Earlier this month, Peter Nelson began his three-year term as managing partner of Minneapolis-based Dorsey & Whitney.

With 17 years at the firm, Nelson has served as co-leader of Dorsey’s Finance and Restructuring Group and is the former co-leader of the Banking & Financial Institutions Industry Group. He also has played a key role in expanding Dorsey’s presence, helping to integrate new market locations such as Dallas and Phoenix.

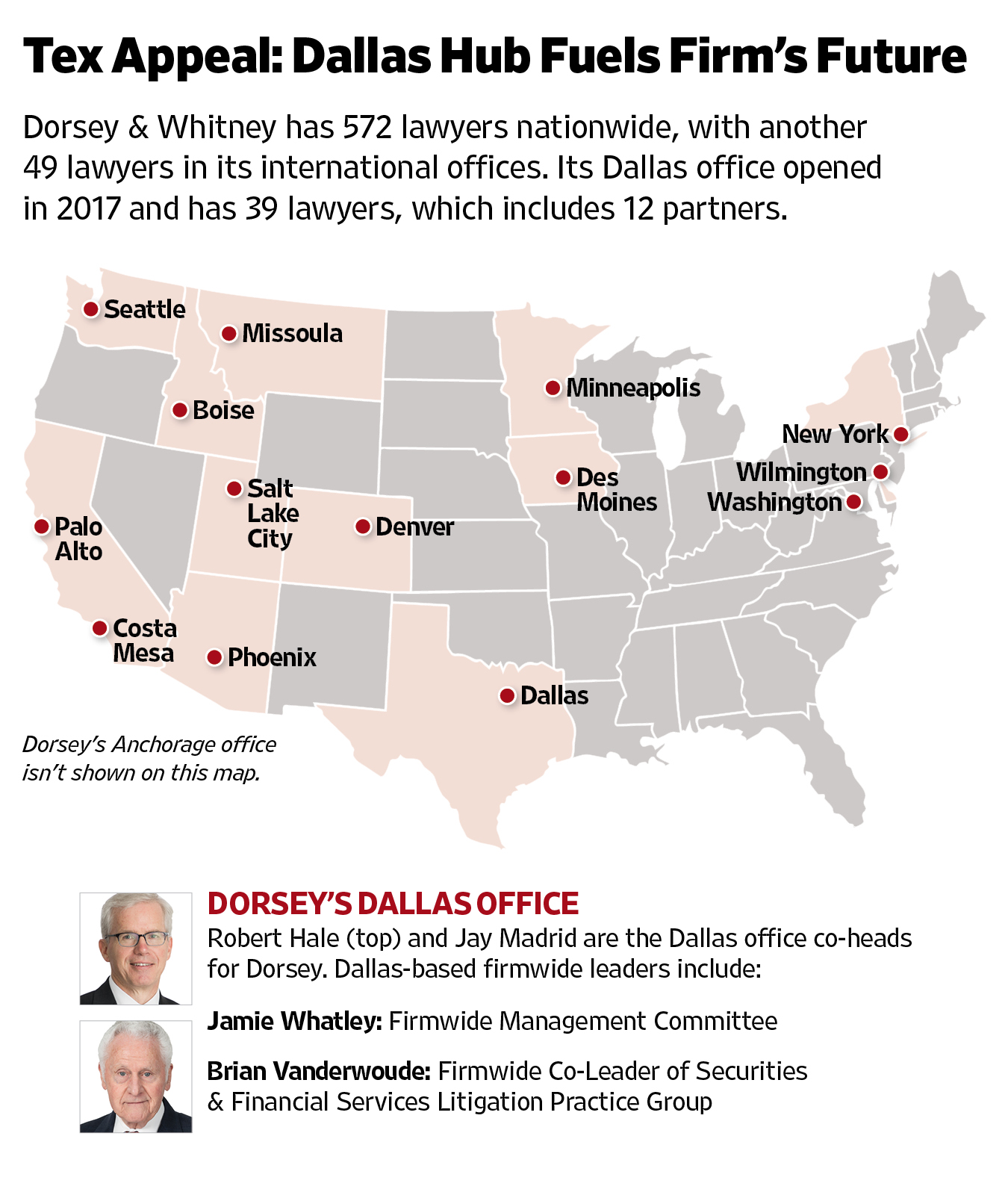

Dorsey’s Dallas office, launched in early 2017 with attorneys — including Larry Makel, Gina Betts and Jamie Whatley — from what was then the Dallas office of Schiff Hardin, is a critical market for the firm’s growth.

A New Jersey native, Nelson earned his undergraduate degree from Carleton College in Minnesota and received his JD from the University of Houston Law Center in 2002. He launched his legal career in the Houston office of Mayer Brown before joining Dorsey as a lateral hire in 2008, based in the firm’s Minneapolis office.

Having spent significant time in both Central Texas and Houston, Nelson has developed a lasting fondness for the Lone Star State. “I had the benefit of being in Austin for four years and in Houston for nine years,” Nelson shared in a recent interview with The Texas Lawbook. “People talk about Southern hospitality, but what they don’t understand is that Texas hospitality is truly on another level.”

Nelson deeply admires the community spirit of Texans and remains “eternally grateful” for the lifelong friendships he forged there. He also expressed heartfelt sympathies to those affected by the devastating flooding in the Hill Country earlier this month.

“Having spent many years in Houston and Austin, I have a number of close friends and family with long multi-generational connections to Camp Mystic and Camp La Junta,” Nelson said. “Words will never be enough to express the impact of this tragedy, but on behalf of the entire Dorsey family, I want to express our deepest condolences for those impacted by this catastrophe.”

In the following interview, which has been edited for length and clarity, The Lawbook spent some time discussing Nelson’s affinity for Texas, the impact of the Dallas office for the firm’s growth trajectory and more:

Lawbook: You became managing partner of the firm this month. How are you settling into the role and what will be your approach?

I’ve had the privilege of serving on the firm’s policy committee for the last five years and that includes the travel we do for the committee, where we try to visit four or five offices outside of Minneapolis every year as a group.

When you’ve got a platform the size of ours, having that sort of connectivity is really important. In addition to that, I’ve had a relatively national practice myself, so I already travel to many of our offices regularly. That was a strength that I could bring to this job.

I’ve already been down to D.C. I’ve already been down to Dallas and I do plan to continue to touch base regularly with all our offices. Obviously, I’m here in Minneapolis, which is our largest office. However, we have more lawyers in our offices outside of Minneapolis, and it’s critical to me that we maintain a unified one-firm approach.

Lawbook: What types of clients are good fits for Dorsey that also present growth opportunities?

The short answer is that it does depend somewhat on our practice group and geography.

Overall, the middle market is a strong strategic growth area for us.

We have folks across our platform who work with emerging companies, as emerging-company work can quickly transition into middle-market and large public companies opportunities for the firm if we connect with the right ones.

Traditionally, we had a strong stable within our corporate group, which consisted of what I would describe as Fortune 500 public companies. We still have those, but we’ve seen a lot of opportunity in the middle market, in particular. Those types of companies, which are growth-oriented, tend not to have large, sophisticated in-house legal departments. It’s often a smaller crew that needs to leverage outside counsel.

In the banking industry we cover a lot of the big five, so to speak, but we also have a great focus in working with regional and super regional banks, and even sometimes community banks, because they need outside counsel more often than a large bank that might have 250 lawyers in house.

So, how can we leverage it? We’ve seen a lot of opportunities in private credit, debt, funds and private equity. These are emerging areas where we fit well in terms of our skill set, expertise and ability to leverage the platform.

Most transactions in these spaces require expertise in M&A. Although we may not be the largest in terms of deal size, our high volume keeps us very much at the forefront as strategic leaders throughout the market. In terms of knowing what the market is, there’s almost always a finance component to what we do, and that’s near and dear to my heart. Our firm was originally established as a banking law firm, and we maintain strong ties to the lending community in general. This has evolved and expanded to include a greater focus on private credit. We’ve pivoted and Dallas is a great example of where we have real strength in that area.

Lawbook: You are quite familiar with the state, so I’d like to know how you see Dorsey’s presence evolving — especially in Dallas and other regions. You mentioned that it’s a strategic market, particularly in key segments. How does Texas fit into your overall plans for growth, especially in terms of attracting talent and expanding into new verticals?

Yes, it’s a great example of how we’re looking to grow across the platform. The short answer is that we’re in growth mode internationally and domestically. We’re absolutely looking to grow in all our markets, and we see good strategic opportunities in every one of them.

Some are more challenging, and some are more over-lawyered than others. But that doesn’t mean that we can stop where we are: We see momentum and growth being key to what we’re doing across our platform, whether that’s in the home office in Minneapolis or whether it’s in some of our stronger regional offices like Dallas, Phoenix, Seattle or Denver.

We also have growth offices in some of our smaller, newer locations, with Boise being a great example. Overall, the message we want to convey to the community and the profession is that we’re looking to expand in all our markets.

If I’m looking at Texas and Dallas specifically, it has been a fantastic market for us.

In 2017 in Dallas, we saw rapid growth outside of the core area of mezzanine and finance and restructuring that we started with. We were able to grow the full-service platform and that was always the objective. If I’m looking at the current makeup, we can always build on our strength of the core finance restructuring team.

I see great opportunities in the M&A space and, frankly, in real estate. We have strong practices already, but those are clear areas for growth.

M&A has had good opportunities in some tech areas and has also leveraged them.

Plus, the real estate side of the market is just so robust. There are numerous opportunities in a wide variety of different practices within it, which is a logical step for organic growth in Dallas. We have a solid core, so let’s build organically by identifying the right practices in the relevant areas.

If we look at the state more broadly, I see a fantastic opportunity, and we are definitely looking to expand into new markets.

Austin is near and dear to my heart. When I first moved to Texas in 1995, I lived in Austin for four years. I’ve seen what the legal market looks like there. I actually started when I was a paralegal at Fulbright and Jaworski all those years ago.

I’ve seen how the Austin market grew in the early to late 1990s and early 2000s when I attended law school. You watched the dot-com bubble burst, significantly tamping down on what was a burgeoning and rapidly expanding economy. And frankly, to watch it grow again and continue to grow has been fascinating, especially now that it’s no longer sector-specific. Yes, tech drives a lot of the Austin economy, but there’s so much more going on there that I see Austin as a great opportunity.

San Antonio is another example of a business community that is more complex and well-developed than it was 20 years ago. It’s fantastic to see. Texas is a testament to the significant growth, development and opportunities that have occurred.

Lawbook: Speaking of economic development and real estate, you were part of a team at Dorsey that was involved with opening the Dallas and Phoenix offices. Is there anything you’ve taken from those experiences as you all expand into new markets across the country?

A couple of good takeaways that I’ve had over the years of being part of the integration platform for two sorts of homegrown, developed offices from the ground up, one of which is that we do leverage our platform. We offer the opportunity for a core group to come in and have immediate access to all the different people you will need to expand your client base and grow your practice. If you were at a regional firm that wasn’t quite as full-service, we’ll connect you. Our practice group model enables us to integrate people quickly throughout the firm.

But all of that has to start with a vision: When you start the office, who do we need to get connected to? How can we leverage their connections to expand their practices by utilizing expertise they previously lacked access to?

In both Phoenix and Dallas, we went in with that mindset. We also went in knowing that we want to grow those offices quickly. We wanted to build around the core that we’ve developed and we needed a strategy for identifying which practices and types of practitioners to target. Those are ideas that you have to develop before you even sign on the dotted line to bring the folks in. You need to go in and have discussions with them, and they must buy in on not just what we’re going to do to get integrated, but also how we’re going to do it.

By having a practice group-managed firm, you need to leverage the knowledge base, connections and boots on the ground in each office to work in concert, collectively developing a vision and strategy for entering a market like Texas, for example.

We have practice groups that say, “We want to have litigation in Dallas. We want to have real estate in Dallas. We want to have M&A in Dallas.”

Well, who’s the best person in Dallas to help find the people that we need to fill those roles? It’s going to be people in Dallas. It’s going to be people with those local connections. So, we’ve always got this balance and this synergy that we need to manage between the local office, their contacts, their connections, and leveraging what they bring to the table.

Lawbook: How do you grow your talent but also retain it? Texas is a very competitive state, but I’m sure it’s no different in your other markets: every firm is out to get your top people.

There are different perspectives depending on the market. I am really focused on getting up-and-comers. I want talent that is ready to hustle. They’re ready to build. We’re usually offering them a proposition: if you’ve hit the ceiling where you are, let us help you grow. Let us take our international platform and let you leverage that so that you can get above the ceiling where you’re capped out because we see you have that entrepreneurial spirit.

We see that you have a strong business development drive, and you bring an amazing skill set to it. We’re going to help you succeed, and in helping you, you’ll help us succeed. That’s really the way we approach our laterals. We know that, over time and investment, there will be value added for us when it comes to associates. We have a couple of different strategies, one of which is that we run relatively lean, so we are not leveraged at a four or five-to-one associate-to-partner ratio. We’re closer to one-and-a-quarter-to-one, a little bit more, depending on how you want to categorize things, which allows us to give our associates very meaningful interactions with clients.

With opposing counsel, they get meaningful chances to develop their skills very early in their careers. In the early stages of their careers and development, that is what a lot of associates are looking for. They want to be where they’re developing. What they’ll notice, if they’re comparing us with an AmLaw 20 firm, is that they may have no realistic opportunity ever to make partner. And by partner, I’m not talking about a title that is thrown at you as a fifth or sixth year to help sell you. I’m talking about being an owner of the business. We offer a realistic opportunity for the right-minded associate who views this as a career and an investment in their future.

They see that they have an opportunity, that they can become an equity partner, and that they can develop a practice they can take their own internal spirit of entrepreneurialism and turn that into a lifetime practice. That’s not something that a lot of firms can offer simply because their leverage model and their business model is a more churn-and-burn approach. Because we have lower leverage, that gives more meaningful opportunity on the backside to actually have this be a place where you can make it a home for your career. Associates appreciate the opportunity to lead a deal and bring in business.

And that’s something that you’re starting to see … that gap now between certain firms. And the retreat from the larger firms now.

Lawbook: What do you miss personally about Texas?

There are a lot of things. But the people and the food.

I had the benefit of being in Austin for four years and being in Houston for nine years. And whether it’s seafood, Tex Mex or barbecue, it’s amazing. I love it all, and you can’t get it outside of Texas.

Not being from Texas, it was incredible how warm and welcoming of a place it was. At first, I thought that might just be Austin. But when we moved to Houston, it was the same thing. People invited you to come to their homes for dinner, such as for Thanksgiving. We became very, very tight with people in the community, and I maintain a lot of very close personal relationships with lifelong friends that we made in Texas. For that, we’ll always be eternally grateful.