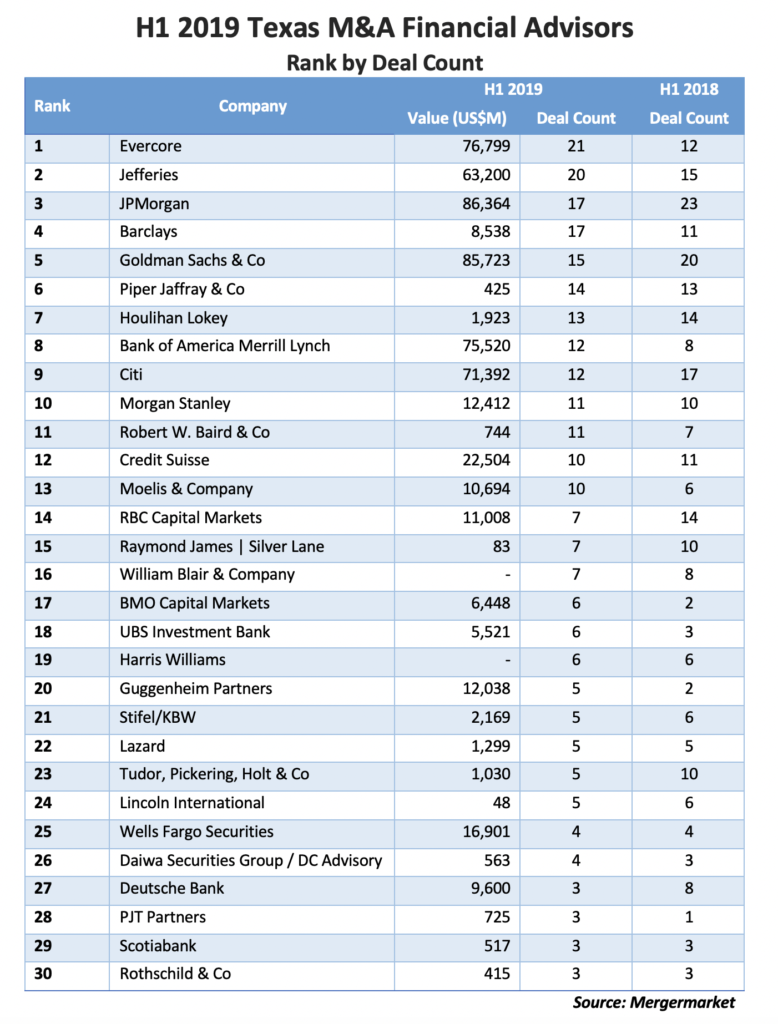

Evercore took top rank as the busiest investment bank advising Texas companies on dealmaking in the first half, according to Mergermarket data provided exclusively to The Texas Lawbook.

The boutique investment bank handled 21 deals in the first six months of 2019, versus 12 in the same period in 2018. It came in number-three in terms of value, working on $76.8 billion worth of transactions versus only $6.2 billion in the first half of 2018.

Evercore edged out Jefferies, which came in second in volume with 20 transactions, while JP Morgan and Barclays tied for third with 17 transactions each.

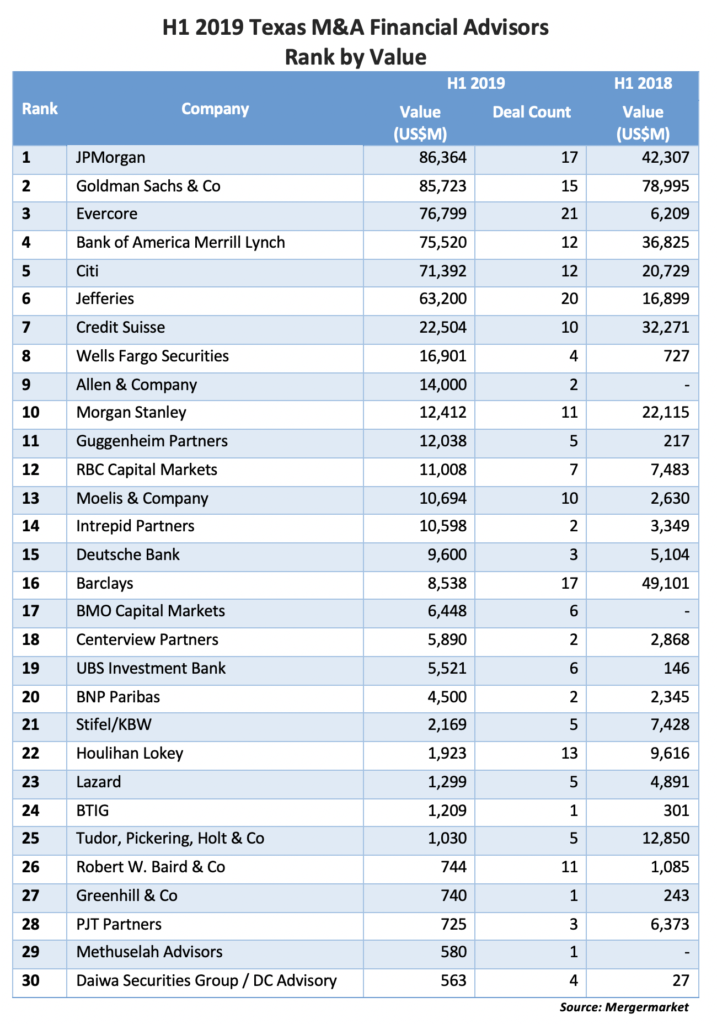

JP Morgan earned the top spot in terms of value handling $86.3 billion worth of deals, according to Mergermarket, followed by Goldman Sachs ($85.7 billion), Evercore and Bank of America Merrill Lynch ($75.5 billion).

Other banks on the rise among the top 10 volume generators were Jefferies, Barclays, Piper Jaffray (which owns Simmons Energy), BAML and Morgan Stanley. Those whose rankings fell were JP Morgan, Goldman, Houlihan Lokey and Citi.

Evercore’s performance was a remarkable comeback over this time last year, when it ranked eighth in deal count and 19th in deal value. It ended 2018 as seventh in volume and eighth in value after being number-two in count and number-one in value for all of 2017.

Evercore’s first-half value ranking was helped by its advice to Anadarko Petroleum on its $54.4 billion sale to Occidental Petroleum, the largest deal in the period, with former Deutsche banker Dan Ward in New York leading the deal team. Goldman Sachs & Co. also advised Anadarko, including Suhail Sikhtian in Houston.

The Anadarko deal also boosted the showings of BAML and Citi, which assisted Occidental on its win of the company. Patrick Ramsey and Purna Saggurti in New York and Brad Hutchinson in Houston led the team from BAML while Steve Trauber and Muhammad Laghari in Houston and Mark Shafir and Serge Tismen in New York did so from Citi.

Credit Suisse missed out on the fun, having advised Chevron on its failed bid for Anadarko. That team had included Greg Weinberger and Jens Becker in New York and Ricardo Concha in Houston. The bank fell from fifth to seventh place in terms of deal value in the first half and from 10th to 12th place in terms of deal volume.

Senior managing director Rob Pacha started Evercore’s investment banking practice in Houston in 2009 after serving as managing director at BAML. He went on to advise on some of the largest transactions in the energy sector, including Kinder Morgan Inc.’s $38.5 billion acquisition of El Paso Corp. and Southern Union Co.’s $10.3 billion merger with Energy Transfer Equity.

Pacha told The Texas Lawbook that the paltry showing in oil and gas M&A in the first half of the year was driven by weakness in the upstream, or exploration and production, part of the market, “not the midstream M&A market.”

Indeed, Evercore advised on several midstream deals in the period, including Australian infrastructure firm IFM Investors on its take-private of Houston pipeline operator Buckeye Partners for $6.5 billion (along with Credit Suisse, Goldman Sachs and BofA Merrill Lynch). Intrepid Partners – led by former Barclays and Lehman banker Skip McGee (who went to University of Texas School of Law) – and Wells Fargo Securities assisted Buckeye.

Pacha also provided financial advice to Houston-based Targa Resources Corp. on its $1.6 billion sale of 45% of North Dakota unit Targa Badlands to GSO Capital Partners and Blackstone Tactical Opportunities (Citi bankers Tim Kisling and Claudio Sauer did so for Blackstone).

The banker also worked with managing director John McGraw advising SunCoke Energy’s board on its simplification transaction with SunCoke Energy Partners that valued the target at $1.52 billion (Citi’s Michael Jamieson, Brad Epstein, Brian Spear and Mark Senter in Houston assisted the conflicts committee of SunCoke Energy Partners’ general partner).

Evercore did other work on the upstream side as well, assisting Ares Management-owned Gastar Exploration of Houston on its merger with Apollo Global Management-backed Chisholm Oil and Gas for undisclosed terms (Tudor Pickering Holt also advised Gastar and Citi assisted Chisholm).

Other senior members in Evercore’s Houston office are Shaun Finnie, who joined in 2011 from Scotia Waterous and works primarily on upstream deals; and Ray Strong, who came over from Goldman Sachs, also in 2011, and is focused on midstream deals.

Others include David Andrews, who joined in 2015 from Deutsche Bank and focuses on oilfield services; Tim Carlson, who hired on in 2011 from JP Morgan; and Lance Dardis and Doug Rogers, who also joined in 2011 and handle acquisitions and divestitures, or A&D.