The COVID-19 pandemic and the downturn in the oil patch have caused pain and cutbacks in the Texas legal community. Yet a handful of corporate law firms are thriving and raking in record revenues because of these crises.

Charging hourly rates between $400 and $1,700, 15 regional and national law firms operating in Dallas and Houston are competing to represent debtors, creditors, financial institutions, conflicts committees and landlords in scores of complex business bankruptcies in which hundreds of millions – in some cases billions – of dollars need to be forgiven, restructured, loaned and invested.

Despite being debt-laden and financially distressed, the companies often pay tens of millions of dollars in compensation to some corporate law firms. A select few firms will make hundreds of millions of dollars.

More than 900 lawyers based in the Texas offices of 34 business law firms have worked on – and billed in – 219 active Chapter 11 restructurings filed in Texas and other jurisdictions across the country, according to more than four months of data research conducted by The Texas Lawbook.

Less than one-eighth of those 900 lawyers actually specialize in bankruptcy law. The majority practice corporate law – from mergers and acquisitions to finance and securities. But there are also litigators, employment and antitrust lawyers, regulatory and real estate counsel and, of course, lots of tax lawyers.

There are more than a dozen corporate bankruptcy lawyers in Texas who are almost certainly representing more clients, working longer hours and billing more time in 2020 than they have in their entire careers, including Alfredo Perez, John Higgins, Lou Strubeck, Timothy “Tad” Davidson, Charles Beckham, Lynda Lankford, John Cornwell, Bill Wallander and Matt Cavenaugh.

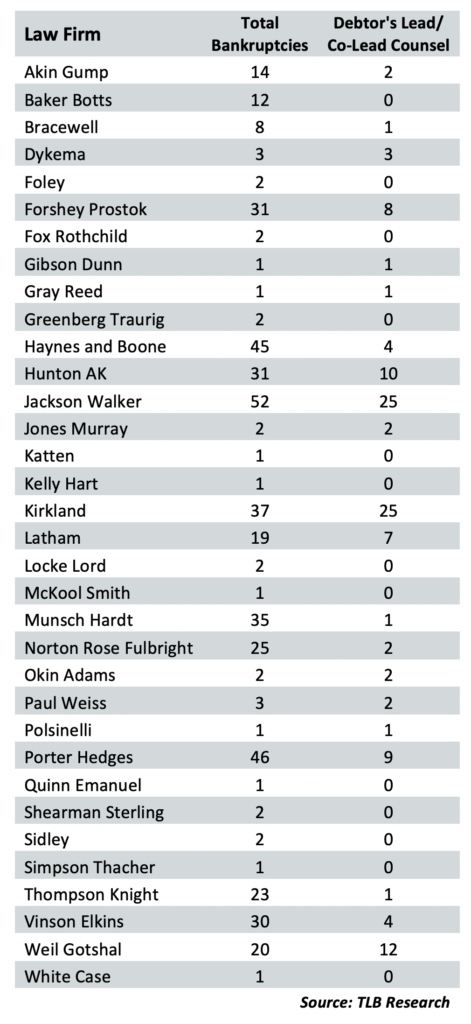

The Texas Lawbook identified six Texas-headquartered full-service law firms – Jackson Walker, Haynes and Boone, Munsch Hardt, Porter Hedges, Thompson & Knight and Vinson & Elkins – that are each involved in 20 or more complex bankruptcies.

Four national law firms with a large presence in Texas – Hunton AK, Kirkland & Ellis, Norton Rose Fulbright and Weil, Gotshal & Manges – have Texas lawyers engaged in at least 20 different corporate restructurings, according to Texas Lawbook research.

Kirkland and Weil are the behemoths of corporate bankruptcy.

In the midst of it all, the data shows that alliances between law firms have developed, which appear to benefit the lawyers and their clients.

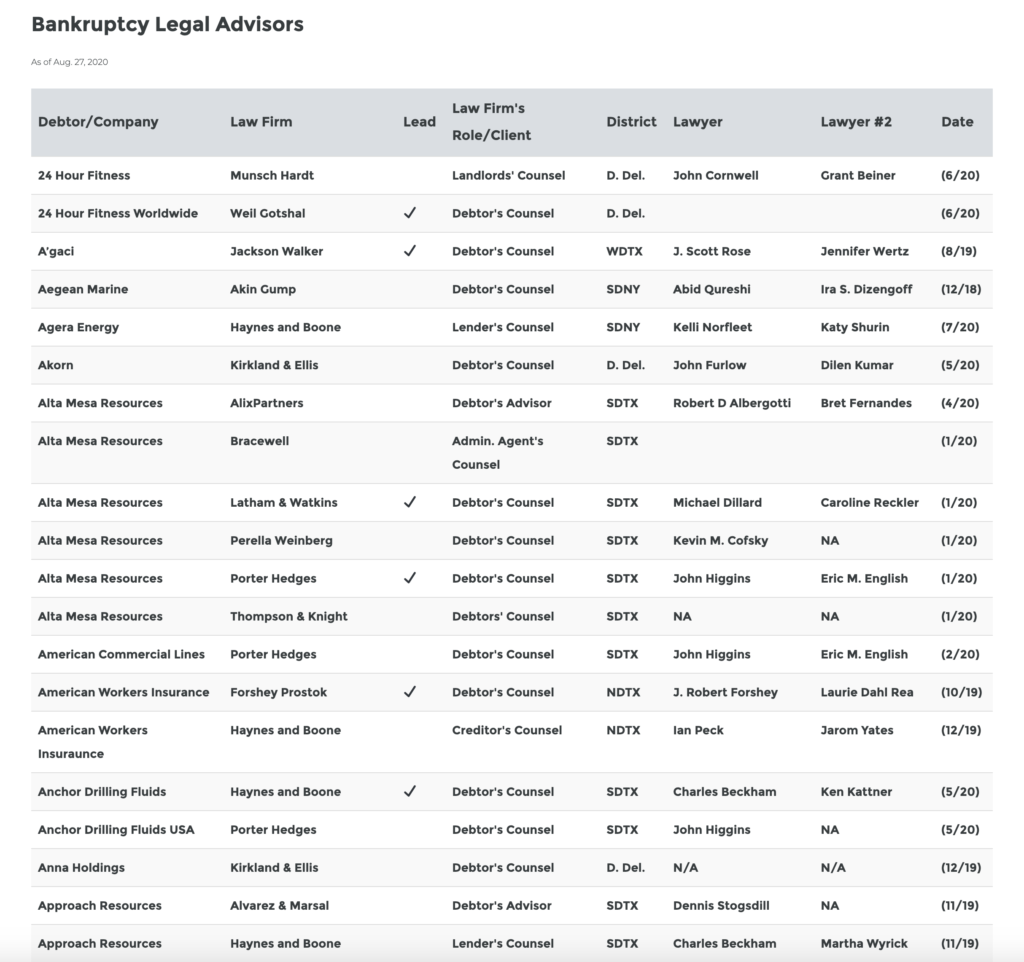

Publisher’s Note: The Texas Lawbook now publishes an ongoing list of all the Chapter 11 bankruptcies that involve Texas lawyers. This data, which is available to PREMIUM SUBSCRIBERS ONLY, will be constantly updated. This database includes (1) the name of the debtor; (2) the list of the law firms, banks and restructuring businesses advising the various parties; (3) the role of those advisors; (4) the names of two Texas lawyers/advisors involved in the case; (5) the month and year the case was filed; and (6) the jurisdiction where the bankruptcy was filed. Contact Brooks Igo (brooks.igo@texaslawbook.net) to learn more about a Premium Subscription.

Forshey Prostok, a 12-lawyer Fort Worth-based bankruptcy boutique that specializes in middle market clients, is involved in 31 different matters. The firm’s lawyers represent creditors in cases ranging from Breitburn Energy to Vanguard Natural Resources and are debtor’s counsel for Mid-Cities Home Medical to Duncan Burch, the parent company of Baby Dolls and other adult clubs.

Of course, not all bankruptcies are equal. Some companies filed for Chapter 11 and exited quickly. Austin-based Mood Media, for example, sought bankruptcy protection on July 1, received court approval of their restructuring plan in less than 24 hours and officially emerged from bankruptcy on July 31.

Dean Foods – also known as Southern Foods – filed for bankruptcy in November 2019 and has paid the legal and financial advisors $60 million so far. And some bankruptcies seem to go on forever, such as Life Partners, which was filed in 2016.

Texas Corporate Bankruptcy Drought is Over

The surge in high-paying bankruptcy legal work for Texas lawyers is a dramatic shift from the past two decades when most large Texas companies – American Airlines, Dynegy, Enron, Energy Future Holdings and Radio Shack, for example – filed their Chapter 11 petitions in the Southern District of New York or Delaware.

As a result, those companies hired non-Texas lawyers to do the legal work. Most corporate bankruptcy practices in Texas suffered as an result.

“No question, the bankruptcy bar in Texas suffered for a lot of years because lawyers and bankers convinced Texas businesses to restructure in SDNY and Delaware,” Lou Strubeck, a partner at Norton Rose Fulbright in Dallas and one of the most prominent bankruptcy experts in the U.S., told The Texas Lawbook in an interview earlier this year. “It was sad and frustrating seeing the legal work leave our state.”

During the past four years, however, the bankruptcy judges in the Southern District of Texas implemented substantive changes that make the court more accessible, more predictable and more user-friendly, especially for debtors in these huge complex corporate restructurings.

The result has been transformational. The number of business bankruptcies in the Southern District of Texas has more than tripled during the past couple of years. There were 602 companies that filed for Chapter 11 in SDTX during the first six months of 2020 – up from 161 during the same period one year earlier.

The economic impact on the legal profession in Texas has been transformational.

Debtors, creditors, banks, lenders, landlords and potential buyers in each of these cases need lawyers in the jurisdictions where the bankruptcies are being litigated.

“The bankruptcy practice was never much of a significant factor regarding revenues for Texas firms,” said Kent Zimmermann, a law firm management consultant at Zeughauser.

“But that has certainly changed big-time this year,” Zimmermann said. “The competition among the firms in Texas for businesses needing to restructure and for top-of-the-market corporate restructuring expertise has been heated. And bankruptcy can be highly profitable for law firms, especially for those that have seen their M&A work decline.”

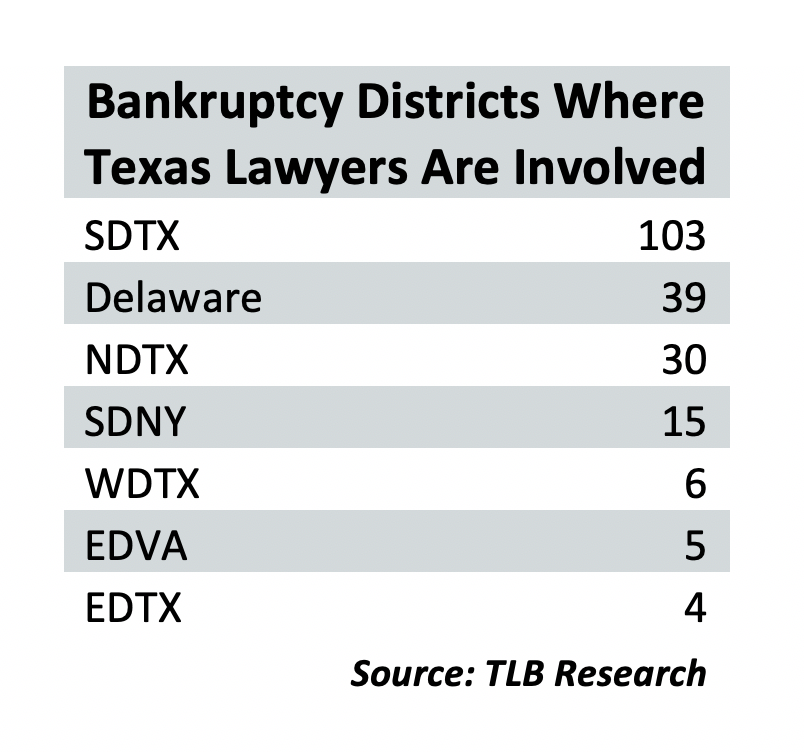

Exactly 104 of the 219 corporate bankruptcies that have Texas-based lawyers working on some aspect of the case are being litigated in the Southern District of Texas, according to Texas Lawbook research.

Texas lawyers are involved in 39 business bankruptcies in Delaware, 30 in the Northern District of Texas (DFW), 15 in the Southern District of New York (Manhattan), six in the Western District of Texas, five in the Eastern District of Virginia and four in the Eastern District of Texas.

Battle of the Advisors

No law firm operating in Texas is involved in more Chapter 11 reorganizations than Jackson Walker.

The Dallas-based firm has lawyers working on at least 52 separate bankruptcies. In half of those, the firm is lead or co-lead counsel for the debtors. Thirty-eight of Jackson Walker’s cases are in the Southern District of Texas. JW represents lenders in 11 bankruptcies and creditors in eight cases.

And then there is Jackson Walker partner Matt Cavenaugh of Houston.

“It seems like every time I get a new case, it has Matt’s name on it,” Chief Bankruptcy Judge David Jones told The Texas Lawbook in an interview three weeks ago. “It is exciting seeing so many great bankruptcy lawyers getting to showcase their talent, and especially younger lawyers like Matt.”

Despite having only a dozen years of legal practice under his belt, Cavenaugh is involved in at least 35 separate bankruptcies, including 23 corporate restructurings in which he is listed as lead or co-lead counsel for the debtors, according to Texas Lawbook data research.

Court records show that Jackson Walker partners Bruce Ruzinsky and Jennifer Wertz are staying quite busy, too.

Cavenaugh and Jackson Walker are benefiting tremendously from an alliance with Kirkland & Ellis, which has one of the premier corporate restructuring practices in the U.S.

Kirkland is the law firm that will make the most money in the 216 cases, even though the Chicago-founded firm has no bankruptcy lawyers in its Texas offices.

Instead, Kirkland uses Cavenaugh as co-counsel when it files cases in the Southern District of Texas and then uses its restructuring lawyers in Chicago and New York to do its part of the bankruptcy work.

Does that mean Kirkland’s 250 lawyers in Dallas and Houston are being left out?

Au contraire.

Bankruptcy court records show that more than 80 Kirkland lawyers based in the firm’s Texas offices are working on at least 37 different corporate bankruptcies and restructurings. The Kirkland lawyers in Texas have billed time on M&A transactional and corporate financing issues that arise during the restructuring, as well as a plethora of litigation matters, according to Texas Lawbook research.

Kirkland and Jackson Walker are co-lead debtor’s counsel in 21 corporate restructurings in the Southern District of Texas, including Chesapeake Energy, J.C. Penny, Neiman Marcus, Denbury Resources and California Pizza Kitchen.

Lawyers for Kirkland declined to comment on their bankruptcy work. Lawyers at Sidley Austin and Winston & Strawn also declined to cooperate with The Texas Lawbook inquiry.

Haynes and Boone lawyers in Texas are currently billing in 45 business bankruptcies – 29 of which are in the Northern or Southern Districts of Texas. The Dallas-based firm represents lenders in a dozen of the restructurings, including Fieldwood Energy, J.C. Penney, and Neiman Marcus. They are the lead debtor’s counsel for Diamondback Industries and Tuesday Morning, and co-debtor’s counsel with Gibson, Dunn & Crutcher in the Rosehill Partners restructuring.

Charles Beckham and Kelli Norfleet are the two Haynes and Boone lawyers who make the most appearances in the 216 bankruptcy cases reviewed by The Texas Lawbook.

Bankruptcy court records show that Munsch Hardt represents parties in 35 different corporate restructurings. Led by partners John Cornwell, Grant Beiner and Kevin Lippman, Munsch Hardt most frequently represents creditors and landlords.

No law firm has filed more business bankruptcies (14) in the Northern District of Texas than Forshey Prostok. The boutique is involved in 31 business bankruptcies – eight of them as lead debtor’s counsel. The firm represents creditors in the bankruptcies of Breitburn Energy, Denbury Resources, Jones Energy and Pier 1.

Can you guess the names of the Forshey Prostok lawyers who lead the great majority of the firm’s 31 restructuring matters?

Trick question. It’s Robert Forshey and Jeff Prostok.

Houston-based Porter Hedges is involved in 47 active bankruptcies – all but two in the Southern District of Texas and 10 of them as lead or co-lead debtor’s counsel. The firm is creditor’s counsel in 23 matters and lenders counsel in eight cases. Porter Hedges is co-lead debtor’s counsel with Latham & Watkins in the Alta Mesa Resources restructuring and co-lead counsel with Paul Weiss in the Diamond Offshore case.

Porter Hedges partner John Higgens, who practiced with David Jones before Jones became a bankruptcy judge, is involved in more than 36 business restructurings, according to Texas Lawbook data. Partner Eric English has billed in more than 20 bankruptcy cases.

Latham is also co-debtor’s counsel with Hunton AK in four matters, including Hi-Crush (a fracking company), Montronics, Sable Permian Resources and Weatherford.

Texas lawyers for Hunton AK are representing parties in 31 bankruptcies – nine of those as lead or co-lead debtor’s counsel. Partner Tad Davidson is the lead in more than 20 of those matters. Robin Russell gets her fair share of advisory roles, too.

Bankruptcy records show that Vinson & Elkins is involved in 30 active bankruptcy cases. The firm is lead or co-lead debtor’s counsel in the Lilis Energy, Unit Corp., CARBO Ceramics and California Resources cases. Bill Wallander and Paul Heath are the lawyers on a great majority of V&E’s matters.

Dallas-based Thompson & Knight is currently involved in at least 23 business restructurings – 13 of them advising creditors, including in the bankruptcies of Alta Mesa, Hertz, Sanchez Energy and Southern Foods. The firm represents the trustee in the Neiman Marcus restructuring. David Bennett and Demetra Liggins are handling most of TK’s restructuring efforts.

Norton Rose Fulbright is lender’s counsel in the Boy Scouts, CARBO Ceramics, Diamond Offshore and Gold’s Gym restructurings and they are debtor’s counsel in the Southern Foods (Dean Foods) and Pioneer Energy cases. Lou Strubeck, Jason Boland and William Greendyke are key partners in the firm’s restructuring practice.

Kirkland’s biggest competitor for lead counsel in multibillion-dollar debtor’s cases is Weil Gotshal. Lawyers in Weil’s Dallas and Houston offices are involved in 20 restructurings, including 17 as lead or co-lead debtor’s counsel. For example, they represent Chuck-E-Cheese, Gavilan Resources, Kingfisher Midstream, McDermott International and Speedcast.

Weil has one significant advantage: Alfredo Perez, a partner in the firm’s Houston office who specializes in corporate restructurings.

The bankruptcy data shows that three other corporate law firms in Texas – Akin Gump, Baker Botts and Bracewell – also have active business bankruptcy practices.

Note: Premium Subscribers can click on the snapshot image below to search The Texas Lawbook’s bankruptcy advisor database.