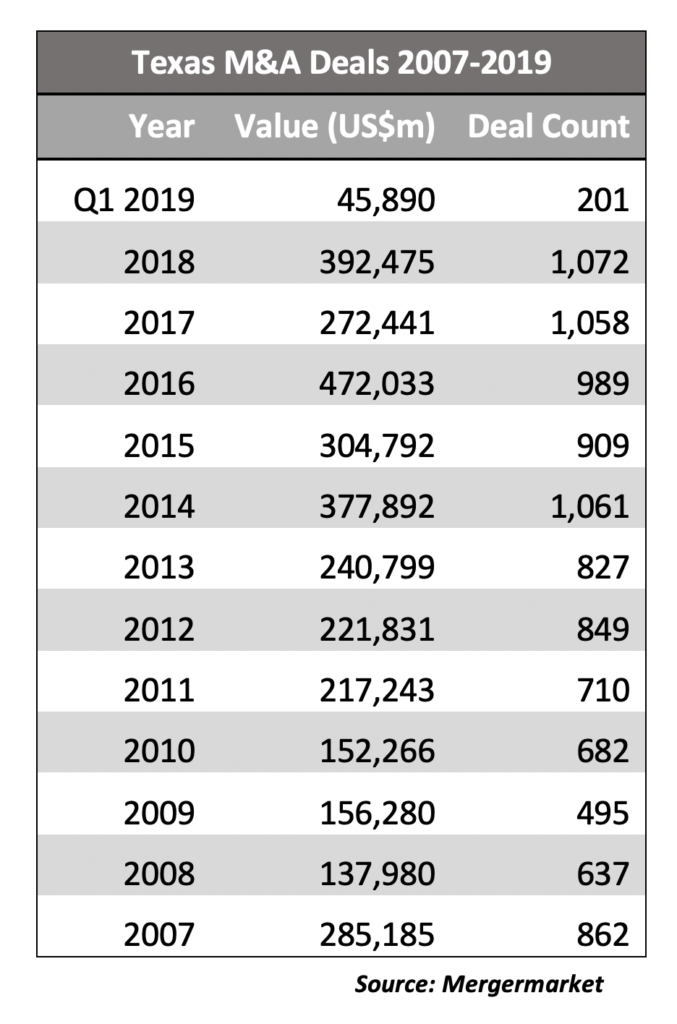

Deal activity involving Texas companies experienced a huge drop in the first quarter of this year, according to Mergermarket data provided exclusively to The Texas Lawbook.

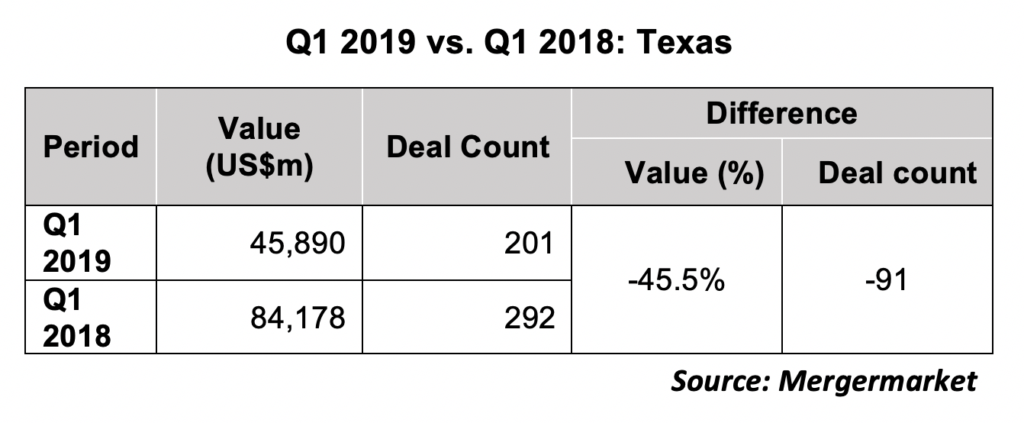

Deal value slid 45.5% over the same period last year to $45.89 billion while deal count slipped by 91 transactions to 201.

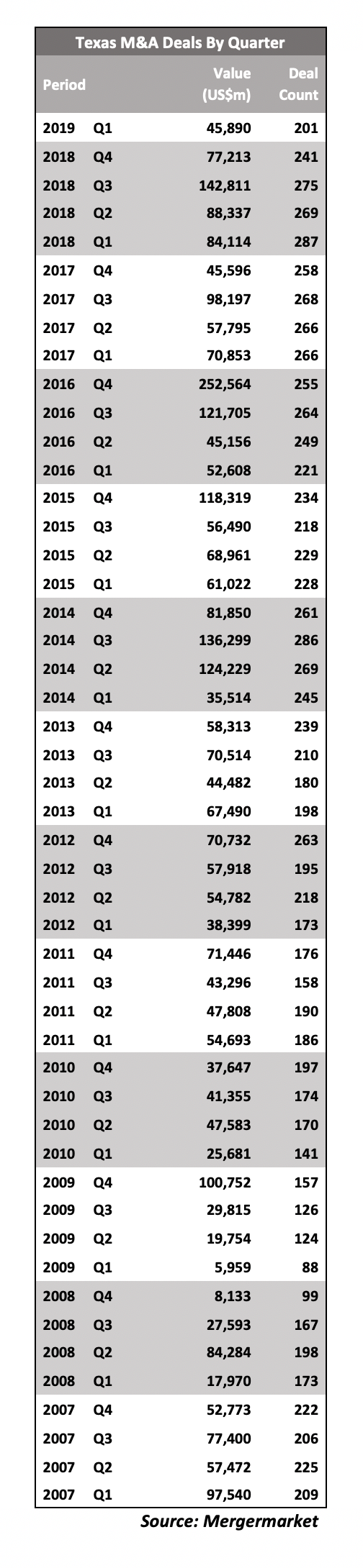

In fact, deal count was the lowest since the second quarter of 2013, which amounted to 181 transactions, but it’s still above the 200 deals per quarter measurement.

Deal value, meanwhile, was the lowest since the fourth quarter of 2017, which came to $42.4 billion.

Deal activity also plunged from the preceding fourth quarter – 40.6% by deal value and 73 deals by count.

The top deal in the quarter was Cousins Properties’ purchase of Dallas-based TIER REIT in March for $2.3 billion, with Wachtell Lipton Rosen & Katz advising Cousins and Goodwin Procter assisting the target.

Jones Lang Lasalle’s $1.97 billion acquisition of Dallas-based HFF Inc., also in March, came in second, with Sidley Austin advising the bidder while Dechert assisted the target (alas, no Texas lawyers from either firm).

That transaction was followed by ArcLight Capital’s $1.259 billion pickup of a 71.53% stake in American Midstream Partners (Texas lawyers from Kirkland & Ellis worked for ArcLight while Gibson Dunn represented American Midstream and Thompson & Knight its conflicts committee); and Tenaris’ $1.2 billion acquisition of Ipsco Tubulars (Sullivan & Cromwell aided the buyer while Texas lawyers from Latham & Watkins did so for the target).

Only two other deals surpassed the $1 billion mark: TPG’s $2.1 billion purchase of Tailwater-backed Goodnight Midstream (Kirkland and Willkie Farr & Gallagher counseled the buyer while Vinson & Elkins and Locke Lord advised the seller, all four with Texas lawyers); and EQM Midstream’s $1.03 billion purchase of 60% of Morgan Stanley Infrastructure’s Eureka Midstream and Hornet Midstream Holdings (Texas lawyers at Latham advised the bidder).

The sale of beer distributor Silver Eagle Distributors’ Houston-area territory to Redwood Capital Investments in March and the sale of Discovery Midstream Partners II to Stonepeak Infrastructure Partners in January both amounted to $1 billion.

Attorneys weren’t disclosed on the Silver Eagle sale to Redwood while Texas attorneys from Kirkland advised Discovery Midstream and Hunton Andrews Kurth counseled Stonepeak.