A fractured en banc ruling from the Fifth Circuit that created a split among the federal appellate courts and struck down as unconstitutional the Federal Communications Commissions’ delegation of taxing authority to a third party seems destined for U.S. Supreme Court review, observers say.

The 9-7 ruling that included two concurrences and two dissents came Wednesday in Consumers’ Research v. FCC. The Fifth Circuit majority focused on the “double-layered delegation” of the authority to set the tax rate for the universal service fund, which is used to subsidize phone and internet services for rural and low-income areas, as well as schools, hospitals and libraries, across the country.

Congress delegated its taxing authority to the FCC under the Telecommunications Act of 1996 that established the fund, but the FCC then subdelegated that authority to a private corporation that the majority found “relied on for-profit telecommunications companies to determine how much American citizens would be forced to pay for the ‘universal service’ tax that appears on cell phone bills across the nation.”

That structure, the majority held, and the “misbegotten tax,” violates the separation of powers and is therefore unconstitutional.

With the holding, the conservative Fifth Circuit did what the Sixth, Eleventh and D.C. circuits had declined to do in cases brought by the conservative nonprofit Consumers’ Research against the FCC raising this same issue. And that division among the intermediate courts is what sets the stage for possible U.S. Supreme Court intervention. The Supreme Court denied petitions for certiorari in those other, similar cases.

“I think it’s fair to say that once they took it en banc, people were probably expecting this outcome, although the closeness of the vote of the en banc court reveals that it was certainly a difficult decision, and I think that was perhaps compounded by the fact that there are other circuits that have addressed the universal service fund and upheld it,” said Aaron Streett, chair of Baker Botts’ Supreme Court and Constitutional Law practice group.

“It wasn’t a foregone conclusion that they would reach this outcome, but everyone knew it was a significant possibility.”

Richard A. Husseini, a tax partner at Kirkland & Ellis, said the circuit split caused by this ruling, combined with recent rulings from the Supreme Court such as Loper Bright v. Raimondo, make this case a likely “prime candidate” for review by the high court.

“Many people, when you have decisions like this, will say it’s a foregone conclusion that it won’t survive Supreme Court scrutiny,” he said. “I don’t think that’s the case here. This is a very interesting question, and it cries out for Supreme Court review.”

Husseini noted that the Fifth Circuit made no decision as to whether each delegation at issue in this case was constitutional, instead holding that it was the combination that violated the separation of powers. But in a concurrence, Judge Jennifer Walker Elrod wrote that she would have found each action is a violation of the constitution.

“You can imagine the Supreme Court wanting to also address her opinion,” he said.

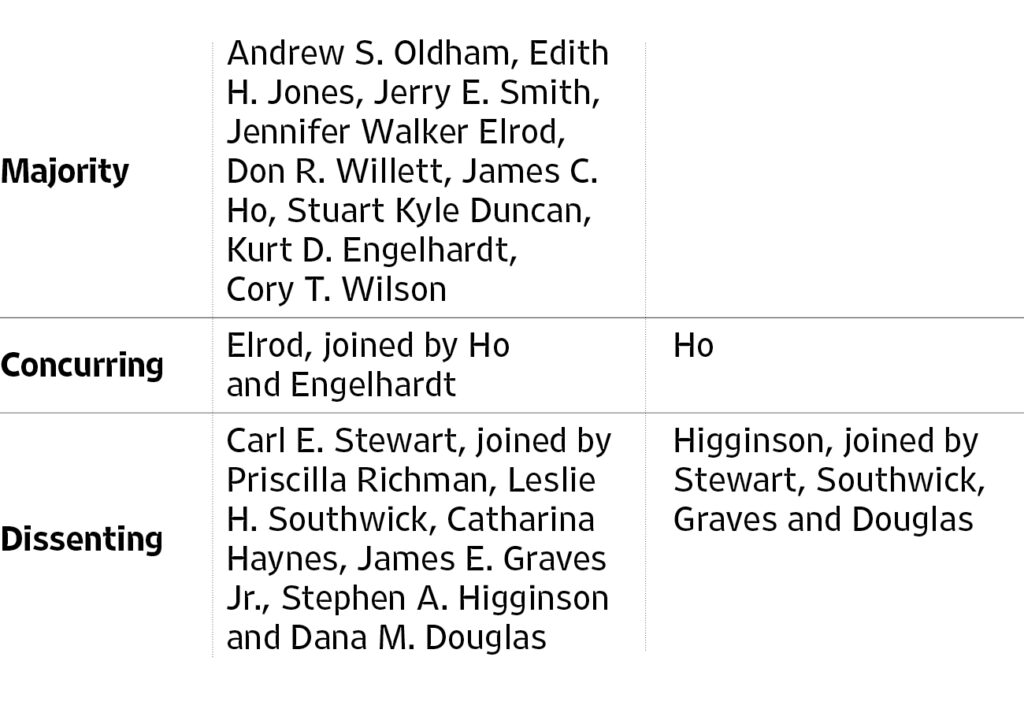

Judge Andrew S. Oldham authored the majority’s 71-page opinion, joined by Judges Edith H. Jones, Jerry E. Smith, Elrod, Don R. Willett, James C. Ho, Stuart Kyle Duncan, Kurt D. Engelhardt and Cory T. Wilson.

“American telecommunications consumers are subject to a multibillion-dollar tax nobody voted for. The size of that tax is de facto determined by a trade group staffed by industry insiders with no semblance of accountability to the public,” Judge Oldham wrote. “And the trade group in turn relies on projections made by its private, for-profit constituent companies, all of which stand to profit from every single tax increase. This combination of delegations, subdelegations, and obfuscations of the USF Tax mechanism offends Article I, § 1 of the Constitution.”

Judge Elrod authored a two-page concurrence joined by Judges Ho and Engelhardt.

“I write separately to say that I would go one step further and address the lawfulness of each individual delegation,” she wrote. “For the reasons explained in the majority’s thorough opinion, Congress’s delegation of legislative power to the FCC and the FCC’s delegation of the taxing power to a private entity each individually contravene the separation of powers principle that undergirds our Constitutional Republic.”

Judge Ho also wrote his own two-page concurring opinion.

“There’s no point in voting if the real power rests in the hands of unelected bureaucrats — or their private delegates,” he wrote. “If you believe in democracy, then you should oppose an administrative state that shields government action from accountability to the people.”

Judge Carl E. Stewart authored the 22-page dissenting opinion, joined by Chief Judge Priscilla Richman and Judges Leslie H. Southwick, Catharina Haynes, James E. Graves Jr., Stephen A. Higginson and Dana M. Douglas.

“The majority has created a split in a sweeping opinion that (1) crafts an amorphous new standard to analyze delegations, (2) overturns — without much fanfare — circuit precedent holding that this program collects administrative fees and not taxes, (3) blurs the distinction between taxes and fees, and (4) rejects established administrative law principles and all evidence to the contrary to create a private nondelegation doctrine violation.”

Judge Stewart wrote that what the FCC has done here is a “classic case” of an agency enlisting a private entity “to assist with ministerial support in the form of fee calculation and collection.”

“Furthermore, the private entity holds not even a modicum of final decision-making power,” he wrote. “Regrettably, the majority has adopted petitioners’ exaggerated conception of USAC’s role and discretion to create a private nondelegation doctrine violation where none exists. To the contrary, I would hold, as the panel did, that there is no private-nondelegation doctrine violation.”

Judge Higginson also authored a dissenting opinion, joined by Judges Stewart, Southwick, Graves and Douglas. Judge Higginson accused the majority of giving the petitioners’ more relief than they sought.

“The majority finds neither an unconstitutional delegation of legislative power nor an unconstitutional exercise of government power by a private entity,” he wrote. “Supreme Court precedent dictates these answers, which is why every other circuit to consider these questions stopped there and the Supreme Court denied petitions for review of those decisions.”

“But our court does not stop there, going beyond even petitioners’ arguments to adopt a novel theory that it is ‘the combination’ of these two non-violations that ‘violates the Legislative Vesting Clause in Article I, § 1.’”

Judge Higginson wrote that the majority’s “convergence sleight of hand not only undoes Supreme Court precedent but also leaves the political branches powerless to address this perceived constitutional deficiency, ignorant as to how to legislate and regulate in ways that will survive judicial review.”

“Here, Article III nullifies a program that has served millions of Americans for over a quarter of a century, which Congress, FCC experts, industry, and consumers revisit yearly in the face of changing technology and markets,” he wrote. “Our court should not constitutionalize policy disagreements nor, worse still, do so with an amorphous standard, not urged by petitioners and contrary to precedent, that leaves the coequal, political branches without stability or clarity. In announcing its new constitutional theory, our court creates a greater threat to the separation of powers than the one it purports to address.”

Originally, a three-judge panel — Chief Judge Richman and Judges Stewart and Haynes — heard oral arguments in the case in December 2022 and issued an opinion in March 2023 finding there had been “no nondelegation doctrine violations” in the FCC’s actions.

“First, federal statutory law expressly subordinates USAC to the FCC,” the panel held in a 15-page ruling. “Second, unlike in National Horsemen, USAC does not enjoy the same type of sweeping rulemaking power — instead it makes a series of proposals to the FCC based off expert analysis, which are not binding on carriers until the FCC approves them.”

“Third, the FCC permits telecommunications carriers to challenge USAC proposals directly to the agency and often grants relief to those challenges. Fourth, the FCC dictates how USAC calculates the USF contribution factor and subsequently reviews the calculation method after USAC makes a proposal.”

While the Fifth Circuit has developed a “bad rap” for its reversal rate at the Supreme Court in recent terms, Streett said that in the area of separation of powers cases, some notable Fifth Circuit rulings have survived Supreme Court scrutiny.

“In separation of powers cases they’ve been pretty effective at anticipating where the Supreme Court is heading,” Streett said.

He noted the Supreme Court’s 2022 ruling in Axon Enterprise v. Federal Trade Commission, which was consolidated for review with a case out of the Fifth Circuit, SEC v. Cochran. In that case the high court agreed 9-0 with the Fifth Circuit that separation of powers arguments can be brought in federal court before going through an administrative proceeding first. The Supreme Court also upheld a Fifth Circuit separation of powers ruling this term in SEC. v. Jarkesy, agreeing those facing prosecution for fraud by the SEC have the right to a jury trial.

And going back to the 2020 term, the Supreme Court agreed with the Fifth Circuit in Collins v. Yellen that the structure of the Federal Housing Finance Agency was a violation of the separation of powers.

“The last three or four years there’s been a pretty significant affirmance of the Fifth Circuit on this issue,” Streett said. “And I wouldn’t be surprised if this case is the fourth.”

David Pratt, a partner at Bradley, agreed this case was likely to be reviewed by the Supreme Court and said he believes the Fifth Circuit is likely to be affirmed. The crux of the issues presented in this dispute fit into a broader category of litigation that address the constitutionality of delegating powers.

“Starting about 40 years ago there was a trend of congress delegating its authority in a variety of aspects … but I think the pendulum has started to swing back toward a movement pushing back on this increase of delegations of power.”

“This general trend of moving away from the regulatory state and delegation of powers, I think, would resonate with the Supreme Court if you look at the [decision overturning the Chevron doctrine] and others,” he said. “But on the other hand, there’s a balance. Congress can’t decide everything.”

Consumers’ Research is represented by R. Trent McCotter and Jared Kelson of Boyden Gray in Washington, D.C.

The FCC is represented by its own James Carr, P. Michele Ellison and Jacob Lewis.

The case number is 22-60008.