The Texas M&A landscape continues to defy economic headwinds. In what has proven to be an increasingly uneven deal environment week-over-week there’s been a steady stream of billion-dollar transactions to kick off the third quarter. Good news, right? Sure, but the devil is in the details.

Even with lingering uncertainties around interest rates and geopolitical tensions (both kinetic and trade), Texas lawyers were part of nine major deals exceeding $1 billion since the beginning of July. The transactions span multiple sectors, from energy infrastructure to data centers, highlighting the state’s continued appeal as a hub for transformative corporate combos and tie-ups.

While overall M&A volume has shown some softening year over year, the sheer size of individual deals demonstrates that when private equity or companies do decide to act, they’re making bold moves, leaving their outside counsel working overtime to close transactions and finding increasingly creative ways to do so.

“We’ve seen a clear acceleration of billion-plus announcements over the past few weeks,” said Latham & Watkins Houston partner Trina Chandler. “Larger deals often feel ‘safer’ in today’s peak-and-valley market because they are sponsored by strategic buyers or large PE funds with dedicated M&A war chests, or committed financing lines, but that said, we are continuing to see strong activity in mid-market M&A as well.”

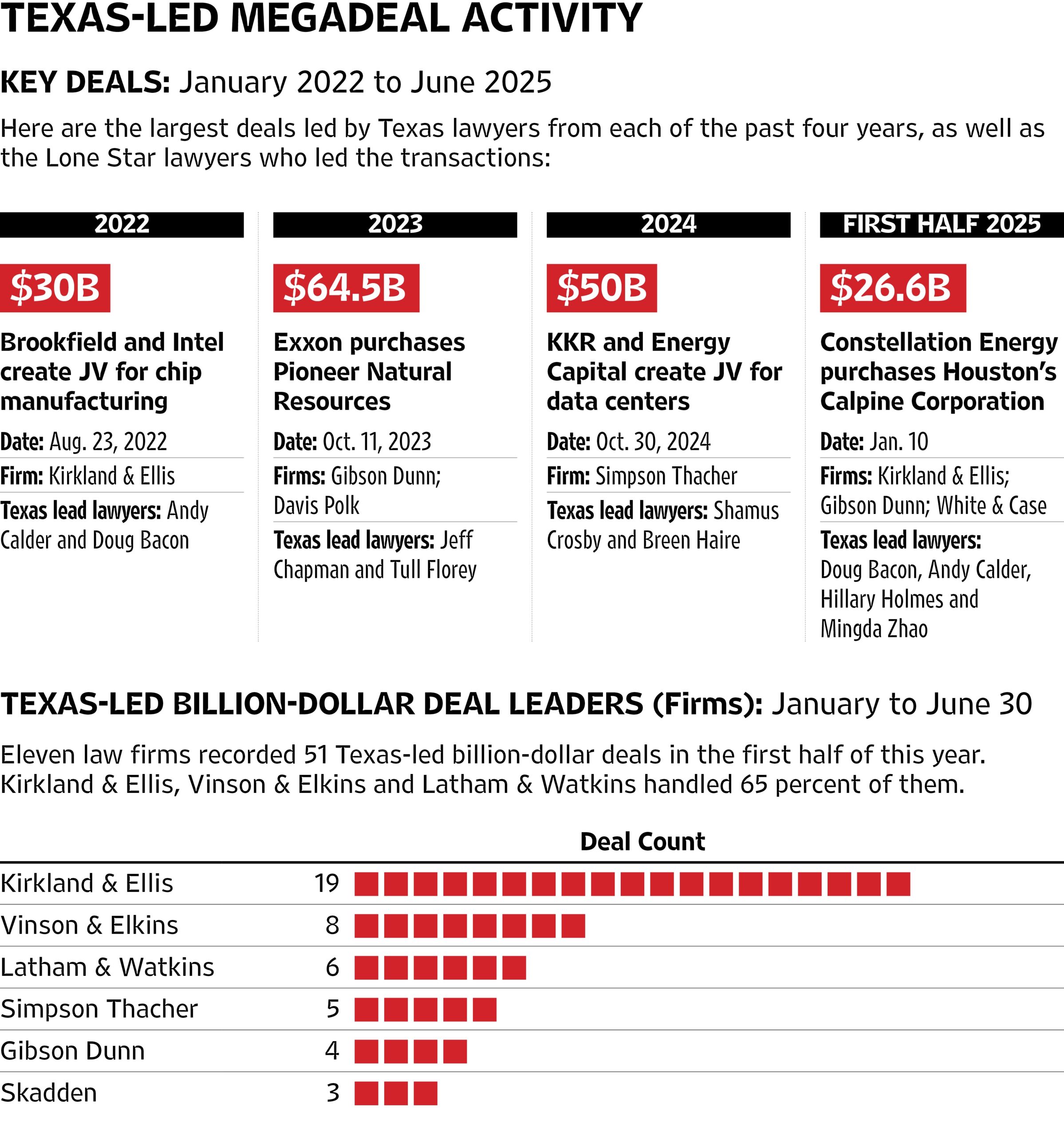

In the first half of this year, The Texas Lawbook’s Corporate Deal Tracker reported 85 deals involving Texas companies or Lone Star lawyers of $1 billion or more, representing the second-highest volume (27.9 percent) recorded, trailing only deals of $100 million and less. Moreover, ten of those 85 billion-dollar deals were megadeals — deals valued at $10 billion or more.

That there are more billion-dollar deals than in past years shouldn’t be surprising; inflation pretty much ensures it. But it’s important to note that, although smaller deals account for the majority of M&A volume in any given reporting period, the most attention (and the greatest share of total deal value) tends to center on the largest, headline-grabbing transactions. These so-called “blockbuster” deals have a disproportionate impact on the market narrative, but they also bill out significantly more hours for outside legal counsel. Megadeals require large, partner-heavy teams, which can translate into hundreds or thousands of additional billable hours per transaction depending on the deal.

As a result, firms involved in these larger transactions see a substantial boost in their revenue and overall profits. And the competitive landscape handling billion-dollar deals in Texas remains dominated by a familiar triumvirate of firms.

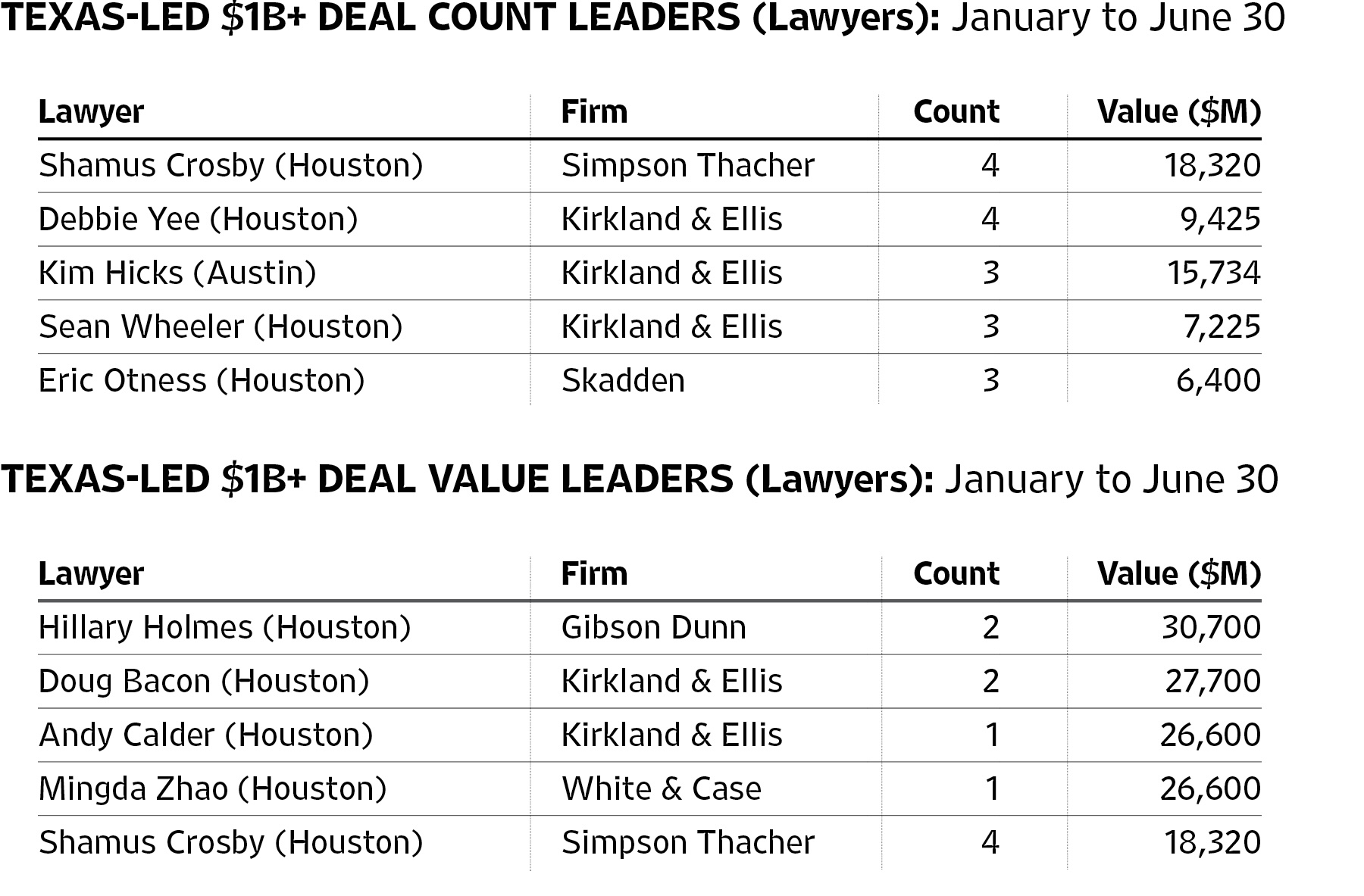

During just the first six months of 2025, eleven law firms were responsible for executing 51 Texas-led transactions valued at $1 billion or more. Notably, three firms — Kirkland & Ellis, Vinson & Elkins and Latham & Watkins — collectively handled 65 percent of those, underscoring their continued dominance in the CDT rankings for billion-dollar deals.

Unsurprisingly, those three firms also ranked in the Texas Lawbook 50’s top ten for revenue generated by their Texas lawyers last year. Kirkland took the No. 1 spot with a record-breaking $1.15 billion. V&E came in second, with $635.1 million and Latham ranked tenth with $318.4 million. All three firms grew their Texas revenue last year, with Kirkland and Latham doing so by double digits.

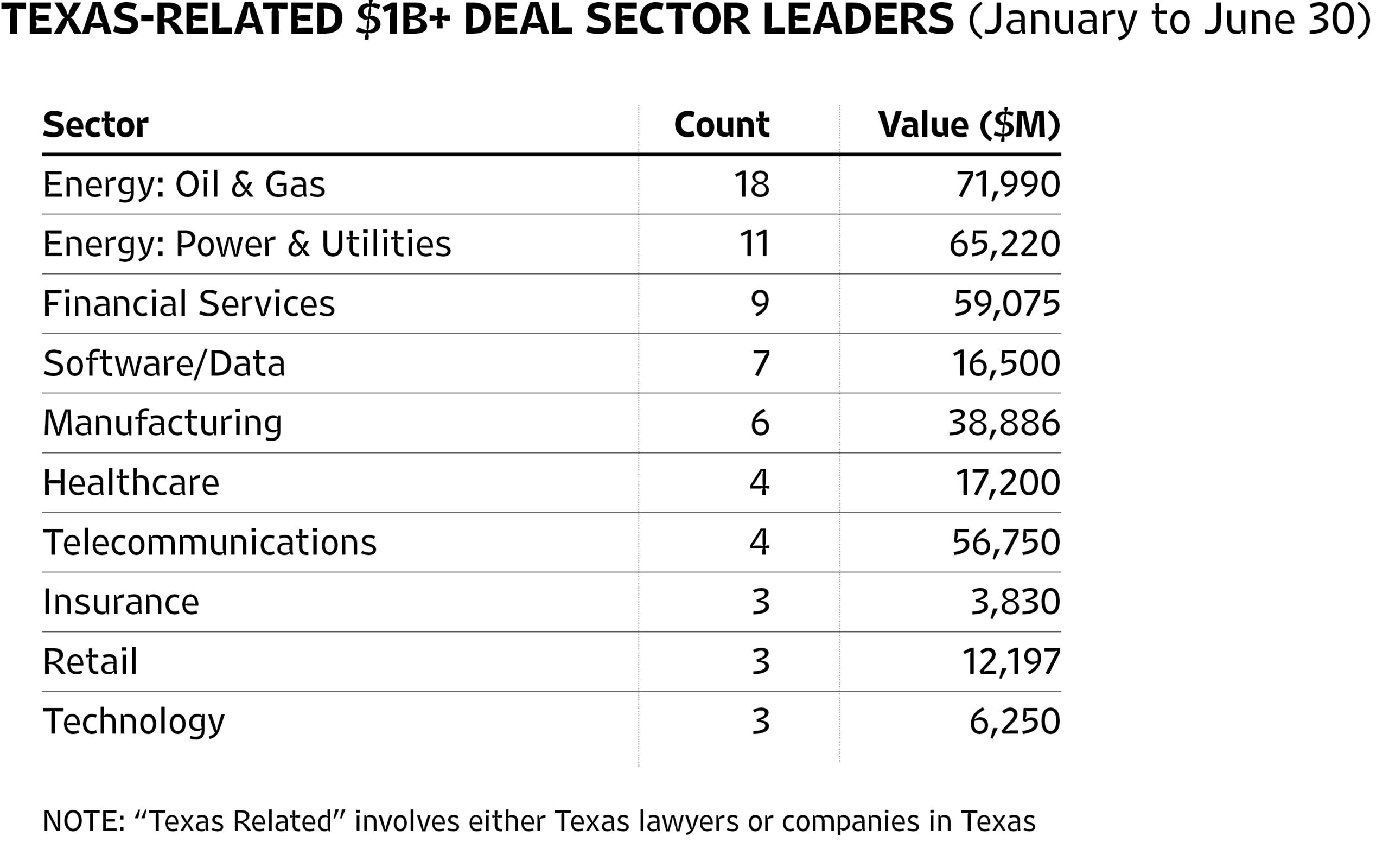

Billion-dollar deals also defied an overall downward trend in M&A segments in the second quarter by surpassing the first-quarter billion-dollar deal count, according to the CDT. In the first quarter of 2025, there were 38 Texas-related billion-dollar deals valued at $152.2 billion in total value. In the second quarter, things picked up, with 47 deals valued at $242.7 billion. By contrast, the total CDT deal count across all valuations dropped by more than 26 percent, falling from 372 in Q1 to 272 in Q2.

And in the third quarter, the billion-dollar deals involving Texas lawyers or companies headquartered in the state keep coming, even if they are increasingly arriving in spurts:

- $13.6 billion: Houston-based Baker Hughes agreed to acquire Chart Industries for $210 per share in an all-cash deal, expanding its liquified natural gas and data center capabilities. The transaction, advised by Cleary Gottlieb Steen & Hamilton and WilmerHale for Baker Hughes and Winston & Strawn for Chart, is expected to close by mid-2026.

- $6 billion: Global investment firm Brookfield Asset Management acquired a 19.7 percent stake in Duke Energy Florida to support grid modernization and capacity expansion. Kirkland & Ellis advised Brookfield, while Skadden represented Duke Energy in the phased investment structure running through 2028.

- $4 billion: Energy Capital Partners and KKR announced their first major investment under a $50 billion joint venture, developing a 700,000-square-foot data center campus in Bosque County. Kirkland & Ellis advised on the transaction, which represents the growing convergence of energy and technology infrastructure.

- $2.3 billion: MPLX agreed to purchase sour gas operator Northwind Delaware Holdings from Houston-based Five Point Infrastructure, expanding its Permian Basin processing capabilities. Latham & Watkins represented Five Point in the all-cash transaction.

- $1.9 billion: Ohio-based Huntington Bancshares expanded its Texas footprint through an all-stock acquisition of Dallas-based Veritex Holdings. Simpson Thacher & Bartlett advised Veritex, while Wachtell, Lipton, Rosen & Katz represented Huntington.

- $1.5 billion: Western Midstream Partners acquired Aris Water Solutions to advance its Permian water pipeline and recycling operations through a cash and stock deal. Vinson & Elkins advised Western Midstream, while Gibson Dunn represented Aris.

- $1.5 billion: DigitalBridge Group and Crestview Partners took broadband provider WideOpenWest private for $5.20 per share. Simpson Thacher & Bartlett advised DigitalBridge, while Wachtell, Lipton represented WOW!’s special committee.

- $1.35 billion: Houston-based Quanta Services completed its acquisition of Austin engineering firm Dynamic Systems for $1.15 billion in cash plus $200 million in stock, targeting the surging data center development market. King & Spalding advised Quanta, while Elder Bray & Bankler represented Dynamic Systems.

- $1.3 billion: ConocoPhillips announced a $1.3 billion sale of assets in the Anadarko Basin to Flywheel Energy. Haynes Boone advised ConocoPhillips on the deal.

Does that mean these larger deals are more resilient in a peak-and-valley transactional environment than smaller deals? Not necessarily, according to Kirkland & Ellis Houston partner Debbie Yee. “Deal activity and discussions have started to pick up,” she said. “I don’t think it’s because these larger deals are necessarily ‘safer’ in this environment than smaller deals, but rather I think companies have started to get more comfortable with the uncertainty around tariffs and although there continues to be volatility, the market has generally recovered and been resilient since the initial losses following Liberation Day.”

As Texas lawyers navigate the billion-dollar deal environment, several themes emerge. Infrastructure continues as a leading asset class for private equity clients, according to Simpson Thacher Houston partner Shamus Crosby, while the growth of segments like data centers and renewable energy infrastructure promises sustained deal flow.

The Lawbook recently asked Texas dealmakers with extensive experience handling billion-dollar transactions to share their perspectives on the current M&A environment, including their assessment of the first half of the year, the third quarter so far and their outlook moving forward:

The Texas Lawbook: Corporate Deal Tracker M&A data shows that 2025 started off hot with big expectations for this year. But Q2 cooled down, with overall transactions dropping by nearly 25 percent, even as $1B+ M&A deals stayed the course. More recently, in the past few weeks, we have seen a slew of $1B+ M&A transactions announced, as well. What were your expectations coming into 2025 and how did it play out?

Shamus Crosby, Simpson Thacher: We came into 2025 with significant tailwinds and no doubt that 2025 would be our best year ever. While we still expect to beat last year, we experienced some choppiness in the second quarter following the tariffs announcement and it has taken some time to fill the pipeline back up to where we were in Q1. That said, we saw most of the choppiness in the middle market space and in energy transition, which was also impacted by tax incentives for those projects being called into question. Larger infrastructure transactions, which typically involve long lead-time projects with significant capital requirements, have generally stayed the course and that’s why I think you’ve seen those $1B+ deals stay level while general M&A has been down. Short and even medium-term blips in the economy and public capital markets tend to have less impact on these transactions than the broader M&A market.

Rahul Vashi, Gibson Dunn: Deal activity was strong coming into 2025 and continued at a good pace the first several weeks of the year. Liberation Day was an obvious shock to the system, largely because the extent of the tariffs was so broad and their long-term impact on costs and inflation is hard to predict. Meanwhile, energy companies with healthy balance sheets focused their efforts on managing capex and weathering the uncertainty. It’s taken a few months, but as companies get more comfortable with the macro impacts of U.S. tariff policy and the One Big Beautiful Bill, we’re starting to see a resumption of the M&A and consolidation trends we saw in the past couple years. One expectation going into 2025 that has generally borne out is that the regulatory policies of the new administration are more deal-friendly. The FTC has been receptive to large deals and has even revisited restrictions placed on prior deals. The expectation of fewer administrative hurdles certainly encourages companies to pursue megadeals.

Debbie Yee, Kirkland & Ellis: A number of deals started to come together towards the end of 2024/beginning of 2025 and there was an expectation that this would be a very busy year. This expectation played out until mid-April when deals started to be put on hold due to the uncertainty around tariffs and other geopolitical concerns.

Trina Chandler, Latham & Watkins: The buzzwords coming into 2025, were “cautious optimism” as we anticipated a modest rebound driven by improving macroeconomic headwinds, continued private-equity dry powder, and renewed sponsor confidence. We thought overall deal count would likely remain below the 2018–2019 peaks, but that total value would climb as larger, more transformative deals closed.

The H1 results largely confirmed that view: global M&A value jumped 33 percent (Latham up 32 percent), even as global deal count fell 10 percent (Latham up 2 percent). In the U.S., target-M&A value was up 13 percent (Latham up 59 percent), despite a 12 percent drop in count. Megadeals (greater than $10 billion) led the way, with 30 announced in H1 totaling nearly $600 billion (up 92 percent), with Latham up 289 percent and a 20 percent market share globally, according to Bloomberg.

Our Texas team helped anchor many of those transactions in the energy and infrastructure space and played important roles in some of the largest global transactions across multiple industries.

Lawbook: $1B+ M&A deals defied the overall downward trend in Q2 2025 by slightly surpassing the Q1 deal count, according to the CDT. Many dealmakers were worried about the lack of predictability or uncertainty hampering M&A activity, including potentially impacting larger deals. Has the uncertainty gone away? What has happened?

Hillary Holmes, Gibson Dunn: The uncertainty that started in Q1 (geopolitical tensions, commodity price volatility, rate uncertainty, market volatility from policy changes) has not gone away, but dealmakers are learning how to navigate it. The unpredictability became predictable. In Q2, the uptick in $1B+ deals despite broader market softness shows that strategic necessity continues to outweigh market hesitation. For many patient energy companies, at this point, transformative M&A is either an imperative or the only move that will make a meaningful difference. After topping out with organic growth or balance sheet-driven smaller acquisitions, larger M&A is needed to get scale or secure critical assets in higher multiple business lines. In addition, the capital markets have thawed, allowing better access to buyer financing, and the regulatory environment is much friendlier to both energy and large deals.

Trina Chandler: Macroeconomic, regulatory, and geopolitical uncertainties still persist — particularly around interest-rate outlooks and antitrust scrutiny — but most buyers and sellers in the $1 billion-plus segment have become adept at navigating them. In addition, M&A has continued to be very active in the power sector due to the increased demand that is anticipated from AI, data centers and electrification.

Lawbook: Are you seeing more consolidation or divestiture activity in energy, infrastructure or other core Texas industries in the $1B+ deal space?

Debbie Yee: In the E&P space, I believe there’s likely to be more consolidation (though not at the pace that we’ve seen over the last few years) and robust divestiture activity as many companies that engaged in M&A in 2024 look to divest of non-core assets.

Trina Chandler: Both trends are in play. Looking ahead to the second half of 2025, we might see more active portfolio rebalancing as companies pursue both divestitures and strategic consolidations to unlock value.

Lawbook: What are your predictions for the $1B+ M&A segment for H2 and into 2026?

Shamus Crosby: We are coming out of it and our pipeline of deals for H2 is really healthy. I think we continue to see uncertainty in the middle market space, but large LNG, data center and utilities transactions are hot right now and I think they will continue to be for the foreseeable future.

Hillary Holmes: The $1B+ M&A market should stay relatively resilient through H2 2025 and into 2026, driven by strategic investments in growing areas of focus and scale-driven consolidation. Well-capitalized buyers still have access to equity and debt markets, and, despite periods of volatility, generally stronger stock valuations could support stock-based deals. However, the thawing of the equity capital markets has warmed up several of the IPOs that were waiting to execute — and this is often correlated with M&A activity. Especially if equity markets hold steady and regulatory reviews stay predictable, we could see a pickup in both in late 2025 and early 2026.

Debbie Yee: As companies continue to get more comfortable with the macroenvironment, I am hopeful that the uptick in deal flow that we’ve seen over the last few months will continue for the remainder of 2025.

Trina Chandler: Strategic M&A in the energy and infrastructure industry should continue in the second half of 2025 and into 2026. Energy security is a dominant theme in the U.S., which could accelerate oil and gas upstream consolidation, and in addition, as noted above, increased demand for power generation from AI, data centers and electrification we believe will continue to drive investments in the power and utilities sector.

Mark Curriden, Allen Pusey and Christi Trammell contributed to this report.