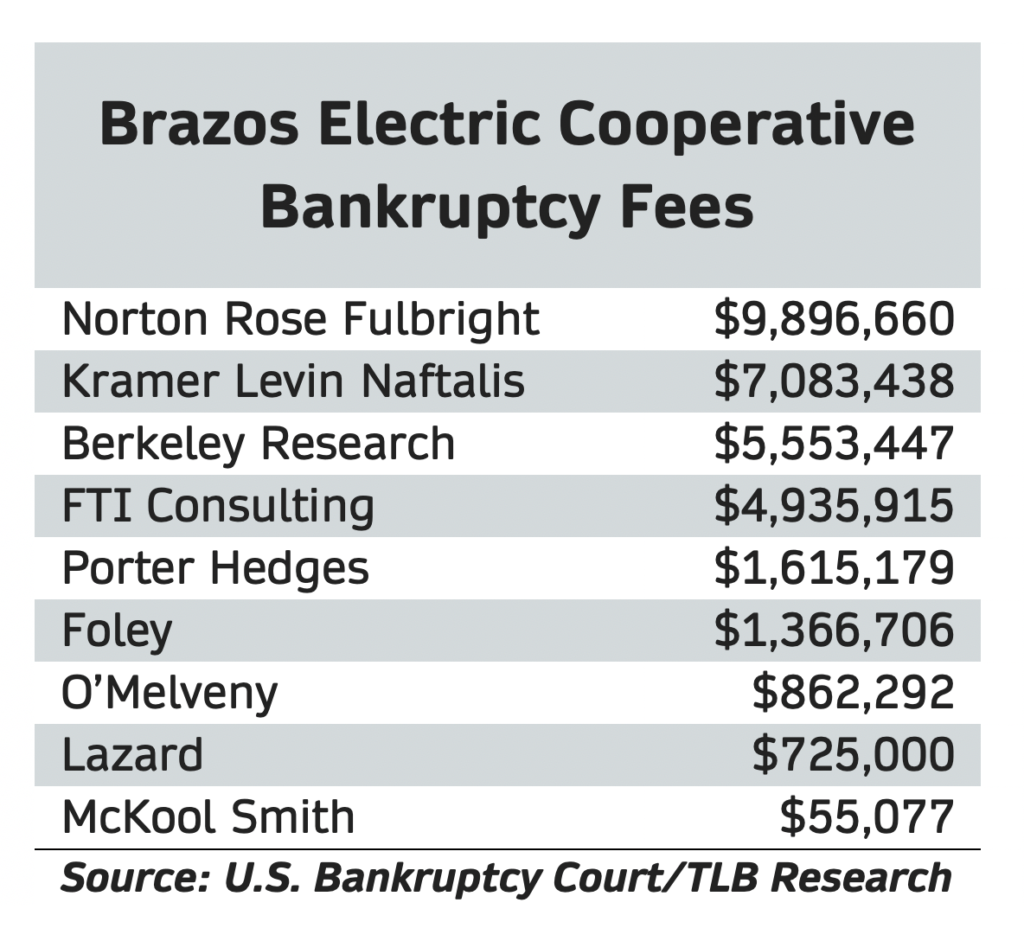

In the 259 days since Brazos Electric Cooperative Inc. filed for bankruptcy protection, 179 lawyers and financial advisors have worked more than 34,700 hours on the complex corporate restructuring and billed the utility more than $33.6 million for their services, according to court documents reviewed by The Texas Lawbook.

Brazos filed for Chapter 11 protection on March 1 after the Electric Reliability Council of Texas (ERCOT), operator of the Texas power grid, hit the Waco-based electric provider with a $1.9 billion tab for power supplied to its customers during Winter Storm Uri last February.

ERCOT’s $1.9 billion claim is by far the largest pending against Brazos; its approval claim could complicate the Waco-based cooperative’s efforts to emerge from bankruptcy as a robust, reorganized business entity.

To put the matter into some perspective, Brazos, in court documents, offered this comparison: The amount sought by ERCOT just for the week of the winter storm is more than Brazos’s total revenues from wholesale delivery of power in 2019 and 2020 combined.

The Brazos bankruptcy is one of the most heated disputes that resulted from the massive winter storm that left 4.5 million Texans without electricity for days. State health officials say at least 210 people died in Texas as a direct or indirect result of the storm; other, unofficial estimates place the death toll much higher.

More than 150 civil lawsuits involving wrongful deaths, personal injuries, property damage, breaches of contracts and pricing disputes have been filed in the state and federal courts in Texas. In addition, there are several foreclosure-related lawsuits pending in New York between Citibank and various hedge funds that have ownership interests in Texas wind farms.

Brazos Electric, the state’s oldest and largest electric co-operative, was the first to file for Chapter 11 after being overwhelmed with invoices from ERCOT. Energy retailers Just Energy Group Inc., Griddy Energy LLC, Brilliant Energy LLC and Entrust Energy Inc. have also declared bankruptcy.

Of the 179 lawyers and financial advisors approved to work on the matter by U.S. Bankruptcy Chief Judge David Jones of the Southern District of Texas, 30 are billing at rates of $1,000 or more.

The two lead law firms representing the Brazos, are O’Melveny & Myers and Norton Rose Fulbright. They have billed more than $10.8 million since March 1. Lead lawyer and O’Melveny partner Lou Strubeck of Dallas bills at $1,165 an hour. The three Norton Rose Fulbright partners who have worked on the Brazos case the most are Jason Boland ($920 an hour), Josh Agrons ($975 an hour) and Michael Parker ($890 an hour).

Kramer Levin Nataflis & Frankel, a New York-based law firm representing the unsecured creditors, has billed more than $7 million. Two Kramer Levin partners – John Coffey and Thomas Moers Mayer – have the highest hourly rate in the entire case at $1,575.

Houston-based Porter Hedges is co-counsel for the creditors and has billed $1.6 million. John Higgins is Porter Hedges highest charging partner at $845 an hour.

Foley & Lardner, which is special counsel to the debtor on issues of conflicts, has billed more than $1.36 million.

Eversheds Sutherland is special counsel to the debtor in possession and has billed more than $1.5 million thus far.

ERCOT is represented by Jamil N. Alibhai, Kevin M. Lippman, Deborah Perry and Ross H. Parker of Munsch Hardt Kopf & Harr in Dallas. The firm has not filed any applications with Judge Jones to be paid yet.

By contrast, senior partners at Cravath, Kirkland & Ellis and Weil Gotshal have charged in excess of $1,600 an hour in some of the larger corporate restructurings that took place last year in Houston.

In addition to the Brazos bankruptcy petition itself, an adversary proceeding filed by Brazos is sucking up hundreds, if not thousands, of billable hours by lawyers for the co-operative and ERCOT. In that proceeding, still pending, Brazos has asked Judge Jones to dismiss or reduce ERCPT’s $1.9 billion claim.

In addition, Brazos asked that any amount the judge allows as owed to ERCOT be reclassified as a general unsecured claim rather than a priority claim. That would shove ERCOT to the back of the creditors’ line; in many Chapter 11 reorganizations, general unsecured claims end up worth pennies on the dollar.