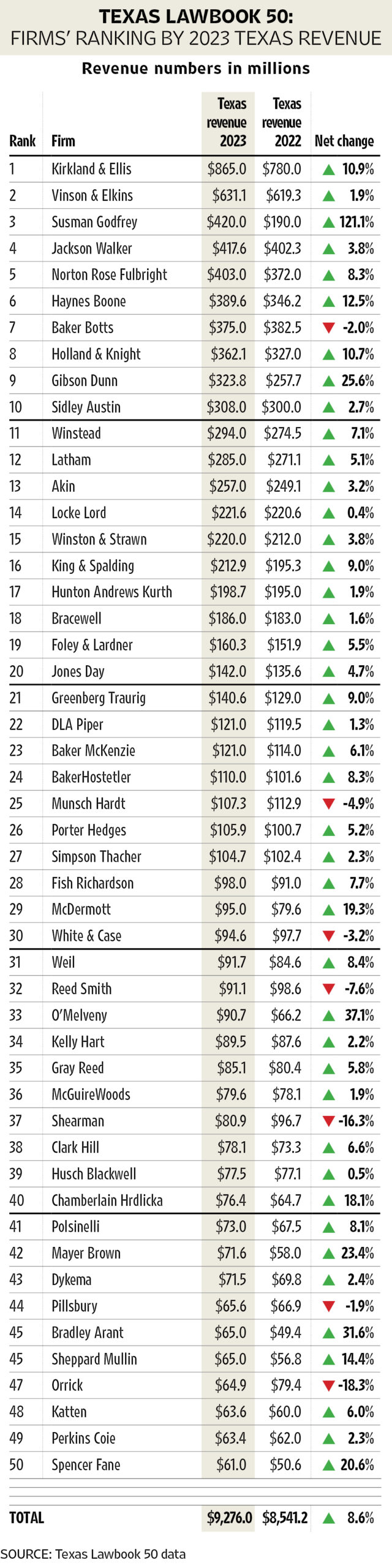

Fueled by record-high contingency fee collections, significant increases in hourly rates and healthy client demand for complex commercial litigation and corporate transactional work, the largest business law firms in Texas grew revenues 8.6 percent in 2023 to more than $9 billion, according to new Texas Lawbook 50 data.

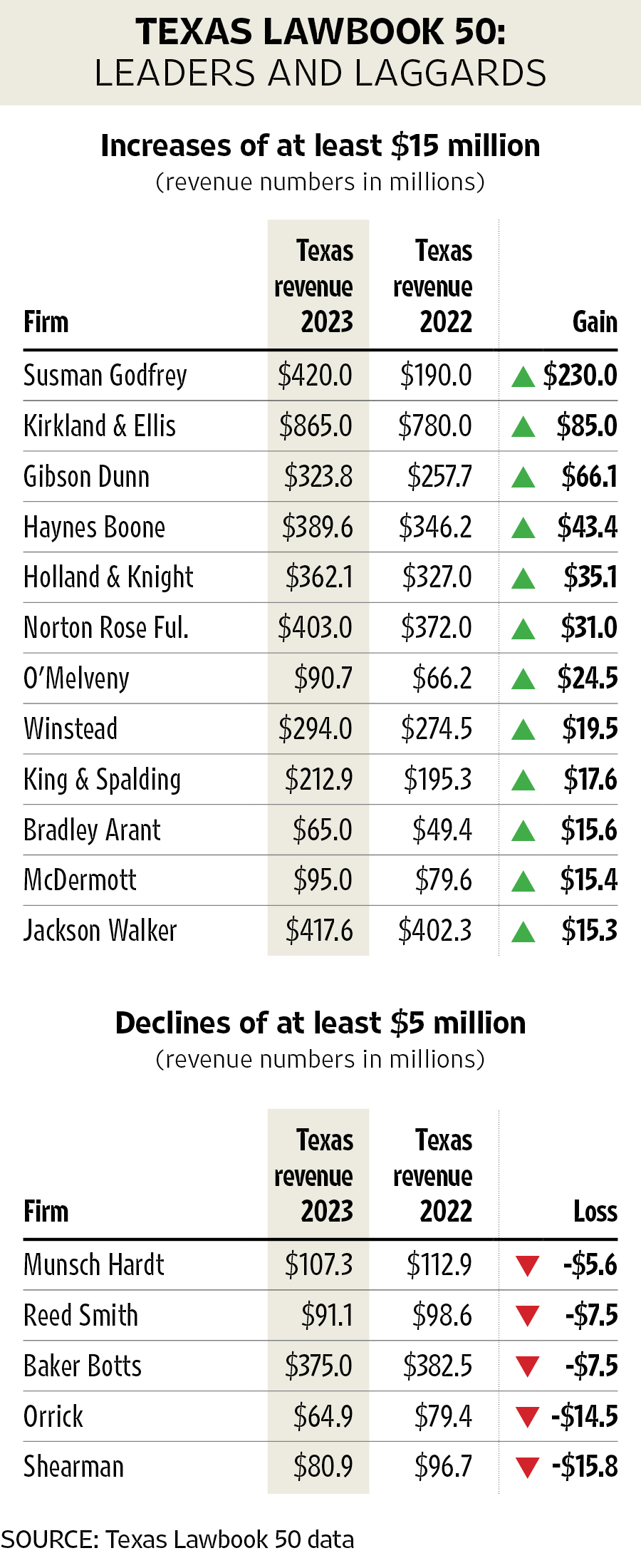

Forty-three of the top 50 corporate law firms posted gains, according to the Lawbook 50, which ranks firms on revenues generated by attorneys based in Texas. Six of the firms achieved increases of $30 million or more, and 18 saw $10 million increases. Only seven firms on the list recorded revenue declines.

The Top 10 welcomed two newcomers in 2023 — Susman Godfrey, a firm that soared thanks to a sudden gusher of cash from contingency fee court victories that were years in the making, and Gibson Dunn, a firm that has steadily climbed in the rankings since 2019 on a combination of litigation and M&A dealmaking.

Thirty-five firms hit record highs in 2023.

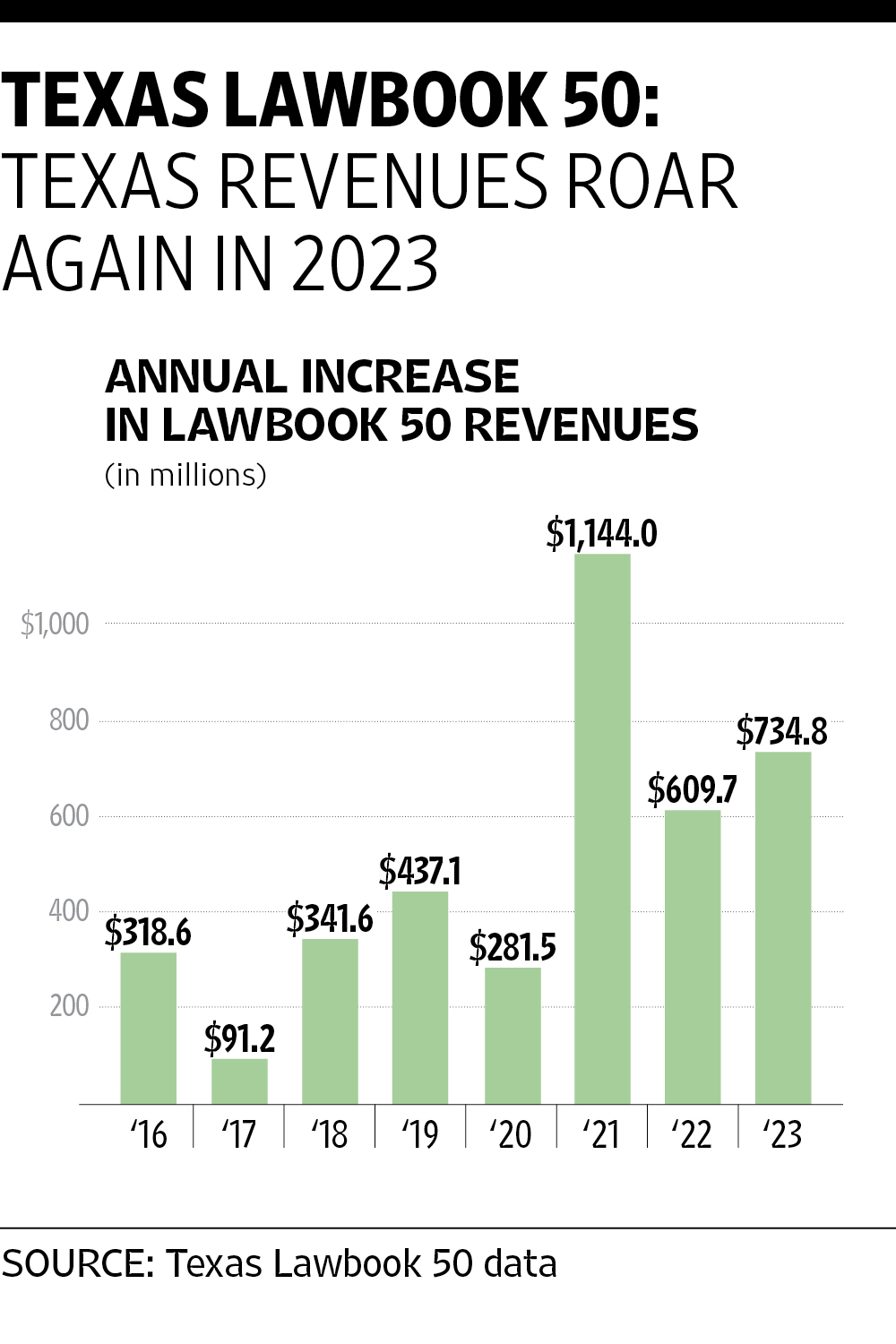

Altogether, the Lawbook 50 generated $9.276 billion in Texas revenues in 2023 — up from $8.541 billion in 2022 and a 40 percent jump from $6.61 billion in 2019.

Ten corporate law firms reported $300 million or more in revenues from their Texas offices in 2023. Just four reached that mark five years ago.

Sixteen law firms recorded $200 million or more in Texas revenues in 2023 — double the number in 2019.

By nearly every data point, 2023 was the second-best year ever for law firms’ Texas revenues. In terms of dollars, the $735 million in additional revenues generated by the Lawbook 50 firms in 2023 exceeded the 2022 gain of $610 million (7.6 percent). The only better year was 2021, when corporate law in Texas rebounded strongly from the disruptions of the Covid-19 pandemic with a 17.6 percent gain, or more than $1.1 billion increase.

“The thing that is different about Texas is the amount of money coming into the market is huge,” law firm consultant Kent Zimmermann said. “Law firms follow the money.”

Lawbook 50 Top 10

Kirkland & Ellis and Vinson & Elkins have been Texas’ highest revenue-generating corporate law firms since 2019. The duo generated a combined $1.496 billion last year — a 59 percent jump from $941.4 million five years ago.

“We were busy across the board,” Kirkland partner Andrew Calder told The Lawbook. “Our core M&A practice was a big driver. “Project finance has been busier than we expected. Litigation has been very strong. And 2024 has started incredibly busy, with energy infrastructure being the busiest.”

Kirkland widened its edge over V&E by increasing Texas revenues by nearly 11 percent in 2023 to $865 million. V&E grew two percent to $631.1 million — at least $210 million more than the 48 other firms in the Lawbook 50.

“The firm had a strong year in 2023,” V&E chair Keith Fullenweider said. “We are focused on sustainable growth. We believe that the strategy of having the right people and treating the clients the right way is the path for growth and success.”

“The debt markets and debt financing are opening, and those are such a driver of M&A activity,” said Fullenweider, who noted the firm is involved in two of the largest offshore wind project financings currently underway. “Energy transition spend is less inflation sensitive. These are decadelong commitments and go forward regardless of economic pressures.”

“The Inflation Reduction Act has made the U.S. the hot market for infrastructure and energy transition,” he said.

Susman Godfrey leaped from 17th on the Lawbook 50 ranking in 2022 to third last year, thanks to multiple contingency collections. The Houston-based litigation boutique increased revenues an astonishing 121 percent last year — from $190 million to $420 million. Susman Godfrey’s additional revenue of $230 million alone would rank 14th in the Lawbook 50, just below Akin Gump. (Editor’s note: The Lawbook did an in-depth report on Susman Godfrey’s historic year here.)

The firms that ranked fourth through eighth in 2023 — Jackson Walker, Norton Rose Fulbright, Haynes Boone, Baker Botts and Holland & Knight — all moved down one place from 2022 because of Susman Godfrey’s ascension. All but one of them experienced strong revenue growth last year.

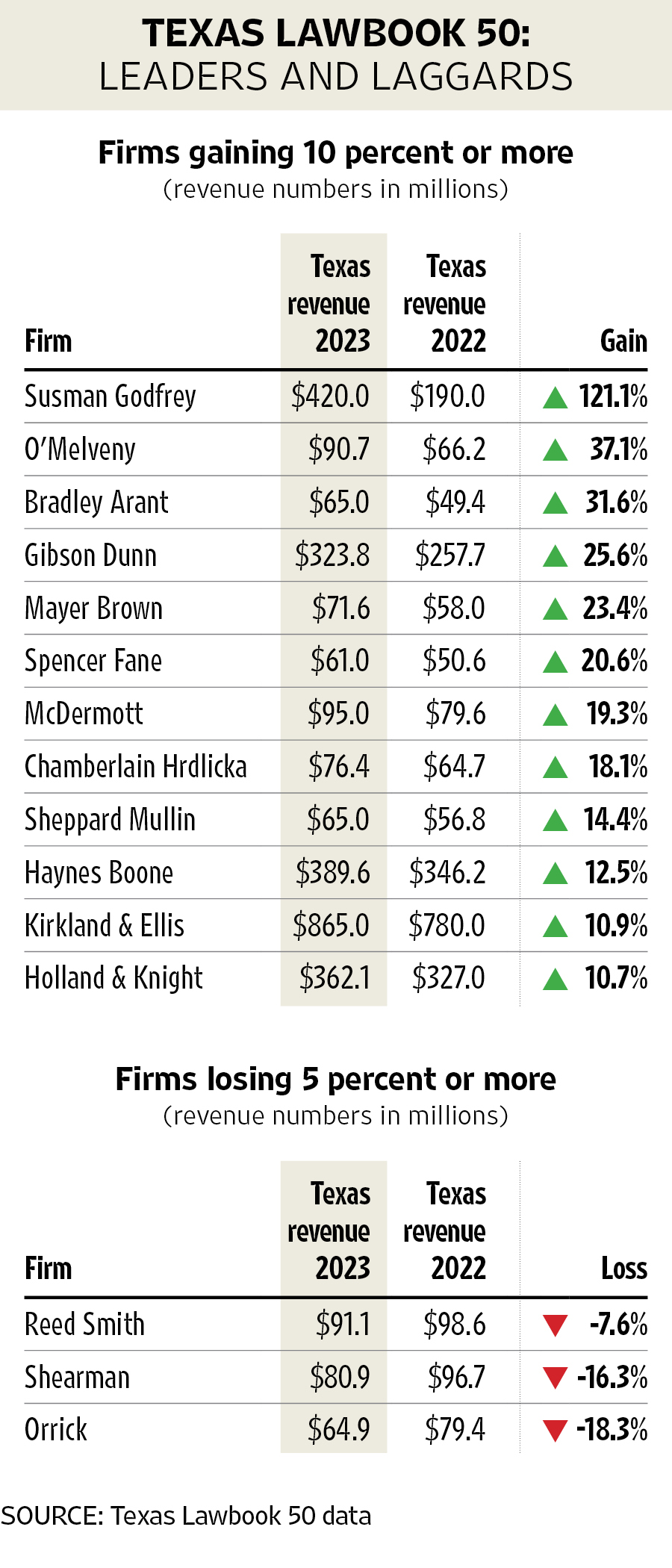

Norton Rose Fulbright topped $400 million for the first time by growing in-state revenues by 8.3 percent in 2023. Holland & Knight saw revenues climb 10.7 percent last year. And Haynes Boone increased its Texas revenues by 12.5 percent in 2023 to $389.6 million.

“We had a very strong year in 2023 — a record-setting year in revenues and revenues per lawyer,” Haynes Boone managing partner Taylor Wilson told The Texas Lawbook. “Energy was strong. Some countercyclical practices, such as litigation and restructuring were stronger than expected. And we are having a great start to 2024. The numbers for the first quarter were up year over year.”

The only Top 10 firm reporting a decline in Texas revenues was Baker Botts. It went from $382 million in 2022 to $375 million in 2023, a drop of two percent.

“We saw some headwinds in 2023 that are now tailwinds for us in 2024,” Baker Botts managing partner Danny David said. “So far in 2024, we are killing it. We are seeing significant increases in billings and collections over last year.”

In addition to Susman Godfrey, the other newcomer to the Lawbook 50 Top 10 was Gibson Dunn, which grew its Texas revenues 25.6 percent in 2023 to $323.8 million, adding to a string of gains from $123.9 million in 2019. (Editor’s note: The Lawbook published a separate article on Gibson Dunn’s growth here.)

Sidley Austin, which grew Texas revenues 2.7 percent to $308 million in 2023, rounded out the Lawbook 50 top 10.

Lawbook 50 Newcomers, Climbers and Decliners

Lawbook 50 data comes from multiple sources, including firms directly reporting their revenues, interviews with current and former partners, American Lawyer reports and other third-party sources that collect and analyze firm revenues.

Three midsized corporate law firms are new to the Lawbook 50 list for revenues. Bradley Arant debuted at No. 45 with 2023 revenues of $65 million — a 31.6 percent jump over the previous year. Sheppard Mullin, tied with Bradley Arant at No. 45, barely missed the 2022 Top 50 at $56.8 million but saw its Texas revenue increase 14.4 percent to $65 million last year. And Spencer Fane grabbed the final spot by increasing its 2023 revenue by 20.6 percent to $61 million.

Three law firms saw Texas revenues drop just below $61 million, the cutoff to make last year’s Top 50. Coats Rose increased its Texas revenue by 1 percent — from $56.6 million to $57.2 million. Alston & Bird’s Texas revenues dropped 14 percent — from $68.4 million to $58.7 million. And Ogletree Deakins’ Texas revenues declined from $62.7 million in 2022 to $60.4 million, leaving it $600,000 shy of making the Lawbook 50.

Two corporate law firms experienced double-digit declines in Texas revenues. Orrick’s declined 18.3 percent — from $79.4 million in 2022 to $64.9 million last year. Shearman & Sterling, which recently merged with London-based Allen and Overy, saw Texas revenues decline from $96.7 million to $80.9 million.

No firm came close to Susman Godfrey’s 121 percent revenue gain. However, five other firms increased revenues by 20 percent or more. Los Angeles-founded O’Melveny was second at 37 percent. It entered the Texas market just three years ago, and its business jumped from $15 million in 2021 to $66 million in 2022 to $90 million in 2023. The other firms that increased revenues by 20 percent or more were Mayer Brown, Gibson Dunn, Bradley Arant and Spencer Fane.

Aggressive Rate Increases

The Lawbook reported earlier this year that lawyer headcount for the Lawbook 50 in 2023 increased by 2.3 percent, or slightly more than 200 attorneys. The additional lawyers contributed to the revenue gains, but that accounts for only a fraction of the 8.6 percent jump in revenues.

Two widely respected industry analysts told The Lawbook that Texas firms benefitted from an industrywide trend of rising rates.

“The extraordinary thing about the bill rate increases we have seen is there has been a fundamental reset,” said Michael McKenney, managing director of the Citi Private Bank Law Firm Group. “That 4.5 percent, which was the historic compound annual growth rate, moving up to numbers like 7.5 and 8.5 (percent) – and even stronger in some markets.”

Zimmermann, a principal at the Zeughauser Group, said his industrywide data on firms indicate demand among American Lawyer 50 firms was flat in 2023, although several individual firm leaders say that’s not their experience. At the same time, rates were up seven percent to 10 percent for the largest firms.

“Smaller firms don’t have quite the same rate increases,” he said. “The larger firms are eating up market share, growing their revenues faster than the smaller firms.”

In addition to raising rates faster, the biggest firms benefit from compounding as the new rates apply to a larger book of business, Zimmermann said. “The larger firms end up with more money to pay the lawyers they want to attract,” he said.

Firms acknowledge the reality of higher rates as a market phenomenon, but they’re generally tight-lipped about what they charge clients.

“Our rate increases were similar to those we see across the country,” Haynes Boone’s Wilson said. “They’ve been well-received by our clients, and we’ve seen increasing interest in alternative fee arrangements.”

The Susman Godfrey Factor

Here’s one way to look at Susman Godfrey’s massive increase in 2023 revenues. Break it into two hypothetical firms. Give one the $230 million in added revenues — it would rank 14th in the Lawbook 50, right between Akin and Locke Lord. The other firm would still claim the $190 million Susman reported last year, fitting it between Hunton Andrews Kurth and Bracewell at No. 19 in the latest revenue ranking.

In short, Susman Godfrey’s massive revenue increase was bound to send out some ripples. If we take the firm out of the Lawbook 50, the growth rate from 2022 to 2023 would be six percent, or 2.6 points below the full sample’s performance. The Lawbook 50’s overall gain last year would trail 2022’s 7.6 percent — so an up year turns into a down one.

In past years, the Lawbook 50 has been a tool to answer questions about groups of firms. Are larger firms growing faster than smaller ones? To what extent have the big-name out-of-state firms elbowed aside the home-grown legacy firms in the Texas market?

Let’s see what the data tells us. Including Susman, the Top 10 firms grew revenues by 13 percent in 2023 — almost double any other quintile. The 10 biggest firms’ share of the Lawbook 50 pot increased from 46.6 percent in 2022 to 48.5 percent in 2023.

Set Susman Godfrey’s 2023 numbers aside, and the Lawbook 50 Top 10 growth rate slows to 7.6 percent, not far above the 7.1 percent of the fourth quintile. The Top 10’s share still rises but by only a half percentage point.

The Lawbook 50 consists of 14 firms based in Texas and 36 firms headquartered out of state, including those born in Texas but merged into non-Texas ones. In the past decade, a grand theme of Texas corporate law has been the explosive growth of out-of-state firms, which have taken many top lawyers and clients from indigenous firms.

The 2023 Lawbook 50 data suggest a change of fortune for Team Texas. Its revenues grew 10.3 percent, compared to 8.6 percent for the national firms. As a result, the Texas firms’ share of the pie increased for the first time in years, rising a half point to 39.4 percent of Lawbook 50 revenues in 2023.

Without Susman Godfrey, the Texas-based firms’ comeback evaporates. Their growth rate would fall to 3.6 percent and their Lawbook 50 share would shrink from 37.6 percent in 2022 to 36.6 percent in 2023.