HOUSTON – Merger and acquisition activity among Texas-based businesses remained healthy during the first half of 2017, but far from the exuberant pace of dealmaking in 2014.

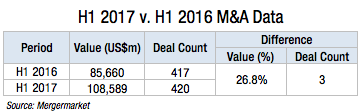

Exclusive data provided to The Texas Lawbook by Mergermarket shows that M&A deal count was relatively flat during the first six months of this year compared with a year earlier.

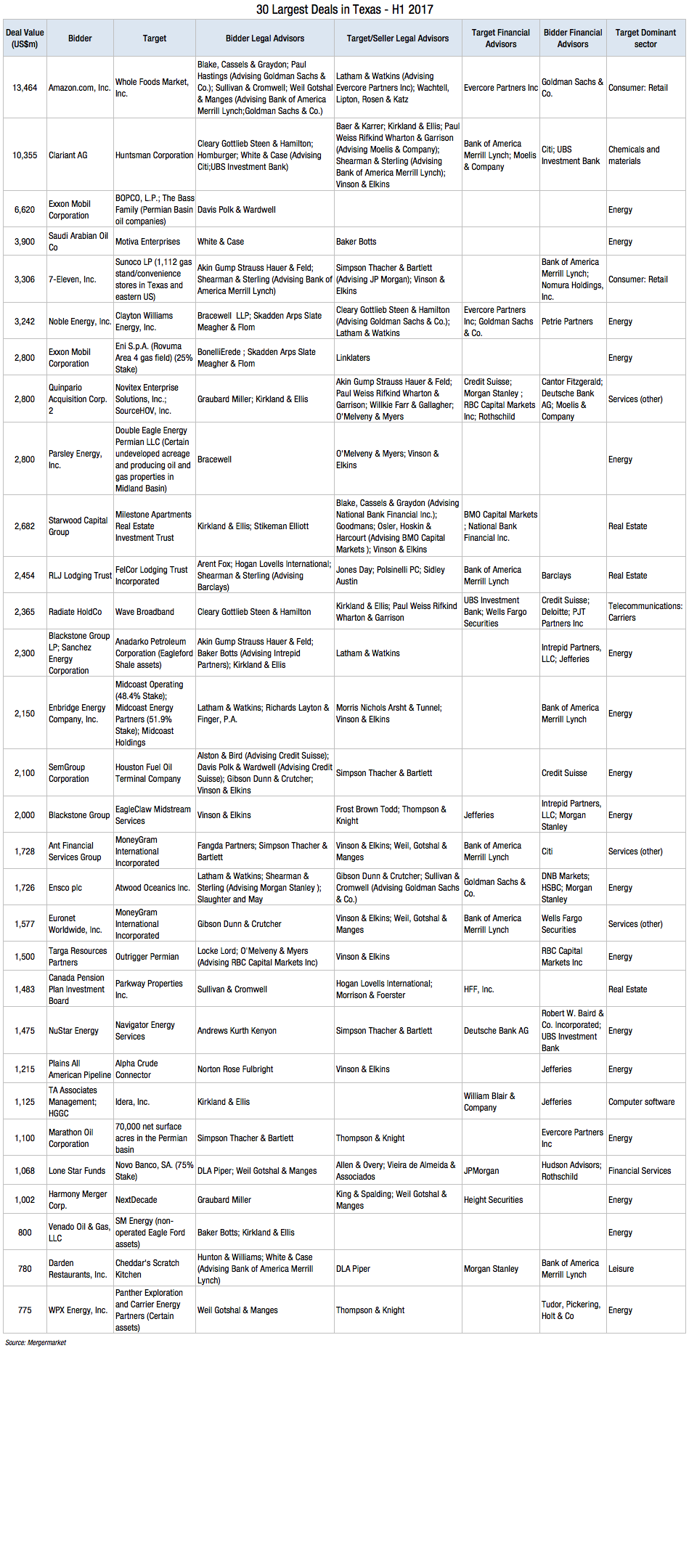

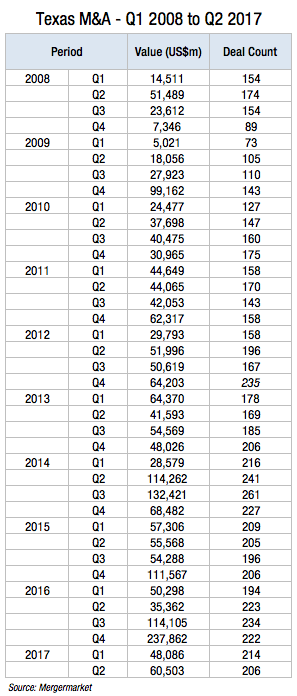

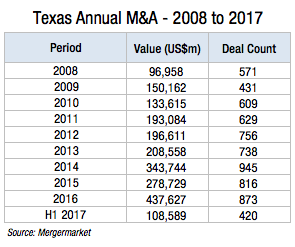

The value of the transactions in the first half of 2017 jumped to $108.6 billion, which is 27 percent higher than the same period last year but 24 percent less than the 10-year high of $142.8 billion in the first two quarters of 2014 before oil prices began to slide, according to Mergermarket.

Deal attorneys say they generally expect a brisk second half of 2017 fueled mostly by transactions in the oil patch.

The Mergermarket data shows that H1 2017 deal count and deal value involving Texas companies were significantly higher than the same periods from 2008 to 2013.

Deal value in 2017 has been largely driven by three transactions:

-

- Amazon.com’s $13.4 billion acquisition of Austin-based Whole Foods Market in June;

-

- Houston-based Huntsman Corp.’s $10.3 billion merger with Clariant AG in May; and

- the billionaire Bass family’s divestiture of their Permian Basin oil companies to Exxon Mobil Corp., which is headquartered in Irving, in January for $6.2 billion.

The largest software deal of the year so far was Houston-based Idera Inc.’s $1.125 billion recapitalization by new investor HGGC LLC in partnership with existing investor TA Associates Management LP.

Not surprisingly, 17 of the top 30 deals in the first half were in the energy sector, according to Mergermarket. They include:

-

- Royal Dutch Shell’s $3.9 billion sale of assets as part its joint venture in Motiva Enterprises LLC to Saudi Aramco;

-

- Houston-based Noble Energy’s $3.2 billion purchase of Clayton Williams Energy; and

- Eni SpA’s $2.8 billion sale of a 25% stake in an offshore Mozambique natural gas field to Exxon Mobil.

Chris LaFollette, a corporate partner in the Houston office of Akin Gump Strauss Hauer & Feld, said her team worked on $5 billion worth of energy deals in the first half, despite falling oil prices later in the period and disagreement between buyers and sellers on prices.

“There was a lot of interest in the Eagle Ford and the Permian [basins], which was driven by private equity that still has funds to invest, and energy companies trying to rationalize their assets and focus on their core areas,” LaFollette said.

Oil and gas M&A during the first half of 2017 was all about the Permian, according to Michael Dillard, a partner in the Houston office of Latham & Watkins.

“That’s the main basin where there’s been A&D [asset and divestiture] work and where we’re still seeing deals,” Dillard said.

M&A activity in the oil and gas sector picked up after last fall’s presidential election when oil prices began to solidify in the $50 to $60 per barrel range, said Frank Bayouth, a partner in the Houston office of Skadden, Arps, Slate, Meagher & Flom.

The result, according to Bayouth, was that several private equity-backed companies sold their properties in West Texas’s and New Mexico’s prolific Permian Basin, and larger companies sold their noncore assets to focus on the Permian.

The state’s top private equity buyouts in the first half were mostly in real estate and energy, including:

-

- Milestone Apartments Real Estate Investment Trust’s sale to Starwood Capital Group for $2.68 billion;

-

- Anadarko Petroleum Corp.’s divestiture of its Eagle Ford shale assets in South Texas to the Blackstone Group and Sanchez Energy Corp. for $2.3 billion;

-

- Encap Flatrock Midstream’s shedding of its EagleClaw Midstream Ventures to a unit of the Blackstone Group for $2 billion; and

- TPG Capital’s divestiture of Parkway Properties Inc. to the Canada Pension Plan Investment Board for $1.48 billion.

Solidifying oil prices also encouraged private equity firms to pick up assets before the market began to turn upward, according to David Asmus, a Houston deal lawyer who recently joined Sidley Austin from Morgan, Lewis & Bockius.

“Private equity saw the opportunity going away to buy at the bottom,” he said.

M&A Experts Make Predictions for H2 2017

Mike O’Leary, co-chair of the corporate/securities practice at Andrews Kurth Kenyon in Houston, said dealmaking activity was high early in the year when the capital markets were open but began tightening with lower oil prices.

But O’Leary said he’s seen it pick up again recently, with companies deciding to jettison noncore assets and private equity having the capital to pick them up.

“There are good opportunities and private equity is jumping on them,” he said.

The best year for M&A in Texas, according to Mergermarket, was 2014, when 945 businesses in the state were involved in mergers, acquisitions, divestitures and joint ventures valued at $343.7 billion.

However, 2016 scored the highest deal value mark with $437.6 billion, thanks in large part to AT&T’s decision last October to buy Time Warner for $105 billion.

There has been a lot of consolidation by oil and gas companies that are intent on becoming single-basin players, according to Andy Calder, an M&A partner in the Houston office of Kirkland & Ellis. Large scale, company-side M&A has been less prolific, mostly because of volatile commodity prices, he said.

“It’s a moving target,” Calder said. “When folks think there’s stability in the goal posts, it changes. It’s a very uncertain environment.”

Keith Fullenweider, head of the corporate department at Vinson & Elkins in Houston, said H1 2017 was exceptionally busy on the upstream and downstream sides of the business.

The capital markets were relatively open in the first few months of the year, as several initial public offerings were launched and some IPO candidates were sold, he said.

When oil prices dropped, the IPO’s went away and M&A became the main game in town, Fullenweider said.

“There’s a rolling consolidation trend going on,” he said. “People are focusing on their core basins, divesting the others and allocating the capital to where their investors want it to go.”