© 2014 The Texas Lawbook.

By Mark Curriden, JD

Senior Writer for The Texas Lawbook

HOUSTON (January 23) – Breitburn Energy Partners General Counsel Greg Brown faced an unfathomable dilemma last year when his oil and gas company decided to buy $860 million of oil fields in Oklahoma.

“We couldn’t find a local lawyer to act as local counsel because every law firm told us they already had too much work and were not taking any more clients,” Brown says. “I never thought I would see the day when there weren’t enough lawyers, but that’s what’s happened in oil and gas.”

The oil and gas boom in Texas has provided a seismic jolt for the law firms that represent energy companies.

Annual revenues for the Texas law firms handling the mergers, acquisitions, divestitures, joint ventures and initial public offerings for the energy companies and their investors are at all-time highs. Profits per partner at those law firms exceed $1.5 million a year.

Now, there’s more good news for those law firms: The general counsel at more than a dozen major energy companies tell The Texas Lawbook they plan to spend more money for legal fees in 2014 because they expect to do more oil and gas deals this year than they have ever done before.

“It is a very good time to be an energy lawyer in Texas right now,” says Stephen Coats, the general counsel at New York-based Riverstone Holdings, a private equity firm that does a steady amount of energy deals in Texas and employs a lot of lawyers to handle those transactions.

“I think 2014 is going to be a very active year for oil and gas M&A,” says Coats. “There’s still an insatiable appetite out there for capital in the midstream and upstream sectors.”

It is hard to believe that it could get any bigger or better than it has been the past five years for energy lawyers and the companies they represent.

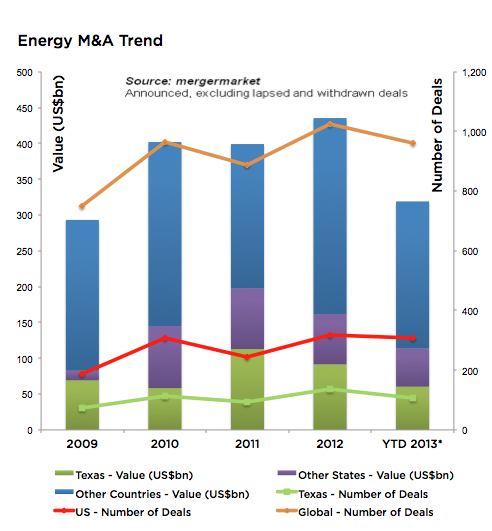

Since 2009, Texas-based energy companies have been involved in more than 537 major M&A transactions valued at $396 billion – 117 of those deals occurred in 2013, according to new data provided to The Texas Lawbook by mergermarket, an independent global research firm associated with the Financial Times.

Between 2009 and 2013, mergermarket reports there were 1,369 energy deals completed in the U.S. valued at a total of $602.2 billion. Globally, there were $1.85 trillion in energy transactions during that same time period.

“There’s a significant need for new pipelines, new drilling wells, new processing plants and lots of assets that need to be developed,” says Dallas-based Crosstex Energy General Counsel Joe Davis. “There’s also a lot of private equity money out there that needs to be put to work.

“That means 2014 should see a lot more of the kind of deals that we’ve seen over the past few years,” says Davis.

Davis and other general counsel point out that every one of those companies involved in each of those transactions – the buyers, sellers and financial institutions – hire their own legal teams that have as few as four or five lawyers for the simple deals or as many as 30 or 40 attorneys for the more complex ones.

An analysis by The Texas Lawbook has found that there are more than 3,500 business lawyers in Texas who spend all or most of their time representing energy clients in 2013. Baker Botts and Vinson & Elkins, widely recognized as the two largest energy-focused law firms in the U.S., each have about 400 lawyers who work a significant amount of their time for clients on energy-related matters.

In addition, Texas energy companies such as Chevron, Anadarko, Apache and Kinder Morgan employ more than 1,500 lawyers in their corporate in-house legal departments.

“Energy M&A goes way beyond the half-dozen lawyers working specifically on the merger or acquisition,” says Keith Fullenweider, who is the head of M&A and private equity at Vinson & Elkins in Houston. “The larger transactions require lawyers who specialize in capital markets, tax law, environmental and regulatory law, securities regulations, intellectual property protections, labor and employment law and executive benefits.

“There are only a few law firms based in Texas that offer the broad legal talent to handle all these issues that pop up,” says Fullenweider.

The more experienced law partners handling most of these energy deals now charge between $650 an hour and $1,050 an hour, according to several energy general counsel. Even mid-level and senior associates at the large law firms are billing at a rate of $300 to $500 an hour.

“It is amazing how many $900 and $1,000 an hour lawyers there are in Texas now,” says Coats, the GC at Riverstone. “But that’s where the market is right now for that kind of high level of experience.”

Robin Fredrickson, an energy partner at Latham & Watkins in Houston, says the reputation of oil and gas lawyers has improved greatly during the past decade.

“Just a few years ago, oil and gas lawyers were viewed by the rest of the legal profession as nothing more than dirt lawyers,” says Fredrickson, who has practiced oil and gas transactional law for 28 years.

“Now, everyone wants to be known as an oil and gas lawyer,” she says. “Oh, how the world has changed in just a few years.”

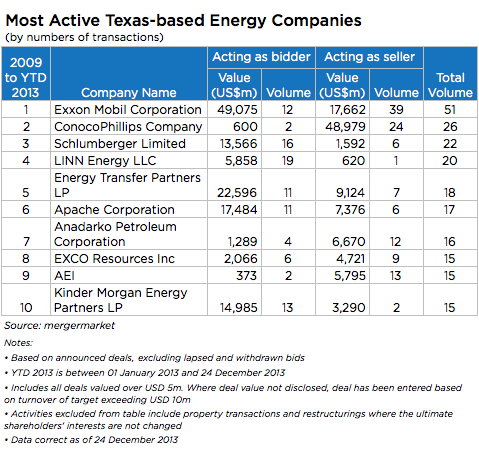

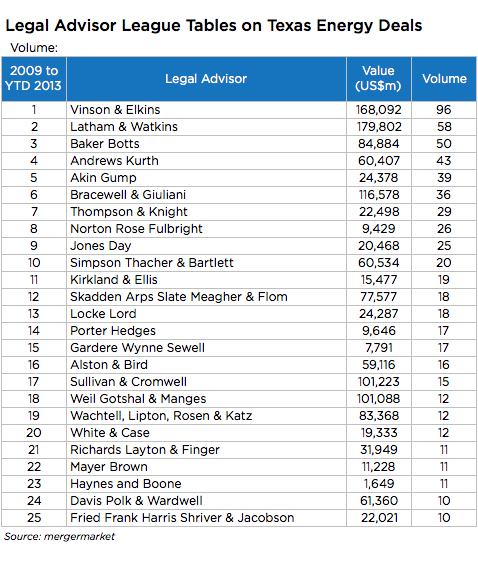

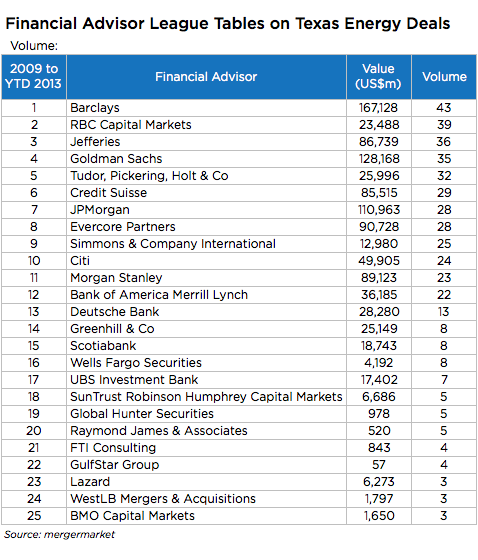

The mergermarket data shows that a handful of major corporate law firms dominate the energy sector.

During the past five years, V&E has advised energy companies and private equity firms in an astonishing 96 major transactions valued at $168.1 billion. In 2013, V&E represented Houston-based Enbridge Energy Partners, Houston-based Plains All American Pipeline, Dallas-based Pioneer Natural Resources, and private equity firms Riverstone Holdings and Fort Worth-based TPG Capital in billion-dollar or more mergers, acquisitions and joint ventures.

“Private equity firms such as TPG Capital, KKR (Kohlberg Kravitz Roberts) and Riverstone continue to be aggressive,” says Fullenweider. “We are seeing new investors coming into the oil and gas market from outside the U.S. and from private equity firms in the U.S. that have not made large energy investments in the past.”

Latham & Watkins did the second most deals (58 transactions valued at $179.8 billion) between 2009 and 2013. Latham is a Los Angeles-based law firm that opened its Houston office in 2010 by hiring top energy and M&A lawyers away from Texas-based firms. Latham’s strategy and timing were perfect, as the firm’s Houston office is now one of the mega-firm’s most profitable.

Houston-based Baker Botts (50 energy deals valued at $84.9 billion) and Andrews Kurth (44 deals with a combined price tag of $61.7 billion) also have enjoyed tremendous success during the oil and gas boom, according to mergermarket. Several Baker Botts partners, for example, represented Crosstex in its multi-billion dollar venture announced in October with Devon Energy.

Akin Gump (39 deals with a value of $24.4 billion) and Thompson & Knight (29 deals with a price tag of $22.5 billion) in Dallas also get their fair share of energy deals.

But even mid-sized law firms, including Porter Hedges in Houston and Kelly Hart & Hallman in Fort Worth, have seen their energy practices prosper.

The law firms note that the mergermarket data misses many smaller oil and gas transactions as well as deals between two private energy companies that are never made public. For example, Andrews Kurth handles a lot of securities offerings for private oil and gas companies that are often kept confidential. And Thompson & Knight reports that it handled about 60 energy industry deals worth about $9 billion in 2013, but that many of those transactions are kept confidential at the request of the privately owned companies.

“Our company is always looking for good deals,” says Dena Denooyer Stroh, the general counsel at Murchison Oil & Gas, which is one of those smaller, private energy companies.

“We are growing. During the next five years, we want to double our growth of revenue and drilling just about every year,” says Stroh. “That growth means more outside legal fees.”

That is good news for Thompson & Knight, which is Stroh’s primary outside counsel on transactional and real estate matters.

Hunter White, an energy lawyer with Thompson & Knight in Houston, says Stroh is not alone among corporate general counsel predicting that upstream oil and gas companies will increase their M&A activity in 2014.

“The appetite for buying assets is still there,” says White. “There has been a narrowing of focus during the past year, as some companies got a little too excited in their acquisitions.”

“A lot of companies stepped back in 2013 and did some strategic planning,” says White. “As long as there’s cash available, these companies are going to be looking for opportunities to grow in targeted areas.”

Chad Watt, an M&A analyst and writer with mergermarket, says that the numbers clearly support White’s position. Watt says there were large numbers of transactions from 2009 to 2012 involving upstream companies seeking to gain a foothold in the natural gas E&P market.

Because capital during those early years was tight, many of those deals were financed through joint ventures with nationalized energy companies from China and India.

Those deals slowed considerably in 2013, as E&P companies re-evaluated their assets and market positions and as money became more accessible through the capital markets.

“The amount of foreign interest in investments seems to be significantly on the wane and we are seeing a lot of private equity funds filling the smaller and mid-sized deals,” says Mark Berg, the general counsel of Pioneer Natural Resources. “The private equity interest is likely to continue or grow stronger in 2014.”

In fact, Berg closed the last large international joint venture when Pioneer engineered a $1.7 billion deal with China’s Sinochem Group exactly one year ago.

Berg and other energy general counsel point out that while the overall number of energy transactions remained high, there were no blockbuster mergers or acquisitions in 2013. He and others predict that most will range from a few hundred million dollars to single digit billion-dollar.

“There are a bunch of energy companies in the $10 billion to $25 billion market cap range,” says David Kirkland, an energy law partner at Baker Botts in Houston. “There’s a possibility, if the stars align, that the super majors make a run at one of them in 2014.”

“The biggest question is, where are commodity prices going?” says Berg, the GC at Pioneer. “If crude prices soften, we might see one of the super major oil companies step out and make a large acquisition.”

Range Resources General Counsel David Poole says that M&A activity slowed in 2013 because oil and gas companies spent the year “rationalizing our assets.”

“Oil and gas M&A will almost certainly increase this year as companies dispose of those assets that are not core to their purpose and buy assets that are,” says Poole.

The rationalizing of assets or focusing on core asset types is happening across the oil and gas sector, according to Kirkland, whose clients include CenterPoint Energy and Schlumberger Limited of Houston.

“There have been times in U.S. history when being a conglomerate was considered a premium,” says Kirkland. “Today, it is all about the pure play.”

Fortunately for energy lawyers, as upstream M&A took a break in 2013, midstream companies, including pipeline owners and service companies, picked up the slack.

While Exxon Mobil, Linn Energy and Apache Corp. dominated the merger and acquisition headlines from 2009 to 2012, last year saw Energy Transfer Partners, Kinder Morgan Energy and Schlumberger Limited making the major deal announcements.

The midstream deals were plentiful in number, but smaller in value. In fact, there were no super mergers or acquisitions in 2013 as there had been in previous years.

A growing number of midstream or pipeline companies are structured as master limited partnerships (MLPs) and an increasing number of the MLPs are going public.

In 2013, a record 23 MLPs – all in the energy sector – filed for an initial public offering. Latham’s Houston office was involved in 13 of them.

“The pipeline of MLP IPOs is still very full,” says Ryan Maierson, a partner at Latham in Houston. “As long as interest rates stay so low, the MLP IPO market will continue to remain heated.”

Brown, the GC at Breitburn, says his company, which has its largest office in Houston, considered about 400 possible acquisitions in 2013 and “looked seriously” at about 40.

Breitburn made bids on about 20 of those and reached deals on less than 10, Brown says.

“Last year exceeded our goals and our goal is to grow,” says Brown of Breitburn, which has its own MLP. “M&A activity in 2014 will almost certainly increase. The economy in other areas may be poor, but the legal energy sector is enjoying tremendous success.”

© 2014 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.

If you see any inaccuracy in any article in The Texas Lawbook, please contact us. Our goal is content that is 100% true and accurate. Thank you.