With deals getting bigger, it’s a good time to be a big investment bank – particularly in Texas.

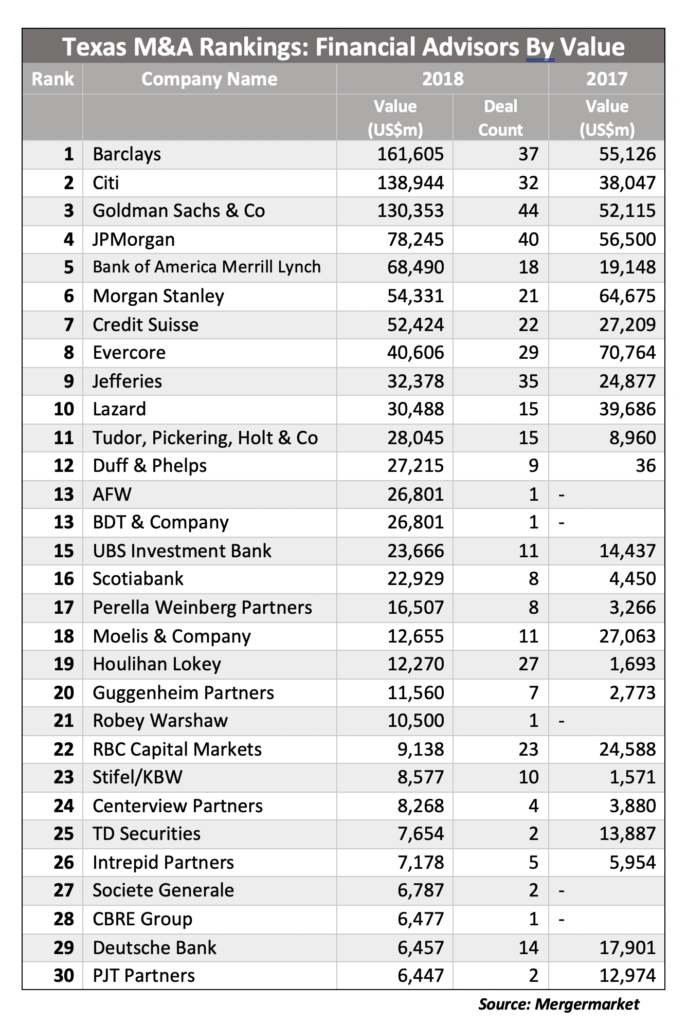

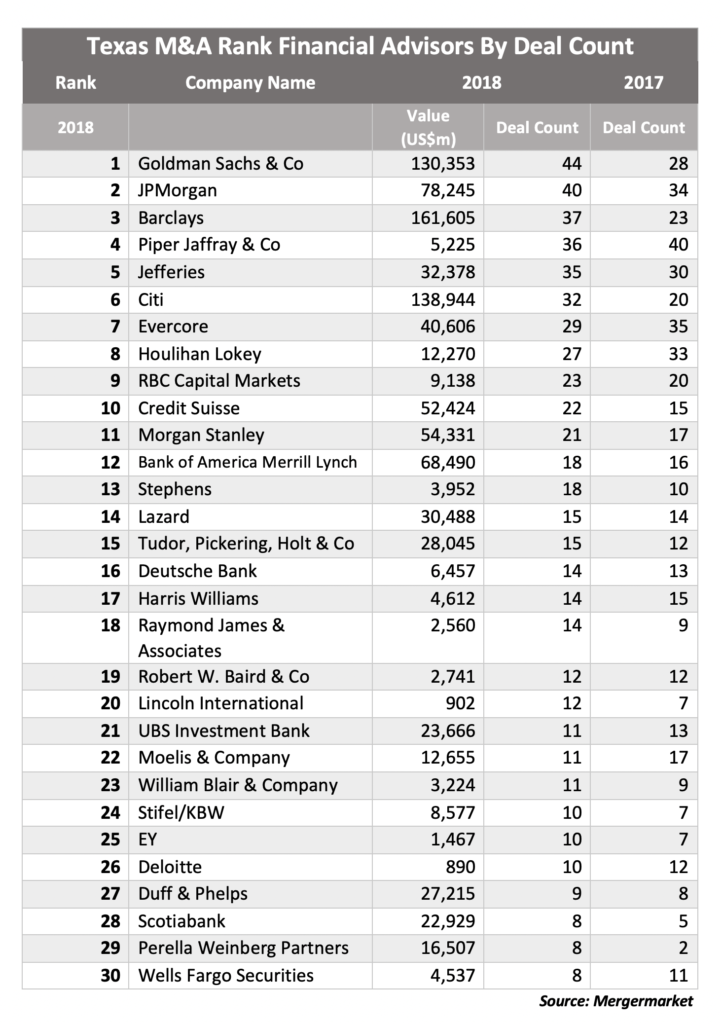

According to Mergermarket data provided exclusively to The Texas Lawbook, Barclays was the top bank advising Texas companies on deals in terms of value, rising from its fourth place ranking in 2017. And Goldman Sachs sprung to number one in volume versus its sixth place spot the previous year.

Citi, Goldman and JP Morgan ranked behind Barclays in terms of Texas deal value last year while JPM, Barclays and Piper Jaffray fell after Goldman in terms of deal count.

Bank of America Merrill Lynch came in fifth in deal value, versus twelfth in 2017, but kept its twelfth ranking in terms of volume. And Credit Suisse ranked seventh in terms of deal value and tenth in deal volume, up from eighth and thirteenth the year before.

Not all the big banks are performing that well in the state.

Struggling Deutsche Bank – which exited the oil and gas advisory business and closed its Houston office last year – plunged to 29th from 13th in deal value in 2017 but kept its 16th ranking in deal volume. And UBS – which lost star investment banker Steve Trauber and his team in Houston to Citi eight years ago – slid to 15th in value from 14th and to 21st in volume from 17th.

Morgan Stanley dropped to sixth in terms of deal value, down from second place in 2017, and likewise down in deal volume from tenth to eleventh place. (The bank lost Jonathan Cox, who did a lot of energy deals out of New York, to JP Morgan last year; he now co-heads its Houston office.)

Barclays’ and Citi’s rankings were helped by their work on the largest deal of the year, Energy Transfer Equity’s purchase of affiliate Energy Transfer Partners for $59.6 billion.

Barclays’ Keith Burba in Houston was part of the team that advised ETP’s conflicts committee while Citi’s Michael Jamieson, also of Houston, assisted ETE.

Goldman also got a boost advising San Antonio-based Andeavor on its $31.3 billion purchase by Marathon Petroleum, which ranked as the second biggest deal in Texas (Barclays assisted Ohio-based Marathon).

Credit Suisse was helped along by its work on Dr Pepper Snapple’s $26.8 billion merger with Keurig Green Mountain, which tapped Goldman for financial advice.

“With big public company deals dominating the landscape, it’s a good time to be a bulge-bracket banker,” said Chad Watt, Mergermarket’s southwest bureau chief in Dallas.

Meanwhile, middle market and boutique investment banks didn’t fare as well in Mergermarket’s rankings.

New York boutique Evercore, which has a Houston office, was number-one in value and number-two in volume in 2017. But it slid on both counts, to eighth in value and seventh in volume.

Mid-sized Piper Jaffray, which bought boutique energy investment bank Simmons in 2015, also fell in the rankings, from number one to number four in terms of deal count. It didn’t make the top 30 list in terms of value.

Moelis, another New York boutique that has a Houston office, also slid on the list, from ninth in value and eleventh in volume in 2017 to 18th in value and 22nd in volume in 2018. And mid-sized RBC Capital Markets plunged from 11th to 22nd in deal value while holding its ninth position in volume.

It makes sense that smaller financial advisors didn’t do as well as the large investment banks given that deal sizes have grown bigger in Texas and elsewhere. But the volatility in commodity prices – which affects oil and gas dealmaking that’s so prevalent in the state – also may have had something to do with it.

Watt is little concerned to see declines for middle-market advisors with strong Texas roots, especially with deal counts more or less static.

“Today’s good mid-market deals set up tomorrow’s bigger deals,” he said. “I’m hopeful we’ll see more of that shake loose in 2019.”

There were some outliers among the mid-sized financial advisors.

Homegrown energy-centric investment bank Tudor, Pickering, Holt of Houston – which Perella Weinberg swallowed in 2016 – rose on both counts, from 18th to 11th in terms of value and from 18th to 15th in volume.

Jefferies – which has offices in Houston and Dallas – went from 10th to 9th in deal value and stayed in the fifth position in terms of deal volume.

The performance of other mid-sized advisors was mixed.

Lazard – a New York boutique with a Houston presence – fell to 10th from 6th in terms of deal value but rose from 15th to 14th in volume. And Houlihan Lokey, which has outposts in Dallas and Houston, rose from 39th to 19th in deal value but fell from fourth to eighth in terms of deal volume.

Duff & Phelps, which has locations in Houston and Dallas, zoomed up to 12th from 111th in value but remained at 27th position for volume. And Stephens – which has an office in Dallas – went from 23rd to 13th in deal volume but didn’t make the top 30 list in terms of value.

Interestingly, there were only three mid-sized or boutique investment banks in the top 10 last year in terms of value compared with four the year before. However, five of the smaller them – Piper, Evercore, Houlihan, Jefferies and RBC – were in the top 10 for volume in 2018, the same as in 2017. They’re a persistent bunch.