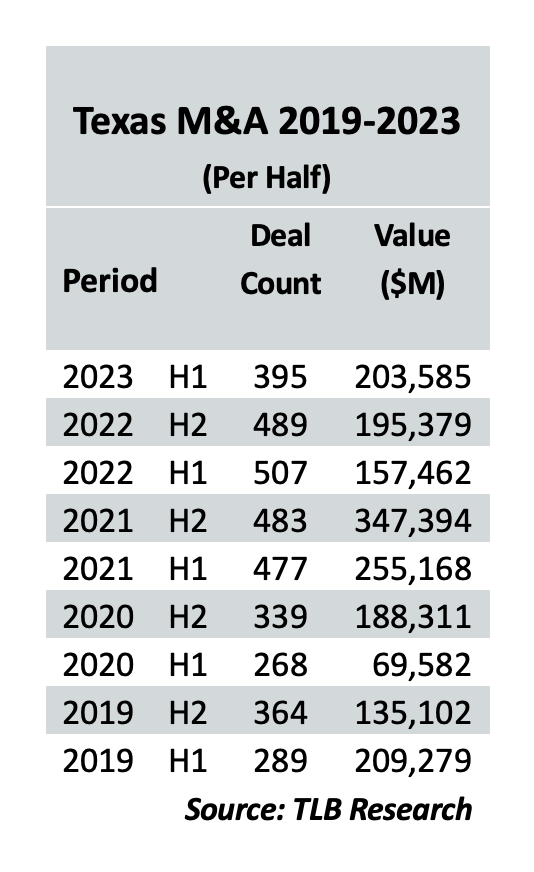

There were 395 Texas-related mergers and acquisitions valued at $203 billion during the first half of 2023, according to The Texas Lawbook’s exclusive Corporate Deal Tracker data.

That’s the worst half of dealmaking since H2 2020, which saw 339 deals for $188 billion. It marks a 19 percent decline from the 489 transactions reported H2 2022 and a 22 percent drop from the 507 deals reported during the first half one year ago.

But while those numbers might mean “meh” for those hoping for another post-pandemic surge of transactions, the reality behind them is far more complicated than a simple verbal shrug.

“It’s been a very interesting year thus far, to say the least,” says Jennie Simmons, a partner in Locke Lord’s Houston office. ” The most interesting part has been simply the episodic nature and unpredictability of the recent deal flow. I am not even sure that you can use the word trend to describe the past six months.”

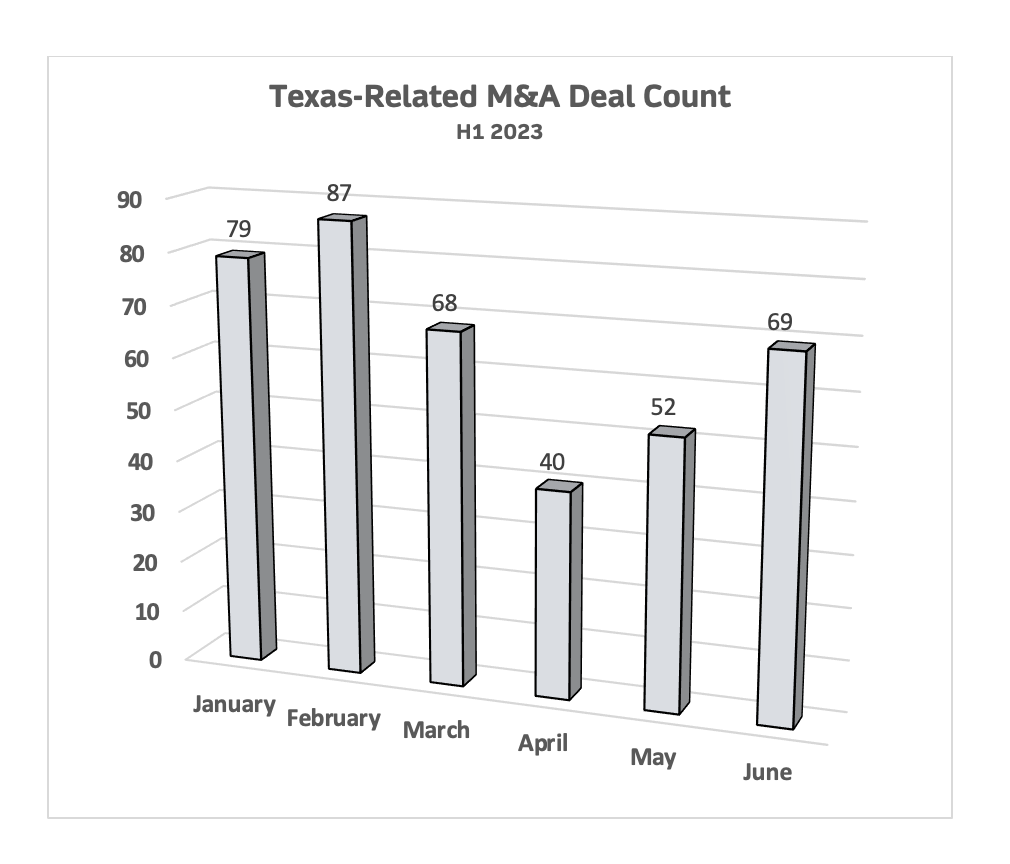

To her point a month-to-month readout of deal activity suggests a sine curve. A strong January (79 deals) yielded to an even-stronger February, which topped out the first quarter — as well as the first half — with 87 transactions. But after a decline in March to 68 transactions, followed by the low-point of 40 in April, deal-making rebounded in May, with 52, and in June, with 69.

“There’s never just one single thread that can adequately capture the entire M&A market,” says Ryan Maierson, a corporate partner at Latham & Watkins in Houston. “The second quarter was largely a continuation of the trends we saw in the first quarter of the year.”

Having no single reason doesn’t mean there weren’t any; and over the past couple of years, several of them have proved both durable and obvious: interest rate changes, cash flow changes and what Mike Blankenship calls the “wobbly equity market.”

“Deals are taking longer to complete given the increase in interest rates and financing sources,” says Blankenship, Houston managing partner at Winston & Strawn.

That wobbliness reached a low point in April, as noted, with 40 deals worth $10 billion. That marked the lowest month of M&A activity since the 28 deals reported for March 2020, the beginning of the pandemic shutdown.

Why? In mid-April the Federal Reserve approved the UBS emergency buyout of Credit Suisse — fresh on the heels of the high-profile failure of Silicon Valley Bank just a month before — events that marked a throttling of credit markets already stung by inflation. The result: a downturn in technology acquisitions and the acceleration of an already emerging trend toward more complicated, slower moving and more risk-averse transactions.

“Private equity buyers are employing seemingly more complicated financing structures, including more earn-outs, seller notes, lower debt to equity ratios and all cash financing, while traditional leveraged buyouts have been less frequent,” notes Garrett Johnston, a Houston corporate partner at O’Melveny. “Sale processes have been few and far between and less competitive this year, although private equity buyers continue to look for add-on opportunities, particularly those that can be financed with all cash.”

Latham’s Maierson describes the action as mixed at nearly every level: “Public company acquirers continue to be quite active, although targets willing to sell have largely been on the smaller side. Megadeals and private equity-led take-privates have seen challenges as a result of choppy and sometime prohibitively expensive financing; but we are seeing large-scale deals in energy and in regulated industries like telecom as well.

Michael Piazza, a partner at Gibson Dunn, agrees that transactions have become more complicated, even in the traditional energy sector, and especially in the middle-market.

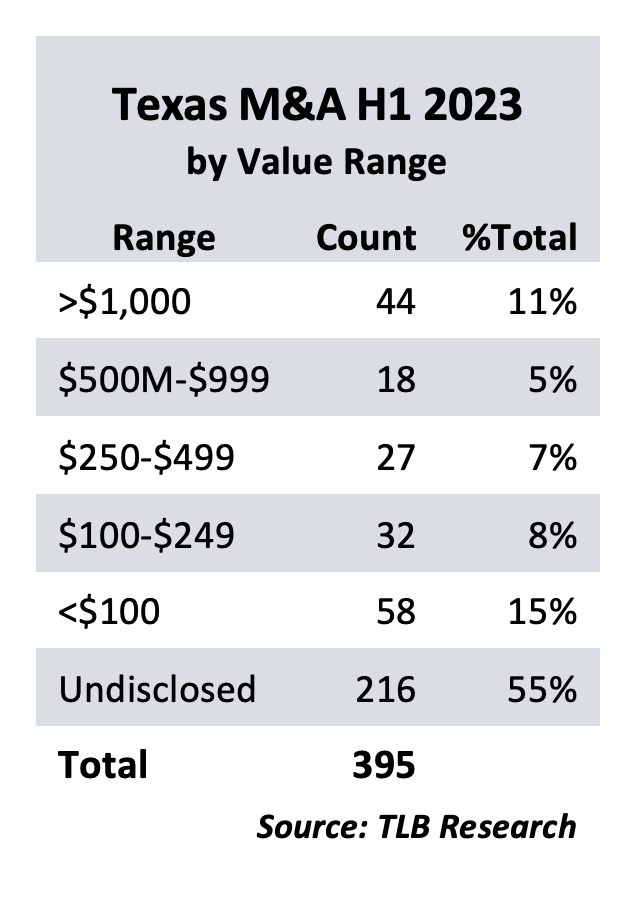

The CDT data supports that impression.

Of the 395 reported transactions, more than half (216) came with values undisclosed. Of the 179 with disclosed values, deals above $1 billion (44) or below $100 million (58) outnumbered the 77 deals with values that fell between.

“I would note, however, that when deals ‘have legs,’ buyers have had less difficulty with financing than people might expect. Many of these buyers have gotten very creative in terms of structuring that financing, including by bringing in asset-level partners,” Piazza says.

Part of that complexity, says Gibson partner Hillary Holmes, is an increasingly creative integration of capital markets into overall M&A deals.

“I know this is an M&A piece,” says Holmes, “but it is worth noting that these transactions are driving some creative capital markets and other financing activity in the energy space — while capital markets in the broader US market is sleepy. The deals we have been preparing for should only accelerate assuming continued decent and stable news on the inflationary, recession and VIX (volatility index) fronts.”

“Bottom line,” says Holmes. “This is one of the periods in which creative and driven dealmakers can find real value creation.”

Locke Lord’s Simmons shares that optimism. She believes that the current deal market is as much a source of light as it is a source for blame; at the end of the day (or the quarter, or the year) deals-in-process, however slowly they might move, are still deals.

“Frankly, if all of the deals that we’ve seen in the pipeline moved forward all at once, it would be very busy—they just aren’t moving or aren’t moving quickly.”

Note: This article includes a correction in the valuation of H1 2023 Texas-related M&A due to a data entry typo.