© 2017 The Texas Lawbook.

By Mark Curriden of The Texas Lawbook

(Jan. 4) – When times were good in the oil patch and crude was selling at a $100 a barrel just three years ago, lawyers and bankers scored record profits advising companies on a record number of mergers, acquisitions, joint ventures and securities offerings.

For the past two-and-half years, the energy industry has been in crisis. Oil slipped to $30 a barrel. Thousands and thousands of people lost their jobs. A record number of oil and gas companies and the businesses servicing them declared bankruptcy.

The law firms and financial counselors working for those distressed energy operations, however, continue to pocket hundreds of millions of dollars thanks to the complex federal bankruptcy system.

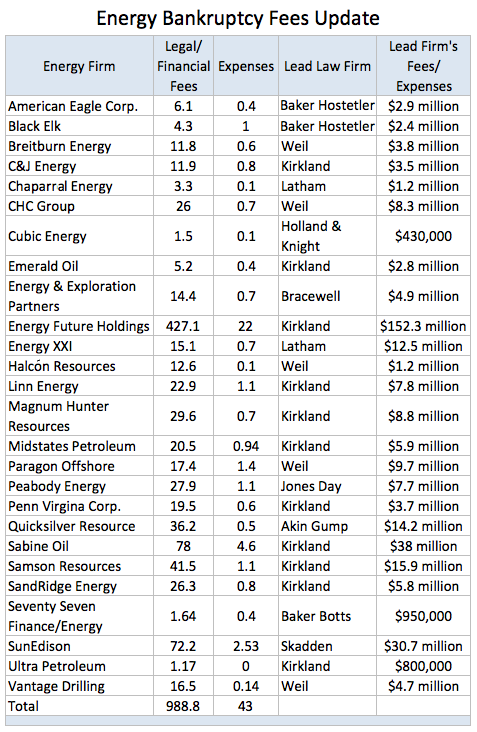

The energy companies that declared bankruptcy during the past 30 months – a majority of them based in Texas – have paid their legal and financial advisers – nearly all of them based in New York and Chicago – more than $1.4 billion in fees and expenses during the past two and one half years, according to a Texas Lawbook examination of court records.

Those same lawyers and consultants have requested another $260 million in payments that are pending the approval of federal bankruptcy judges in Texas, Delaware, New York and Oklahoma.

In addition, there are more than 60 active bankruptcy cases in which the legal and financial advisers have not yet filed their fee requests for the fourth quarter of 2016 – fees that experts conservatively estimate will add another $80 million to the final tab.

Since July 2014, three law firms – Kirkland & Ellis, Weil, Gotshal & Manges and Skadden Arps – have been paid a combined $354 million for their representation of distressed energy companies during the past two and a half years, which does not include pending requests for payment or yet-to-be filed invoices for expected for work already completed.

“The business of corporate bankruptcy has become very lucrative for a small group of professionals,” Gary Kennedy, the former American Airlines general counsel who guided the Fort Worth company through Chapter 11 two years ago, said at a seminar at SMU Dedman School of Law last year. “It has gotten so expensive that some companies can no longer afford to go bankrupt.”

Companies that did seek bankruptcy protection tended to file in Delaware or New York instead of Texas. As a result, Texas law firms either fired lawyers who specialized in restructurings or had them focus on other practice areas.

All that changed in the second half of 2014 when the price of petroleum sank. More than 1,280 Texas businesses have filed for bankruptcy during the past two years – many of them related to the downturn in oil and gas prices, according to new data research provided by Androvett Legal Media.

“Most bankruptcy law practices were pretty slow, but now most bankruptcy lawyers are either busy or crazy busy,” says Vinson & Elkins partner Bill Wallander, who leads the firm’s reorganization and restructuring practice.

The Androvett data shows that 752 businesses filed for bankruptcy restructuring in Texas federal courts in 2016 – up 42 percent from 2015 and up 80 percent from 2014.

The data demonstrate a clear connection between bankruptcy activity in Texas and the financial health in the oil patch.

New business bankruptcies filed in the Western District of Texas increased by 100 percent during the past two years – from 73 in 2014 to 146 in 2016, according to the Androvett study. The jump was even bigger in the Southern District, where 293 companies filed for Chapter 11 bankruptcy protection in 2016 – up from 141 in 2014.

The Northern District witnessed a 49 percent escalation in corporate bankruptcies from 2014 to 2016. Business restructurings in the Eastern District climbed 75 percent during the past two years.

More than 150 oil and gas companies filed for bankruptcy in 2016 – 71 of them were exploration and production operations with a cumulative debt of $56.8 billion, according to Haynes and Boone’s Oil and Gas Bankruptcy Monitor.

The Haynes and Boone data shows that 70 oil and gas services companies and a dozen midstream firms also filed for Chapter 11 protection last year.

“We are not seeing the wave of E&P bankruptcies that we witnessed earlier, but there is still a lot of distress out there, and there’s still a lot of first lien debt that is non-performing,” says Thompson & Knight partner Tye Hancock, who specializes in oil and gas bankruptcy.

“A lot of it depends on where the assets are located,” Hancock says. “The cost of performing in North Dakota is a lot more than in the Permian Basin.”

When Houston-based Stone Energy sought Chapter 11 protection on Dec. 14, it was the 114th E&P company to declare bankruptcy. The total debt of those companies, according to Haynes and Boone, was $74.2 billion. More than 110 oil and gas service companies with a cumulative debt of $18.8 billion have filed. The 16 midstream firms that are in bankruptcy have a combined debt of $17.2 billion.

“There are still several large oil and gas companies out there that may still be forced to file Chapter 11,” says Norton Rose Fulbright partner Lou Strubeck, who is widely considered one of the leading bankruptcy lawyers in the U.S.

Some energy companies have been able to efficiently use bankruptcy court to fix their balance sheets in only a couple months and pay only a few million dollars to their advisers.

The longer a company stays in bankruptcy, however, the more expensive it gets. Law firm partners working on these energy company restructurings charge hourly rates ranging from $950 to $1,450, according to The Texas Lawbook’s review of court records.

There’s no better example than the oil services firm CHC Group, which filed for bankruptcy in Dallas last May. The company expanded quickly when petroleum prices were high, buying hundreds of helicopters to ferry workers and cargo to energy production sites around the globe.

When oil fell to $30, CHC idled nearly 100 of its choppers, laid off scores of employees and filed for Chapter 11 bankruptcy protection citing $1.5 billion in debt.

CHC is still a couple months away from getting U.S. Bankruptcy Chief Judge Barbara Houser’s final stamp of approval, but the company has already paid its legal and financial advisers – including Weil, Gotshal & Manges, Ernst & Young, Debevoise & Plimpton, Gardere, DLA Piper and PricewaterhouseCoopers – more than $26 million in combined fees and expenses, according to court records.

That figure could double, as it does not include any fees for work those firms have done for the past three months. Those bills have not yet been submitted to Judge Houser for approval.

“Oil and gas is an industry that has highs and lows,” says Jackson Walker bankruptcy partner Bruce Ruzinsky. “The temptation in the oil and gas business is to catch the wave when things are blowing and going.

“This downturn has been more difficult than past ones because it has gone on longer and prices went lower than people expected,” Ruzinsky says.

The CHC bankruptcy is far from unique.

Fort Worth-based QuickSilver Resources paid $36.7 million in fees and expenses for only a year in federal bankruptcy court. Another Fort Worth company, Energy & Exploration Partners, paid $15 million in professional fees and expenses. Oklahoma-based Samson Resources has paid its legal and financial advisers more than $42 million during the past 15 months, while Houston-based Sabine Oil & Gas has compensated its advisers more than $78 million for 14 months in bankruptcy court.

But none of these compare to the mother of all bankruptcy cases – Dallas-based Energy Future Holdings, which filed for protection in April 2014.

To date, EFH has paid its lawyers and financial advisers more than $449 million – a tab that analysts predict will hit $600 million before the bankruptcy is concluded this spring.

Kirkland is the biggest beneficiary. In April 2014, the Chicago-based law firm opened its first Texas office in Houston by luring Andrew Calder away from a competing law firm. That same month, EFH hired Kirkland to be the lead counselor for the debtor. In the months since, EFH has paid the firm more than $160 million in fees and expenses.

“Kirkland was willing to spend the resources and now they are reaping the benefits,” says bankruptcy litigation specialist Nick Foley, who joined McKool Smith as a partner in December.

Foley points to a University of Texas bankruptcy law conference held in Austin the week before Thanksgiving as an example.

“Several bankruptcy ‘big guns’ were scheduled to speak, but they were unable to appear because they were too busy,” he says. “As for 2017, it depends mostly on commodity prices.”

© 2016 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.

If you see any inaccuracy in any article in The Texas Lawbook, please contact us. Our goal is content that is 100% true and accurate. Thank you.