Dealmaking involving Texas companies took a nosedive during the first half of 2019.

New data shows that mergers and acquisitions in which businesses headquartered in Texas were the buyers or sellers plummeted to the lowest level for the period since 2015, which was the year of the last big oil price crash.

And dealmakers are mixed about whether M&A activity will get any better during the rest of this year.

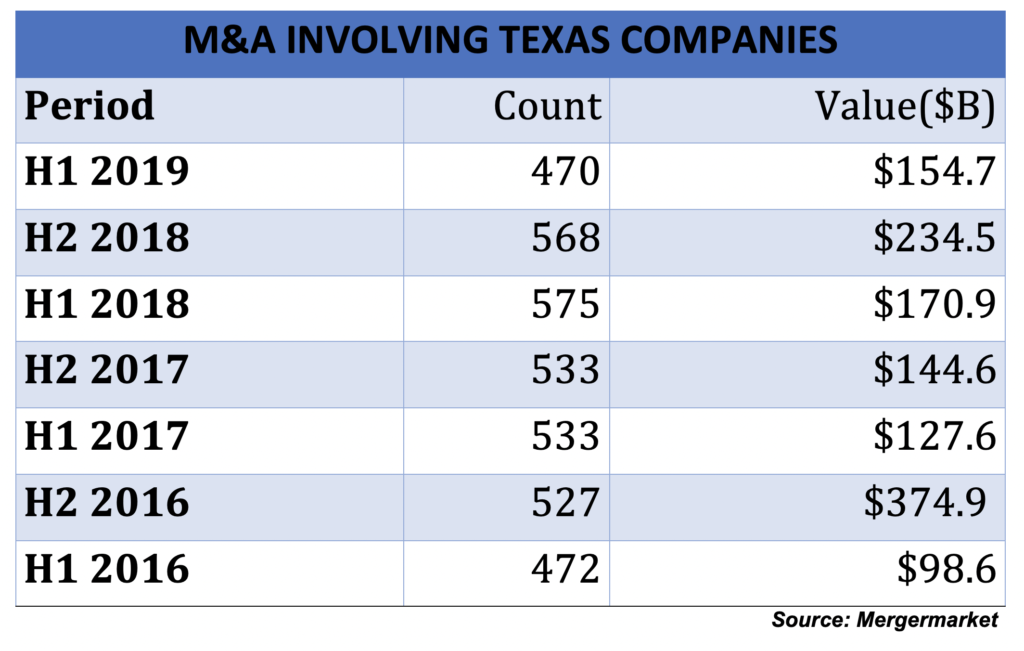

There were 470 M&A transactions in the first six months of 2019 – 18 percent fewer than during the same period last year, according to Mergermarket, which provides data exclusively to The Texas Lawbook.

Deal value also slipped 9.4 percent to $154.7 billion, and one-third of that came from one huge oil and gas acquisition.

Corporate transactional lawyers and investment bankers who thought the first quarter of 2019 was slow were even more disappointed in M&A activity during the second quarter. Mergermarket reports that the number of Texas deals announced dropped from 240 during the first three months to 230 in April, May and June.

“Regrettably, I would say the deal market in Dallas, in Texas, nationwide and seemingly worldwide is tepid with buyers being exceedingly cautious,” R. Scott Cohen, a partner at Jones Day in Dallas, said in an email. “Even in the case of deals that are actively negotiated and documented, buyers have pulled back at the eleventh hour.”

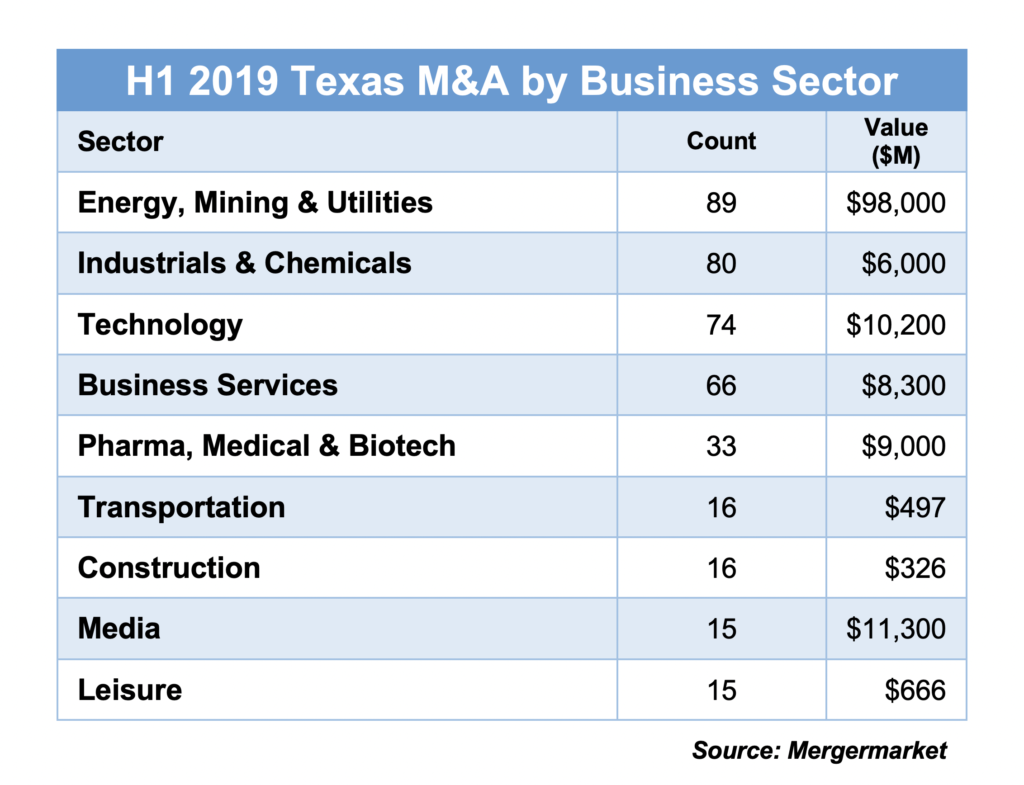

Mergermarket data shows that companies involved in the energy, mining and utility sectors were involved in 89 transactions during the first half of 2019 – down from 103 deals a year earlier.

Even so, those deals had a combined value of $98 billion, or 63.4 percent of the total.

Stephen Szalkowski, a partner at Latham & Watkins in Houston, blames the drop in oil prices at the end of 2018 and into the start of 2019 for dampening market enthusiasm for energy deals, along with retreating equity capital markets and renewed pressure from stakeholders on explorers and producers to live within cash flows.

“It’s forced E&P companies to reevaluate their business models and analyze more closely their own business plans, assets and operating margins,” he said in an email.

Consolidation among producers and oilfield services providers, privatizations of midstream master limited partnerships and financing transactions for infrastructure build-out are the M&A themes so far for 2019, according to Doug Bacon, a partner at Kirkland & Ellis in Houston who has worked on six public M&A transactions in the last seven months.

“We represent a number of oil and gas companies and private equity funds focused on the oil and gas industry,” Bacon said. “So we’re either consolidating companies or financing companies in the oil and gas space.”

The five largest M&A deals involving Texas companies so far this year are:

- Occidental Petroleum’s $54.4 billion purchase of Anadarko Petroleum;

- IFM Investors’ $10.2 billion acquisition of Buckeye Partners;

- Sinclair Broadcast Group’s $9.6 billion pickup of Fox Sports Net from Walt Disney Co.;

- Anadarko’s $8.8 billion divestiture of Mozambique and other overseas assets to France’s Total; and

- Acelity’s $6.7 billion sale to 3M Co., which preempted its planned initial public offering.

While energy dealmaking is definitely down, technology M&A is booming, according to Travis Wofford, a partner at Baker Botts in Houston. But tech deals aren’t as large in terms of value as energy deals and are often private, he said.

“The public activity in terms of volume is down, but in terms of private deal flow, I think it’s probably in line with last year,” Wofford said.

Jackson Walker partner Stephanie Chandler in San Antonio said she’s seeing a lot of family-owned businesses – such as baking products purveyor C.H. Guenther last year and fast food chain Whataburger last month – being sold because there’s a lot of private equity money looking for a home and because families want to involve the next generation in new investments and philanthropy.

“In both of those transactions, the companies had very good longstanding professional management teams supporting the family owners, who are looking for relationships with funds so their companies can grow and keep their employees employed,” she said.

Deal lawyers around the state are mixed as to whether conditions will improve in the second half.

“We have seen an uptick in recent months, but I can’t yet say that it points to a sustainable improvement,” Jones Day’s Cohen said.

Kirkland’s Bacon said he remains optimistic about consolidation in the oil and gas industry, as there are still too many oil and gas companies that aren’t big enough to meet investors’ demands for operating within cash flow and returning capital to investors.

“You’re in a situation where the equity markets are functionally closed to oil and gas companies and so are the regular debt markets. So you’re left wondering, how do we navigate the next few years?” he said. “There’s a lot of consolidation that still needs to happen. I don’t see an end to that.”

Terry Radney, a partner at Locke Lord in Houston, has seen a lot of activity around midstream assets, including water, as a way for oil and gas producers to bring in much needed cash, including divestitures and JV’s with investors.

“The first half of the year was really about water, with producers looking to monetize their water assets,” he said.

Baker Botts’ Wofford said there’s a lot of pent-up deal capacity in the energy sector and activist investors may force companies to do deals, particularly consolidating ones in basins such as the Permian.

“Investors are so focused on living within cash flow, maintaining the balance sheet and getting to scale that a lot of the management teams have taken that to heart and more teams that are looking at potential transactions,” he said. “I really believe activism is going to push management teams to consolidate.”

Latham’s Szalkowski also expects to see asset divestitures and swaps as merged companies begin to shed non-core assets and private equity firms combine multiple platform companies within their fund portfolios to reduce operating expenses. But he thinks the spread between what sellers want and what buyers are willing to pay hasn’t yet harmonized enough for sizable deals to get done.

“So, as the year goes on, sellers will need to secure additional revenue and/or buyers may be more anxious to put static capital to work, which could result in that bid-ask spread tightening enough for parties to find common ground on price,” he said.

Second half M&A activity also will depend on macro trends, as investors wonder whether the U.S. economy – and the stock market – still has legs, Baker Botts’ Wofford said.

“I actually think there will be incrementally more deals announced in the second half than the first, absent any government shutdown or political change,” he said.

Wofford also is bullish on technology deals.

“The IPO market in the last few months has been strong, but the stronger companies will be more likely to go with a sale,” he said.

Jackson Walker’s Chandler is seeing more family-owned business and oil and gas deals in her shop along with health care.

“The next six months will be health care driven,” she said.

Locke Lord’s Radney said higher oil prices at mid-year also may spur more activity in the oil and gas sector but he’s not wholly optimistic.

“With prices firming up some in the second quarter, we’ve seen a bit of a pick-up, but it’s still difficult to get deals done,” he said. “The biggest factor is the capital markets. If they open up, the publics start to spend money and deal flow will increase. If that doesn’t happen, it’s going to be tough.”

M&A Transactions With Texas-Headquartered Companies By Quarter

Source: Mergermarket| Year | Quarter | Deal Count | Value ($M) |

|---|---|---|---|

| 2019 | Q2 | 230 | $129,431 |

| 2019 | Q1 | 240 | $25,341 |

| 2018 | Q4 | 276 | $73,897 |

| 2018 | Q3 | 292 | $160,624 |

| 2018 | Q2 | 279 | $86,712 |

| 2018 | Q1 | 296 | $84,197 |

| 2017 | Q4 | 263 | $45,891 |

| 2017 | Q3 | 270 | $98,692 |

| 2017 | Q2 | 266 | $57,344 |

| 2017 | Q1 | 267 | $70,273 |

| 2016 | Q4 | 260 | $253,148 |

| 2016 | Q3 | 267 | $121,767 |

| 2016 | Q2 | 249 | $45,651 |

| 2016 | Q1 | 223 | $52,997 |

| 2015 | Q4 | 235 | $118,318 |

| 2015 | Q3 | 219 | $56,349 |

| 2015 | Q2 | 230 | $68,961 |

| 2015 | Q1 | 229 | $61,009 |

| 2014 | Q4 | 265 | $81,918 |

| 2014 | Q3 | 287 | $136,299 |

| 2014 | Q2 | 270 | $124,313 |

| 2014 | Q1 | 246 | $35,536 |

| 2013 | Q4 | 241 | $58,313 |

| 2013 | Q3 | 211 | $70,514 |

| 2013 | Q2 | 182 | $44,612 |

| 2013 | Q1 | 200 | $67,490 |

| 2012 | Q4 | 264 | $70,747 |

| 2012 | Q3 | 194 | $57,918 |

| 2012 | Q2 | 219 | $54,782 |

| 2012 | Q1 | 173 | $38,399 |

| 2011 | Q4 | 176 | $71,446 |

| 2011 | Q3 | 159 | $43,296 |

| 2011 | Q2 | 192 | $47,808 |

| 2011 | Q1 | 188 | $54,719 |

| 2010 | Q4 | 199 | $37,697 |

| 2010 | Q3 | 173 | $41,394 |

| 2010 | Q2 | 171 | $47,583 |

| 2010 | Q1 | 141 | $25,681 |

| 2009 | Q4 | 157 | $100,752 |

| 2009 | Q3 | 126 | $29,815 |

| 2009 | Q2 | 124 | $19,754 |

| 2009 | Q1 | 88 | $5,959 |

| 2008 | Q4 | 100 | $8,133 |

| 2008 | Q3 | 168 | $27,593 |

| 2008 | Q2 | 197 | $73,685 |

| 2008 | Q1 | 175 | $17,977 |

| 2007 | Q4 | 222 | $52,773 |

| 2007 | Q3 | 206 | $77,400 |

| 2007 | Q2 | 225 | $57,472 |

| 2007 | Q1 | 209 | $97,540 |