Mergers and acquisitions practices at nearly all law firms operating in Texas thrived in 2024.

Eight law firms in Texas — Gibson, Dunn & Crutcher, Gray Reed, McGuireWoods, Weil, Gotshal & Manges, Baker Botts, Clifford Chance, DLA Piper and Morgan Lewis — saw their M&A lawyers lead buyers, sellers and targets in 50 percent more M&A deals last year than they did in 2023, according to exclusive new data from The Texas Lawbook’s Corporate Deal Tracker.

Nine other law firms, including Vinson & Elkins, Akin Gump, Willkie, Winston & Strawn, Simpson Thacher and Locke Lord, witnessed a 10 percent or more increase in leading the principals in M&A activity in 2024, CDT data shows.

No law firm’s Texas deal lawyers were busier in 2024 than those at Kirkland & Ellis, which set a record by leading 202 clients who were buyers, sellers or targets in mergers, acquisitions and joint ventures — an increase from 140 such corporate transactions in 2023. Kirkland had had previously set the record for Texas lawyers by leading 163 deals in 2022.

CDT data shows that Kirkland’s attorneys in Austin, Dallas and Houston also ranked No. 1 in Texas-led deal value at $130.2 billion, which is down slightly from $140.5 billion in 2023. In all, Texas lawyers for Kirkland led 34 transactions with deal values of $1 billion or more, including representing Marathon Oil in its $22.5 billion sale to ConocoPhillips and Global Infrastructure Partners’ $12.5 billion sale to BlackRock.

Kirkland’s 2024 year-over-year increase in deal count — 62 — was more than the overall total of all but four other law firms operating in Texas.

Texas attorneys at Gibson Dunn had a great year, leading 98 M&A transactions (up from 62 in 2023) with a combined deal value of $37.4 billion. Gibson lawyers led 13 deals valued at $1 billion or more, including AT&T’s sale of DirecTV to TPG for $7.6 billion.

Third-ranked V&E also increased the number of deals its Texas lawyers led from 71 in 2023 to 80 last year, according to CDT data. V&E ranked second in total deal value at $83.3 billion. The Houston-based firm led 17 clients in billion dollar-plus transactions, including Endeavor Energy Resources’ $26 billion sale to Diamondback Energy and Sunoco’s $7.3 billion acquisition of NuStar Energy.

Dallas-based Haynes Boone ranked fourth by leading 73 M&A transactions in 2024, up from 71 the year before. The firm ranked 11th in deal value at $7.6 billion. Haynes Boone was the lead legal advisor to Aera Energy in its $2.1 billion sale to California Resources Corporation and it led Arcosa in its $1.2 billion purchase of Stavola Holdings.

Texas lawyers for Latham & Watkins ranked fifth by leading 61 corporate clients in deals and fourth in deal value at $56.6 billion. The firm led Schlumberger in its $7.7 billion purchase of ChampionX Corporation and Chesapeake Energy in its $7.4 billion acquisition of Southwestern Energy.

CDT Calculations

The Corporate Deal Tracker documents M&A transactions reported by law firms, businesses and other sources in two unique categories: “Texas-led,” which means that Texas lawyers were the lead legal advisors for a firm representing the buyers, sellers or targets; and “Texas-related,” which includes law firms whose Texas-based lawyers helped represent any client in the deal, which also covers the attorneys who represented financial institutions, third-party investors, lenders and other individuals or entities, such as conflicts committees in the deals.

The Lawbook focuses more on Texas-led transactions since the law firms representing the buyers, sellers and targets almost always earn more money because they have more attorneys from different practice groups — including antitrust, employment, executive compensation, securities and tax — working on the deals.

In addition, CDT data includes transactions by Texas attorneys without regard to client geography. A deal handled by Texas lawyers for two companies in Mexico or Hell for Certain, Kentucky, counts just as much as two businesses in Dallas or Houston.

CDT deal information comes from reports from law firms, businesses involved in the deals, news releases and interviews with dealmakers.

CDT deal counts include transactions of undisclosed value, as well as those whose values or other details are submitted under the agreement that The Lawbook will not publish those specific details. More than half of the 1,545 M&A transactions submitted last year were with values that were not disclosed. For instance, McGuireWoods didn’t disclose any values for the 45 Texas-led deals it submitted, so the firm won’t appear on The Lawbook’s deal value rankings despite being No. 8 in Texas-led deal count last year.

The Lawbook, for the purpose of rankings, does not include client participation in funding rounds or similar private fund investments as M&A. They will continue to be accepted for publication but will be treated as “fundings” for rankings and deal analytics.

A handful of law firms submitted some of their 2024 M&A transactions after the original deadline and two deadline extensions had expired. Those deals will be added to the 2024 CDT database, but are not included in these rankings.

Of the top 10 law firms in the CDT M&A rankings for deals led by Texas lawyers, seven are headquartered outside the state. Only eight of the top 25 are based in Texas.

Overall, 52 law firms operating in Texas saw their Lone Star lawyers lead M&A deals in 2024. Ten of those 52 firms are headquartered in Texas.

The Texas lawyers working for the 40 law firms based outside of the state led 746 M&A transactions in 2024 with a combined value of $380.2 billion. The 10 Texas-headquartered law firms led 303 deals with a combined value of $144.2 billion.

New York-based Simpson Thacher, which has an office in Houston, ranks 16th in deal count by leading 16 M&A transactions, but the firm ranks third in deal value at $81.1 billion. The firm’s Houston office represented private equity giant KKR in its $50 billion data center venture with Energy Capital Partners and it was the lead legal advisor for Silver Lake Holdings in its $13 billion acquisition of Endeavor Group.

Dallas firm Bell Nunnally reported only one transaction to the CDT in 2024, but it was the leading role in representing Carrollton-based JBB Advanced Technologies in its $12.25 billion sale to Tronic Ventures.

Several law firms operating in Texas had huge jumps in their CDT rankings, including Gray Reed, Weil Gotshal, and Clifford Chance.

CDT data shows that five law firms — Latham, Sidley, Norton Rose Fulbright, A&O Shearman and Katten — witnessed significant declines in Texas-led dealmaking by their Lone Star attorneys last year. The reasons for the lower numbers range from firms missing the reporting deadlines, submitting deals that could not be verified or simply choosing not to disclose some of the transactions they handled.

Texas-Related Rankings

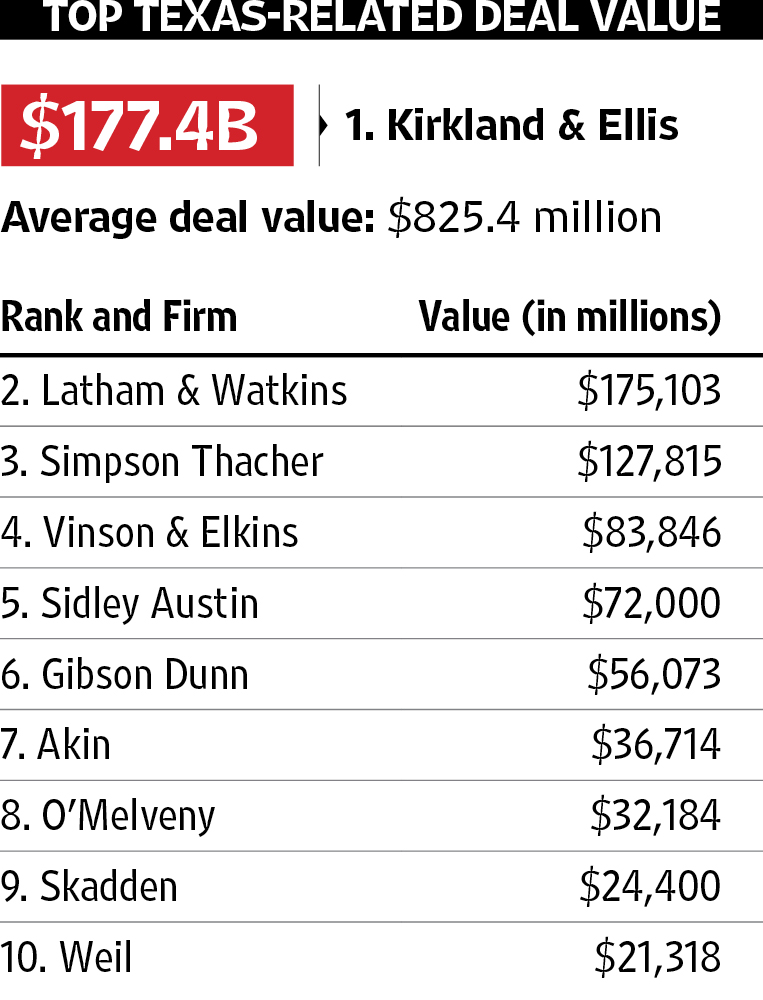

Kirkland also dominated the Texas-related rankings, which was the lead legal advisor in 202 of its 215 Texas-related transactions, according to CDT data.

But a handful of law firms — Gibson Dunn, Latham, Sidley, Simpson Thacher, Akin and DLA Piper — feasted by representing non-principal third parties in deals.

The Pillsbury law firm ranked 12th on the Texas-related list with 40 such representations by submitting more of its qualified deals to the CDT last year.

No law firm’s Texas lawyers advised financial institutions and third parties in M&A transactions in 2024 more than Latham, according to CDT data. The firm’s Texas attorneys were involved in 135 Texas-related transactions — 62 as lead counsel for the buyers, sellers or targets, and 73 times as advisors to a third party. The deal value on those 73 transactions was more than $105 billion, making Latham’s total deal-related value $175.1 billion — just $2.3 billion behind Kirkland’s $177.4 billion.

Sidley ranks sixth in the Texas-related M&A rankings with 66 deals — 32 of those representing third parties.

Simpson Thacher is ranked 16th in the Texas-led M&A rankings, but seventh in the Texas-related rankings.

Legal industry insiders agree that while representing the buyers, sellers and targets may be more lucrative, advising financial advisors, banks, lenders, conflicts committees and other third parties is still a pretty good gig.

Proof? Gibson Dunn, Latham, Sidley, Simpson Thacher and Akin are among the most profitable corporate law firms in the world.

Corrections: A previous version of the table incorrectly credited Pillsbury with 39 Texas-related deals. The firm had 40 for $12.596 billion in value. Additionally, a previous version of this table and selected infographics in this story incorrectly stated the Texas-related deal count for Latham & Watkins. The firm had 135 Texas-related deals valued at $175.103 billion, not 134 deals valued at $162.203 billion. The Texas Lawbook regrets the errors.