Note: This story contains updated numbers for Jackson Walker.

The lateral partner market in Texas hit a fevered pitch during the first six months of 2024 — especially in Houston and among litigation practices, according to exclusive Texas Lawbook data.

Some big-name lawyers changed locations during H1 2024: Mary Kay General Counsel Julia Simon joined Lynn Pinker, Gibson Dunn partner Veronica Moyé jumped to King & Spalding and Shearman’s Sarah McLean and Sidley’s J. Foster Holt both moved to Willkie Farr.

Dozens of the lateral partner moves are the result of a few law firms opening new offices in Texas, including King & Spalding, Willkie, SBSB Eastham and Sorrels Law opening an outpost in Dallas (all four already have offices in Houston), Polsinelli opening a branch in Fort Worth and Nelson Mullins launching a Houston office.

Four law firms took their first plunge into the Texas legal market. Steptoe, Weinberg Wheeler and Brown Rudnick opened Houston branches while Dowd Bennett launched in Dallas.

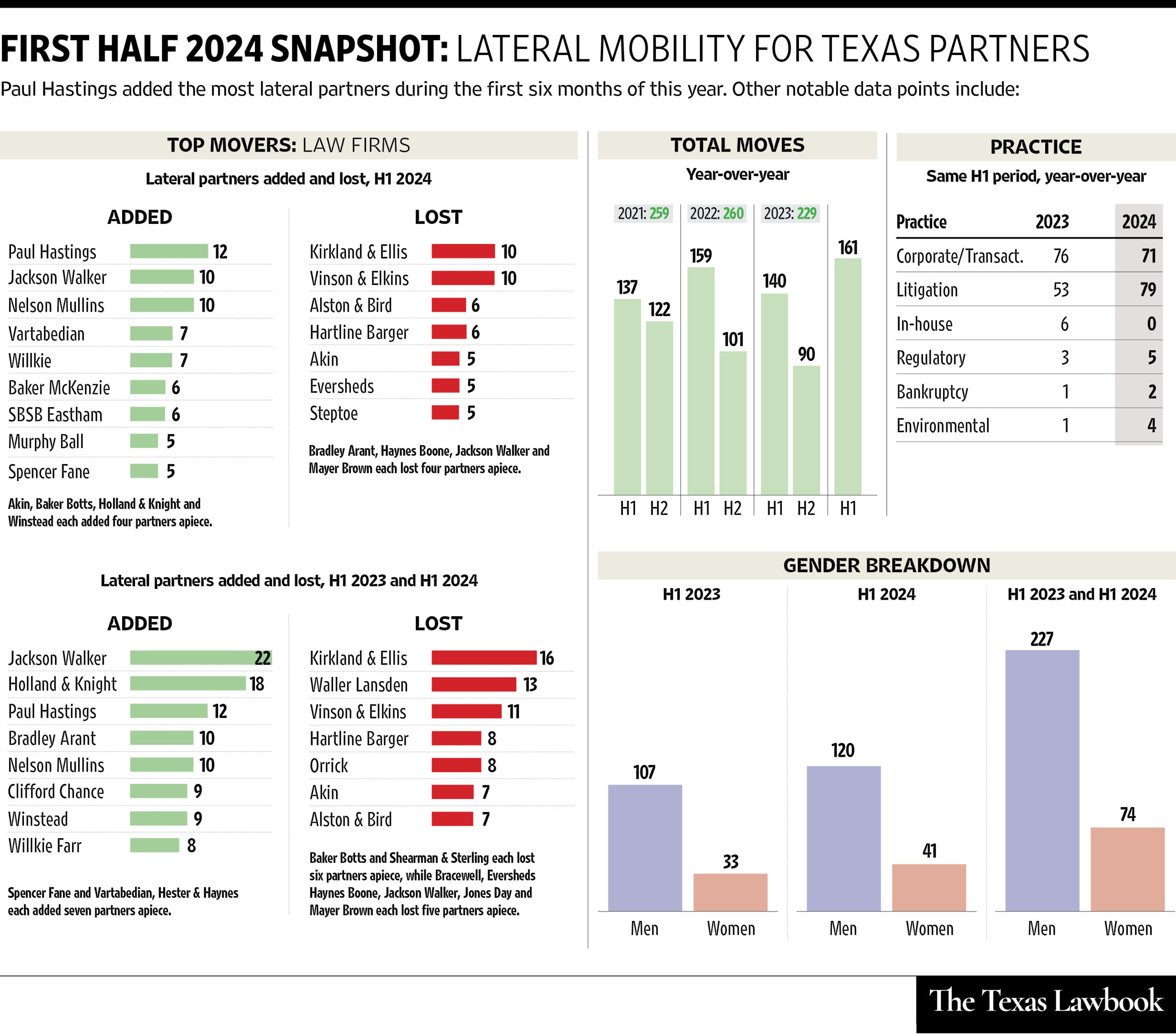

Texas Lawbook data shows that 161 Texas law partners were involved in lateral moves from Jan. 1 through June 30 — 15 percent higher than during H1 2023 and up 79 percent over H2 2023.

In fact, going back to 2021, the 161 partner moves in Texas during H1 2024 ranked first, topping only the 159 partners who moved their practices during the first six months of 2022.

“Q1 is generally when most partners move — after year-end distributions and perhaps some partners not pleased compensation projects for the upcoming year,” said Kate Cassidy, founding attorney of Lotus Legal Search. “The increase in lateral partners this year is largely from new office openings in the last year or so. Texas was second only to California in new AmLaw 200 office openings.”

More litigation partners (79) moved their practices than corporate partners (71) during H1 2024, which is a reversal of H1 2023.

“I think firms are still incorporating all of the transactional hires from the early 2020s and those areas — private equity, M&A, finance and real estate — are generally down,” said Cassidy, who is the former corporate counsel for the Texas Rangers baseball club. “Some top litigators have moved or will move after year end, as they had less movement in the early 2020, so there are more good candidates ready for a new platform.”

“I personally have the most requests for litigation partners, including white-collar, securities, antitrust and energy,” she said. “Private credit finance is also recently a requested area, rather than traditional bank finance. Healthcare also remains a top need.”

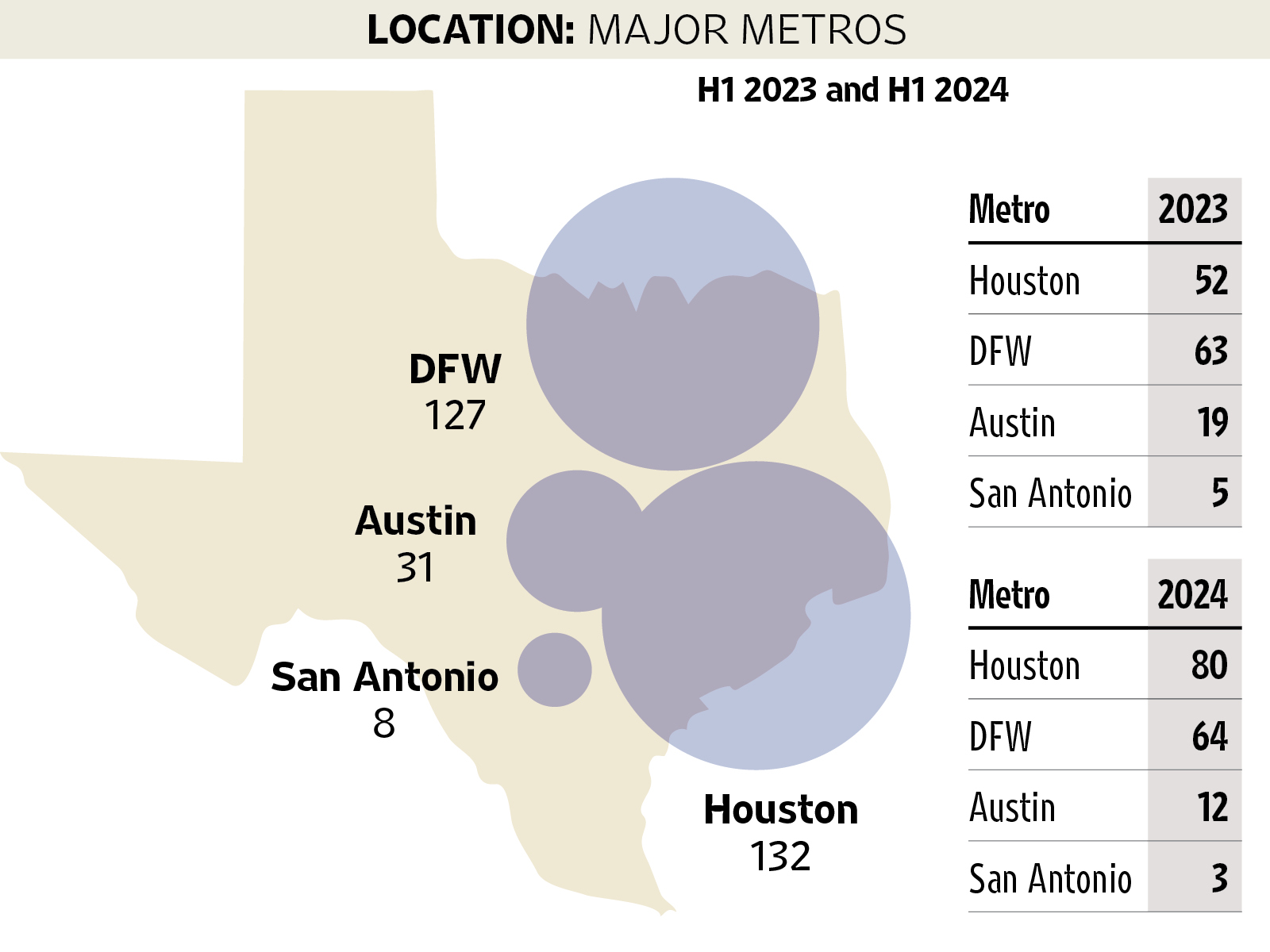

Houston lawyers regained the top slot for most lateral partner moves by metro. Texas Lawbook data shows that 80 Houston partners switched law firms during H1 2024 — up from 52 during the same period a year ago. Fifty-eight Dallas partners were involved in lateral moves during the first six months of this year, up from 55 in H1 2023.

The Austin lateral market cooled during H1 2024 when only 13 partners changed firms compared to 19 during the same period in 2023.

“I think we’ll see more Austin partner movement later this year, as more AmLaw firms are looking to open there to capitalize on the strong economy — some new corporate headquarters are in Austin — and preference for partners on the quality of life that Austin provides,” Cassidy said. “Austin is second only to Denver in requested relocation cities for candidates.”

In the gender breakdown, twice as many male partners (120) as women partners (41) made moves during H1.

Paul Hastings ranks No. 1 in adding new partners with 12 during H1 2024, while Jackson Walker and Nelson Mullins added 10. Two firms — Vartabedian, Hester & Haynes and Willkie Farr — added seven lateral partners and two firms — Baker McKenzie and SBSB Eastham — added six lateral partners.

The two most profitable law firms in Texas — Kirkland & Ellis and Vinson & Elkins — each lost 10 partners to lateral moves in H1 2024, while Alston & Bird and Hartline Barger each lost six.

But Texas Lawbook 50 data shows that Kirkland and V&E actually added more lawyers last year and both firms report having the two largest classes of first-year hires of associates of any Texas law firms.

To show how competitive firms are, Kirkland and A&O Shearman are offering $50,000 bonuses to those to successfully recruit associates and counsel.