Overview

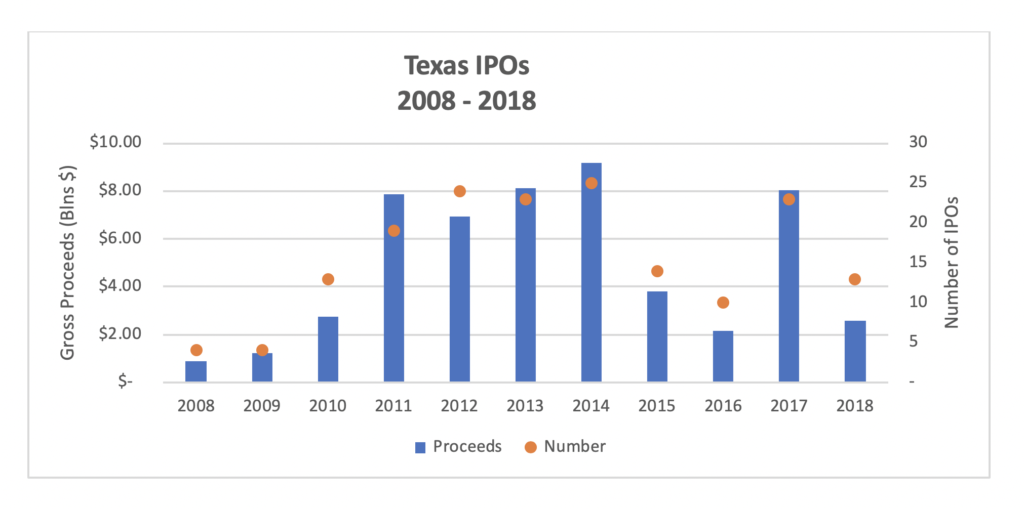

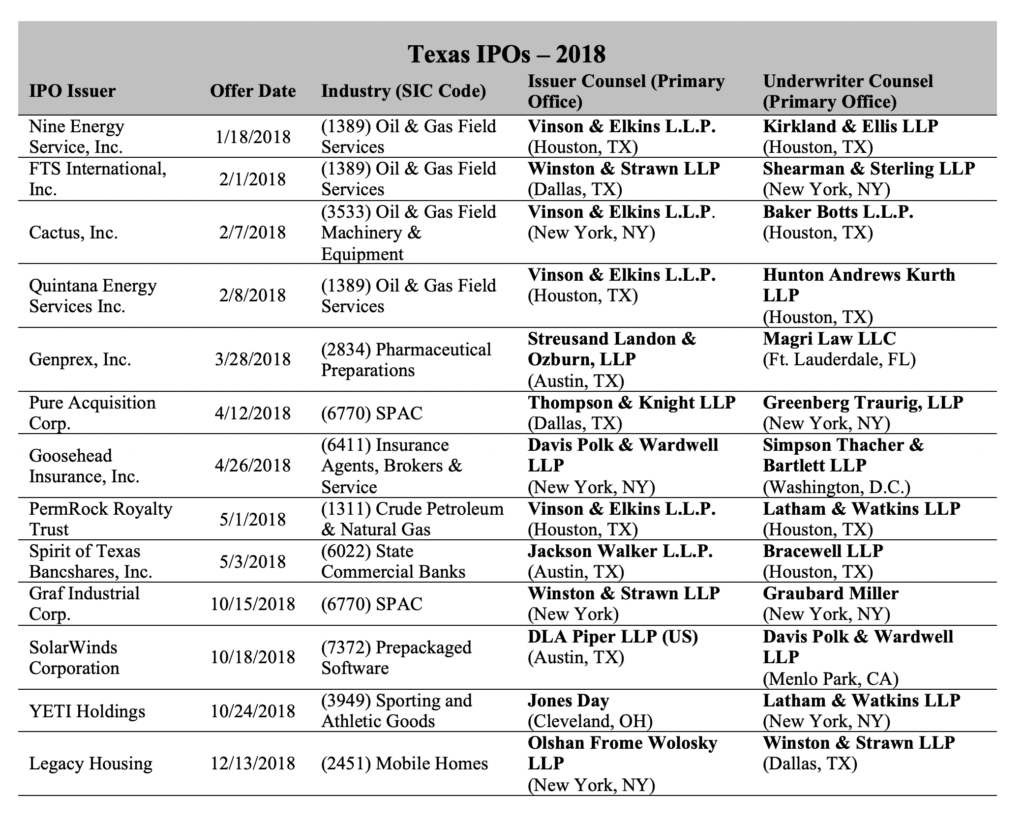

During 2018, 13 IPOs of Texas-headquartered companies were completed, raising approximately $2.6 billion of gross proceeds (excluding any exercise of the underwriters’ green shoe – all of the proceeds figures that follow exclude any exercise of the shoe). This compared to over 190 IPOs nationwide in the same period, raising almost $46.8 billion of gross proceeds.

The number of Texas IPOs in 2018 was down from 23 — the third-most Texas IPOs since 2008 — the previous year. Over the last decade, Texas has averaged approximately 16 IPOs per year, with energy companies making up 45.3% of all IPOs in Texas during that time (excluding Special Purpose Acquisition Companies (“SPACs”)).

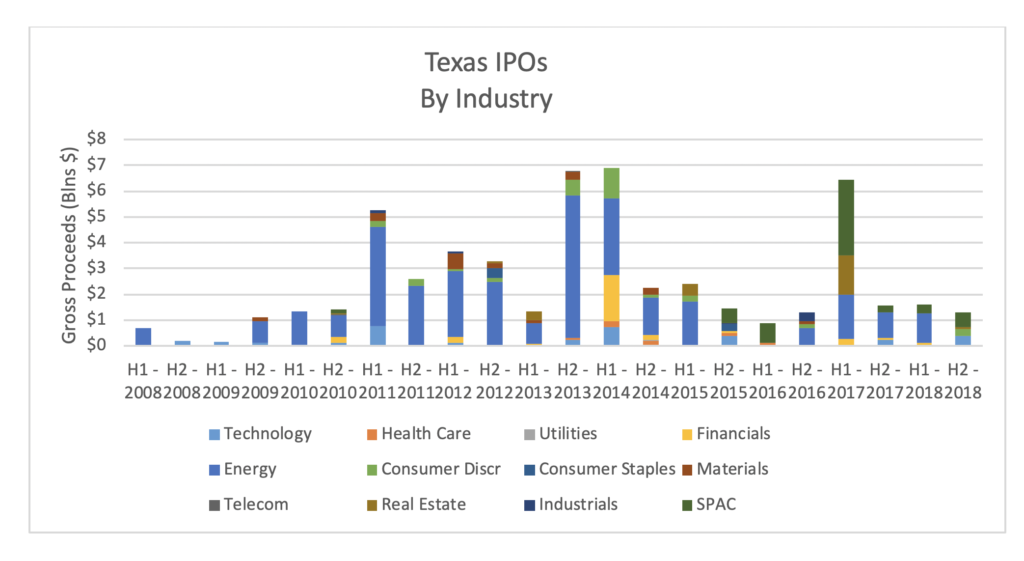

Breaking down Texas IPO activity within the last year between the first and second halves unveils a concentration of activity in the first six months of 2018. The first half of 2018 had nine IPOs, accounting for 63.7% of the gross proceeds from Texas IPOs in 2018, while there were just four in the second half (all in the fourth quarter).

Industry Breakdown

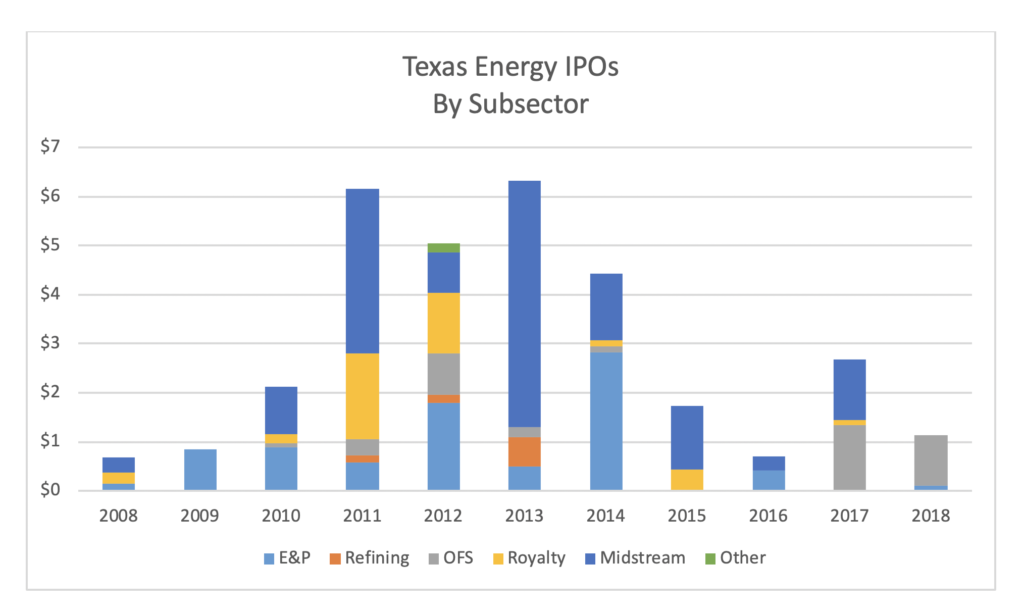

Although the first half of 2018 saw a flurry of energy IPOs, the decrease in oil and gas prices created a difficult IPO environment for the remainder of the year, and no energy IPOs by Texas-headquartered companies were completed during that time. Although only approximately a third of the companies that went public during 2018 were energy companies, proceeds from energy companies made up approximately 45% of the total proceeds raised, followed by SPACs (~22%), technology (~15%), consumer discretionary (~11%), financials (~5%), real estate (~2%) and health care (<1%). Of the two SPAC IPOs during 2018, one had a stated intention of acquiring an energy business, while the other had a stated intention of acquiring an industrial company. If the energy-focused SPAC is categorized as an energy IPO, the percentage of Texas IPOs comprised by energy would increase to approximately 58% of gross proceeds for the year.

Houston-based Cactus Inc. was the largest Texas IPO of the year. Outside of energy and SPACs, the only Texas IPOs greater than $100 million in gross proceeds were SolarWinds, Inc. ($375 million) and YETI Holdings, Inc. ($288 million).

Within energy, but excluding energy-focused SPACs, oil-field services companies (“OFS”) dominated Texas IPOs with 91% of gross energy proceeds, followed by exploration & production (9%). There were no midstream IPOs during 2018.

All of the 13 Texas IPOs during 2018 were emerging growth companies (companies with less than $1.07 billion in revenue that have not raised more than $1 billion in non-convertible debt securities during the prior three-year period) under Securities Exchange Commission (“SEC”) rules. All of the 13 chose to avail themselves of the ability to confidentially submit registration statements with the SEC.

The SEC appears to be continuing to take a light hand in terms of comments on IPO filings, perhaps in an effort to be more supportive of capital-raising and to promote more IPOs. The average number of initial SEC comments on the registration statements of the 13 Texas IPOs was 18. This reflects a significant reduction from prior years: a survey of US IPOs from 2013 to 2016 reflected a median of 31 initial SEC comments. Of the 13 Texas IPOs, the fewest initial comments (3) were received by Graf Industrial Acquisition Corp., which is a SPAC. Excluding SPACs, the fewest comments were received by technology company SolarWinds Corporation, which received 13 initial comments. The most initial comments (38) were received by Genprex, Inc., a pharmaceutical company that develops gene therapies for cancer treatment and the smallest Texas IPO of the period.

For Texas IPOs, the duration from first registration statement filing (or confidential submission) to the pricing date was an average of 226 days and a median of 288 days, compared to the median of 113.5 days for IPOs from 2008 to 2016. However, the 2018 IPOs constituted some of the extreme ends of the range, including three IPOs with a duration of 100 days or fewer (Pure Acquisition Corp., Graf Industrial Acquisition Corp. and Goosehead Insurance, Inc.) and four IPOs with a duration of 300 days or more (FTS International, Inc., Cactus, Inc., Spirit of Texas Bancshares, Inc. and Legacy Housing Corp.), with timing seeming more dependent upon market conditions than the SEC review process.

In sum, during 2018, Texas OFS IPOs continued their remarkable resurgence in 2018, while E&P and midstream IPOs continued in drought. Texas IPOs during 2018 represented diverse industries, and energy IPOs represented a large portion of the gross proceeds raised. All of the Texas IPO companies were emerging growth companies, and most of them availed themselves of the ability to confidentially submit registration statements with the SEC.

The Pipeline

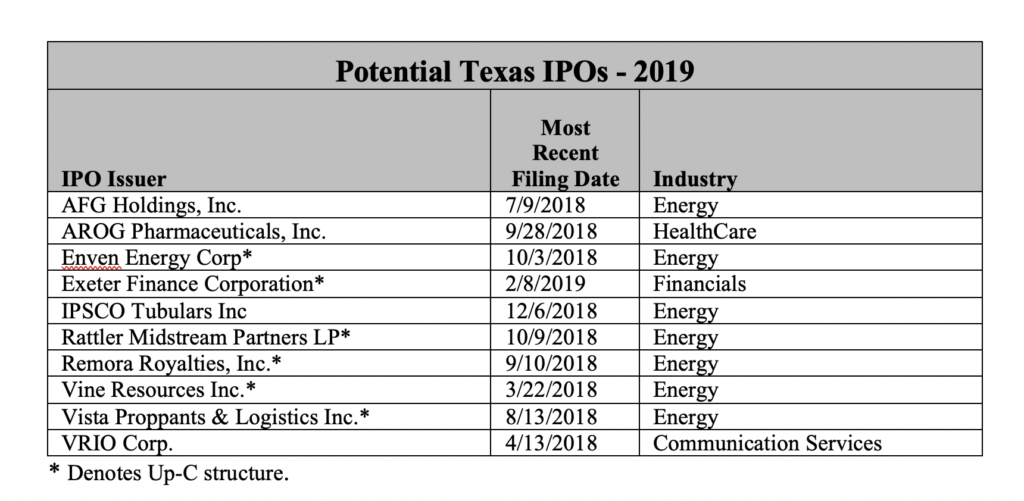

The first month of 2019 featured a slow start to IPOs, which is typical for January but was likely exacerbated by the government shutdown. Ten Texas-based companies publicly filed registration statements for IPOs in 2018 and through February 2019 that have remained on file in 2019, providing some insight into what might be coming down the pike. Of those 10 companies, seven are energy companies, one is health care, one is communications services and one is financials. There were also three energy companies headquartered outside of Texas that filed registration statements (New Fortress Energy, New York City; Riley Exploration – Permian, Oklahoma City; Carbon Energy, Denver).

Of the 10 Texas-based companies that are currently on file with registration statements, six (demarcated with an asterisk below) are utilizing the “Up-C” structure. The Up-C structure is a two-tier ownership structure where public investors hold stock in a newly formed publicly traded corporation (or partnership that elects to be taxed as a corporation). The publicly traded corporation is a holding company whose sole material asset is equity interests in the historic pre-IPO partnership, which owns the operating assets. The equity interests in the pre-IPO partnership not held by the publicly traded corporation, are held by some or all of the pre-IPO owners. The pre-IPO owners are generally permitted to exchange their pre-IPO partnership units for public corporation shares on a one-for-one basis, subject to certain exchange restrictions.

The Up-C structure allows (i) significant flexibility when structuring the IPO and future asset acquisitions on a tax-deferred basis by utilizing either the public corporation stock or the pre-IPO partnership units as consideration, (ii) the pre-IPO owners to continue to benefit from the pass-through taxation (not subject to two layers of tax on cash distributions) of the pre-IPO partnership (until they exchange their interests for the public corporation shares), and (iii) provides the public corporation with a basis-step upon the pre-IPO owners’ exchange of pre-IPO partnership units for the public corporation stock, resulting in a tax shield against future public corporation income. Any company considering the Up-C structure must carefully consider the added cost and complexity of such a structure. A company must generate enough income to take advantage of the tax benefits, and the tax benefits must justify the added expense and administrative burden inherent in the Up-C structure.

While future trends for 2019 are unclear, as few are currently braving the IPO market due to the recent government shutdown, it looks like the Up-C structure will continue to be popular among Texas energy companies.

E. Ramey Layne is a partner in the Capital Markets and Mergers & Acquisitions section in the Houston offices of Vinson & Elkins. Co-authors are Jessica M. Lewis (senior associate) and Alexandra M. Lewis (associate), also in the Houston offices of V&E.