Private equity deal activity in Texas last year hit the highest dollar level in 10 years. The $50.6 billion for 2017 wasn’t just the highest since 2007, it was 42 percent higher than 2016.

That wasn’t a mark reached with the help of a single, spectacular deal or even by an increase in the number of deals (there were actually fewer). Rather, in a marketplace where capital is abundant, opportunities rife and competition keen, Texas is seeing a surge in private equity that is beginning to change the way law firms do business as well as the transactions themselves.

According to The Wall Street Journal, valuations on buyout deals everywhere have risen steadily since the financial crisis and are now higher than they were in 2007. And with a lot of capital needing to be put to work – $1 trillion nationally, $362 billion of which was raised last year – Texas attorneys expect private equity deals to continue their growth trajectory this year.

The amount of money looking for a home has created competition for deals between private equity firms and strategic companies, leading to higher and higher values.

“Private equity is everywhere and they seem to be able to outbid the strategics at this point,” says Sean Wheeler, a partner in the Houston office of Latham & Watkins. “Strategics are having a hard time buying quality assets because private equity is buying them all.”

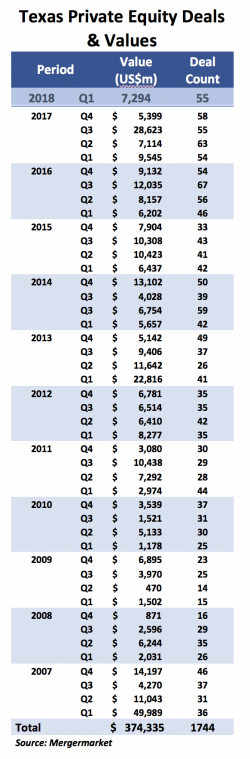

According to data provided by Mergermarket exclusively to The Texas Lawbook, the number of private equity deals was down by two in 2017, from 220 to 218. The $50.6 billion price tag on those deals was the highest since the $79.5 billion recorded in 2007, a figure inflated by the $45 billion purchase of TXU, a Dallas utility, by KKR, TPG and Goldman Sachs.

According to data provided by Mergermarket exclusively to The Texas Lawbook, the number of private equity deals was down by two in 2017, from 220 to 218. The $50.6 billion price tag on those deals was the highest since the $79.5 billion recorded in 2007, a figure inflated by the $45 billion purchase of TXU, a Dallas utility, by KKR, TPG and Goldman Sachs.

By contrast, the three biggest private equity buyouts of 2017 totaled barely half that amount: Energy Capital Partners’ acquisition of Houston power producer Calpine for $17 billion; the $3.8 billion merger of Riverstone-backed Silver Run Acquisition with Alta Mesa Holdings and Kingfisher Midstream; and Starwood Capital’s $2.8 billion purchase of Milestone Apartments Real Estate Investment Trust.

The top five deals were rounded out by Anadarko Petroleum’s sale of its oil and gas properties in South Texas’ Eagle Ford Shale to the Blackstone Group and Sanchez Energy for $2.3 billion and ClubCorp’s sale to Apollo Global Management for $2.1 billion.

Texas lawyers were involved in two of the top five deals.

Latham & Watkins’ Houston office advised Riverstone and Silver Run on the Alta Mesa deal while Haynes & Boone counseled Alta Mesa, Bracewell represented Kingfisher and Kirkland & Ellis’ Houston office assisted Alta Mesa backer Bayou City Energy. The Houston office of Latham also advised Anadarko and the Houston office of Kirkland counseled Blackstone and Sanchez on their transaction.

The Calpine deal was the second largest M&A transaction overall last year while Alta Mesa was the 12th and Milestone the 18th, according to Mergermarket.

The number of private equity deals in Texas averaged around 150 per year over the 10-year period, Mergermarket reports. The uptrend in private equity deals seems to have started back in 2014, when oil prices began to collapse, building each year in value to last year’s 10-year record.

The activity is not just coming from traditional deals, in which private equity firms back management teams or conduct wholesale takeovers of existing companies. They’re investing in targets through special purpose acquisition companies, or SPAC’s, and through joint ventures for specific capital-thirsty assets. They’re also investing in debt or picking up preferred shares of companies that are looking for a bridge to an initial public offering or an exit.

Stonepeak Infrastructure Partners has been active in the preferred market for midstream companies, doing such deals with Targa Resources and Plains All American in 2016 and Phillips 66 Partners last year.

Preferred investments aren’t just happening in the midstream. CrownRock Holdings, an oil and gas producing joint venture of CrownQuest Operating and private equity firm Lime Rock Partners, attracted a $475 million perpetual preferred equity investment from funds managed by Magnetar Capital and EIG Global Energy Partners in January.

Latham’s Wheeler said he’s counseling one SPAC that’s in confidential registration mode and another that’s trying to buy up oil and gas assets. He’s also advising an upstream company on a possible preferred instrument and has had a couple of clients get funding from family offices.

“There’s a fund for every kind of investing and any management team with any credibility can get money,” he said. “It’s very easy to get capital these days.”

Kirkland & Ellis partner John Pitts said large infrastructure funds – including one from Blackstone that could reach as high as $40 billion – have only added to the competitiveness of investing in the sector. (The New York Times recently reported that the short-term total may be scaled back to $15 billion due to “hesitant investors.”)

Pitts notes that Kirkland has a dedicated funds partner in Houston – San Francisco transfer Matt Nadworny – who is finding himself quite busy given the number of entities fundraising right now. The firm has seven associates to support him with an eighth to start soon. Simpson Thacher & Bartlett’s Houston office also launched a funds practice this month led by counsel James Hays, who previously worked in Blackstone’s real estate group and has six associates to support him.

Kirkland’s Nadworny said he’s seeing a lot of management teams that are interested in going directly to investors for capital commitments instead of through private equity funds (much like the EnerVest, Merit Energy and Fleur de Lis models). He’s also advising a family office that wants to put the proceeds from a large disposition to work and fielding inquiries from public pension plans and sovereign wealth funds that are looking for long-term investment opportunities, some of which stretch out 20 years.

Thompson & Knight partner Holt Foster, who does a lot of fund formation work, said he’s seeing a deeper dive on due diligence by investors who were burned by funds during the last downturn. “They’re also asking about how the electric car affects their model,” he said.

Foster also is seeing several middle market private equity firms popping up. “There is a big appetite for those on investor side and they get funding very quickly,” he said.

One recent one is Houston-based Pelican Energy, which closed its third fund in February at $233 million after only two months of capital raising (Baker Botts represented it). The firm focuses solely on energy service and equipment company investments.

Like the other attorneys, Foster is seeing a lot of competition for private equity deals, even by management teams that haven’t cemented their funding sources yet.

“Sellers were surprised at first, thinking the relationship between the private equity firm and the management team was a little more solidified,” he said. “But sometimes the bid is so much higher — sometimes by 20 to 30 percent – that it would be foolish not to look at it while keeping the second and third bidders around the rim.”

Foster said private equity firms in other sectors are increasing their activity as well, with specific funds rather than broad funds being the norm.

Given the competition for oil and gas deals in West Texas’ and New Mexico’s Permian Basin, some private equity firms are looking further afield, particularly in the Eagle Ford (witness the Sanchez deal last year) and the Powder River Basin in the Rockies (i.e., SM Energy’s $500 million property sale to Apollo’s Northwoods Energy in January). Other places they’re looking are the Scoop/Stack plays in Oklahoma and the Haynesville in East Texas and northern Louisiana.

“We’re seeing lots of transactions outside the Permian,” said Marc Rose, a Dallas attorney who last year joined Sidley Austin from V&E and focuses on private equity investment and M&A. “There was a lot of pent-up demand, with companies wanting to sell their noncore acreage to pay down debt but couldn’t at lower oil prices.”

Wheeler thinks 2018 will be bigger than 2017 in terms of private equity deals. He noted Double Eagle’s management team re-upping with Apollo, which committed $1 billion to the company in February. “That’s massive and an example of how much a high quality management team can bring in,” he said.

Private equity firms are raising bigger and bigger funds. They include EnCap Investments, which closed its 11th fund in December at a target-exceeding $7 billion; and Quantum Energy Partners, which recently raised $5.25 billion versus its goal of $4.5 billion.

“Opportunities are not in short supply,” Quantum founder and CEO Wil VanLoh told a crowd at the NAPE conference in Houston in February. “What is [in short supply] is good management teams.”

With all the competition in the marketplace and paltry to zero returns during the oil bust, some funds are struggling, sources say.

EnerVest and First Reserve’s problems are already well known, including taking on too much debt and making the wrong bets. But sources say other old-line private equity shops are struggling.

One is Natural Gas Partners, or NGP, which is raising its 12th fund with the hopes that it will match its previous $5.325 billion fund. The final close is expected later this year.

The Dallas-based private equity firm – which is owned in part by the Carlyle Group – has lost talent over the years with some of its managing directors going off to start new funds, which include Pearl Energy Investments, Carnelian Energy Capital and Edge Natural Resources. And NGP’s onetime chief Ken Hersh moved to an advisory role after he became president and CEO of the George W. Bush Presidential Center.

Lime Rock also is said to be having difficulty putting together its $1 billion eighth fund, a third of which was raised by December, according to an SEC filing (it hopes for a spring closing). The firm was an early investor in LRR Energy, which it sold to Vanguard Natural Resources in 2015 for $539 million in stock and debt. Vanguard later filed for bankruptcy.

Lime Rock is not alone in having its portfolio companies file for Chapter 11. Fieldwood Energy – which Riverstone backed with a $700 million commitment in 2012 – sought bankruptcy protection on Feb. 15. The proposed plan will leave Riverstone with a smaller equity stake in Fieldwood but it could later benefit from the upside of the company’s $480 million purchase of cash flow-boosting Gulf of Mexico properties from Noble Energy.

One bright spot for private equity firms is the possibility of the market for initial public offerings reopening, which would give them an exit for their stakes. After stalling out last year, a handful of oilfield services companies have managed to make their debuts recently. And bankers are telling attorneys that oil and gas explorers and producers might come next in the third or fourth quarter if commodity prices continue to rise or at least solidify.

Vinson & Elkins partner Keith Fullenweider said private equity activity in the oil and gas industry continues to be very active, both by leading diversified funds and specialist funds. “We see the level of activity strong,” he said. “I think it’s going to be a good year for PE lawyers.”

Sidley’s Rose said there were a lot of challenges for private equity firms investing in the oil and gas industry when oil prices were low and lenders weren’t willing to commit to deals. But with conditions improving, he thinks there will be more activity this year. “Lenders are becoming more open and we’ll see a lot of private equity M&A activity this year,” he said.

Unlike some, Fullenweider doesn’t believe that there’s too much private equity money chasing too few opportunities. “Look at the amount of capital required, at least in Texas, to transport hydrocarbons that are going to be produced in West and South Texas,” he said. “Compared with strategics like Occidental Petroleum and Kinder Morgan, private equity plays a relatively modest role.”

Rose, who does a lot of midstream work, agrees. “There’s a real need for buildout in the Permian Basin,” he said. “Private equity wants to be a part of it.”

Kirkland & Ellis’ Pitts disagrees, saying that opportunities continue to be limited and competitive, particularly in certain sectors, including the midstream.

In terms of M&A, Fullenweider expects private equity-backed, early stage companies to sell out to larger financial sponsors, as EnCap Flatrock’s EagleClaw Midstream Ventures did with Blackstone. However, he doesn’t expect a bunch of public company buyouts of private equity-backed firms or take-privates of public companies by private equity. “I think we’ll see some consolidation, but there’s already been a fair amount of that,” he said.