Corporate transactions in which companies and private equity firms headquartered in Texas were the buyer, seller or target fell dramatically in the first quarter of this year. Energy – for the first time in more than 12 years – lost its lofty ranking as the biggest deal generator in the state, according to Mergermarket data provided exclusively to The Texas Lawbook.

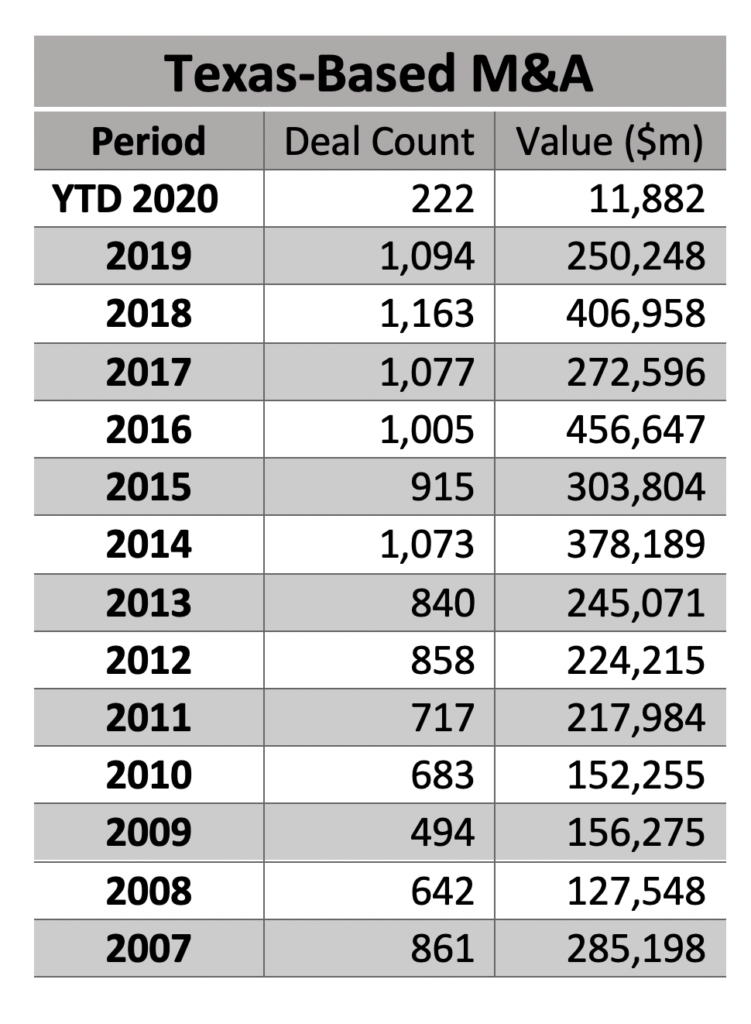

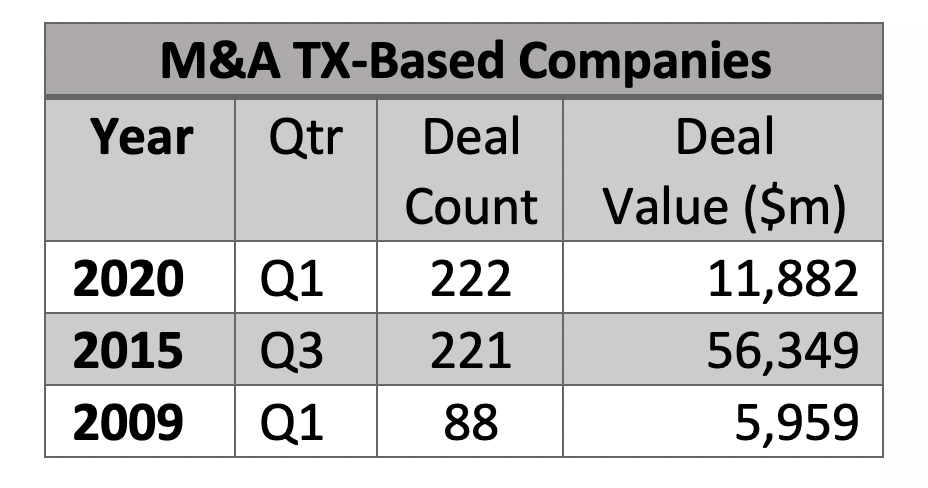

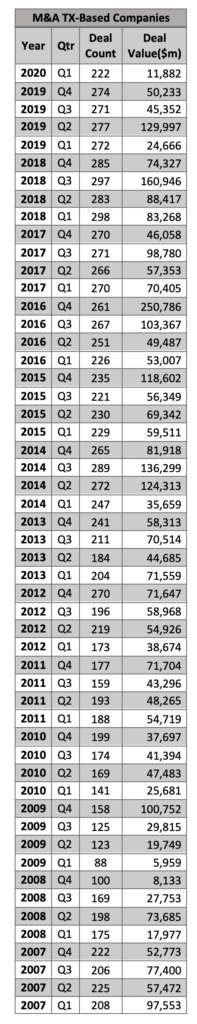

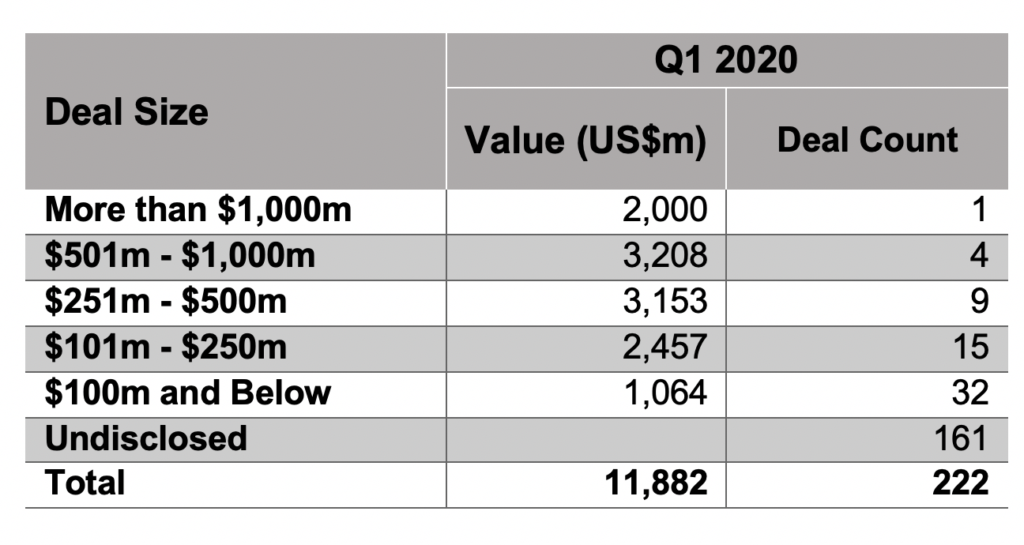

The Texas deal count in Q1 2020 fell to 222 transactions, an 18% drop from the first quarter of 2019. The value of the deals announced in January, February and March plunged nearly 52% to only $11.8 billion.

Many observers blame the quarter’s poor performance on the out-of-favor oil and gas industry, which normally dominates M&A activity in the state, and the beginnings of the coronavirus spread, which caused many dealmakers to put their pencils down for a period.

“The Lone Star State took a one-two punch in early 2020 from the COVID-19 crisis and a sharp decline in oil prices,” said Mark Druskoff, a reporter and data-driven content coordinator for North America at Mergermarket, which is owned by Acuris Global.

While global M&A value in the first quarter was down 39% at levels not seen since 2013, Texas suffered “outsized pain” with totals more comparable to the global financial crisis, Druskoff said.

Indeed, deal count in the quarter was the lowest since the third quarter of 2015 – after the last big oil price collapse – while deal value was the lowest since the first quarter of 2009 – the heart of the last recession.

On the upside, it was the 27th consecutive quarter of 200 M&A deals or more – the second quarter of 2013 had only 184. But transactions were smaller in this most recent quarter, with only two reaching $1 billion or more.

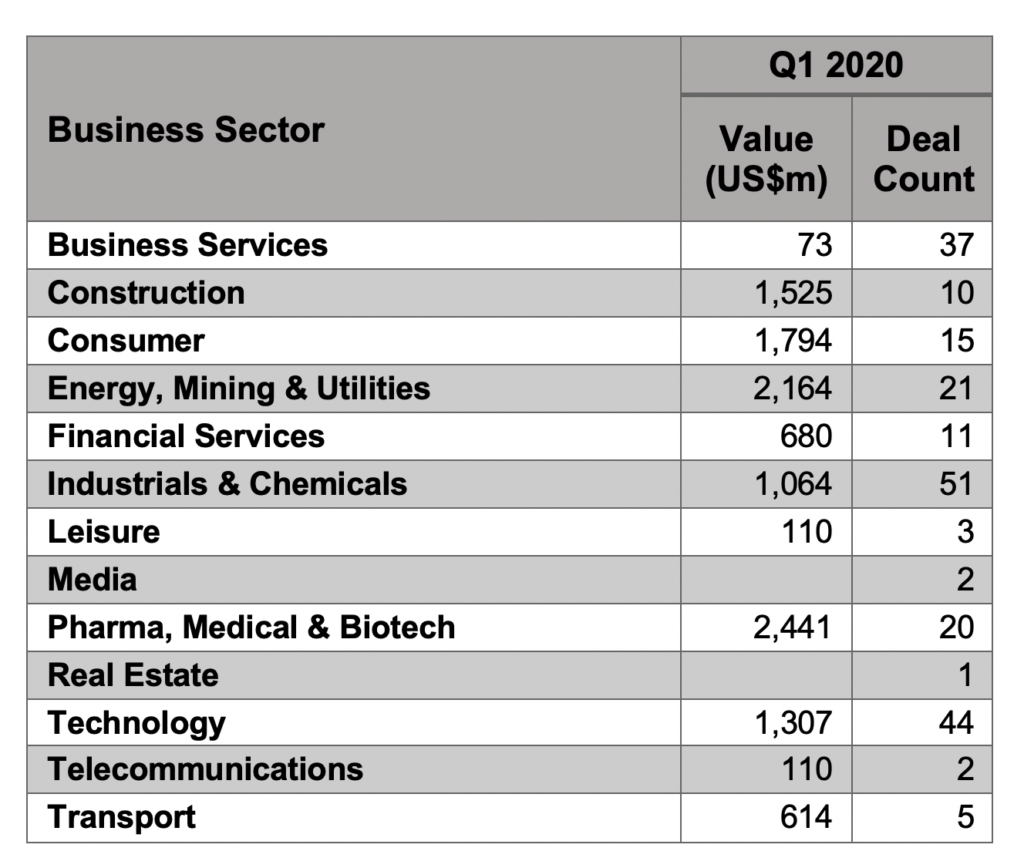

One of the more unusual findings in the data is that energy – including mining and utilities – was not the top business industry in terms of deal count, as it had been for 51 consecutive quarters in Texas, according to Mergermarket. Instead, the sector ranked fourth after industrials and chemicals, technology and business services.

In fact, industrials and chemicals had more than twice as many M&A deals as energy in the period.

The seven largest deals of last quarter were not in the energy sector, which generated only six of the top 20 deals.

In terms of value, energy came in second with $2.164 billion worth of deals, or 18.2% of the market. The top sector was actually pharma/medical/biotech, which generated $2.441 billion worth of transactions or 20.5% of the market.

That’s quite a switch from the last three years, when energy was ranked No. 1 in terms of deal value among Texas companies, according to Mergermarket. But the sector has been shrinking as a percentage of the total pie, making up 31% of deal count and 66.5% of deal value in 2017, 23% of deal count and 64.7% of deal value in 2018 and 19% of deal count and 57% of deal value last year.

Druskoff said even industries more resilient to the coronavirus’ direct effects, such as critical environmental and waste services, have seen M&A impacted. He noted Houston-based Waste Management’s nearly $5 billion acquisition of Advanced Disposal, which was delayed by the Department of Justice because of COVID-19.

Looking ahead, Mergermarket expects the technology, business services and pharma/medical/biotech industries to continue to attract strong interest globally. Druskoff noted that Texas’ largest deal in the quarter was Pathway Vet Alliance’s sale to TSG Consumer Partners for a reported $2 billion.

For energy, Druskoff said that oil and gas producers may sell midstream assets to raise cash in this challenging environment, which could attract private equity-backed buyers, and that some oil and gas software companies may take advantage of the opportunity to make acquisitions as valuations are expected to decline from their recent heights.

As for renewable energy, Druskoff expects investment to continue forward relatively unaffected as the sector is driven by capital from private equity and infrastructure investors “who have raised plenty of dry powder in recent years,” he said.

Mark Curriden contributed to this report.