(July 27) – Even for a 2018 characterized by shake-ups – firm mergers, office openings, lateral raids – the changes at the top of the first-half M&A legal advisor charts are remarkable. V&E dropped. Kirkland ascended. And two national firms with no presence in Texas took the top deal value spots.

According to Mergermarket M&A data involving Texas-based companies provided exclusively to The Texas Lawbook, Houston-based Vinson & Elkins lost its top-ranked spots in both deal volume and deal value.

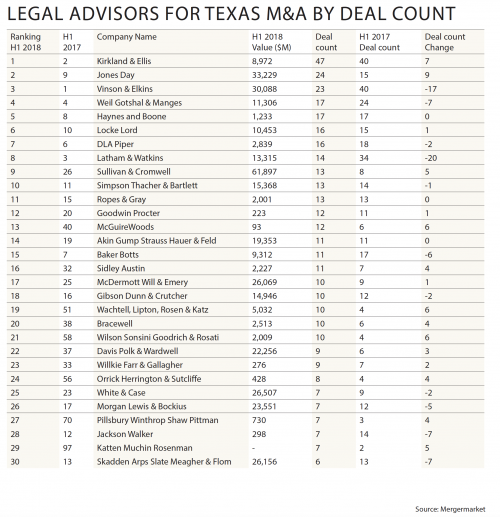

With only 23 reported deals, the venerable Texas firm dropped behind both Kirkland & Ellis with 47 transactions and Jones Day with 24 deals. Last year, Kirkland ranked second and Jones Day was ninth.

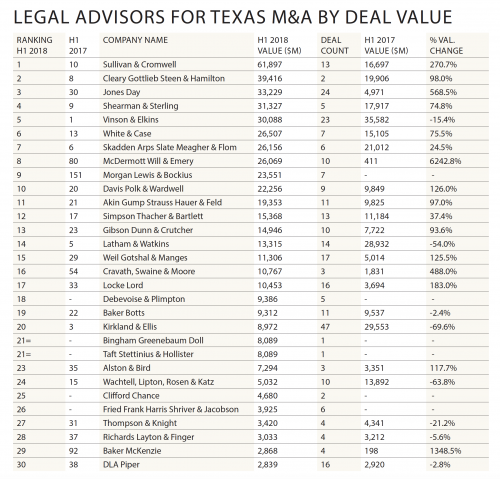

In deal value, V&E dropped to fifth behind first-place Sullivan & Cromwell ($61.9 billion) and second-place Cleary Gottlieb Steen & Hamilton ($39.4 billion), two New York firms with no offices in Texas. Last year, S&C ranked 10th in deal value. Cleary Gottlieb ranked eighth.

V&E’s transactions, valued at $30 billion, also ranked behind third-place Jones Day at $33.2 billion and fourth-place Shearman & Sterling at $31.3 billion. Jones Day, which has locations in Houston and Dallas, rose from 30th last year. Shearman, which opened offices in Houston and Austin earlier this year, ranked ninth last year.

Chad Watt, Mergermarket’s energy sector head for North America, said it’s interesting to see Jones Day and Locke Lord rally back up the charts (the latter jumped from 10th to sixth place in terms of deal count) while V&E, Latham & Watkins and Baker Botts slid down the list in terms of deal volume.

“Vinson & Elkins slipping to No. 3 on the legal advisor side is likely energy-correlated,” Watt said, referring to the difficulty in getting oil and gas deals to transaction during the period.

The cause also could be increasing competition for deal work.

Kent Zimmermann, a law firm management consultant at the Zeughauser Group in Chicago, said there’s been an influx of out-of-state firms into Texas either through mergers or new offices and other high-performing national and international firms are actively trying to enter the market.

“So competition for deals and lawyers has been growing and it’s going to continue grow,” Zimmermann said.

Others in the top 10 by value were White & Case, which came in at sixth versus a previous 13th (it opened a Houston office in February); Skadden Arps Slate Meagher & Flom, which dropped from sixth to seventh (it’s had a Houston office since 1993); and McDermott Will & Emery, which rose to 8th from 80th (it opened an outpost in Houston 10 years ago after putting down stakes in Dallas).

Morgan Lewis & Bockius, which has offices in Houston and Dallas, came in ninth versus 151st last year, while Davis Polk & Wardwell ranked 10th versus 20th last year.

Davis Polk doesn’t have an office in Texas but has been widely rumored to be interested in opening one in Houston.

In terms of deal count, Weil Gotshal & Manges stayed the same at fourth (it has offices in Dallas and Houston); Haynes and Boone rose to fifth from eighth (it has six Texas offices); and DLA Piper dropped to seventh versus sixth (it’s in Houston, Dallas and Austin).

Meanwhile, Latham fell to eighth versus third last year in terms of volume (its only Texas outpost is in Houston); Sullivan & Cromwell rose to ninth from 26th; and Simpson Thacher Bartlett jumped to 10th from 11th (it’s also only in Houston).

Noticeably absent from both top-10 lists were indigenous firms like Baker Botts, which ranked 19th in terms of deal value ($9.3 billion) and 15th in terms of deal volume (11 transactions). The firm had ranked seventh in volume in the first half of 2017 and 21st in deal value.

Another Texas native, Bracewell, didn’t rank in the top 30 for deal value but did come in 20th in terms of volume (a jump from its 38th ranking last year). Jackson Walker also didn’t rank in the top 30 for deal value and came in 28th for deal volume (a drop from its 12th ranking last year).

Thompson & Knight was 27th in terms of deal value (up from 31st) but didn’t make the top 30 for deal volume. And neither Porter Hedges nor Hunton Andrews Kurth made the top 30 on either list.

Porter Hedges dropped off the top 30 list in terms of deal count in the first half of last year. And Andrews Kurth was number five in terms of deal count in the same period last year, versus 24th in 2016.