Four Houston-area men were among eight social media influencers accused Wednesday by the U.S. Securities and Exchange Commission of using Twitter, online chat rooms and a podcast to manipulate stock prices in a $100 million trading scam.

According to a civil action filed by the SEC in federal court in Houston, the eight defendants conspired to promote stocks via social media, then dumped shares they’d purchased once their promotional efforts drove up the stocks’ prices.

“To their legions of followers on social media, the eight defendants have, for years, promoted themselves as trustworthy stock-picking gurus. In reality, they are seasoned stock manipulators,” the SEC complaint said.

“They identify stocks ripe for manipulation, acquire substantial positions in these securities, and then recommend those stocks as good investments. … They encourage their followers to purchase the selected stocks, often claiming that they likewise have bought or intend to buy these stocks for themselves and hold them. Instead, the defendants sell their shares into the demand that their deceptive promotions generate.”

The defendants – who are also named in a parallel criminal complaint filed under seal last week in federal court in Houston – are:

- Daniel Knight of Houston;

- Edward Constantin, identified in the civil suit as a Houston resident, but in a request by the government for issuance of a summons as living in Montgomery;

- Perry Matlock of The Woodlands;

- John Rybarczyk of Spring;

- Thomas Cooperman and Gary Deel of Beverly Hills, California;

- Stefan Hrvatin of Miami;

- Mitchell Hennessey of West New York, New Jersey.

Seven of the defendants – Matlock, Constantin, Cooperman, Deel, Hennessey, Hrvatin and Rybarcyzk – promoted themselves as successful traders on Twitter and Discord, an instant messaging and voice chat platform, the SEC complaint said. It said that, combined, they had more than 1.8 million followers on Twitter.

The eighth defendant, Knight, co-hosted with Hennessey “a popular stock-trading podcast that promoted the other defendants as expert traders and provided a platform … to deceptively promote the stocks they intended to dump,” the complaint said.

As of Wednesday afternoon, court records available electronically did not list attorneys for the eight men in either the civil or the criminal case.

Matlock’s Twitter account has been deleted; five of his co-defendants last tweeted on Monday, one on Saturday.

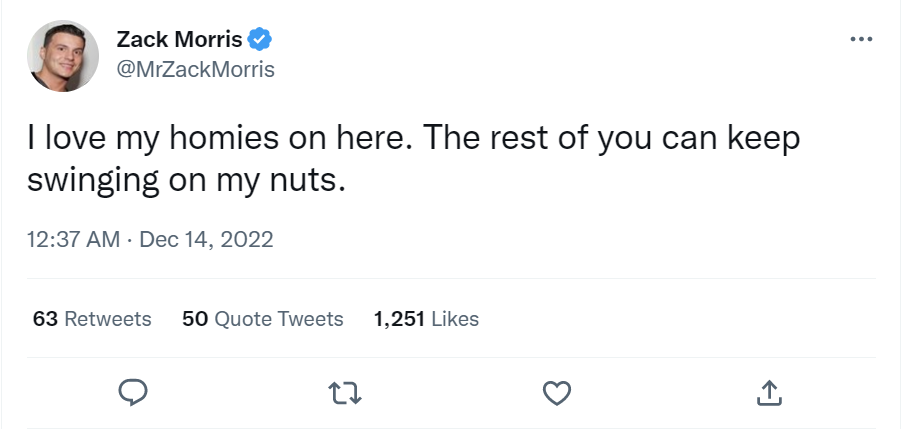

Only Constantin, whose Twitter handle is @MrZackMorris, was still active on the platform Wednesday, tweeting at 12:37 a.m.: “I love my homies on here. The rest of you can keep swinging on my nuts.”

Joseph Sansone, chief of the SEC Enforcement Division’s Market Abuse Unit, said in a news release: “The defendants used social media to amass a large following of novice investors and then took advantage of their followers by repeatedly feeding them a steady diet of misinformation, which resulted in fraudulent profits of approximately $100 million.

“Today’s action exposes the true motivation of these alleged fraudsters and serves as another warning that investors should be wary of unsolicited advice they encounter online.”

The government team in the civil suit is led by two SEC lawyers from Boston, David D’Addio and Amy Burkhart. The lead prosecutor in the criminal case is Thomas Heyward Carter of the U.S. attorney’s office in Houston.

The SEC is seeking permanent injunctions, disgorgement, prejudgment interest, and civil penalties against each defendant. The criminal complaint charges them with securities fraud and conspiracy.