With M&A volumes down due to worries over the global economy, it’s a tough time to be an investment banker. So those with heft and a record of leadership seem to be winning whatever business there is out there – and Texas is no exception.

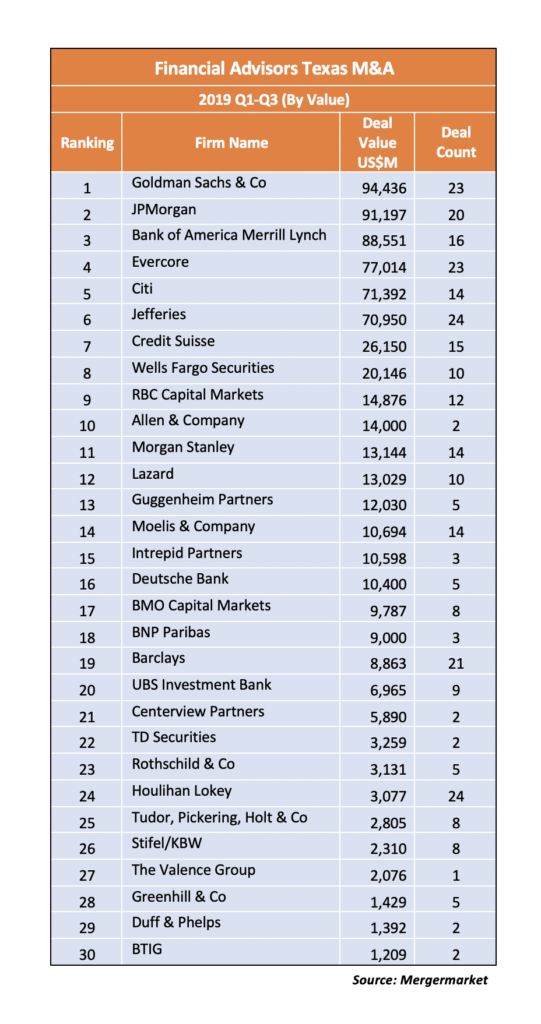

Goldman Sachs, one of the biggest investment banks in the U.S., regained its number-one spot in terms of handling deals for Texas companies, according to Mergermarket data provided exclusively to The Texas Lawbook.

The bank worked on $94.4 billion worth of transactions in Texas in the first nine months of this year. However, that’s still a 21.7% drop over the same period last year, when its volumes hit $120.7 billion, putting it in third place.

Goldman also is the top advisor on M&A worldwide so far this year working on 249 deals worth $982 billion, analytics provider GlobalData has reported.

Chalk up Goldman’s top-ranked performance in Texas and worldwide to its work on “megadeals,” or those worth more than $10 billion, including advising Anadarko Petroleum on its $54 billion sale to Occidental Petroleum this past spring (co-head of global natural resources Suhail Sikhtian in Houston led the team).

Goldman was followed in Mergermarket’s ranking by JPMorgan, which rose to second place from fourth advising on Texas company deals valued at $91.2 billion.

JPM advised Acelity/KCI, UGI Corp., Kinder Morgan, LegacyTexas and C&J Energy on billion-dollar-plus deals. It also worked with Callon Petroleum on its pending purchase of Carrizo Oil & Gas for $3.2 billion, a transaction that may be scuttled by activist investors who don’t like the deal (Jonathan Cox, who joined JPM last year from Morgan Stanley, was the lead banker).

Bank of America Merrill Lynch jumped from fifth to third with $88.5 billion worth of deals, thanks to its advice to Occidental on the Anadarko purchase, including from Brad Hutchinson in Houston (he joined from Barclays in 2015),

Meanwhile, boutique investment bank Evercore advanced to fourth from eighth with $77 billion worth of deals, thanks to its work for Anadarko on the Oxy purchase (led by New York banker Dan Ward, who joined in 2016 from Deutsche Bank). And Citi came in fifth from second at $71.4 billion in deal value (Steve Trauber and Muhammad Laghari in Houston were part of the bank’s team that advised Oxy).

Rounding out the top 10 in terms of value were Jefferies, Credit Suisse, Wells Fargo, RBC Capital Markets and Allen & Co., with Jefferies jumping from 12th to fourth and Credit Suisse holding its fifth-place position. CS would have been higher in the ranking if client Chevron had chosen to up its bid for Anadarko (Ricardo Concho in Houston was part of the deal team).

Wells ranked eighth from 32th, RBC went from ninth to 22nd and Allen & Co. rose from 126th to 10th.

Among the biggest investment bank declines in deal value in Texas were Morgan Stanley, which dropped from sixth to 11th; UBS from ninth to 20th; Barclays from first to 19th; Houlihan Lokey from 19th to 24th; Tudor, Pickering, Holt from 16th to 25th; and Duff & Phelps from 13th to 29th.

In terms of deal count, Goldman slipped from first to third with 23 transactions, topped by Jefferies and Houlihan Lokey, with each working on 24 deals. Evercore remained at fourth handling 23 deals while Barclays stayed at fifth with 21.

Investment banks in Houston have had widespread layoffs due to the drop in M&A business, mostly in the acquisitions and divestitures, or A&D, part of the energy market.

Jefferies and Wells Fargo have let go staff in Houston, according to several reports, as have Piper Jaffray’s Simmons Energy and UBS. To cut costs, Deutsche Bank exited the oil and gas advisory business last year and closed its Houston office, laying off around 70 people, The Wall Street Journal and Bloomberg both reported.

Simmons’ long-time managing director Jay Boudreaux has been asked to retire at the end of the year and UBS has let go managing directors David Edwards and Miles Redfield, who it poached from BMO Capital Markets in 2015, Reuters reported Oct. 21. None of the banks have commented.

Conditions may get worse in the overall banking sector, consulting firm McKinsey & Co. wrote a report released this month, given signs that the industry has entered the late phase of the economic cycle (slowing growth in volumes and top-line revenues, flattening yield curves and weakening investor confidence).

“On balance, the global (banking) industry approaches the end of the cycle in less than ideal health, with nearly 60% of banks printing returns below the cost of equity,” the firm wrote. “A prolonged economic slowdown with low or even negative interest rates could wreak further havoc.”