As each celebrity Instagram post announcing a move to Austin suggests, a wave of new residents is moving to Texas — a fact that municipal-bond attorneys have not missed.

As the Lone Star State continues to grow, so does the need for new schools, roads, hospitals and homes. The future looks bright for public-finance practice groups in Texas, they contend, though it won’t be all smooth sailing.

In 2021, there were 2,098 issues totaling $61.3 billion, according to the Municipal Advisory Council of Texas, a slight dip from a record-breaking $66 billion issued the year before. But it was higher than in 2019, when 1,797 issues totaled $49.9 billion.

While low-interest rates in 2020 provided opportunities to refinance both tax-exempt and taxable bonds, attorneys say the state’s continued growth was the principal driver in 2021.

In 2020, the Texas population was 29.7 million people, according to Texas Water Development Board statistics. In its 2022 report the board projects another 4.2 million Texans in 2030 and an additional 12.6 million residents by 2050, compared with 2020.

Companies like Tesla and Oracle have moved their corporate headquarters to the Austin area, and Samsung has announced a semiconductor-manufacturing plant for Taylor, Texas. This growth brings the need for infrastructure, much of it financed through municipal bonds.

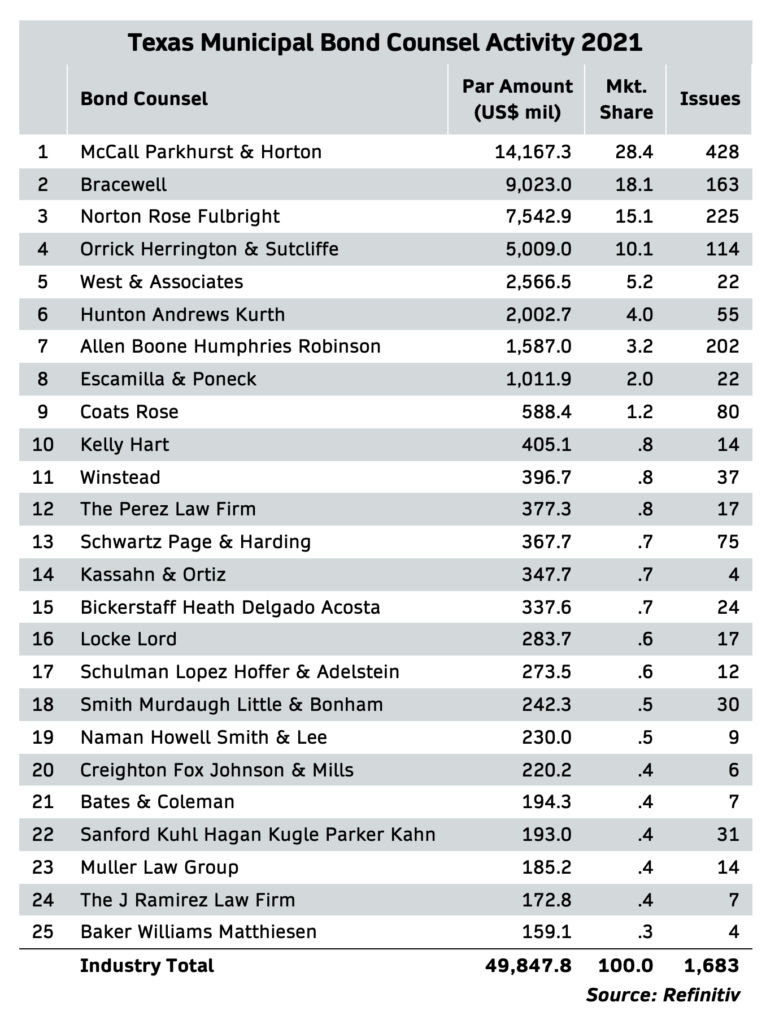

McCall, Parkhurst & Horton had the largest market share of municipal-bond work in the state, 28.4%, according to Refinitiv. Bracewell came in second with an 18.1% market share. Norton Rose Fulbright had 15.1% and Orrick Herrington & Sutcliffe 10.1%.

“At McCall, we had a very busy year,” said Mark Malveaux, the firm’s managing partner. “I think it’s a continuation of liquidity being in the market. There is still a demand for infrastructure in Texas. We continued to see that last year.”

Although 2020 was exceptional, the trend continued in 2021, mainly because of low rates and “people understanding that now is the time to be in the market,” said Barron Wallace, a partner at Bracewell.

Looking ahead, as interest rates are creeping up, public-finance attorneys are optimistic but wary.

“I do think rates are trending a little higher and that may impact volume a little bit,” Wallace said. “But at the same time, we’re fielding calls from clients about bond elections and other capital needs, and I think there are certain sectors that are going to continue to be strong.”

Rapid population growth coupled with the effects of COVID-19 had a significant influence on public school financing, said Tom Sage, co-lead of the Hunton Andrews Kurth public-finance group. Many school districts paused plans last year because of the pandemic’s uncertainties, he said.

“I have clients that had hundreds and hundreds of millions of dollars’ worth of bond programs,” Sage said. “Everybody hit the brakes, because we didn’t want to get out ahead and start building schools if there are no kids coming in. We needed to do something, but nobody really knew what.”

This year, plans are progressing again. Sage estimates he has about $2 billion of school bonds scheduled for the election in May, an “extremely unusual” amount.

“That’s a big number anytime,” Sage said. “Another [district] just called me yesterday. So everybody’s seeing it. Kids are coming back. Time to build. You have that, plus the influx of humans into the state.”

In addition to schools, increased population inevitably has a huge impact on bond-financed mass-transit and roads.

At Orrick, the public-finance group’s revenue in 2021 increased 20% over 2020, said Adrian Patterson, public-finance partner and Houston office leader at Orrick. Among Patterson’s clients are the Metropolitan Transit Authority of Harris County and the Harris County Toll Road Authority. He expects a busy 2022.

“If you look at Harris County Metro, they passed a $3 billion bond election two years ago, [but] they haven’t issued any of those bonds,” Patterson said. “If you look at the infrastructure bill, there’s a ton of money in there for transit. How those federal dollars drop down into local governments is going to be key, but clearly there’s a lot that needs to be done on the transit side.”

Potential resiliency projects may also affect the municipal-bond market this year. Patterson’s group has been talking with Harris County about flood-control improvements.

“They’re trying to figure out how to get dollars to do these improvements and to do them quickly, particularly before we go into another hurricane season,” Patterson said.

Although some bonds already have voter approval, it’s not clear what kind of appetite voters have to approve new projects, even if the need is there.

Revenue bonds — bonds repaid from revenues generated by airports, convention centers or sanitation services — don’t need voter approval, but tax bonds — those paid with tax dollars — require it. This includes bonds issued by school districts.

The politics, however, doesn’t stop with a bond election. Municipal bonds in Texas must also have the attorney general’s approval before they can be issued, a level of authority designed to ensure that bonds are not issued if the governmental entity can’t afford to repay them.

New restrictions created by the Texas Legislature can complicate bond issuances, including a 2021 provision that bars local governments from engaging banks that refuse to lend money to gun companies.

Concerned that the Legislature will continue to restrict local government debt issues, municipal governments and investment banks are planning to take a more active role in lawmaking, attorneys said.

“Texas is still a place that is growing and still has tremendous needs for public works and public infrastructure deals,” Malveaux said. “This is a dynamic state to be doing public finance, and I don’t see that changing in 2022.”