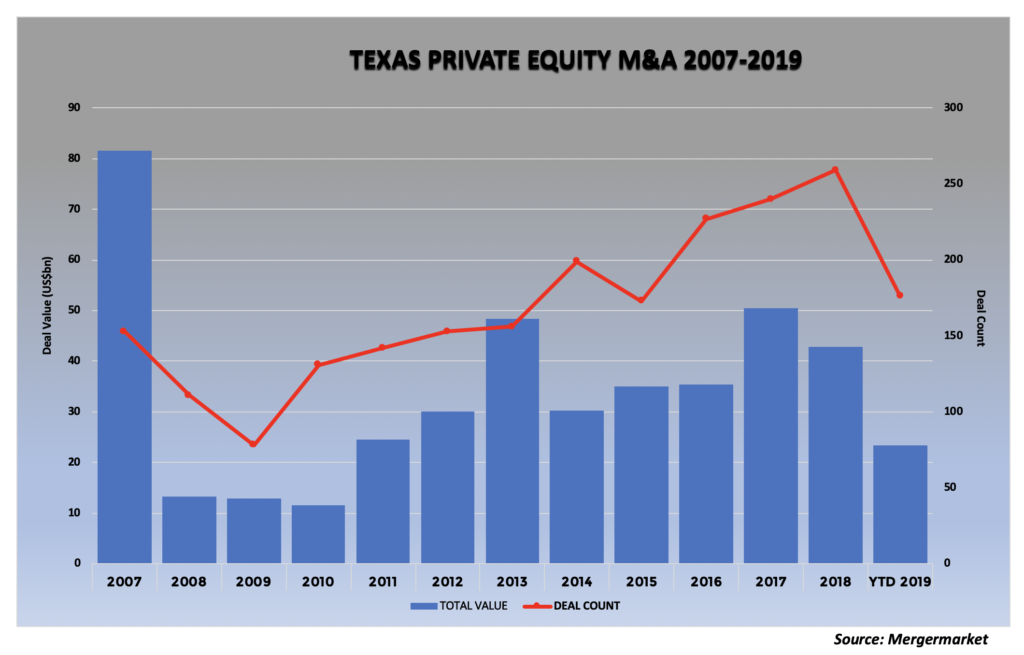

Private equity dealmaking involving Texas-based businesses is down considerably so far this year, according to Mergermarket data provided exclusively to The Texas Lawbook. Oil and gas M&A has seen an even more significant decline.

Last year there were 259 transactions valued at $43 billion, a pretty healthy year for private equity dealmaking in the state. But as of Nov. 13, there were only 176 deals valued at $23 billion this year, according to the data firm.

The private equity deal trend shows deal count is down near 2015 levels so far this year and deal value fell to 2011 levels.

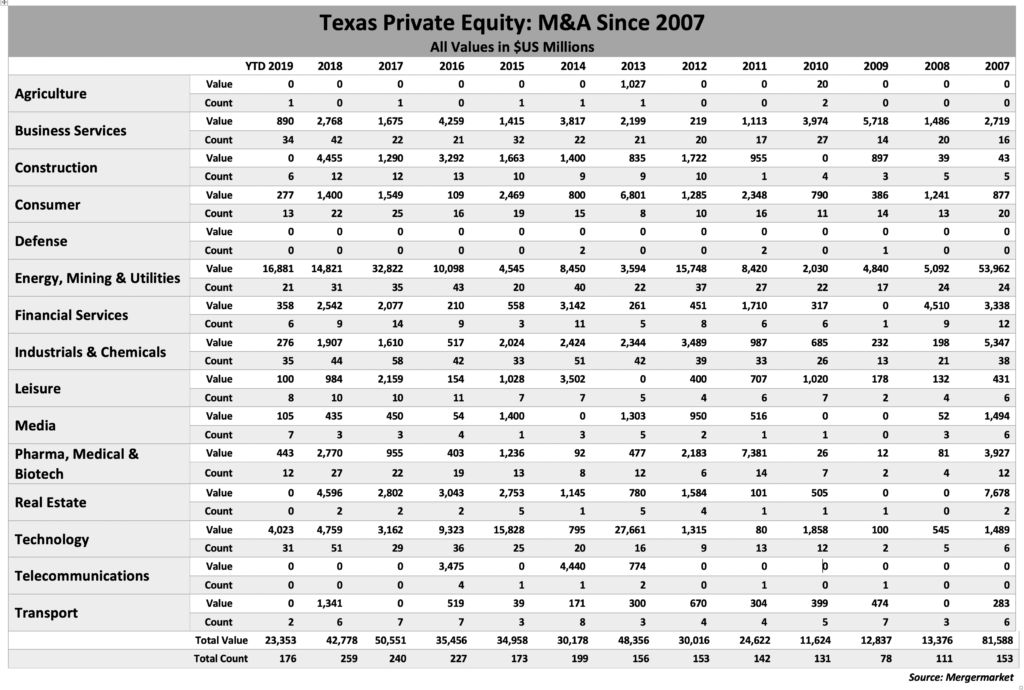

Interestingly, private equity media deals are at a high this year in Texas over the 13-year period, with seven transactions valued at $105 million. But other sectors have declined, including construction, consumer and pharma/medical/biotech, which experienced 12 deals valued at $443 million for the period versus 27 transactions worth $2.7 billion for all of last year.

Energy-related private equity deals also are down so far this year, with 21 transactions worth almost $16.9 billion over the period compared with 31 last year valued at $14.8 billion and 35 worth $32.8 billion in 2017. This year’s count is the lowest since 2015.

Private equity executives at Privcap’s energy conference this week in Houston talked about the difficulty finding exits given the out-of-favor nature of the oil and gas industry. In particular, initial public offerings in energy have become nearly non-existent and, fearing pushback from investors, publicly-traded oil and gas companies are reluctant to pick up assets.

“Selling is just not happening,” EnCap Investments partner Brad Thielemann said on one panel. “The ones that are are in the Permian.”

Instead, many private equity firms are extending the lives of their funds so they can hold their oil and gas assets longer, merging their portfolio companies together and doing land swaps with other companies to boost their bases in certain areas and create economies of scale.

“Scale really does matter,” said Chuck Yates, managing partner for Kayne Anderson Capital Advisors’ energy private equity activities in Houston. “We’ve been trading more than buying and selling, like NBA general managers.”

Brittany Sakowitz, a partner at Vinson & Elkins in Houston who specializes in M&A and private equity matters, said the deals that are getting done are by people who are taking a longer view of the industry.

“It’s a longer due diligence process,” she noted. “Compensation (for portfolio company teams) also is changing, as they (private equity firms) don’t see a payday anytime soon.”

Overall oil and gas dealmaking – including but not limited to private equity – also slipped over the 11 month-plus period, according to Mergermarket, with 152 deals valued at $130 million. That’s the lowest count since 2008 and the lowest value since 2015.