No two law firms in Texas sat across the table from each other negotiating large mergers, acquisitions and joint ventures in 2022 more often than the Texas lawyers at Kirkland & Ellis and Vinson & Elkins.

Kirkland and V&E were the lead legal advisors for buyers or sellers last year in 16 M&A transactions together — more than double the number of times any other firms faced each other, according to The Texas Lawbook’s Corporate Deal Tracker.

Latham & Watkins’ lawyers in Texas were across the proverbial deal table from V&E eight times and against Kirkland six times. The Texas lawyers for Sidley Austin faced V&E lawyers four times.

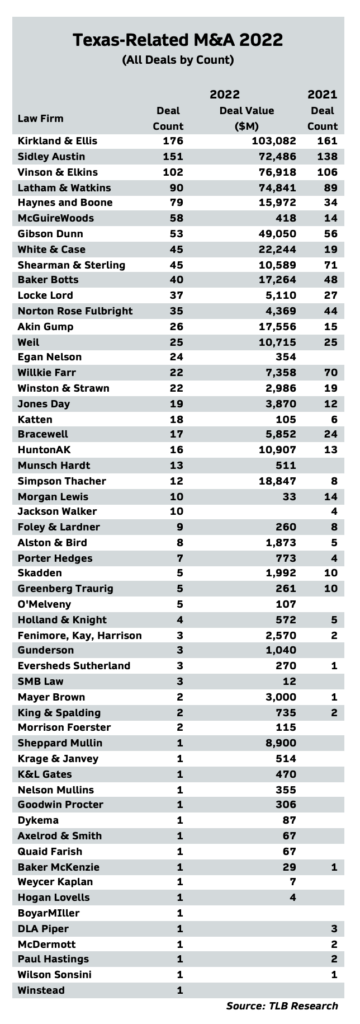

The Corporate Deal Tracker final 2022 law firm rankings for M&A activity by Texas lawyers have been tabulated. Lawyers for 57 firms operating in Texas worked on 1,082 transactions that were announced last year — the highest amount of M&A activity ever reported.

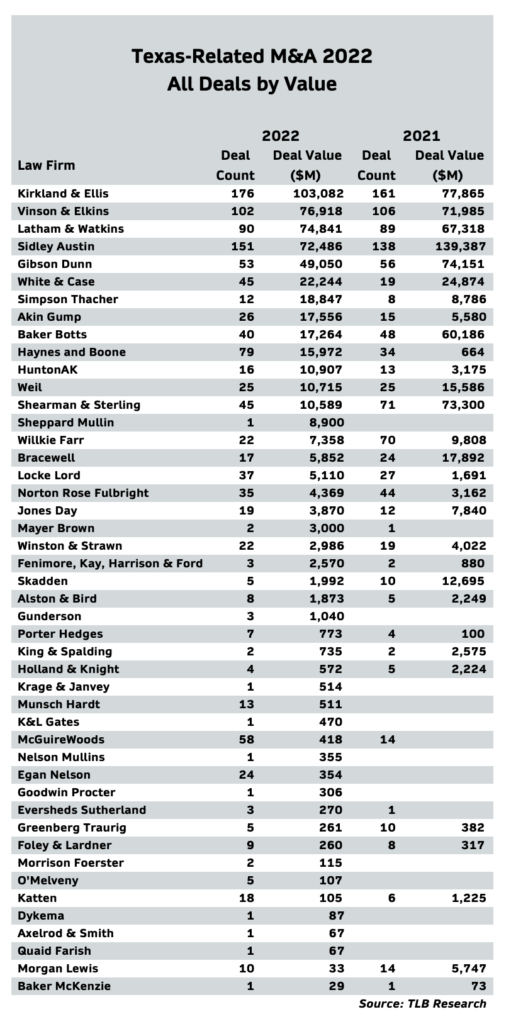

The CDT has two categories for M&A law firm rankings. First, there is the overall category of law firms who had Texas lawyers represent any party in the transaction, such as the buyers, sellers, conflicts committee, investment banks and third-party investors. We list these by deal count or deal volume and deal value, which calculates the amount of money the buyer pays the seller plus any debt assumed.

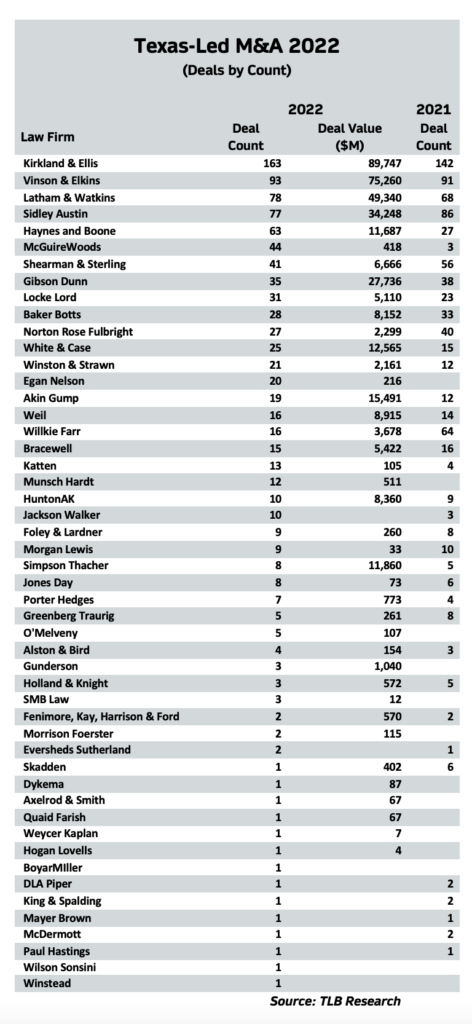

The second category is narrower and much more refined: Lead counsel for the principals, meaning they led the transactions for the buyers, sellers or targets. These are the legal advisors involved in the dealmaking from start to finish. They do the most work, bill the most hours and get paid the most money.

Editor’s note: These rankings only include M&A activity. The Corporate Deal Tracker ranks fund closings, fund formations and capital markets transactions as separate categories, which we will publish within the next week. CDT data relies on law firms to submit their deals to The Texas Lawbook.

CDT Overall Firm Rankings for 2022

No law firm in Texas has ever recorded more M&A in a single year than Kirkland did in 2022.

Kirkland lawyers in Austin, Dallas and Houston worked on 176 transactions last year — up from 163 in 2021, which was the previous record. Kirkland’s Texas lawyers were lead counsel for Brookfield Infrastructure Fund in an unusual $30 billion joint venture partnership with Intel Corp. They also were the lead legal advisors for Whiting Petroleum in its $6 billion sale to Oasis Petroleum.

Kirkland’s New York partners were lead counsel for Celanese Corporation in its $11 billion acquisition of a majority ownership stake in DuPont’s mobility and materials business. But the Kirkland partners turned to a corporate partner in Austin for support.

Those three transactions were among 19 deals of a billion-dollar or more that Kirkland lawyers in Texas handled in 2022. The firm’s total deal value ranked No. 1 on the CDT charts at $103.1 billion.

Texas lawyers for Sidley Austin also had a record year in 2022 with their Texas lawyers billing on 151 corporate transactions, which is the third most ever, and an increase of 13 deals over 2021. Sidley’s Texas lawyers represented Regal Rexnord in its $4.95 billion purchase of Altra Industrial Motion Corp. and Ensign Natural Resources in its $3 billion sale to Marathon Oil.

Sidley attorneys in Texas worked on 14 billion-dollar transactions. The 151 deals had a value total of $72.5 billion.

Deal count for V&E’s Texas lawyers fell from 106 in 2021 to 102 last year, but its combined deal value increased to $76.9 billion, compared to $72 billion in 2021.

V&E lawyers in Houston were lead counsel for Chevron Phillips Chemical in its $8.5 billion acquisition of Golden Triangle Polymers and Oasis’ $6 billion purchase of Whiting.

V&E and Latham continued their eight-year streak of being in the top five M&A firms for deal count in Texas.

Latham’s Houston lawyers were lead counsel for Consolidated Edison in its $8.5 billion divestiture of its renewable storage assets to RWE Renewables and Centennial Resources in its $3.9 billion acquisition of Colgate Energy Partners. Overall, Latham lawyers in Texas worked on 90 deals – up one from 2021 – with a combined deal value of $$74.8 billion.

The dealmakers at Haynes and Boone, McGuireWoods, White & Case and Katten Muchin also reached new annual M&A count highs for their firms in 2022.

The Corporate Deal Tracker’s law firm overall rankings also found that:

· Eighteen of the top 30 law firms in Texas increased their M&A deal count in 2022 over the prior year;

· Twenty-five firms recorded 10 transactions or more;

· Ten law firms had Texas lawyers working on 40 deals or more;

· Three law firms worked on more than 100 transactions;

· Nine law firms — Akin Gump, Haynes and Boone, Katten, Kirkland, Locke Lord, McGuireWoods, Munsch Hardt, Sidley and White & Case — increased their Texas deal count by double-digits;

· Only two law firms — Shearman & Sterling and Willkie Farr — experienced double-digit declines in their overall deal count in 2022 from the prior year; and

· Nine of the top 30 M&A firms are headquartered in Texas.

The Corporate Deal Tracker shows two law firms that witnessed the biggest jump in M&A activity were McGuireWoods, which leaped from only 14 reported transactions in 2021 to 58 last year, and Haynes and Boone, which jumped from 34 deals in 2021 to 79 in 2022.

Both firms focus primarily on middle market M&A. Haynes and Boone advised on two multibillion-dollar transactions last year, including representing Dallas-based Beneficient Company Group in its merger with blank-check vehicle Avalon Acquisition valued at $3.5 billion and Germany-based IKAV Energy in its $2 billion acquisition of assets from Shell Offshore.

For the first time ever, there were more deals reported to The Lawbook with undisclosed values than deals with published values.

Fifty-three of the 79 deals that Haynes and Boone reported to the CDT were reported with undisclosed values. Fifty-four of McGuireWoods’s 58 reported transactions were similarly undisclosed.

Six law firms jumped into the CDT’s top 30 deal count ranking for the first time: Egan Nelson, Katten, Munsch Hardt, Jackson Walker, Alston & Bird and Porter Hedges. (only six firms listed, but sentence says there are seven)

The Texas Lawbook puts more emphasis on deal count than deal value for a simple reason: Size does not equal complexity. In fact, most corporate lawyers agree that midsized M&A deals, especially those in which a founder is selling her or his privately-held business, are usually significantly more complicated and more work intensive to get across the finish line.

Lead M&A Counsel for the Principals Rankings

Four of the highest revenue-generating and profitable law firms in Texas have at least one data point in common: Their Texas lawyers led the most corporate mergers, acquisitions and joint ventures in 2022.

New data from The Texas Lawbook’s Corporate Deal Tracker shows that Kirkland, V&E, Latham and Sidley rank one through four in being the lead counsel for the principals (buyers, sellers and targets) in M&A activity last year.

The CDT tracks lead counsel for the principals for a simple reason: That’s where the most money is.

Lead counsel for the buyers, sellers and targets work the most hours on dealmaking and often employ large teams of lawyers from other practice groups — for example, antitrust, labor and employment, executive compensation and tax — to get transactions across the finish-line.

Four of the top five corporate law firms increased the number of transactions they led in 2022 over the previous year, and 21 of the top 30 law firms increased their deal count as lead counsel in the Corporate Deal Tracker rankings.

Of the 1,082 deals submitted to the CDT in 2022, Texas lawyers were the lead advisors for the buyers, sellers or targets in 853 of them.

Texas lawyers at Kirkland were lead counsel for the principals in 163 transactions in 2022 — up from 142 in 2021. The firm also almost doubled the combined value of the deals it led — from $47.7 billion in 2021 to $89.7 billion last year.

V&E lawyers in Texas ranked second by leading 93 transactions in 2022 — up two from a year earlier.

Latham jumped to the No. 3 ranking by leading 78 deals last year — an increase of 10 deals from the prior year. Sidley was only one transaction behind with 77 in 2022.

Haynes and Boone and McGuireWoods each witnessed huge jumps in the number of transactions that their Texas lawyers led.

Winston & Strawn, Jackson Walker, Munsch Hardt and White & Case also witnessed significant increases.

CDT M&A Flashback to 2015

The Texas Lawbook launched the Corporate Deal Tracker in 2014. The first full year of complete data was 2015.

How has M&A evolved during the past seven years?

In 2015, the top M&A law firm operating in Texas was V&E. The Houston-based firm reported handling 91 transactions with a combined deal value of $87.2 billion.

Ranked second in 2015 was Andrews Kurth – now Hunton AK – with 73 deals with a price tag of $85.4 billion. Akin Gump and Bracewell tied for third with 55 deals.

Baker Botts reported 47 M&A transactions with a deal value of $85.5 billion in 2015, which gave it a fifth place ranking.

Kirkland, which only opened a Texas office in April 2014, reported 25 transactions handled by their Texas attorneys in 2015. The CDT ranked the Chicago-founded firm 13th.By 2016, Kirkland had jumped to the seventh ranked spot with 45 deals.

Latham’s Texas operations ranked seventh in 2015 with 45 transactions, but jumped to fifth in 2016 and has been ranked in the top five ever since.

Sidley reported that its Texas lawyers worked on 22 deals in 2015, which grew to 31 the following year.