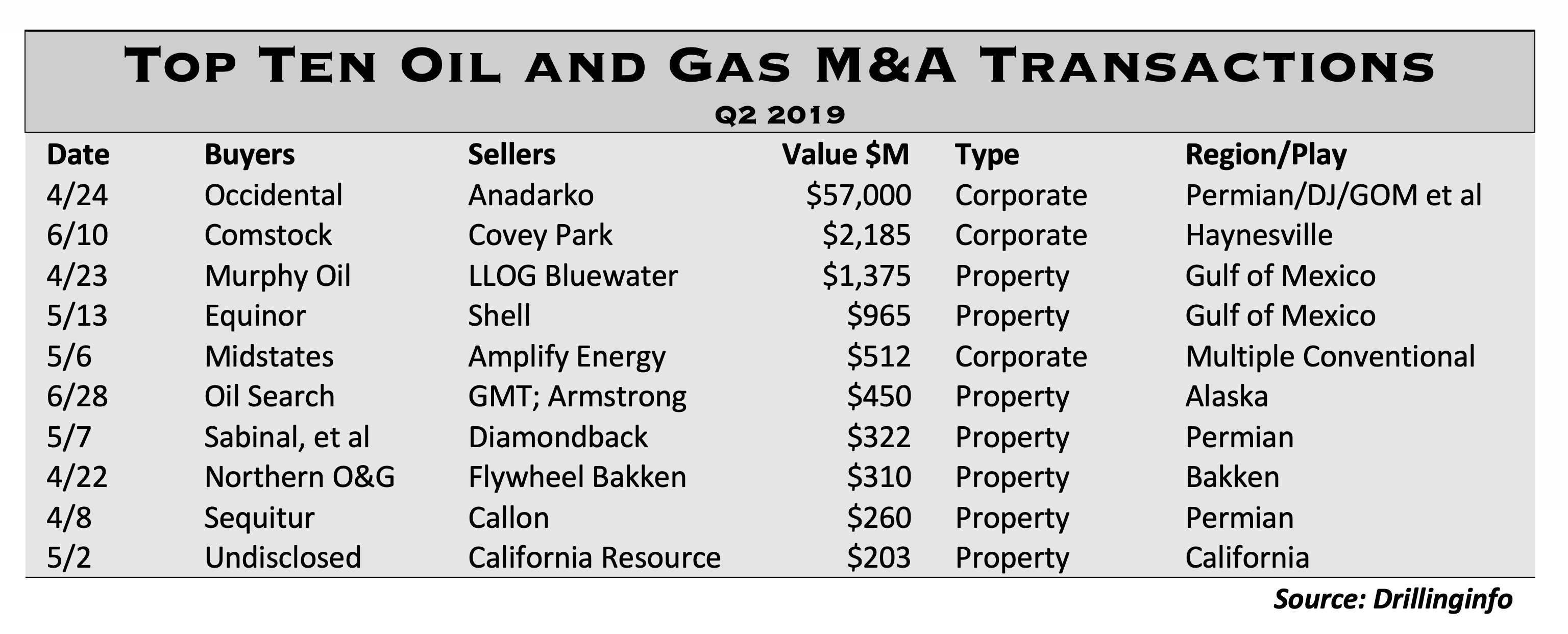

M&A in the oil and gas exploration and production sector rebounded in the second quarter to $65 billion, according to data released Tuesday by Austin-based Drillinginfo.

Excluding Occidental Petroleum’s $57 billion announced purchase of Anadarko, the total came to $7.6 billion, which Drillinginfo said matched its expectations. While that figure is nearly a four-fold increase over the $2 billion low reached in the first quarter, it’s less than half of the average $19 billion quarterly total seen between 2017 and 2018.

Drillinginfo M&A analyst Andrew Dittmar said in a statement that the Occidental-Anadarko deal is largely a play on U.S. shale – “particularly in the juggernaut Permian” – despite the fact that Anadarko’s assets are located around the world.

Other large deals in the quarter focused on the Haynesville, the Gulf of Mexico and onshore U.S. conventional assets.

The firm expects deal activity likely to remain slow but steady in the third quarter as private capital is put to work.

Comstock Resources had the second-largest deal of the quarter when it acquired private equity-backed Covey Park for $2.2 billion to expand its Haynesville operations. That transaction involved Dallas Cowboys owner and Comstock controlling shareholder Jerry Jones boosting his commitment to Comstock by $475 million to $1.1 billion.

Drillinginfo said Jones’ support permitted Comstock to avoid one of public oil and gas companies’ key impediments to acquisitions — “a near complete lack of Wall Street financial support.”

The firm said there’s been little-to-no growth capital provided via follow-on equity raises to U.S. publicly traded oil and gas companies and bond issuances are on track for a decade low. Drillinginfo added that operators are focused on efficiently drilling existing inventory to expand production, despite the firm’s expectation that capital expenditures will be cut by an average of 20% for more than 50 explorers and producers this year.

“Wall Street, consistent with the message for E&Ps to live within cash flow, has cut off new investment dollars from public markets,” Dittmar said. “Smaller E&Ps, many of which were focused on growth and counting on continued funding, have been particularly impacted. Some of these smaller companies could evaluate whether they would be better off private.”

John Spears, director of market research at Drillinginfo, said private capital is still being deployed, albeit potentially with a different model from past years.

“Private money is finding targeted opportunities,” he said, noting companies like Kayne Anderson-backed Sabinal buying production-heavy assets as public companies trim their portfolios. “The investment timeline may have lengthened from past years, but these companies still see opportunity to generate cash flow.”

Other private moves include the merger of Ares-backed Gastar with Apollo-backed Chisholm and talks between Elliott Management and QEP Resources for a go-private deal.

Wiidespread consolidation didn’t happen in the second quarter in the wake of Oxy-Anadarko because of wide price expectations between buyers and sellers, the firm said. But further “mergers of equals” like the Midstates/Amplify deal in May and the recent oilfield services combination of Keane Group and C&J Energy may continue.

Other predictions: That operators will continue to pursue alternative financing, such as drillcos, with tight capital markets; and the royalty market will keep gaining momentum with more buyers expanding their portfolios.

Drillinginfo noted that Brigham Minerals joined the ranks of public royalty companies in the quarter with a $300 million initial public offering. It also said that the Gulf of Mexico is seeing some activity as companies look at cash flow generating assets; and explorers and producers are looking to midstream asset sales and joint ventures as additional capital sources.