If the past 13 months have demonstrated anything, mergers, acquisitions, and joint ventures in the oil patch are keeping corporate lawyers in Texas incredibly busy.

With two major M&A deals this week — Chord’s $4.2 billion acquisition of Enerplus and CenterPoint’s $1.2 billion shedding of natural gas assets to Bernhard Capital — Texas lawyers have officially worked on 198 oil and gas transactions with a combined deal value of $326 billion since Jan. 1, 2023, according to The Texas Lawbook’s exclusive Corporate Deal Tracker database.

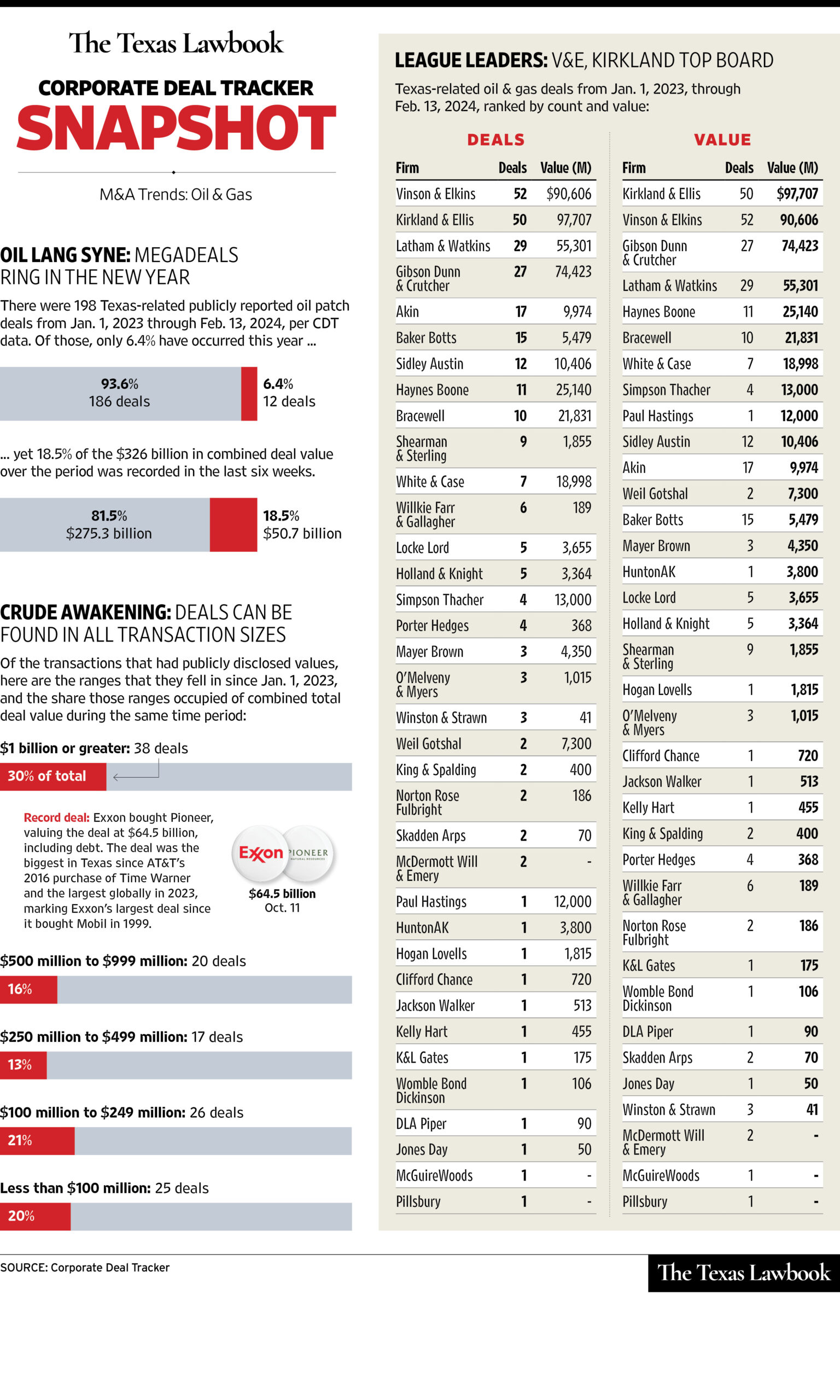

In 2024, there have been a dozen M&A such deals with a value of $50.7 billion.

The Corporate Deal Tracker shows that Houston-headquartered Vinson & Elkins has been involved in 52 oil and gas transactions since Jan. 1, 2023, while Kirkland & Ellis is a close second with 50 deals. Latham & Watkins and Gibson Dunn ranked third and fourth, respectively. Akin is fifth.

Kirkland ranks first in oil patch deal value. V&E is second, Gibson Dunn is third, Latham comes in fourth and Haynes Boone is fifth.

CDT data shows that 46 percent of the oil and gas transactions were valued at $500 million or more, while 20 percent had deal valuations of less than $100 million.